Press Releases

Nektan Games Now Available for Slot Machine Players at Tunf.com Online Casino

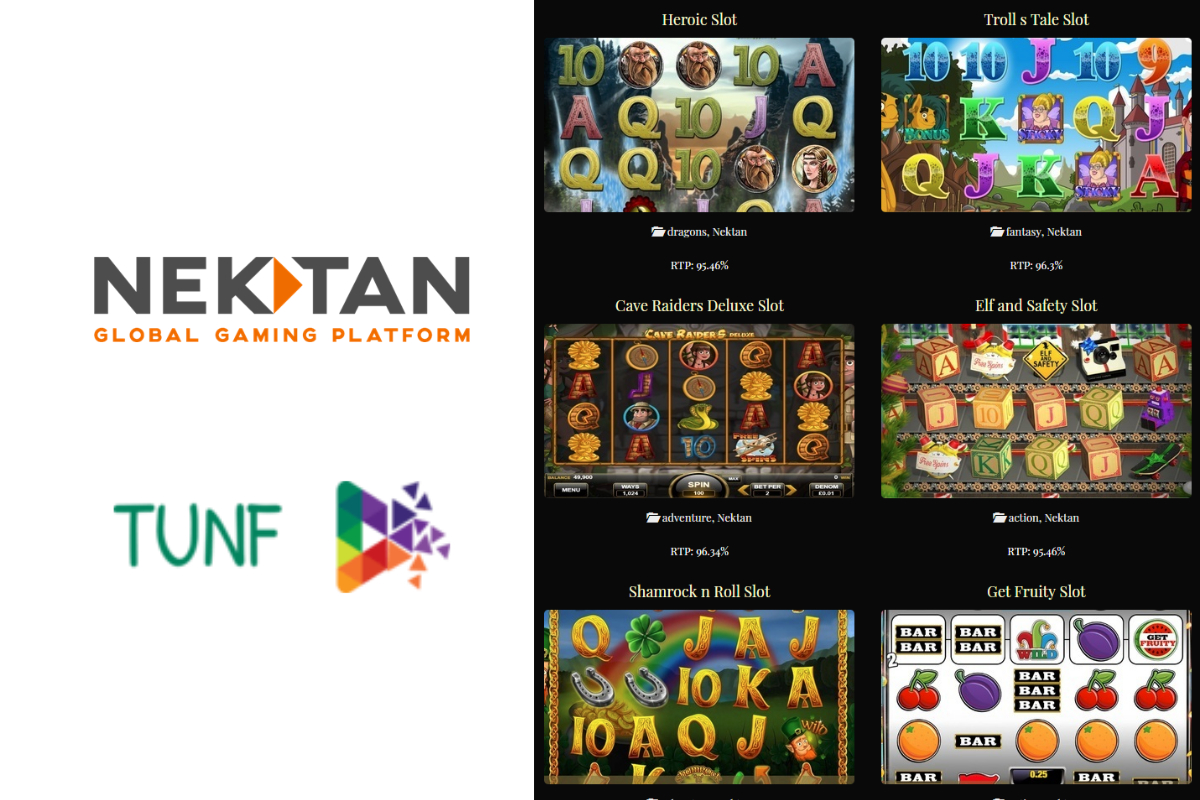

Fans of Nektan slot machines just got a boost from the company’s contribution to the extensive slot machine library at Tunf.com.

Nektan games are widely known in this industry. The company has a long history of innovating and producing exciting games for players in real casinos. This series of online games also have many of the same features that appear in the real casino games.

The addition of Nektan games to the Tunf slots library signals an exciting development for players. It is now possible to enjoy the best slot machines on the Web right from one convenient location. Examples of popular Nektan games include Plucky Pirates, Shamrock’n’Roll, Meow Money, Dragon’s Dynasty and Gunslinger’s Gold. All of these games are now listed within the themes inside of the filter menus, but players can also find them by typing the name of the game into a convenient search field. Tunf designed the site to make it simple and easy to get started playing the best slots on the Web.

This site is quickly developing as the Internet’s one-stop location for slot machine lovers. The site has an extensive library, and players can now quickly find their favorite Nektan slot games immediately. The games are played by simply using the site’s built-in software. The responsiveness of the games simulates the experience players have in real casinos, and this is a huge deal for slot machine players. Many of these players tried slots on other sites where the reaction time was not good. The Nektan slot machines create a powerful experience that will allow players to feel as if they are playing the slots in a real casino. Additional sound effects, premium graphics and animations complete that effect.

There are many additional features on the site that players will come across as well. For example, the return-to-player number is listed below each game, and it gives players information about the previous payout rate of the game.

Latest News

William Hill Announced as Official Betting Partner of Qipco Guineas Festival

Leading bookmaker becomes official betting partner of first UK Classic meeting of 2024

William Hill has been announced as the new official betting partner of the Qipco Guineas Festival, the first UK Classic meeting of the season.

It’s the latest addition to William Hill’s spring racing roster, following sponsorship of The Lincoln Handicap at Doncaster, the Punchestown Champion Chase and its status as official betting partner of the Randox Grand National Festival.

The 2,000 and 1,000 Guineas headline the three-day meeting and the leading bookmaker will sponsor 15 races across the weekend with the Jockey Club Stakes, Palace House and Dahlia Stakes among the races now featuring the William Hill title.

Aidan O’Brien’s unbeaten superstar City of Troy is still all the rage for the 2,000 Guineas at 4/6 whereas Karl Burke’s Fallen Angel heads a competitive looking 1,000 Guineas market at 7/2.

“We’re delighted to become the official betting partner of the Qipco Guineas Festival, strengthening our relationship with The Jockey Club on the back of a fantastic Grand National Festival,” a spokesperson for William Hill, Lee Phelps, said. “It’s brilliant for William Hill to be associated directly with such a prestigious event at Newmarket, the home of the thoroughbred, for this season’s first two Classics. The company has a close connection with the history of the 2,000 Guineas as William Hill himself bred the 1949 winner, Nimbus, who then went on to win the Derby.

“We’re excited to be involved at racing’s key meetings and see the Qipco Guineas Festival as the perfect sponsorship as the British flat season kicks into gear.”

Newmarket – 2,000 Guineas: May 4, 2024

| City Of Troy | 4/6 |

| Rosallion | 4/1 |

| Notable Speech | 12/1 |

| Henry Longfellow | 12/1 |

| Night Raider | 16/1 |

| Alyanaabi | 16/1 |

| Ancient Wisdom | 16/1 |

| Task Force | 16/1 |

| Ghostwriter | 16/1 |

| Iberian | 20/1 |

| BAR | 25/1 |

Newmarket – 1,000 Guineas: May 5, 2024

| Fallen Angel | 7/2 |

| Ylang Ylang | 4/1 |

| Dance Sequence | 5/1 |

| Ramatuelle | 10/1 |

| See The Fire | 12/1 |

| Content | 12/1 |

| One Look | 14/1 |

| Pretty Crystal | 14/1 |

| Buttons | 20/1 |

| Purple Lily | 20/1 |

| Porta Fortuna | 20/1 |

| Star Style | 20/1 |

| BAR | 25/1 |

Gaming

Midjiwan Supports Reforestation Efforts With New Elyrion Tribe Skin In The Battle Of Polytopia

Midjiwan, the award-winning independent studio behind The Battle of Polytopia, is celebrating Elyrion (∑∫ỹriȱŋ) Tribe Week with a brand-new Midnight (₼idŋighţ) skin and donations to support reforestation.

Tapping into the Elyrion Tribe’s nature magic abilities, every purchase of an Elyrion item in the game will plant one real-world tree from April 22-28 2024. Midjiwan has teamed up with The Canopy Project, an organisation that works with global partners to reforest areas in urgent need of rehabilitation, combining The Battle Of Polytopia’s themes with a desire to make real change in the world. Previous years of Elyrion Tribe Week have resulted in the planting of over 12,000 trees.

The Elyrion Tribe is a mysterious group of elves, dedicated to defending their woodland home with their unique magic and connection with nature. Players using the Elyrion tribe have the ability to enchant animals into Polytaurs and summon powerful Fire Dragons.

Christian Lövstedt, General Manager at Midjiwan, commented:

“This is a hugely exciting partnership, allowing players to support the planet and contribute to reforestation whilst also accessing brilliant new content to use in The Battle Of Polytopia.”

Alongside donating to The Canopy Project, The Battle Of Polytopia also boasts a brand-new skin for the Elyrion Tribe! The Midnight skin allows players to create graves, build crypts, and summon demons in dark forests, all in service of the mysterious Shard of D’Naeh.

The Midnight skin re-skins the entire Elyrion Tribe as the Midnight Cult. Everything the Elyrion Tribe is all about – nature, enchantment, and sanctuary – is turned on its head, corrupted into a dark, twisted dystopia of itself.

Midjiwan has already invested €250,000 in solar power projects in rural areas around Africa, and other charitable projects. The studio continues to seek opportunities to combine its in-game creativity with real-world benefits. The Battle of Polytopia is available on Nintendo Switch, the App Store, Google Play, PC, and Tesla cars.

Bitcoin

Should iGaming Be Worried About 2024 Bitcoin Halving?

In its LinkedIn newsletter, ‘The SOFTSWISS Special’, SOFTSWISS, a global tech expert with over 15 years of experience in iGaming, delves into the impact of Bitcoin Halving on the iGaming realm.

The recent historical moment of Bitcoin Halving took place on 19th April 2024. SOFTSWISS, a pioneer in crypto-friendly iGaming software, shares its insights and forecasts for how this event may shape the future of iGaming, shedding light on potential opportunities and challenges for industry stakeholders.

What is Bitcoin Halving?

The Bitcoin halving is a scheduled event that occurs approximately every four years or every 210,000 blocks. During this event, the reward for mining and verifying new blocks is reduced by 50%, resulting in miners earning only half the number of BTC per mined block.

Since its launch in 2009, Bitcoin’s mining reward has halved four times, occurring in 2012, 2016, 2020, and 2024. The recent April halving reduced the reward to 3.125 BTC per block. Such events are crucial for Bitcoin’s scarcity and inflation control, ensuring that the total supply never exceeds 21 million coins and aligning with its deflationary principles.

Historically, each halving event has resulted in a rise in Bitcoin’s price. This is attributed to the reduced supply and increased scarcity, although other market factors have also influenced these outcomes.

Exploring the Impact of Bitcoin Halving on the iGaming Industry

To provide an in-depth analysis of the Bitcoin Halving impact on iGaming, SOFTSWISS invited Bradley Peak, blockchain expert and tokenomics adviser, to share its anticipations.

- Bets rise: The halving is expected to lead to an increase in Bitcoin’s value. If the trend of impressive price surges persists, Bitcoin-friendly iGaming brands could see a positive impact.

- Crypto adoption increase: Implementing crypto-friendly models has the potential to boost player trust and transparency in iGaming. Additionally, it could rejuvenate unique gaming experiences like provably fair games and decentralised casinos.

- Regulatory frameworks improvement: The recent Bitcoin halving could prompt regulatory bodies to reassess their stance on cryptocurrency gambling. This could lead to new regulations ensuring fairness, responsible gambling, and anti-money laundering measures in the crypto-driven iGaming sector.

Bradley Peak, blockchain expert, comments on the recent changes: “Any transformation will not be without its challenges. It is important to adapt – invest in employee learning and development, onboard crypto processing, and make sure your platform remains secure in the process.”

Explore the influence of the 2024 Bitcoin Halving on the iGaming industry in the fourth edition of The SOFTSWISS Special newsletter on LinkedIn.

About SOFTSWISS

SOFTSWISS is an international tech company supplying software solutions for managing iGaming projects. The expert team, which counts over 2,000 employees, is based in Malta, Poland, and Georgia. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.

-

Central Europe6 days ago

Central Europe6 days agoWazdan amplifies Swiss presence with Swiss4Win launch

-

Latest News6 days ago

Latest News6 days agoEvoplay strikes distribution agreement with Light & Wonder

-

eSports6 days ago

eSports6 days agoEverything you need to know ahead of ESL Pro League Season 19

-

Central Europe6 days ago

Central Europe6 days agoAleatrust Signs Up as Supporting Member of the Austrian Sports Betting Association

-

Latest News6 days ago

Latest News6 days agoWeek 16/2024 slot games releases

-

Latest News6 days ago

Latest News6 days agoCasino Guru’s Complaint Resolution Center Leads Industry in 2023

-

Latest News6 days ago

Latest News6 days agoGood 1st quarter of 2024 for FDJ, in line with Group projections

-

Latest News6 days ago

Latest News6 days agoNew Market Alert! Hacksaw Gaming Touch Down in Portugal with Solverde.pt