Press Releases

Amelco and RISQ team up to provide groundbreaking risk-free sports betting

Partnership to deliver revolutionary new sports betting solution for operators in industry first

Amelco, the leading sports betting software and trading services provider has teamed up with RISQ to offer a unique model to sportsbook platforms and their clients.

The first of its kind, the collaboration will see Amelco offer its clients the option a fixed percentage of sports betting turnover rather than the traditional gross gaming revenue-led deals where their clients are exposed to loss making periods.

Traditionally, when an operator decides to offer sports betting as a standalone or additional product vertical, it splits revenues with the platform provider and usually in favour of the client, however – when a sportsbook has a losing month, the client also takes all the downside.

In partnership with RISQ, who will provide its financial liquidity and sports trading expertise to take on the risk posed by the variance inherent in sports betting, Amelco believes this new industry model will redefine operator-client sports betting partnerships.

Commenting on the deal, Sam Foulkes, Trading Director at Amelco said:

“This service is set to offer the industry a completely new trading instrument and a unique opportunity for our clients – and we’re delighted to be delivering something so innovative.

“RISQ is unrivalled when it comes to experience in sports betting analytics, coupled with access to liquidity, risk management tools and pricing expertise – and this service is a very exciting proposition.”

Tom Mitchell of RISQ added:

“We’re thrilled to partner with a leading, established tech company like Amelco on this deal and to notch-up another industry first. We feel this really is something very innovative that cements our position at the forefront of risk management and sports trading services for the global gaming industry.”

With more than a decade of experience in supplying tailored software solutions for pricing, trading and execution, Amelco provides bespoke enterprise sports betting and trading platforms to a large number of leading sportsbooks around the world.

As well as its latest groundbreaking proposition, this year has also seen Amelco launch Quantum Omnichannel, the industry’s first fully automated price differentiation model, as well as Quantum Outrights, the industry’s most advanced football outright pricing model.

Industry News

Europe Sports Betting Market Size, Share & Trends Analysis Report 2024-2030 Featuring Bet365, William Hill, Betfair, Paddy Power, 888sport, Bwin, Unibet, Ladbrokes, MGM, and Betsson

The “Europe Sports Betting Market Size, Share & Trends Analysis Report by Type, Platform, Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others), Country, and Segment Forecasts, 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

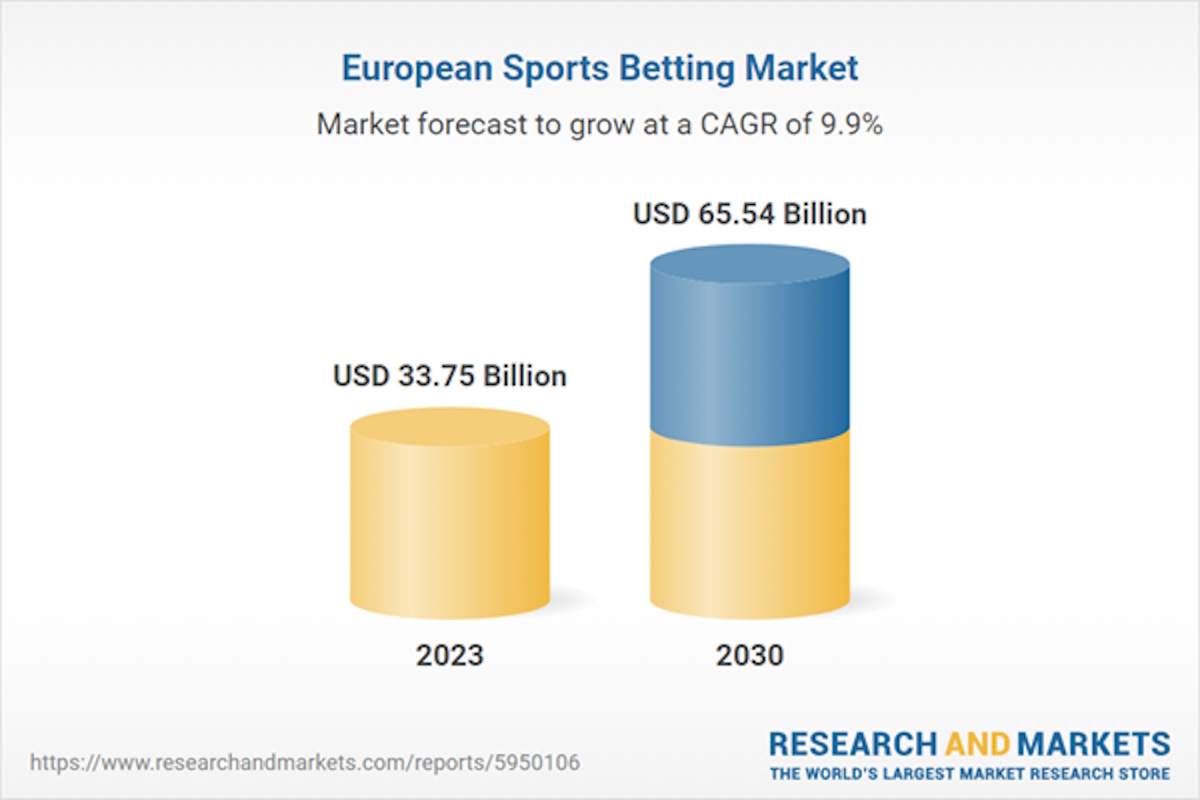

The Europe sports betting market size is anticipated to reach USD 65.54 billion by 2030 and is expected to expand at a CAGR of 9.9% from 2024 to 2030

The globalization of sports and the integration of international leagues and tournaments into European betting markets have fueled the growth of sports betting. Major sporting events such as the FIFA World Cup, UEFA European Championship, Wimbledon, and the Olympics attract widespread attention and betting interest from European consumers, driving significant betting volumes and revenues for sports betting operators, thus driving the growth of the sports betting market in Europe.

The COVID-19 pandemic had a negative impact on the European sports betting market. The cancellation or postponement of sports events during the pandemic restrained the market growth. With major tournaments, leagues, and competitions either suspended or canceled outright, the absence of live sports events severely diminished consumer betting opportunities. It led to a significant decline in betting volumes and revenues for sports betting operators.

The presence of favorable betting policies in the region is driving the growth of the sports betting market in the region. Many European countries, such as the UK, Ireland, Denmark, and France, have progressive policies promoting a competitive and well-regulated betting market. It facilitates the entry of new operators into the market and encourages competition, leading to innovation, improved services, and better value for consumers.

Moreover, established responsible gambling initiatives and regulatory bodies in Europe, such as the European Gaming & Betting Association, help build trust and confidence among consumers by promoting responsible gambling practices, ensuring fairness and transparency in betting operations, and providing avenues for dispute resolution, to protect consumers and maintain the integrity of the betting market, thus driving the growth of sports betting market in the region.

Europe Sports Betting Market Report Highlights

- Based on the type of betting, the fixed odd wagering segment accounted for the highest revenue share of 27.7% in 2023 due to the stability and predictability of the payouts

- Based on platform, the online segment dominated the market in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. It can be attributed to the collaborations between sports teams, leagues, and betting companies, thus increasing the visibility of sports betting and attracting a larger customer base.

- In terms of sports type, the football segment accounted for the largest revenue share in 2023. It can be attributed to the popularity of football in Europe due to popular football clubs like Real Madrid, Liverpool FC, FC Barcelona, and Manchester United.

- The UK held a significant share of 34.6% in 2023 and is expected to grow at a significant CAGR during the forecast period. Favorable gambling policies in the country drive the market’s growth.

Company Profiles

- Bet365

- Ali William Hill

- Betfair

- Paddy Power

- 888sport

- Bwin

- Unibet

- Ladbrokes

- MGM Resorts International

- Betsson

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 80 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $33.75 Billion |

| Forecasted Market Value (USD) by 2030 | $65.54 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Europe |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Europe Sports Betting Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing number of sport events

3.2.1.2. Growing number of sporting events and leagues in Europe

3.2.2. Market restraint analysis

3.2.2.1. Lack of unified regulations

3.2.3. Market opportunity analysis

3.2.3.1. Growth in E-sports audience

3.3. Europe Sports Betting Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.2. PESTEL Analysis

Chapter 4. Europe Sports Betting Market: Platform Estimates & Trend Analysis

4.1. Platform Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Europe Sports Betting Market by Platform Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

4.4.1. Offline

4.4.2. Online

Chapter 5. Europe Sports Betting Market: Type Estimates & Trend Analysis

5.1. Type Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Europe Sports Betting Market by Type Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

5.4.1. Fixed odds wagering

5.4.2. Exchange Betting

5.4.3. Live/In Play Betting

5.4.4. eSports Betting

5.4.5. Others

Chapter 6. Europe Sports Betting Market: Sports Type Estimates & Trend Analysis

6.1. Sports Type Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Europe Sports Betting Market by Sports Type Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

6.4.1. Football

6.4.2. Basketball

6.4.3. Baseball

6.4.4. Horse Racing

6.4.5. Cricket

6.4.6. Hockey

6.4.7. Others

Chapter 7. Europe Sports Betting Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.4. Company Profiles

For more information about this report visit researchandmarkets.com

Latest News

NeoGames’ Christopher Shaban appointed Managing Director iLottery

NeoGames S.A, a technology-driven provider of end-to-end iGaming and iLottery solutions, has made a key appointment to the leadership team of its iLottery business unit with Christopher Shaban becoming Managing Director, iLottery.

This is the latest phase of NeoGames’ organizational restructure to support its upcoming plans as the company progresses towards the closing of its acquisition by Aristocrat, expected in the second quarter of fiscal year 2024.

With his appointment effective immediately, Shaban will oversee all iLottery activity for the NeoGames Group globally, including new business, customer growth, the continued global expansion of NeoGames’ iLottery solution, and lastly, NeoGames Studio, the Company’s in-house game studio.

Shaban brings a wealth of knowledge to the position with over 27 years of experience in the global lottery industry. He joined NeoGames in 2021 in the role of EVP Global Business and Customer Development for the Company’s iLottery business.

Moti Malul, Chief Executive Officer at NeoGames, said: “Chris is hugely respected within the lottery industry and his track record speaks for itself. I am thrilled about his appointment and look forward to seeing him drive us forward in our iLottery business.”

Latest News

BETCORE Expands Reach with Launch of iGaming Products at BOOMPARI Bookmaker

BETCORE, a leading provider of top-notch iGaming products, has announced its successful integration with BOOMPARI Bookmaker, marking a significant milestone in its rapid expansion across the iGaming industry.

Despite its recent launch, BETCORE has swiftly gained popularity and secured partnerships worldwide, cementing its position as a trusted provider of innovative gaming solutions. The latest collaboration with BOOMPARI Bookmaker reflects BETCORE’s commitment to delivering exceptional gaming experiences to players globally.

BOOMPARI Bookmaker, a burgeoning player in the online betting market since its establishment in 2015, has quickly garnered a reputation for providing lucrative and reliable conditions for sports betting enthusiasts. With a diverse offering that includes sports betting, live betting, e-sports, casinos, and TV games, BOOMPARI Bookmaker is poised to captivate players with its comprehensive gaming portfolio.

“We are thrilled to join forces with BOOMPARI Bookmaker and expand our presence in the global iGaming field,” said BETCORE CEO Peter Korpusenko. “This partnership underscores our dedication to offering cutting-edge gaming solutions that enhance the player experience and drive engagement.”

As part of the collaboration, BETCORE has seamlessly integrated its flagship verticals into the BOOMPARI platform, including:

- TVBET: Offering a captivating array of live games broadcast worldwide 24/7.

- El Casino: Featuring immersive live Roulette game that emulate the ambiance of a real casino.

- FASTSPORT: Providing thrilling local sports matches with an extensive line of bets and dynamic odds.

“This is a strategic step for our company to move to a new level in iGaming. I am sure that integration with such a reliable supplier of innovative products as BETCORE will bring great prospects for our organization to further development and strengthening our positions in the market,” said BOOMPARI CEO Boris Pokrovskij.

Games from BETCORE are now available for play on the BOOMPARI website, offering players an enhanced gaming experience and access to a wide range of entertainment options.

-

Industry News7 days ago

Industry News7 days agoFullCircl Announces Appointment of Georgio Anastasi as CFO

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoSpanish Advertising Restrictions Struck Down: Learn More at the 2024 Gaming in Spain Conference

-

Asia6 days ago

Asia6 days agoAsia-Pacific Sports Betting Market Report 2024-2030, Featuring Dafabet, SBOBET, 1xBet, TAB, CrownBet, UBET, Sports Toto Malaysia, Mansion88, 12BET and W88

-

Asia7 days ago

Asia7 days agoProfiles of Animesh Agarwal, Naman Mathur, Payal Dhare and Tirth Mehta

-

Australia7 days ago

Australia7 days agoVGCCC Introduces New Rules for Wagering Account Statements

-

Latest News7 days ago

Latest News7 days agoSOFTSWISS & BitStarz Celebrate Ten Years of Partnership

-

eSports6 days ago

eSports6 days agoCopenhagen Major 2024 – Betting Overview

-

Compliance Updates6 days ago

Compliance Updates6 days agoIOC and UEFA host joint betting integrity workshop