Asia

Philippines Approves New 5% Tax on Gaming Revenues of POGOs

The Philippines authorities have approved a new 5% tax on the gaming revenues of Philippine Offshore Gaming Operators (POGOs).

The House Committee on Ways and Means passed the measure which sees POGOs classified as resident corporations and therefore subject to an additional 5% franchise tax on top of current tax and fees.

PAGCOR currently collects a 2% franchise tax from licensed offshore operators, generating around Php8 billion in revenue each year, but the 5% tax is expected to push that figure to Php20 billion.

The new measure also allows for all foreign employees of POGOs earning Php600,000 (US$11,850) or more to be taxed 25% on their wages and other allowances, potentially pushing the government’s annual revenue from the POGO industry north of Php45 billion.

-

Bitcoin6 days ago

Bitcoin6 days agoCrypto Casinos EU 2025 – Top 10 European Bitcoin Casino Sites (Updated List)

-

Compliance Updates6 days ago

Compliance Updates6 days agoGeoLocs and Shufti Join Forces to Streamline Player Onboarding and Compliance

-

Latest News7 days ago

Latest News7 days agoBest 10 Trusted Bitcoin & Crypto Casinos for USA August 2025

-

Latest News7 days ago

Latest News7 days agoBest No Verification Casinos: Top No KYC Casinos With Instant Withdrawals & Latest Bonuses Of August 2025

-

Latest News7 days ago

Latest News7 days ago5 Best Crypto Casinos (August 2025) – Top 10 Bitcoin Casino Sites, Rated By Experts- 1st Update

-

Gaming7 days ago

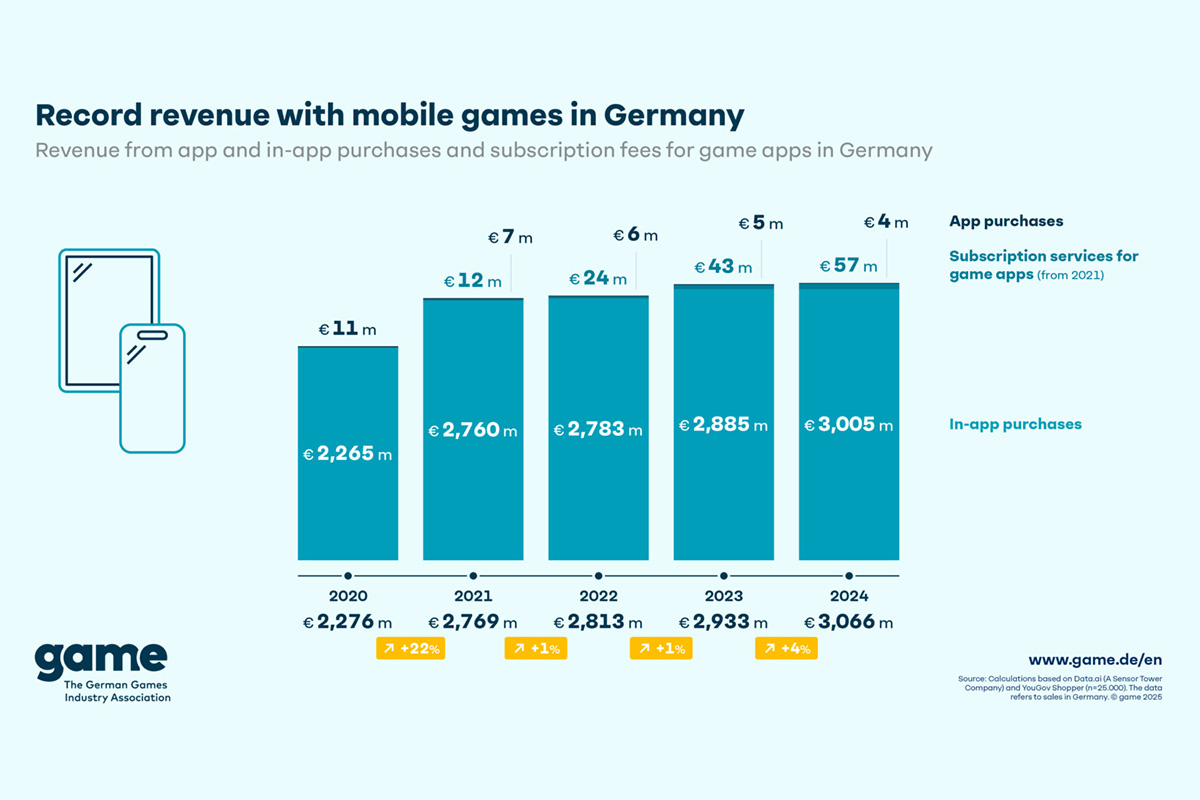

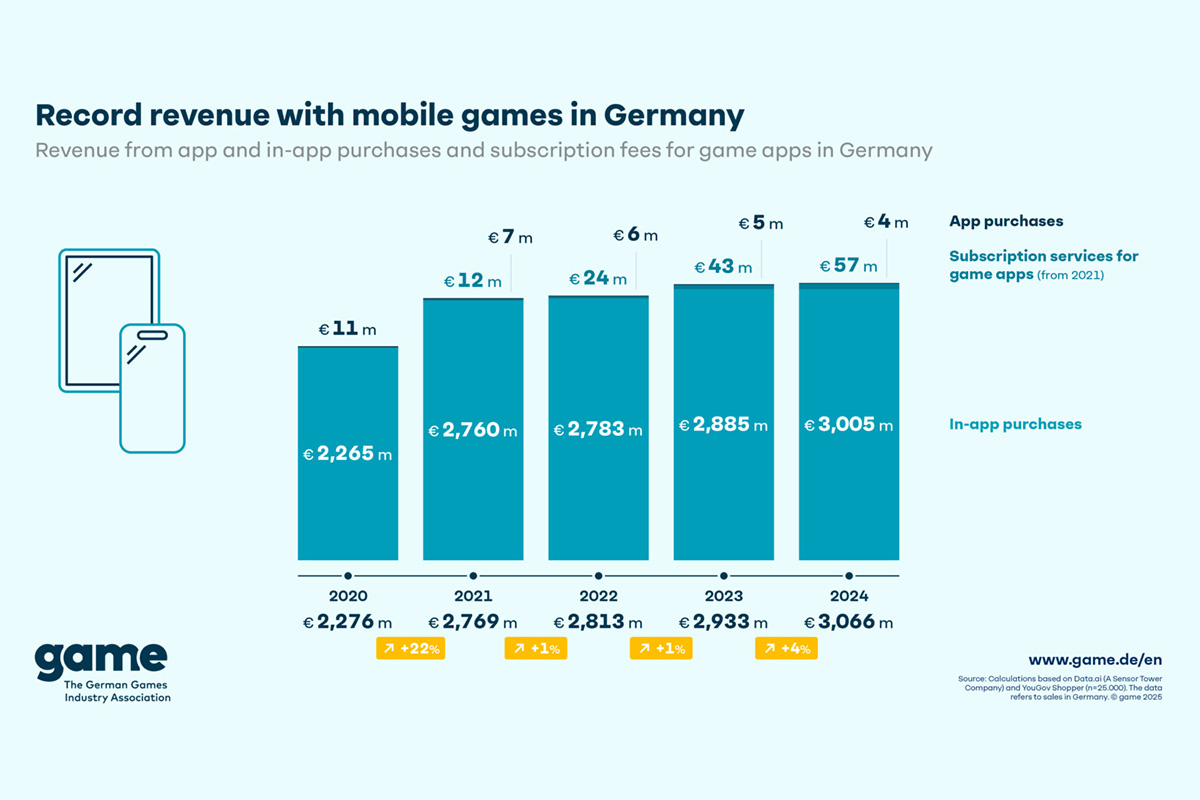

Gaming7 days agoRecord Revenue with Mobile Games in Germany

-

Latest News6 days ago

Latest News6 days agoBest Bitcoin & Crypto Casinos in Canada for 2025: Top 10 Picks

-

Latest News6 days ago

Latest News6 days agoFlutter Entertainment: Q2 2025 Update