Latest News

JKR Investment Group shakes off with the new brand identity

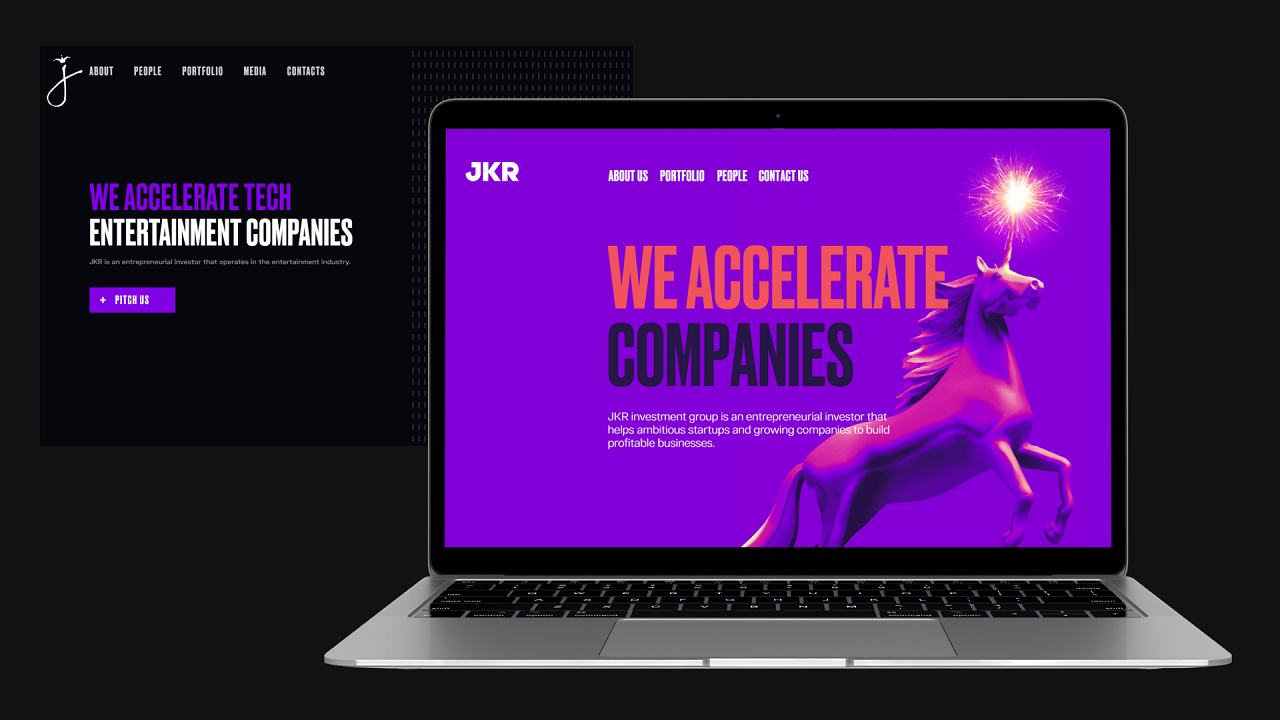

JKR Investment Group is to enter 2022 within the new branding that includes refreshed logo, added corporate colours, and visual elements reflecting the company’s philosophy.

Previously known as a leading investor in the entertainment industry, JKR decided to diversify its portfolio and leverage its expertise in new industries and companies that work in complex markets.

Being a venture builder in companies like BETER Sport, BETER Live, Speed Media, and investor in BETEGY, JKR is now to focus on sectors like Logistics, EdTech, Longevity, and other technology markets.

The shift in positioning has logically led to the rebranding.

«Our previous look corresponded to the positioning of a venture builder, being conservative and formal. As we grew, explored the new markets, and shifted our profile from a builder to an investor, we needed a fresh look that would reflect our upgraded philosophy. JKR stands for Joker, and the new branding reflects his nature of outdoing oneself and lighting the fuse to blow up the conventional», says Alexander Gusev, co-founder, and CEO of JKR Investment Group.

The rebranding brief was to preserve the brand awareness raised in the industry so far and convey it in design. The refreshed JKR identity has a bold digital-like logo replacing the previous hand-written one. The new logo displays JKR’s expertise in the tech industry. The ultraviolet from the previous version is associated with the company’s unconventional investment approach. The branding also introduces certain visual analogies that reflect the company’s investment philosophy. For instance, a unicorn with a spark symbolizes startups on fire for their ideas, while the dynamite reflects the passion and desire to light up founders’ inner fuse and disrupt industries. In addition, the design team added a gradient to the main visual objects, to demonstrate the flexibility of JKR identity.

JKR Investment Group continues developing its entertainment ecosystem simultaneously helping ambitious and fast-growing businesses from logistics and EdTech and other markets.

About JKR Investment Group

JKR Investment Group — is an entrepreneurial investor that helps ambitious startups and growing companies to build profitable businesses. The group was founded in 2017 and since then invested in and built over a dozen companies.

The total group revenue is expected to reach €162 million in 2021.

JKR invests in digital marketing, sports and eSports content creation, sports data analytics, logistics, and EdTech.

Industry Awards

WhichBingo Reveals 2024 Award Winners at 10th Anniversary of the WhichBingo Awards

WhichBingo, one of the UK’s best-known and most trusted online bingo review and affiliate sites, owned and operated by Gambling.com Group, has announced its 2024 WhichBingo Award winners at an action-packed event aboard the Sunborn Yacht Hotel in Gibraltar. The headline sponsor of the event was Pragmatic Play, a prolific provider of slot games and a powerhouse bingo platform. Other big-name sponsors included Eyecon and its parent company, Playtech.

Gala Bingo and Buzz Bingo were the big winners of the night, picking up four awards each. Popular choice awards for Gala Bingo included Best Bingo Site, Best Proprietary Bingo Site and Best Slots site for its Gala Spins game. In addition, Gala Bingo was awarded Best Marketing Campaign by an expert panel of judges. Buzz Bingo walked away with the trophies for Best Chat Team, Best Exclusive Bingo Game and Best Playtech Bingo site thanks to the player votes – and Best Livestream Entertainment from the judging panel.

There were several new features to mark the 10th anniversary of the WhichBingo Awards, including the first WhichBingo Player Panel. Designed to bring real players and their insights to industry insiders, and hosted by WhichBingo safer gambling partner Better Change, the panel was a highlight of the event. Themes included what players value most in online bingo games and a deep dive into their preferred play styles. In another first, the inaugural Better Change Positive Play Award was presented to PlayOJO in recognition of its efforts to ensure players stay safe while still having fun.

The night’s entertainment included the UK’s own Dabbers Social Bingo, famous for its annual contest to find the best comedy bingo caller. The bingo operators were the ones dabbing the bingo cards for a change, and the winners walked away with some enviable prizes.

“Congratulations to all of the winners of the 2024 WhichBingo Awards. It’s truly inspiring to see the passion and dedication of the bingo community celebrated in such a spectacular fashion. At Gambling.com Group, we value our partnerships with operators, affiliates, and industry leaders, and we are proud to be part of such an engaged and vibrant community,” Owen Watters, Vice President Commercial at Gambling.com Group, said.

WhichBingo was founded more than two decades ago, and the WhichBingo Awards remain one of the annual highlights in the UK’s online bingo industry calendar, a unique celebration that recognizes the best brands in the gaming business.

All the Award Winners in Full:

Best Bingo Site: Gala Bingo

Best Slot Game: Big Bass Amazon Xtreme (Pragmatic Play)

Best Exclusive Bingo Game: Buzz Bingo Live Bingo

Best Pragmatic Play Bingo Site: Heart Bingo

Best Dragonfish Bingo Site: 888Ladies

Best Playtech Bingo Site: Buzz Bingo

Best Proprietary Bingo Site: Gala Bingo

Best Bingo Chat Team: Buzz Bingo

Best Slots Site: Gala Spins

Judged Awards

Better Change Positive Play Award: PlayOJO

Best Customer Service: tombola

Best Marketing Campaign: Gala Bingo

Best Mobile Bingo Site: bet365 Bingo

Best Livestream Entertainment: Buzz Bingo

Latest News

Bet365 Debuts its Bespoke Live Game Show Super Mega Ultra in Collaboration with Playtech

Playtech announced the launch of the new live game show, Super Mega Ultra, in collaboration with bet365. The game is now accessible to players in multiple territories, including the UK, Mexico and Ontario.

The live game show is crafted in-house and draws inspiration from one of bet365’s popular slots. It stands as a testament to the synergistic efforts between Playtech and bet365, aiming to provide players with an immersive live entertainment experience.

As wheel-based live game shows continue to gain popularity, bet365 has positioned itself at the forefront by offering a range of captivating options for players. The introduction of this innovative three-tier base game across two wheels further solidifies bet365’s reputation as a leading provider of premium, entertaining gaming experiences and high-quality, in-house gaming content.

The game features three payout levels – Super, Mega, and Ultra – providing players with the chance to win significant rewards. Each round offers maximum multipliers (×300 for Super, ×500 for Mega, and ×2500 for Ultra). The game starts at the Super level, and with each “Level Up” spin result, players advance to the next payout level, either Mega or Ultra.

To add to the excitement, two bonus rounds – 7s Heaven and Slot Spins – have been incorporated to further enrich the player’s gaming experience.

bet365 spokesperson commented: “We’re thrilled to unveil this new game to our global community, marking a significant milestone for us. It is a valuable addition to our Live Casino portfolio, taking our in-house game production to new heights. With the introduction of the three-tier base live game spanning two wheels, we’re setting a new industry standard – a testament to our commitment to creating innovative, top-quality and engaging game experiences for our players. Playtech’s expertise and collaboration were instrumental in the development of this exciting new game show. The partnership between both companies continues to drive success, as we continue to work together to create groundbreaking gaming experiences for players around the world.”

Kevin Kilminster, Chief Product Innovation Officer at Playtech Live, said: “We are excited to collaborate with bet365 to launch their bespoke Live game show, Super Mega Ultra to their player base. It is fantastic to see one of our most trusted partners taking the opportunity to continuously build bespoke content and utilise the knowledge and experience that the Playtech Live team has to offer. The debut of the three-tier base live game across two wheels is a new industry standard and reflects our joint dedication to crafting innovative, high-quality, and captivating gaming experiences for players. We look forward to continuing our strong and successful partnership with this world-class operator.”

Central Europe

Aleatrust Signs Up as Supporting Member of the Austrian Sports Betting Association

The Austrian Sports Betting Association (OSWV) has welcomed Aleatrust as a new supporting member on board.

Above all, the comprehensive training offered by the E-Casino Academy launched by Aleatrust, which also focuses on the needs of the sports betting industry, is an important asset that will also be available to OSWV members from now on. Central topics such as money laundering prevention, data protection, data security and compliance, including anti-corruption, whistleblower protection and code of conduct, are of central importance here and are comprehensively covered by the E-Casino Academy.

Sharif Shoukry, Managing Director of OSWV, said: “The new active supporting membership of Aleatrust is an important step forward for the OSWV and its members. It provides access to tailor-made training that is specifically tailored to the requirements and challenges of our industry. We are convinced that this cooperation will make a significant contribution to professionalization and security in the Austrian sports betting market.”

A significant benefit of the partnership is the availability of their training programs online, allowing OSWV members to access essential knowledge anytime and anywhere. This flexible learning environment offers an optimal solution to meet the need for continuous education and training without relying on traditional, time- and location-bound training formats. This type of training not only saves valuable resources, but also allows for consistent and high-quality training of employees, regardless of their individual schedules or the location of the company.

“To be accepted into the circle of supporting members of the OSWV is a great recognition for Aleatrust. It confirms our commitment and expertise in developing and delivering world-class training programs that are specifically tailored to the gambling and sports betting industry,” Niklas Sattler, Managing Director of Alatrust, said.

Particularly noteworthy is the specialised course on money laundering prevention, developed in collaboration with the renowned expert Dr. Elena Scherschneva. Given their extensive experience and recognized expertise in training employees of numerous sportsbooks, the availability of this course online represents a unique opportunity for members to benefit from the highest level of expertise. This underscores the OSWV’s commitment not only to strengthen the industry in terms of compliance and security, but also to promote a responsible and honest betting environment.

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoSpanish Advertising Restrictions Struck Down: Learn More at the 2024 Gaming in Spain Conference

-

Balkans7 days ago

Balkans7 days agoMaking a Bang in Bulgaria! Hacksaw Gaming goes live with Alphawin

-

eSports7 days ago

eSports7 days agoCopenhagen Major 2024 – Betting Overview

-

Compliance Updates7 days ago

Compliance Updates7 days agoIOC and UEFA host joint betting integrity workshop

-

Latest News7 days ago

Latest News7 days agoWeek 15/2024 slot games releases

-

Latest News7 days ago

Latest News7 days agoInspired steps into Spring with its latest line up of slots: Space Invaders Win And Spin, Big Big Fishing Fortune and Piggy Bandits

-

Gaming7 days ago

Gaming7 days agoSortium Revolutionizing Video Game Development with Groundbreaking AI Tools Launch and $4 Million+ Funding Round

-

Latest News7 days ago

Latest News7 days agoAltenar appoints Sam Hill as Sales Director