Affiliate Industry

LeoVegas AB Q4: Quarterly report 1 October – 31 December 2019. LeoVegas reiterates its long-term financial targets, remove short term financial targets and raises the dividend

“We have entered 2020 with good underlying growth and profitability, and an ever-stronger balance sheet”

– Gustaf Hagman, Group CEO

FOURTH QUARTER 2019: 1 october–31 december 2019[1]

- Revenue increased by 3% to EUR 87.1 m (84.5).

- EBITDA was EUR 14.5 m (8.1), corresponding to an EBITDA margin of 16.7% (9.6%)

- Adjusted EBITDA was EUR 9.2 m (8.1), corresponding to a margin of 10.6% (9.6%).

- The number of depositing customers was 351,613 (327,156), an increase of 7%.

- The number of returning depositing customers was record-high 207,982 (181,747), an increase of 14%.

- Adjusted earnings per share were EUR 0.06 (0.06).

Events during the quarter

- LeoVegas investment company LeoVentures sold the subsidiary Authentic Gaming to Genting. The sales price was EUR 15.2 m on a debt-free basis and generated a capital gain of EUR 11.4 m.

- LeoVegas carried out strategic measures in the UK and has called off a move to new offices in Malta. These initiatives will lead to annual cost savings of approximately EUR 3.7 m. Restructuring costs of EUR 6.1 m are reported under items affecting comparability for the fourth quarter. At the same time, an impairment loss of EUR 10.2 m has been recognised for the Royal Panda investment.

Events after the end of the quarter

- Preliminary revenue of EUR 30,1 m in January (28.7), representing growth of 5%.

- In light of a more pronounced focus on profitability in an increasingly dynamic business environment LeoVegas has decided to remove the financial targets to reach sales of EUR 600 m and EBITDA of EUR 100 m by 2021. At the same time, the company has reaffirmed its long-term financial target to achieve organic growth that outperforms the online gaming market and an EBITDA margin of no less than 15%.

- LeoVegas’ Chairman, Mårten Forste, hired as new COO in Malta.

- The Board of Directors proposes a dividend of SEK 1.40 per share (1.20), an increase of 17%, to be paid out – as in the preceding year – on two occasions during the year.

COMMENT FROM GUSTAF HAGMAN – GROUP CEO

sustainability and long-term growth

During 2019 we worked hard to reduce complexity in the Group, be more efficient and adapt to the changes taking place in the gaming industry. In parallel with this we have enhanced the attraction of our product through new functionality and greater personalisation. We have launched new brands, focused more on Casino, and expanded to new markets. Towards the end of the year we intensified the integration of our previous acquisitions, which is expected to contribute to cost savings and increased economies of scale.

Our investments in sustainability have been particularly meaningful, where LeoVegas is one of the leading operators. For example, today we have some 70 employees who work exclusively with responsible gaming and compliance.

an industry in change

2019 was a year characterised by change in our industry, with external challenges coupled to higher demands for compliance, higher gambling taxes and undertainty surrounding future regulation. In the near term this is presenting challenges to navigate in an increasingly complex world, but it also presents long term competitive advantages for a company like LeoVegas, which has a scalable organisation, proprietary technology and focus on sustainable growth along with an increasingly broader revenue base spread across several markets and brands.

We have entered 2020 with a good starting point, with an increasingly efficient organisation and many ongoing initiatives surrounding product innovation and brand expansion. Owing to the increasingly dynamic business environment and a more pronounced focus on profitability, we have decided to remove our financial targets for 2021 while we reiterate our long-term financial targets of organic growth in excess of the market and an EBITDA margin of at least 15%.

At the same time, our underlying profitable growth and favourable financial position have created the foundation for the Board’s proposal to raise the dividend for 2019 by 17% to SEK 1.40 per share.

fourth quarter 2019

Revenue for the fourth quarter amounted to EUR 87.1 m (84.5), representing organic growth of 3%. Growth during the period remained good in most of our markets. Excluding the UK market, organic growth in local currencies was 11%. We are especially pleased with our performance in Sweden, where we continue to take market shares.

EBITDA for the fourth quarter adjusted for items affecting comparability during the period totalled EUR 9.2 m (8.1), corresponding to an EBITDA margin of 10.6% (9.6%). We thereby improved our underlying profit by 13% compared with a year ago despite a higher burden from gambling taxes and increased regulatory complexity, which confirms that our focus on efficiency and cost control is yielding the desired result.

A couple of weeks ago we communicated a number of strategic decisions coupled mainly to the UK and our ambitions to create a less complex and more scalable organisation. These initiatives gave rise to one-off restructuring costs that affected fourth quarter earnings by a total of EUR 6.1 m and are expected to lead to annual cost savings of approximately EUR 3.7 m. The savings consist mainly of platform and product costs, a more efficient organisation and more optimized premises.

During the fourth quarter we recognised a capital gain on the sale of Authentic Gaming, which was sold in October. The capital gain was EUR 11.4 m. EBIT for the fourth quarter was also affected by an impairment loss of EUR 10.2 m related to goodwill in Royal Panda.

markets

We had favourable performance in most of our markets during the full year 2019. Three of our major markets, Sweden, the UK and Germany, underwent major changes during the past year. In Germany, the removal of a key payment services provider affected our revenue during the fourth quarter. Development improved gradually during the quarter in pace with customers finding alternative payment methods. We are now growing again sequentially month-on-month in Germany. We are confidently waiting for clarity regarding what future regulation will look like in Germany. Based on the most recent information, the German federal states are now in agreement to regulate the market at the national level at the end of 2021.

As previously communicated, we are addressing the challenges in the UK by migrating all of our brands in the UK to our proprietary technical platform. In parallel with this we are refining our brand portfolio and closing Royal Panda in the UK. Altogether these measures are leading to a more focused and efficient operation and opening up economies of scale within the Group. Revenue for the remaining operations in the UK, consisting of 13 brands, grew 15% over the third quarter and showed good profitability. Royal Panda will now focus entirely on fast-growing markets outside the UK.

In the Swedish market we are stronger than ever. It is clear that we are benefiting from our strong brand, focus on responsible gaming and experience from regulated markets. In addition, GoGoCasino has exceeded our expectations and was successful in the strategy of filling an empty space in the Swedish casino market. December was record-strong and we ended the year with revenue as well as the number of customers at record high levels. During 2020 we expect to see the authorities taking a harder line against unlicensed actors, which will improve channelisation and consumer protection in the Swedish market.

Comments on first quarter 2020

Revenue for the month of January amounted to EUR 30.1 m (28.7), representing growth of 5%.

Royal Panda in the UK, which was closed in January, is not expected to generate any significant revenue during the first quarter. During the fourth quarter Royal Panda generated revenue of EUR 1.1 m in the UK.

With good momentum in many of our markets and a number of growth initiatives, we are looking forward to the remainder of 2020. We continue to work hard to deliver profitable growth at the same time as we are working to live up to our vision, to be “King of Casino”.

Presentation of the report – today at 09:00 CET

To participate in the conference call, and thereby be able to ask questions, please call one of the following numbers: SE: +46 (0) 8 50 69 21 80, UK: +44 (0) 20 71 92 80 00, US: +1 63 15 10 74 95, Confirmation code: 9682129 or join at the web https://edge.media-server.com/mmc/p/g9y6w2q8

Affiliate Industry

47 New Brands in Q1’24: Affilka by SOFTSWISS Results

Affilka by SOFTSWISS, a leading affiliate management software provider, is approaching a new milestone of 360 brands in Q1’24.

The first quarter of the year brought remarkable achievements to the Affilka by SOFTSWISS team. The Asian gaming community recognised the company’s affiliate management software as the Best Affiliate Marketing Solution on the market.

This year, Affilka’s team participated in iGB Affiliate London 2024 with a dedicated stand for the first time. During the concurrent iGB and ICE events, the team had nearly 200 meetings over several days. First agreements quickly followed and were signed shortly after the exhibition period.

Affilka by SOFTSWISS experienced substantial growth, adding 47 new brands to its partner network, bringing the total to nearly 360 brands in Q1 2024. More than 33 thousand new affiliate accounts were registered during this period, marking a 118% increase compared to the previous year’s last quarter.

The rise in new affiliate accounts has led to an acceleration in new player registrations, exceeding 7.4 million over the first quarter of the year. Compared to the last quarter of 2023, this metric demonstrated a 106% increase.

The number of unique clicks on referral links with Affilka by SOFTSWISS during this period showed 115% growth and reached almost 436 million in absolute numbers. The rising metrics underscore the crucial role of effective affiliate management in achieving success within the iGaming industry.

Moving to the financial metrics of Affilka by SOFTSWISS, stable growth is evident over the first quarter of 2024 compared to the last quarter of 2023. The affiliate GGR revealed a 112% increase, while the player deposit amount showed a 113% enlargement. The growth within affiliate payments amounted to 117% in Q1’24 compared to the previous quarter.

Anastasia Borovaya, Head of Affilka by SOFTSWISS, summarises: “The recent product performance showcases a steady and continuous growth trajectory, a testament to our ongoing investment in innovation and user experience enhancement. Acknowledging affiliate marketing’s crucial role in the iGaming ecosystem, we prioritise delivering exceptional service to exceed our clients’ expectations.”

The global affiliate marketing industry is expected to double in size within the next five years. Finding a reliable affiliate marketing platform provider ensures a competitive edge in the rapidly expanding market.

The team is ready to share valuable industry insights and unveil the upcoming updates at the SiGMA Americas Summit in San Paulo on 23–25 April. Clients and potential partners can book a meeting with the Affilka team at stand i70 on the SOFTSWISS events page.

About SOFTSWISS

SOFTSWISS is an international tech company supplying software solutions for managing iGaming projects. The expert team, which counts over 2,000 employees, is based in Malta, Poland, and Georgia. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.

Affiliate Industry

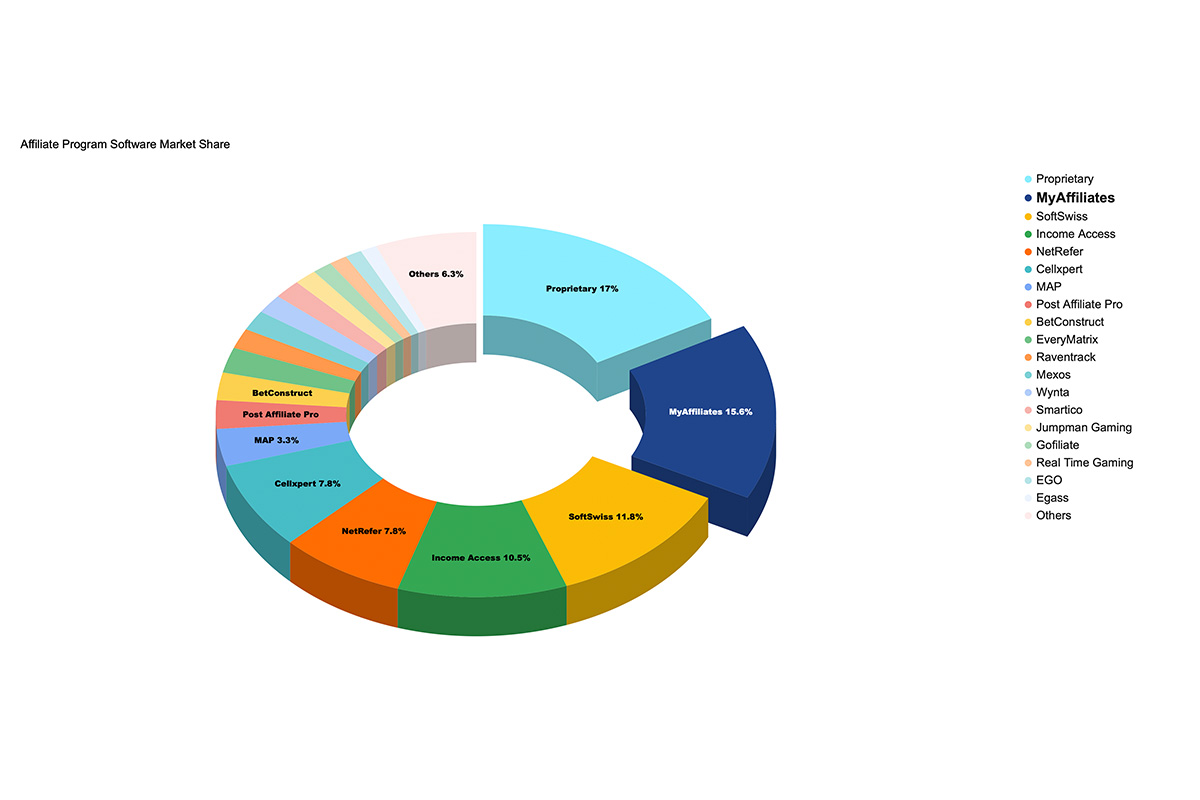

StatsDrone data reveals MyAffiliates as the most used affiliate marketing software by the iGaming industry

New research from StatsDrone – the affiliate programme stats tracker – today, Thursday 11 April, unveils MyAffiliates as the most used affiliate marketing software in the gaming industry.

The research was conducted this month – April 2024 – on a sample of 1,100 affiliate programs with the latest StatsDrone data revealing that MyAffiliates is used by almost 16% of gaming operators, followed by Affilka (11.8%), Income Access (10.5%) and NetRefer (7.8%).

MyAffiliates is an established affiliate marketing software platform, empowering iGaming operators to combine all of their gaming brands and products under one umbrella affiliate system. It has been in operation since 2007.

The findings of the latest research, affirms MyAffiliates’ position as the preferred choice among gaming operators and, with nearly 16% of operators utilizing its software, has today cemented its position as a market leader.

Furthermore, with 17% of gaming operators still relying on proprietary software, the potential for solutions such as MyAffiliates is significant. As a ready-built solution, MyAffiliates seeks to further expand their market share and empower more operators to optimize their affiliate marketing strategies.

John Wright, CEO of StatsDrone, expressed his insights regarding MyAffiliates’ dominance in the iGaming industry, stating, “We know that MyAffiliates has an advanced platform for operators and is one of the reasons we know that MyAffiliates has become the most popular affiliate platform in iGaming. We hear from affiliates it is one of their preferred platforms to work with so, for us, it isn’t much of a surprise to see why operators choose MyAffiliates. In the last 6 months, we’ve noticed more MyAffiliates brands being requested on our platform, and I can’t see why that trend won’t continue.“

Clemence Dujardin, MyAffiliates Group CEO comments: “Considering this significant milestone, we at MyAffiliates extend our heartfelt gratitude to our clients and partners for their unwavering trust and support. This achievement underscores not only the effectiveness of the MyAffiliates platform but also the dedication of our team to continually innovate and provide unparalleled service to our users.” She added, “As the leading affiliate marketing software in the iGaming industry, MyAffiliates remains committed to delivering cutting-edge solutions that empower gaming operators to maximize their affiliate programs’ performance and ROI.”

Affiliate Industry

Affilka by SOFTSWISS Announces Partnership with 10bet

Affilka by SOFTSWISS, a leading provider of affiliate tracking software for the iGaming industry, announces a new collaboration with 10bet, a prominent player in the iGaming realm.

10bet operates in diverse markets, including Europe, LatAm, and Africa. Offering both casino and sportsbook solutions, 10bet brings over 20 years of global experience and expertise to the table.

This partnership marks a significant milestone for both companies as they join forces to enhance affiliate marketing strategies and expand their market reach. 10bet has already launched seven brands through the collaboration with Affilka by SOFTSWISS. Five of these brands were successfully migrated, while two were created from scratch, with another one to follow shortly.

Notably, 10bet made a strategic decision to transition from third-party software to leverage the advanced features and tailored solutions offered by Affilka by SOFTSWISS. Thanks to a designated Project Manager in the 10bet team, the integration process was smooth and seamless. Allocating a single point of contact is crucial to ensure effective migration and ongoing success.

“We are delighted to partner with Affilka by SOFTSWISS,” says Yotam Peretz, VP of Acquisition at 10bet. “The platform provides us flexibility, reliability, and personalised support. That’s exactly what we need to optimise our affiliate programs and drive growth in our target markets. I’m sure this collaboration marks the beginning of an exciting and successful journey.”

Angelika Antonova, Head of Sales at Affilka by SOFTSWISS, comments on the recent partnership: “This migration serves as further validation of Affilka’s superiority over existing solutions in the market, highlighting its distinct advantages. We are happy to welcome 10bet to the Affilka family. This partnership signifies our shared vision for excellence in affiliate marketing. We look forward to collaborating with the 10bet team to deliver outstanding results and unlock new opportunities in the dynamic iGaming landscape.”

Affilka by SOFTSWISS is ready to present valuable industry insights and unveil the upcoming reporting system updates at the SiGMA Americas Summit in San Paulo on 23–25 April. Clients and potential partners can book a meeting with the Affilka team at stand i70 on the SOFTSWISS events page.

About SOFTSWISS

SOFTSWISS is an international tech company supplying software solutions for managing iGaming projects. The expert team, which counts over 2,000 employees, is based in Malta, Poland, and Georgia. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.

-

Asia7 days ago

Asia7 days agoMaharashtra Government rewards state’s Asian Games 2022 Esports athletes with INR 10 lakhs; marks historic moment for Indian Esports

-

Central Europe6 days ago

Central Europe6 days agoWazdan amplifies Swiss presence with Swiss4Win launch

-

Latest News6 days ago

Latest News6 days agoEvoplay strikes distribution agreement with Light & Wonder

-

Asia7 days ago

Asia7 days agoPAGCor Welcomes Lawyer Wilma Eisma as New President and Chief Operating Officer

-

Compliance Updates7 days ago

Compliance Updates7 days agoGoldenRace is now certified in the Netherlands

-

Latest News7 days ago

Latest News7 days agoAltenar releases trio of betting widgets to enhance customer engagement

-

Australia7 days ago

Australia7 days agoSkyCity Appoints Jason Walbridge as Chief Executive Officer

-

Latest News7 days ago

Latest News7 days agoXtremepush Expands Reach in Brazil Through Senna Sport Deal