Industry News

Scout Gaming Conducts Two Directed Share Issues And Receives Proceeds Of Approximately SEK 27 Million

Scout Gaming Group ABtoday announces that the Company has successfully completed two directed share issues of approximately MSEK 27 corresponding to approximately 1.3 million shares in the Company.

The board of directors of Scout Gaming Group AB has, based on a authorization granted by the annual general meeting on 23 May 2019, resolved on a Private Placement through a so called accelerated “book building”-procedure of 818,871 shares (the “Private Placement”) and an additional directed share issue to Tekkorp Holding LCC in its capacity as external investor of 431,129 shares (the “Directed Share Issue”). Through the Private Placement the Company will receive proceeds of approximately SEK 17.6 million before transaction costs and through the Directed Share Issue proceeds of approximately SEK 9.3 million before transactions cost, equal to a total amount of approximately SEK 27 million. The subscription price in the Private Placement has been set to SEK 21.51 per share through a so called accelerated ”book building”-procedure, which corresponds to a discount of 10 percent compared to the last closing price of the Company’s share on Nasdaq First North Stockholm. The subscription price in the Directed Share Issue has been set at the same rate as in the Private Placement. The Private Placement was directed to Swedish and International institutional investors. In order to facilitate the Private Placement, the new shares were initially subscribed for by ABG Sundal Collier AB for an amount corresponding to the shares’ quota value. The shares will then be transferred to new and current shareholders of the Company in accordance with an agreement entered into between ABG Sundal Collier AB and the actual investors. The current shareholders who have decided to participate and receive shares in the Private Placement are Swedbank Robur Fonder AB, Provobis Invest AB and Knutsson Holding AB, and in addition a number of foreign and institutional investors have subscribed for shares in the Private Placement. In connection with payment from the investors in the Private Placement, which is expected to occur around the 4 July 2019, the Company will be added the remaining amount, i.e. the difference between the quota value and the price in the Private Placement.

The reason for the deviation from the shareholders’ preferential rights is mainly to raise capital in a time- and cost efficient manner. Through the Private Placement and the Directed Share Issue, Scout’s product offering can be further strengthen and the geographical expansion continue.

After the registration of the Private Placement and the Directed Share Issue, the total number of shares in the Company will amount to 14,533,455 shares. The Company’s share capital will increase with approximately SEK 65,789.47 to SEK 764,918.68. The Private Placement and the Directed Share Issue entails a dilution of approximately 8.6 percent of the number of shares in Scout after the Private Placement and the Directed Share Issue.

In connection with the Private Placement and the Directed Share Issue, the Company has appointed ABG Sundal Collier as Sole Lead Manager and Bookrunner and Advokatfirman Delphi as legal counsel.

-

Bitcoin5 days ago

Bitcoin5 days agoCrypto Casinos EU 2025 – Top 10 European Bitcoin Casino Sites (Updated List)

-

Compliance Updates5 days ago

Compliance Updates5 days agoGeoLocs and Shufti Join Forces to Streamline Player Onboarding and Compliance

-

Latest News6 days ago

Latest News6 days agoBest 10 Trusted Bitcoin & Crypto Casinos for USA August 2025

-

Latest News6 days ago

Latest News6 days agoBest No Verification Casinos: Top No KYC Casinos With Instant Withdrawals & Latest Bonuses Of August 2025

-

Latest News6 days ago

Latest News6 days ago5 Best Crypto Casinos (August 2025) – Top 10 Bitcoin Casino Sites, Rated By Experts- 1st Update

-

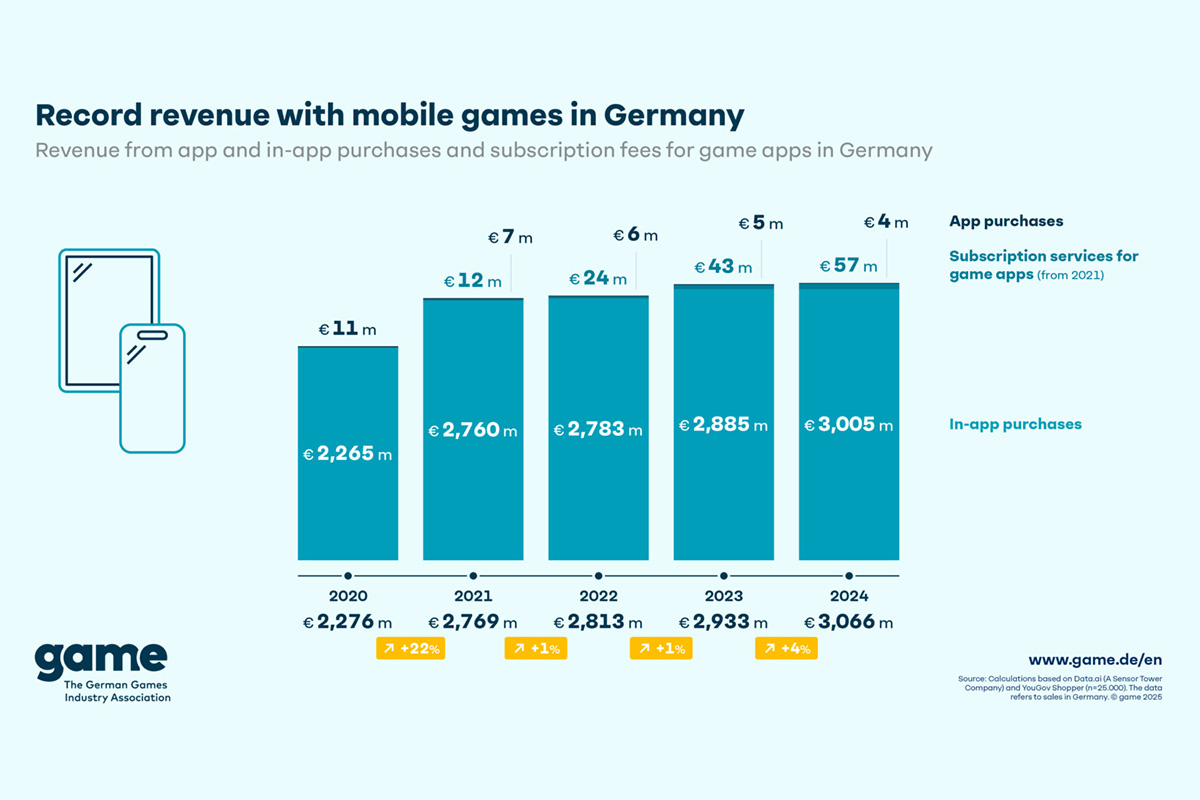

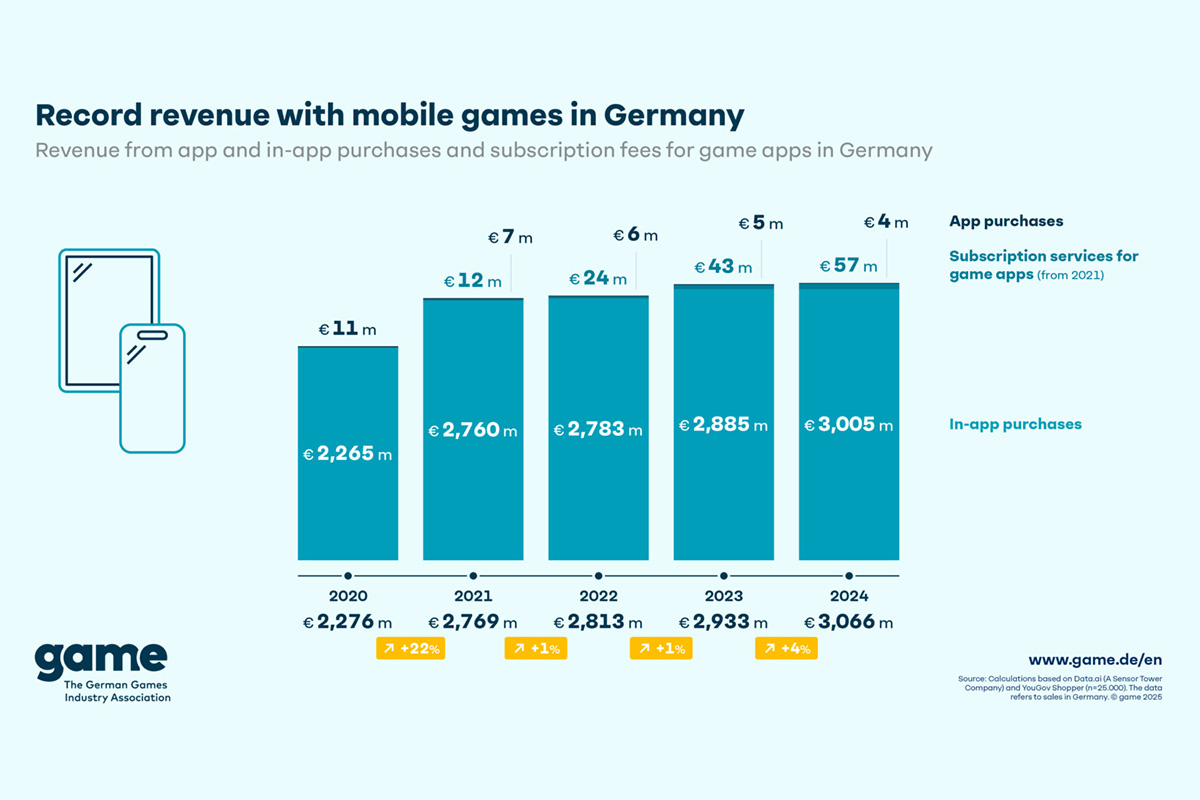

Gaming7 days ago

Gaming7 days agoRecord Revenue with Mobile Games in Germany

-

Latest News6 days ago

Latest News6 days agoBest Bitcoin & Crypto Casinos in Canada for 2025: Top 10 Picks

-

Latest News5 days ago

Latest News5 days agoFlutter Entertainment: Q2 2025 Update