Latest News

From $546M Blueprint to Global Reach: Can Nexus International Scale its LATAM Lead

Nexus International has spent the past two years methodically building a position in Latin America. The first-half print for 2025, $546 million in revenue, up 110% year on year, suggests the model travels. The question now is whether that model, forged in Brazil and refined across a small stable of labels (Megaposta, Spartans, Lanistar), can stretch beyond the region and hold its own against the industry’s global heavyweights.

Those heavyweights are not standing still. Bet365, the privately held British operator, returned to profit in its 2023–24 fiscal year, posting roughly £3.7 billion in revenue and a swing back to pre-tax profit after a loss the prior year, evidence that its US push and product tune-ups are paying through. The company’s governance remains tightly held and operationally decisive, a combination that has let it expand into the Americas with unusual speed for a business of its size.

Across the Atlantic, Flutter Entertainment’s FanDuel continues to dominate US online sports betting and hold a leading position in iGaming, reporting a 41% sportsbook GGR share and 27–28% iGaming share in Q2 2025. DraftKings, the American No. 2 by revenue, logged $1.51 billion in Q2 2025 alone, up 37% year on year, and keeps widening its product mix and state footprint. BetMGM, the MGM–Entain venture, has lifted its 2025 guidance to at least $2.7 billion in net revenue and $150 million in EBITDA as omnichannel synergies firm up. Together, those three define the competitive tempo in the world’s richest regulated market.

Europe, meanwhile, is consolidating. France’s FDJ completed its €2.45 billion acquisition of Kindred in late 2024 and reported €3.07 billion in 2024 revenue (pro forma €3.79 billion), creating a larger, more geographically balanced group with new reach in Northern Europe. That deal, along with ongoing restructurings among listed operators, has tightened the fight for share across the continent.

Latin America, Nexus’s home field, has become more formal in a hurry. Brazil’s federal framework moved from promise to practice over the past year, with a first wave of licensed operators, led by Betano (Kaizen Gaming), clearing the bar at the end of 2024. Dozens more have since joined the roster, turning compliance and payments execution into the difference between steady growth and churn.

Against that backdrop, Nexus has tried to compete less on spectacle and more on sequencing. The company tends to build the plumbing, licensing, payments orchestration, risk controls, before it touches the volume knob. In Brazil, Megaposta paired local rails (including PIX) with fast-path identity checks and a conservative payout design so that promotions didn’t outrun operations. Spartans leans into crypto-aware users where allowed, treating stablecoins as a parallel rail rather than a separate universe; Lanistar extends a mobile-first template across jurisdictions, localizing presentation and offers while reusing the same ledgering, dispute handling, and fraud tooling underneath.

That structure gives Nexus two forms of leverage if it looks beyond Latin America. First, reuse: once a brand hardens its cash-out logic or reduces payout exceptions, the other labels inherit the gain. Second, containment: when a regulator tightens rules in one market, the company can localize the change without rewriting its core stack everywhere else. For a firm without a balance sheet to buy shares on sight, those are the compounding mechanics that matter.

Still, going global requires a different rhythm. In North America, customer acquisition is expensive and increasingly professionalized; FanDuel’s lead reflects not just product and pricing, but the benefit of years of coordinated generosity and marketing spend. DraftKings has matched that pace with data-driven promotional discipline and broader content. BetMGM’s momentum shows the value of omnichannel: retail floors, loyalty programs, and cross-sell to digital iGaming. None of this can be met with engineering alone.

Europe presents another kind of test. Operators like Bet365 bring deep oddsmaking, mature in-play experiences, and long-standing relationships with rights holders. Newcomers must thread between high regulatory expectations and consumers already well served. Even in growth pockets, parts of Eastern Europe, Italy under new tax regimes, or the Nordics, local incumbents and pan-European groups (Betsson among them) have entrenched playbooks.

So what, precisely, travels from Nexus’s Latin American build? Three things, if it executes. The first is time-to-readiness. When a country finalizes rules, the advantage goes to the operator that can go live quickly with clean KYC flows, auditable ledgers, and payout liquidity that holds under load. Brazil was a case in point for many operators: the brands that treated licensing as product work, not paperwork, grew faster once the switch flipped. The second is cost-to-serve. A shared operational spine, risk, payments, customer operations, should push unit costs down as volume rises, protecting margin when CAC spikes. The third is reliability under stress. Consumers remember fast withdrawals and stable cash-outs; regulators remember clean audit trails. Those are portable advantages if they are real and repeatable.

There are, of course, risks that scale as well as advantages. Crypto rails remain politically sensitive in several jurisdictions; banks and processors can change risk posture abruptly; and the temptation to buy shares with blunt promotions grows as a company diversifies. Nexus’s decision so far to fund growth internally keeps external clocks at bay, but it also limits the ability to blanket new markets. If outside capital is added later, it will need to serve the system, shortening time-to-market and strengthening the shared spine, rather than just the story.

What will signal that Nexus is crossing from regional contender to global force? Not a single announcement. Look instead for licensing outside Latin America tied to live dates measured in weeks, not quarters; for cross-brand convergence (loyalty, dispute handling, payouts) that reduces duplication; and for peak-event stability in new markets that looks like the performance the company has claimed at home. If those appear, and if the $546 million first half proves a base rather than a spike, the competitive conversation will shift from whether Nexus can challenge leaders to where and how fast.

The incumbents remain formidable. Bet365’s return to profit underscores resilience after a costly expansion phase; FanDuel, DraftKings, and BetMGM have set pace in the US that others must match to matter; FDJ–Kindred’s combination shows Europe’s center of gravity consolidating rather than fragmenting. But the industry is also moving from improvisation to formalization in market after market. In that world, preparation is strategy. Nexus has built a business around that premise. The coming years will test how far it can carry.

-

Asia6 days ago

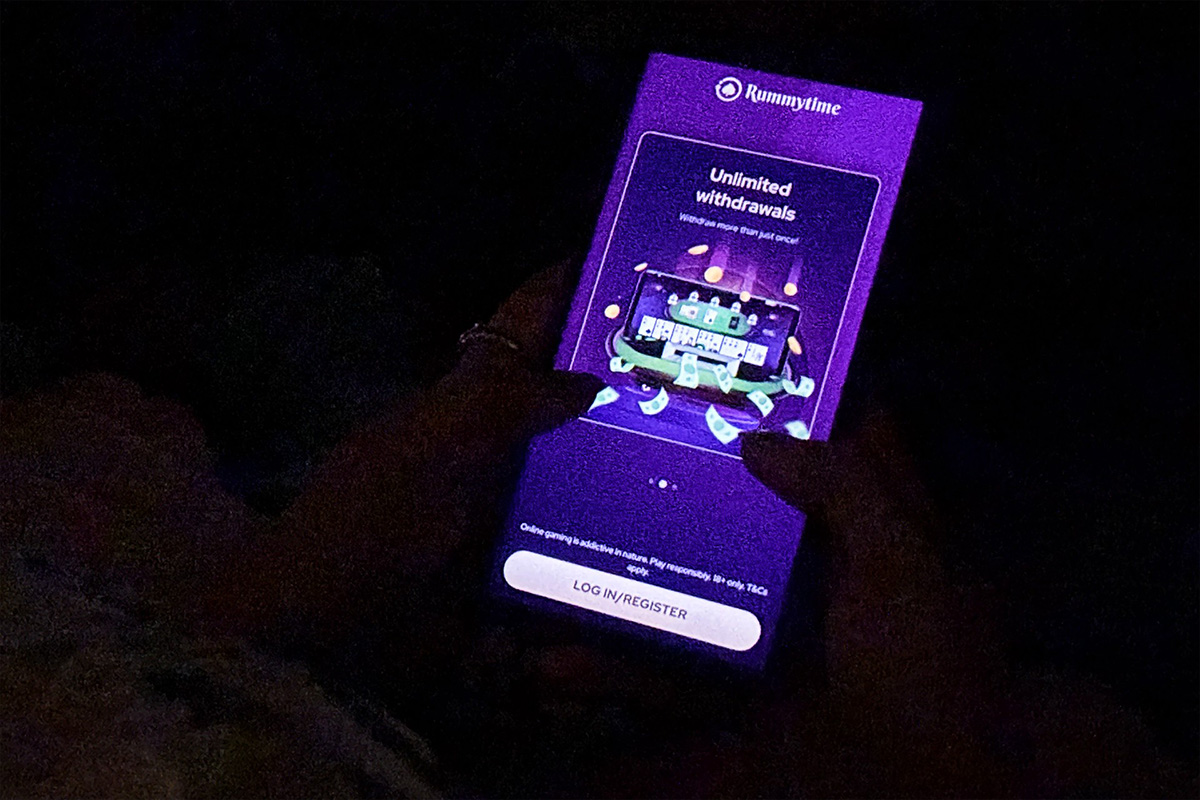

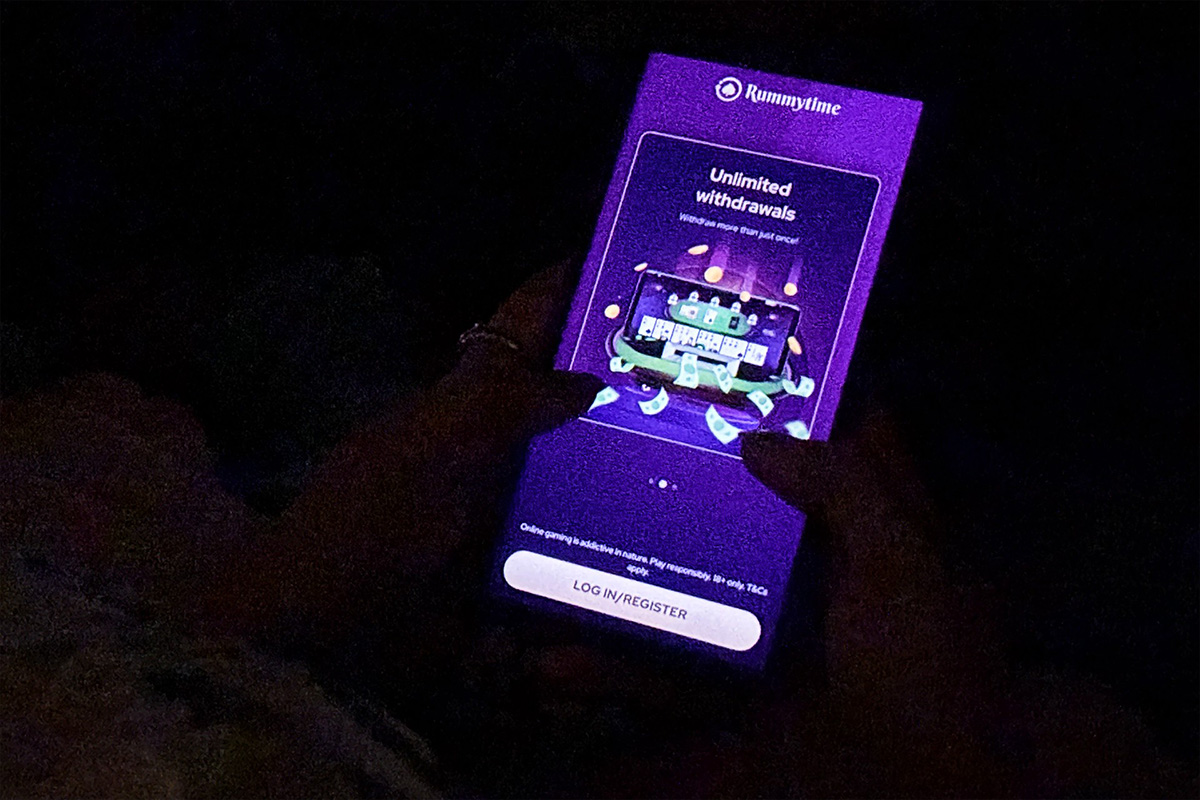

Asia6 days agoIndia Bans Real-Money Gaming

-

Latest News6 days ago

Latest News6 days agoMeitY Blocked 1300 Illegal Sites But Offshore Platforms Still Exist

-

eSports7 days ago

NODWIN Gaming Acquires Sony Interactive Entertainment’s Stake in Evo; Becomes Majority Holder

-

Latest News6 days ago

Latest News6 days agoDATA.BET Secures Spot at SBC Summit 2025

-

Compliance Updates6 days ago

Compliance Updates6 days agoBacta commissioned research shows huge support for seaside arcades led by Gen Z

-

Latest News7 days ago

Latest News7 days ago5 Reasons Mobile iGaming is Growing (and How to Earn from It)

-

Latest News6 days ago

Latest News6 days agoWhy Gamification Is Reshaping Online Poker

-

Latest News7 days ago

Pragmatic Play Launches 40,000x Jackpot Spellmaster Slot