Industry News

Online gambling in Finland: value of Finnish casino players reaching new Highs

Despite there only being a small amount of land-based casinos in Finland, this does not indicate a lack of desire on the part of Finnish gamblers and the country’s population of 5.5 million.

In fact, if recent industry trends are anything to go by, the casino industry is undergoing something of a mini-boom given the increased revenues casinos have been posting.

This bodes well for the casino industry as a whole in Finland — the growth of which has been stunted in recent years due to long-standing restrictions on access to gambling providers.

Despite the relatively small footprint of land-based casinos in Finland, the Finns have nevertheless proven themselves to be committed casino-goers. The majority of punters prefer to do their gambling online, and in recent years online casino usage has boomed. When speaking about online casinos, a spokesperson at kasinonetti.com said these are “currently the hottest trend in the casino world”.

It should be noted, however, that land-based casino gaming is currently run under a state-owned monopoly system, meaning there is a limit on what operators can actually enter into and set up in the Finnish market. The three local government gambling monopolies are the Raha-automaattiyhdistys

(RAY), which controls slot machine games, Fintoto Oy, which oversees horse racing, and Veikkaus, which is responsible for lotteries and gambling. These three entities have full control over all gambling activities undertaken in the state.

However, in recent years more and more Finns have been accessing online casinos, which has created a massive spike in gambling activities amongst the population. Due to the restrictions on gambling entities in the state, all of these online casinos are based outside Finland.

Access to these casinos is relatively simple for Finnish players, however. While no international operators are allowed to set up inside the state, players can nevertheless access them if they are based outside Finland. There are currently no restrictions put in place by the Finnish state to prevent individual players from accessing these websites, which has helped these international operators to increase their market share of players within Finland. It should be noted, however, that while the Finnish government won’t actively block access to these sites, they are still unable to advertise directly to consumers based in Finland.

In response to the increased presence of international operators servicing Finnish customers, the Finnish casinos have begun to increase their online presence. Most recently, the Veikkaus casino entity has announced plans to significantly invest in its online offerings, which could present a challenge to these international operators.

Although the increase in competition might be potentially bad business for the local monopolies, it is ultimately good news for Finnish gamblers. The Finns now find themselves with more options than ever before when it comes to online casino gaming. With that said, the next few years will be a key tipping point in the growth of the industry in Finland as the local operators look to respond to these developments.

Industry News

Trustly Announces Major Move to Guarantee Growth for Businesses Across Europe

Trustly announced a bold pledge to boost growth for businesses across Europe. In a major move to revolutionise the checkout experience for millions of people, the payments tech firm unveils the new Trustly Growth Guarantee.

The market-leading account-to-account provider is offering clients – current and new – a fresh way to pay at the checkout. As part of this, businesses are guaranteed to see an increase in conversion rates, to as high as 98.8%, and a clear reduction in the fees they pay in comparison with traditional payment methods.

Customers will enjoy fewer steps to pay and the added efficiency of return user recognition; Trustly guarantees supercharged success at the checkout. With predictable pricing, costs will be just one amount per transaction – with no variable fees at all. Trustly also states that it is dedicated to providing a seamless integration and will include Success Concierge as standard.

The initiative, revealed only a matter of days after impressive 2023 growth results were announced for the global leader in the industry, reflects Trustly’s unwavering confidence and commitment to continuing to innovate account-to-account payments. Last week, Trustly announced a 79% increase YoY in annual transaction value – reaching $58 billion in total.

Its track record for already attracting major global clients – some examples being Meta, eBay, HMRC, Zalando and Hargreaves Lansdown – signifies that there’s been a distinct change in customer preference and merchants priorities.

Businesses are making attempts to remain innovative and ahead of the curve as millions of consumers increasingly adopt open banking-enabled account-to-account solutions instead of other more standard options when they pay.

Jussi Lindberg, Chief Revenue Officer of Trustly Europe, said: “Our market-leading payment setup embodies Trustly’s mission: to be a growth partner for our clients. We don’t just provide payment solutions; we drive efficiency and value in their businesses. Trustly Azura has delivered remarkable results, and now businesses can experience its benefits. Account-to-account payments are booming, and we’re here to help businesses seize the opportunities it offers.”

If merchants do not see a boost in conversion or a drop in payment costs – at a processing rate of at least 50K transactions each month, for three months, Trustly will reimburse three months’ worth of processing fees. The guarantee is available for both new and existing European customers and is subject to Trustly’s general terms & conditions.

Industry News

Wazdan set to gain more ground at Casino Beats Summit Malta

Wazdan, the gain-focused developer behind some of the world’s most rewarding casino game experiences is set to make the most of the networking and relationship-building opportunities at Casino Beats Summit 2024 and share its groundbreaking Online gaining™ approach.

Leading a formidable team of Wazdan talent will be Chief Commercial Officer Andrzej Hyla. Joining him in Malta is Promo Tools Specialist Marcin Trafiałek, who has been nominated for the prestigious Product Manager of the Year award at the CasinoBeats Game Developer Awards 2024.

Trafiałek’s nomination recognises his pivotal role in the triumphant success of the Mystery Drop™ promo tool. Additional representatives from Wazdan’s Account Management and Marketing departments will also be on hand, eager to connect and share the latest Wazdan innovations.

Wazdan’s commitment to excellence is further underscored by its multiple nominations at the CasinoBeats Game Developer Awards 2024. The company’s exciting new titles and features are vying for top honours in various categories, including:

- Slot to Watch: 25 Coins™

- Game Mechanic of the Year: Coins™ series

- Game Feature of the Year: Coins™ series

- Game Music/Soundtrack: Book of Faith™

- Game Music/Soundtrack: Los Muertos™ II

- Game Retro-Style: Mighty Symbols™: Crowns

As a proud sponsor of CasinoBeats Summit 2024, Wazdan reaffirms its dedication to fostering a vibrant iGaming community and actively participating in industry-shaping events. The company looks forward to setting a course for success and collaboration at the summit.

Andrzej Hyla, Chief Commercial Officer at Wazdan said: “Casino Beats Summits are always fantastic events. This year sees us in the enviable position of being shortlisted for six awards which reflects the hard work our team of engineers and inventors have put into the experiences that add value for demanding players.

“We’re looking forward to meeting friends old and new at the event and sharing how we gain ground and ground gain.”

Industry News

Europe Sports Betting Market Size, Share & Trends Analysis Report 2024-2030 Featuring Bet365, William Hill, Betfair, Paddy Power, 888sport, Bwin, Unibet, Ladbrokes, MGM, and Betsson

The “Europe Sports Betting Market Size, Share & Trends Analysis Report by Type, Platform, Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others), Country, and Segment Forecasts, 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

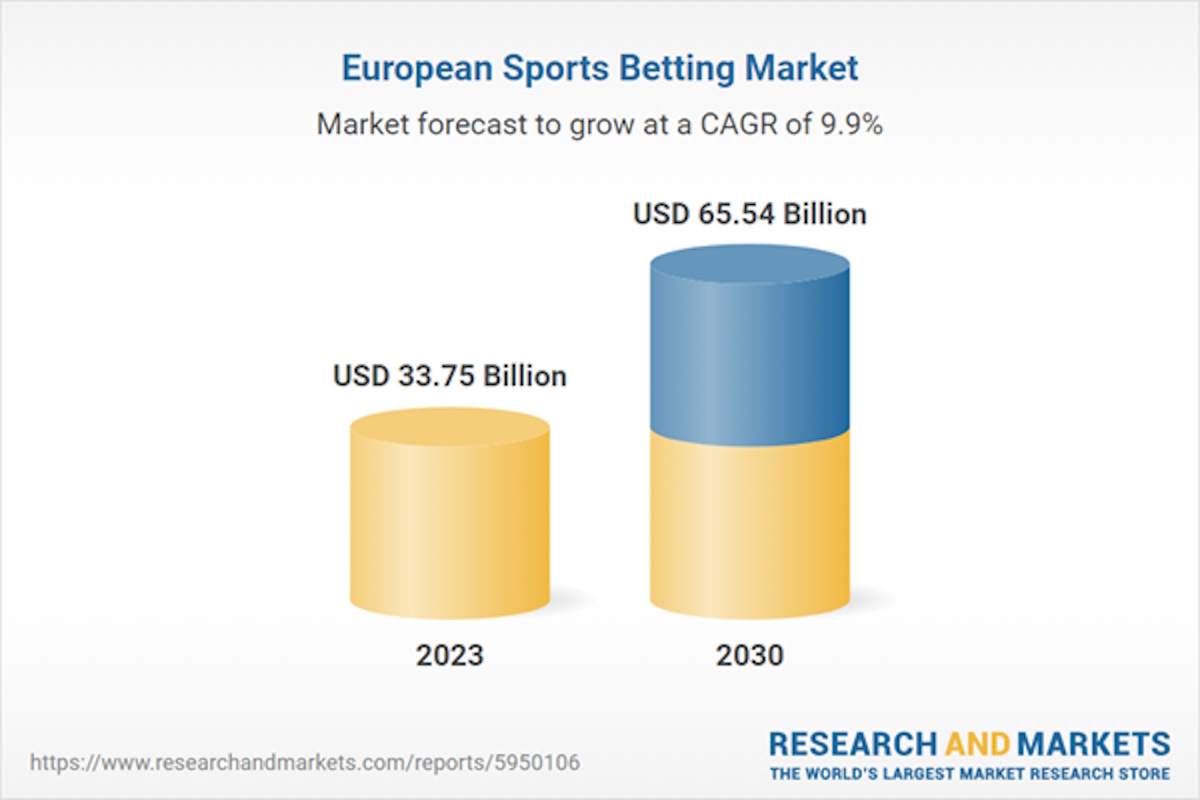

The Europe sports betting market size is anticipated to reach USD 65.54 billion by 2030 and is expected to expand at a CAGR of 9.9% from 2024 to 2030

The globalization of sports and the integration of international leagues and tournaments into European betting markets have fueled the growth of sports betting. Major sporting events such as the FIFA World Cup, UEFA European Championship, Wimbledon, and the Olympics attract widespread attention and betting interest from European consumers, driving significant betting volumes and revenues for sports betting operators, thus driving the growth of the sports betting market in Europe.

The COVID-19 pandemic had a negative impact on the European sports betting market. The cancellation or postponement of sports events during the pandemic restrained the market growth. With major tournaments, leagues, and competitions either suspended or canceled outright, the absence of live sports events severely diminished consumer betting opportunities. It led to a significant decline in betting volumes and revenues for sports betting operators.

The presence of favorable betting policies in the region is driving the growth of the sports betting market in the region. Many European countries, such as the UK, Ireland, Denmark, and France, have progressive policies promoting a competitive and well-regulated betting market. It facilitates the entry of new operators into the market and encourages competition, leading to innovation, improved services, and better value for consumers.

Moreover, established responsible gambling initiatives and regulatory bodies in Europe, such as the European Gaming & Betting Association, help build trust and confidence among consumers by promoting responsible gambling practices, ensuring fairness and transparency in betting operations, and providing avenues for dispute resolution, to protect consumers and maintain the integrity of the betting market, thus driving the growth of sports betting market in the region.

Europe Sports Betting Market Report Highlights

- Based on the type of betting, the fixed odd wagering segment accounted for the highest revenue share of 27.7% in 2023 due to the stability and predictability of the payouts

- Based on platform, the online segment dominated the market in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. It can be attributed to the collaborations between sports teams, leagues, and betting companies, thus increasing the visibility of sports betting and attracting a larger customer base.

- In terms of sports type, the football segment accounted for the largest revenue share in 2023. It can be attributed to the popularity of football in Europe due to popular football clubs like Real Madrid, Liverpool FC, FC Barcelona, and Manchester United.

- The UK held a significant share of 34.6% in 2023 and is expected to grow at a significant CAGR during the forecast period. Favorable gambling policies in the country drive the market’s growth.

Company Profiles

- Bet365

- Ali William Hill

- Betfair

- Paddy Power

- 888sport

- Bwin

- Unibet

- Ladbrokes

- MGM Resorts International

- Betsson

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 80 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $33.75 Billion |

| Forecasted Market Value (USD) by 2030 | $65.54 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Europe |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Europe Sports Betting Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing number of sport events

3.2.1.2. Growing number of sporting events and leagues in Europe

3.2.2. Market restraint analysis

3.2.2.1. Lack of unified regulations

3.2.3. Market opportunity analysis

3.2.3.1. Growth in E-sports audience

3.3. Europe Sports Betting Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.2. PESTEL Analysis

Chapter 4. Europe Sports Betting Market: Platform Estimates & Trend Analysis

4.1. Platform Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Europe Sports Betting Market by Platform Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

4.4.1. Offline

4.4.2. Online

Chapter 5. Europe Sports Betting Market: Type Estimates & Trend Analysis

5.1. Type Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Europe Sports Betting Market by Type Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

5.4.1. Fixed odds wagering

5.4.2. Exchange Betting

5.4.3. Live/In Play Betting

5.4.4. eSports Betting

5.4.5. Others

Chapter 6. Europe Sports Betting Market: Sports Type Estimates & Trend Analysis

6.1. Sports Type Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Europe Sports Betting Market by Sports Type Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

6.4.1. Football

6.4.2. Basketball

6.4.3. Baseball

6.4.4. Horse Racing

6.4.5. Cricket

6.4.6. Hockey

6.4.7. Others

Chapter 7. Europe Sports Betting Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.4. Company Profiles

For more information about this report visit researchandmarkets.com

-

Industry News7 days ago

Industry News7 days ago -

eSports7 days ago

eSports7 days agoeSports in the CIS region , Q&A w/ Viktor Block, Senior Sales Manager/PandaScore

-

Industry News6 days ago

Industry News6 days agoLeading online slot developer announces launch of Snoop’s High Rollers which will go live exclusively with popular crypto sportsbook and casino

-

Australia6 days ago

Australia6 days agoVGCCC Fines BlueBet AU$50,000 for Gambling Advertising Breaches

-

Latest News7 days ago

Latest News7 days agoOpenBet Powers Record-Breaking 100,000+ Peak Bets per Minute at Grand National 2024

-

Latest News6 days ago

Latest News6 days agoBooming Games Establishes Strategic Partnership with Danske Spil

-

Industry News6 days ago

Industry News6 days agoIDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA: Updated Non-Profit Tombola and Lottery Application Requirements