Industry News

Worldwide Casino Management Systems Market Insights, 2020-2027

The “Casino Management System Market Size, Share & Trends Analysis Report by Application (Security & Surveillance, Analytics, Accounting & Cash Management, Player Tracking), by Region, and Segment Forecasts, 2020 – 2027” report has been added to ResearchAndMarkets.com’s offering.

The global casino management system market size is expected to reach USD 15.5 billion by 2027, expanding at a CAGR of 14.9%.

The growing demand for casino establishments and increasing social acceptance of casinos are expected to emerge as crucial factors for driving the market. The increasing use of technological solutions and systems across gambling clubs to boost operational efficiency will further drive the growth of the market.

North America emerged as the highest revenue generating segment in 2019 and is expected to witness a CAGR of 13.8% from 2020 to 2027. However, it is estimated that Asia Pacific will witness significant growth and will exhibit the fastest CAGR of 16.8% over the forecast period. The growth of the casino gaming industry, especially in Japan, China, and India, is expected to play a major role in propelling the demand for the systems over the forecast period. Governments across the region are gradually legalizing casino gaming, owing to several social and economic benefits. Rising number of gambling establishments and evolving customer preferences towards casino-style gaming is anticipated to boost market growth.

Casino operations involve a multitude of monetary transactions, which have resulted in an increase in the number of fraud and spoofing attacks. To safeguard against cheating, fraud, and other crimes, gambling club operators are heavily investing in security and surveillance solutions to ensure a safe gaming environment across the floor. Hence, security and surveillance systems have become a vital component of a casino management system enabling gaming club operators to monitor and manage security threats in real time. Video analytics, license plate recognition, facial recognition, and automated surveillance technologies are being increasingly implemented across gambling clubs, which is expected to spur market growth.

Casino management system incorporate analytic tools, management systems, player tracking, and other tools. The analytics segment of the casino management system is expected to witness the fastest CAGR of 16.3% over the forecast period. Casino management systems are expected to witness high penetration as gaming clubs become more data driven and analytical tools can help gain a competitive edge.

Analytical tools offer varying insights on customer behaviour, game preferences, spending patterns, and win/loss probabilities. Such insights enable gambling club operators to deliver a personalized gaming experience, enhancing customer retention rate, and streamline gaming operations. However, emerging online gaming platforms are expected to gain increased market penetration owing to the evolving customer preferences, which is likely to hinder market growth.

Further key findings from the study suggest:

- The security and surveillance segment is expected to dominate the casino management system market and was valued at USD 1.2 billion in 2019. Advancements in automated security solutions is further expected to drive market growth in this segment

- The analytics segment is expected to witness significant growth at a CAGR of over 16% from 2020 to 2027. Analytical tools are likely to witness increased adoption over the forecast period owing to varying insights offered, enabling operators to remain profitable

- The player tracking segment was valued at USD 780.3million in 2019. Gaming club operators are incorporating digital technologies to deliver a more personalized gaming experience and drive customer retention rate

- Asia Pacific is expected to witness the highest growth rate over the forecast period. Increased demand for gambling establishments coupled with changing consumer preferences and rising disposable income will augment regional market growth

- Key players include International Game Technology (IGT), Micros Systems, Inc., Aristocrat Leisure Limited, Konami Corporation, Bally Technologies, and Honeywell International, Inc. Key players are adopting organic and inorganic growth strategies such as investments in R&D, product innovation, and M&A activities to acquire larger market share.

Key Topics Covered

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

1.3. List of Data Sources

1.4. List of Abbreviations

Chapter 2. Executive Summary

2.1. Casino Management Systems Market – Industry Snapshot & Key Buying Criteria, 2014-2027

2.2. Casino Management Systems Market, 2016 – 2027

Chapter 3. Casino Management System Industry Outlook

3.1. Market Segmentation

3.2. Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.3.3. Market opportunity analysis

3.4. Penetration & Growth Prospects Mapping

3.5. Industry Analysis – Porter’s Five Forces Analysis

3.6. PEST Analysis

Chapter 4. Casino Management System: Application Outlook

4.1. Casino Management System Market Estimates & Forecasts By Application, 2019 & 2027 (USD Million)

4.2. Security & Surveillance

4.3. Analytics

4.4. Accounting & Cash Management

4.5. Player Tracking

4.6. Property Management

4.7. Marketing & Promotions

4.8. Others

Chapter 5. Casino Management System Market: Regional Outlook

5.1. Casino Management System Market Estimates & Forecasts By Region, 2019 & 2027 (USD Million)

5.2. North America

5.3. Europe

5.4. Asia Pacific

5.5. Latin America

5.6. Middle East & Africa

Chapter 6. Competitive Landscape

6.1. Konami Corporation

6.2. Agilysys, Inc.

6.3. Bally Technologies

6.4. Casinfo Systems

6.5. International Game Technology (IGT)

6.6. LGS (Lodging & Gaming Systems)

6.7. Micros Systems, Inc. (Oracle Corporation)

6.8. Honeywell International, Inc.

6.9. Next Level Security Systems, Inc.

6.10. Aristocrat Leisure Limited

For more information about this report visit https://www.researchandmarkets.com/r/phnt1e

Industry News

Europe Sports Betting Market Size, Share & Trends Analysis Report 2024-2030 Featuring Bet365, William Hill, Betfair, Paddy Power, 888sport, Bwin, Unibet, Ladbrokes, MGM, and Betsson

The “Europe Sports Betting Market Size, Share & Trends Analysis Report by Type, Platform, Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others), Country, and Segment Forecasts, 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

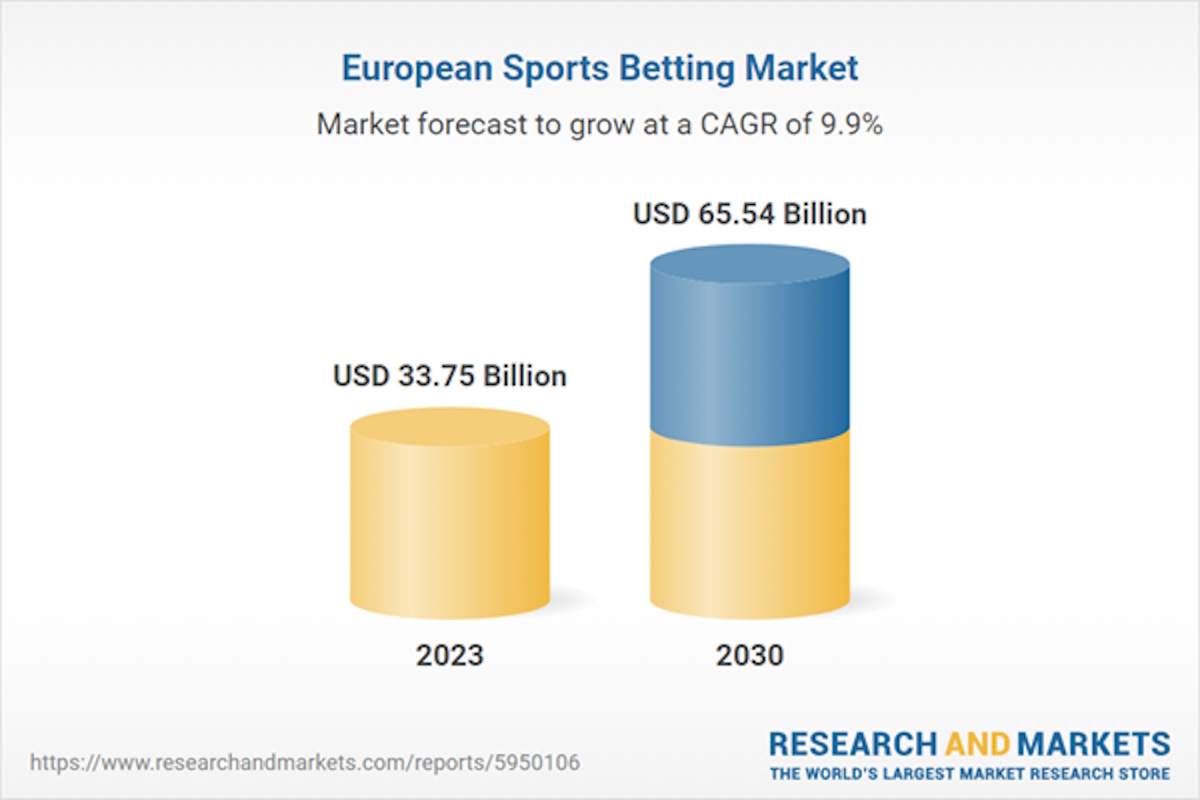

The Europe sports betting market size is anticipated to reach USD 65.54 billion by 2030 and is expected to expand at a CAGR of 9.9% from 2024 to 2030

The globalization of sports and the integration of international leagues and tournaments into European betting markets have fueled the growth of sports betting. Major sporting events such as the FIFA World Cup, UEFA European Championship, Wimbledon, and the Olympics attract widespread attention and betting interest from European consumers, driving significant betting volumes and revenues for sports betting operators, thus driving the growth of the sports betting market in Europe.

The COVID-19 pandemic had a negative impact on the European sports betting market. The cancellation or postponement of sports events during the pandemic restrained the market growth. With major tournaments, leagues, and competitions either suspended or canceled outright, the absence of live sports events severely diminished consumer betting opportunities. It led to a significant decline in betting volumes and revenues for sports betting operators.

The presence of favorable betting policies in the region is driving the growth of the sports betting market in the region. Many European countries, such as the UK, Ireland, Denmark, and France, have progressive policies promoting a competitive and well-regulated betting market. It facilitates the entry of new operators into the market and encourages competition, leading to innovation, improved services, and better value for consumers.

Moreover, established responsible gambling initiatives and regulatory bodies in Europe, such as the European Gaming & Betting Association, help build trust and confidence among consumers by promoting responsible gambling practices, ensuring fairness and transparency in betting operations, and providing avenues for dispute resolution, to protect consumers and maintain the integrity of the betting market, thus driving the growth of sports betting market in the region.

Europe Sports Betting Market Report Highlights

- Based on the type of betting, the fixed odd wagering segment accounted for the highest revenue share of 27.7% in 2023 due to the stability and predictability of the payouts

- Based on platform, the online segment dominated the market in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. It can be attributed to the collaborations between sports teams, leagues, and betting companies, thus increasing the visibility of sports betting and attracting a larger customer base.

- In terms of sports type, the football segment accounted for the largest revenue share in 2023. It can be attributed to the popularity of football in Europe due to popular football clubs like Real Madrid, Liverpool FC, FC Barcelona, and Manchester United.

- The UK held a significant share of 34.6% in 2023 and is expected to grow at a significant CAGR during the forecast period. Favorable gambling policies in the country drive the market’s growth.

Company Profiles

- Bet365

- Ali William Hill

- Betfair

- Paddy Power

- 888sport

- Bwin

- Unibet

- Ladbrokes

- MGM Resorts International

- Betsson

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 80 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $33.75 Billion |

| Forecasted Market Value (USD) by 2030 | $65.54 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Europe |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Europe Sports Betting Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing number of sport events

3.2.1.2. Growing number of sporting events and leagues in Europe

3.2.2. Market restraint analysis

3.2.2.1. Lack of unified regulations

3.2.3. Market opportunity analysis

3.2.3.1. Growth in E-sports audience

3.3. Europe Sports Betting Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.2. PESTEL Analysis

Chapter 4. Europe Sports Betting Market: Platform Estimates & Trend Analysis

4.1. Platform Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Europe Sports Betting Market by Platform Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

4.4.1. Offline

4.4.2. Online

Chapter 5. Europe Sports Betting Market: Type Estimates & Trend Analysis

5.1. Type Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Europe Sports Betting Market by Type Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

5.4.1. Fixed odds wagering

5.4.2. Exchange Betting

5.4.3. Live/In Play Betting

5.4.4. eSports Betting

5.4.5. Others

Chapter 6. Europe Sports Betting Market: Sports Type Estimates & Trend Analysis

6.1. Sports Type Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Europe Sports Betting Market by Sports Type Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

6.4.1. Football

6.4.2. Basketball

6.4.3. Baseball

6.4.4. Horse Racing

6.4.5. Cricket

6.4.6. Hockey

6.4.7. Others

Chapter 7. Europe Sports Betting Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.4. Company Profiles

For more information about this report visit researchandmarkets.com

Industry News

Leading online slot developer announces launch of Snoop’s High Rollers which will go live exclusively with popular crypto sportsbook and casino

Gaming Corps, a publicly listed game development company based in Sweden, has signed a major deal that will see it launch an exclusive slot game in collaboration with rap legend, Snoop Dogg. The game will drop exclusively on Roobet, the online casino where Snoop Dogg is a brand ambassador.

Snoop Dogg needs no introduction. He made his music industry debut when he appeared on Dr Dre’s 1992 album, The Chronic, and has since sold more than 50 million albums worldwide. He’s also made several movie and TV show appearances, making him one of the most iconic artists of all time.

The game is “Snoop’s High Rollers” and allows players to experience what it’s like to live life as a music legend. The soundtrack is inspired by Snoop’s early and later works and the main man has also narrated parts of the game to really bring it to life.

Snoop has also played a part in creating the gameplay, hand-picking mechanics and bonus features to really put his stamp on the game. Roobet has also got in on the action, leading to a unique online slot that will soar to the top of the charts among its players.

Snoop’s High Rollers will make its debut exclusively on Roobet, the crypto casino and sportsbook that has taken the market by storm since its launch in 2019. The casino’s team has put a comprehensive marketing strategy behind the game with plans to use it to drive new customer acquisition at scale.

“It is with much pride that we at Gaming Corps have had the chance to develop a game in close collaboration with Snoop Dogg and Roobet, where we have combined our unique gaming perspective with Snoop Dogg’s unparalleled style and charisma,” Juha Kauppinen, Gaming Corps CEO, said:-

“Our vision is to offer players an experience where music, culture and gaming merge into something extraordinary. Our close collaboration with Roobet has enabled us to do the impossible, namely world-class marketing, game release is planned for 20 of April. We’re thrilled, and discussions are already underway about several game concepts!”

Anthony Brennan, Head of Partnerships at Roobet, added: “Roobet loves pushing the envelope and never flinches at an opportunity to bring iGaming and pop culture together. Snoop loves his game, we love the game, and we’ve been delighted at the experience of building something that feels fresh in an industry full of remixes.

“We can’t say enough nice things about the Gaming Corps team, and we’re excited to hear what the gaming community has to say!”

Industry News

IDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution

IDnow, a leading identity verification provider in Europe, has unveiled VideoIdent Flex, a new version of its expert-led video verification service that blends advanced AI technology with human interaction. The human-based video call solution, supported by AI, has been designed and built to boost customer conversion rates, reduce rising fraud attempts, increase inclusivity, and tackle an array of complex online verification scenarios, while offering a high-end service experience to end customers.

The company’s original expert-led product, VideoIdent, has been a cornerstone in identity verification for over a decade, serving the strictest requirements in highly regulated industries across Europe. VideoIdent Flex, re-engineered specifically for the UK market, represents a significant evolution, addressing the growing challenges of identity fraud, compliance related to Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes and ensuring fair access and inclusivity in today’s digital world outside of fully automated processes.

As remote identity verification becomes more crucial yet more challenging, VideoIdent Flex combines high-quality live video identity verification with hundreds of trained verification experts, thus ensuring that genuine customers gain equal access to digital services while effectively deterring fraudsters and money mules. Unlike fully automated solutions based on document liveness and biometric liveness features, this human-machine collaboration not only boosts onboarding rates and prevents fraud but also strengthens trust and confidence in both end users and organisations. VideoIdent Flex can also serve as a fallback service in case a fully automated solution fails.

Bertrand Bouteloup, Chief Commercial Officer at IDnow, said: “VideoIdent Flex marks a groundbreaking advancement in identity verification, merging AI-based technology with human intuition. In a landscape of evolving fraud tactics and steady UK bank branch closures, our solution draws on our decade’s worth of video verification experience and fraud insights, empowering UK businesses to maintain a competitive edge by offering a white glove service for VIP onboarding. With its unique combination of KYC-compliant identity verification, real-time fraud prevention solutions, and expert support, VideoIdent Flex is a powerful tool for the UK market.”

Whereas previously firms may have found video identification solutions to be excessive for their compliance requirement or out of reach due to costs, VideoIdent Flex opens up this option by customising checks as required by the respective regulatory bodies in financial services, mobility, telecommunications or gaming, to offer a streamlined solution fit for every industry and geography.

Bouteloup added: “Identity verification is incredibly nuanced; it’s as intricate as we are as human beings. This really compounds the importance of adopting a hybrid approach to identity – capitalising on the dual benefits of advanced technology when combined with human knowledge and awareness of social cues. With bank branches in the UK closing down, especially in the countryside, and interactions becoming more and more digital, our solution offers a means to maintain a human relationship between businesses and their end customers, no matter their age, disability or neurodiversity.

“VideoIdent Flex is designed from the ground up for organisations that cannot depend on a one-size-fits-all approach to ensuring their customers are who they say they are. In a world where fraud is consistently increasing, our video capability paired with our experts adds a powerful layer of security, especially for those businesses and customers that require a face-to-face interaction.”

-

Compliance Updates5 days ago

Compliance Updates5 days agoBet on Compliance: Navigating the Stakes with the UK’s Affordability Checks

-

Industry News5 days ago

Industry News5 days agoReal Dealer Studios: Offering a fresh spin on classic roulette

-

Industry News5 days ago

Industry News5 days agoCheltenham and Grand National 2025 start now

-

eSports5 days ago

eSports5 days agoDenis ‘electroNic’ Sharipov is a New Virtus.pro Player

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – April 8-14

-

eSports5 days ago

eSports5 days agoNODWIN Gaming Partners with Global Esports Federation as Portfolio Management Company for Key Emerging Markets

-

Asia5 days ago

Asia5 days agoAurora Gaming Crowned Champions of $350,000 Skyesports Masters 2024, Earns Spot in Skyesports Championship

-

Industry News5 days ago

Industry News5 days agoGolden Matrix Acquisition of MeridianBet Group Receives High Praise from IPO Edge