Asia

Cambodia Implements New Taxation Regime for Commercial Gambling Establishments

Cambodia has started to implement a new taxation regime on commercial gambling establishments, on a self-declaration basis. The new regime encompasses a revenue-based tax rule and procedures, following a lump sum-based regime which had been in place for decades.

The gambling establishments are also required to follow the International Financial Reporting Standards, governing how certain types of transactions and events are reported.

The secretary of state of the nation’s Ministry of Economy and Finance said that the move “means that there would no longer be cases of hiding cash to be paid to the authority even by casino owners and tax officials as the rules and procedures determine check-and-balance practices for the balanced power among operators, regulators, inspectors and other relevant stakeholders involved in the implementation of the new proclamation.”

Furthering the statement, the official noted that “Check-and-balance practices mean all relevant parties are required to check or examine one another. None of them can exploit anything in the gambling business operations, while the casino party would not be able to cheat the gamblers and the gamblers would not be able to cheat the casino. Gamblers at casinos can file complaints if they have sufficient evidence.”

-

Interviews7 days ago

Interviews7 days agoHIPTHER Community Voices: Alieu Kamara – Founder and CTO of AmaraTech

-

Compliance Updates7 days ago

Compliance Updates7 days agoCT Interactive grows its certified portfolio in Romania

-

Asia7 days ago

Asia7 days agoMetal Genesis Announces “Barrel of a Gun” Song Collab with Priscilla Abby

-

Latest News7 days ago

Latest News7 days agoFrom gut feeling to game-changer: how AI is rewriting the rules of sports betting

-

Latest News7 days ago

Latest News7 days agoWeek 36/2025 slot games releases

-

Latest News7 days ago

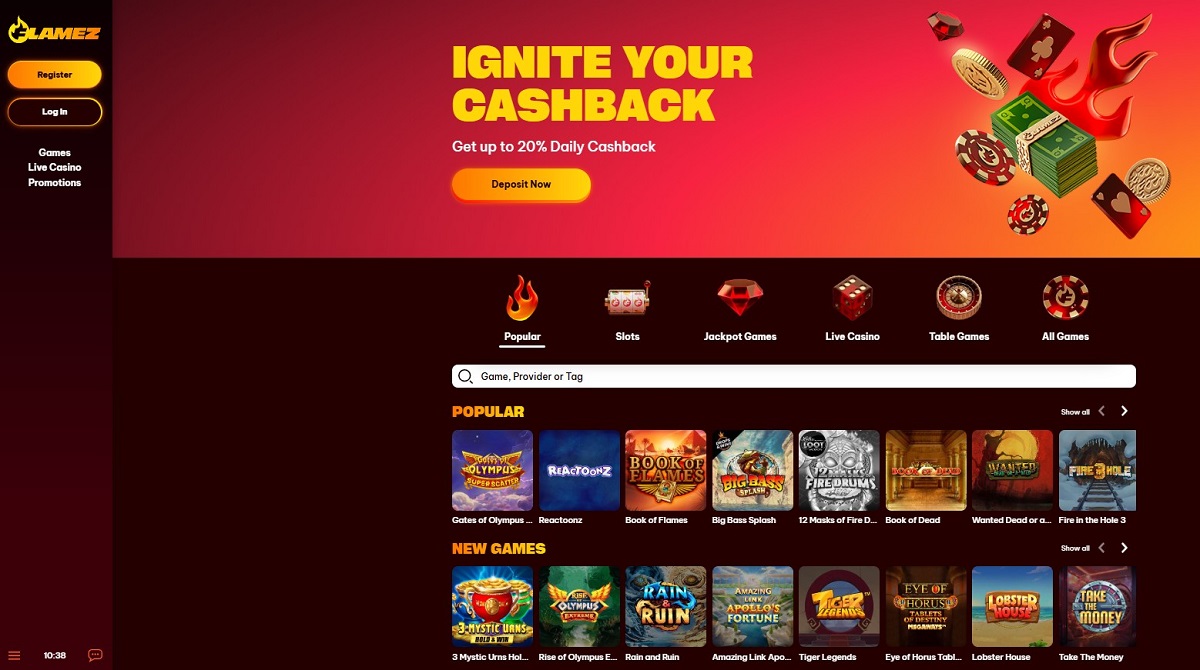

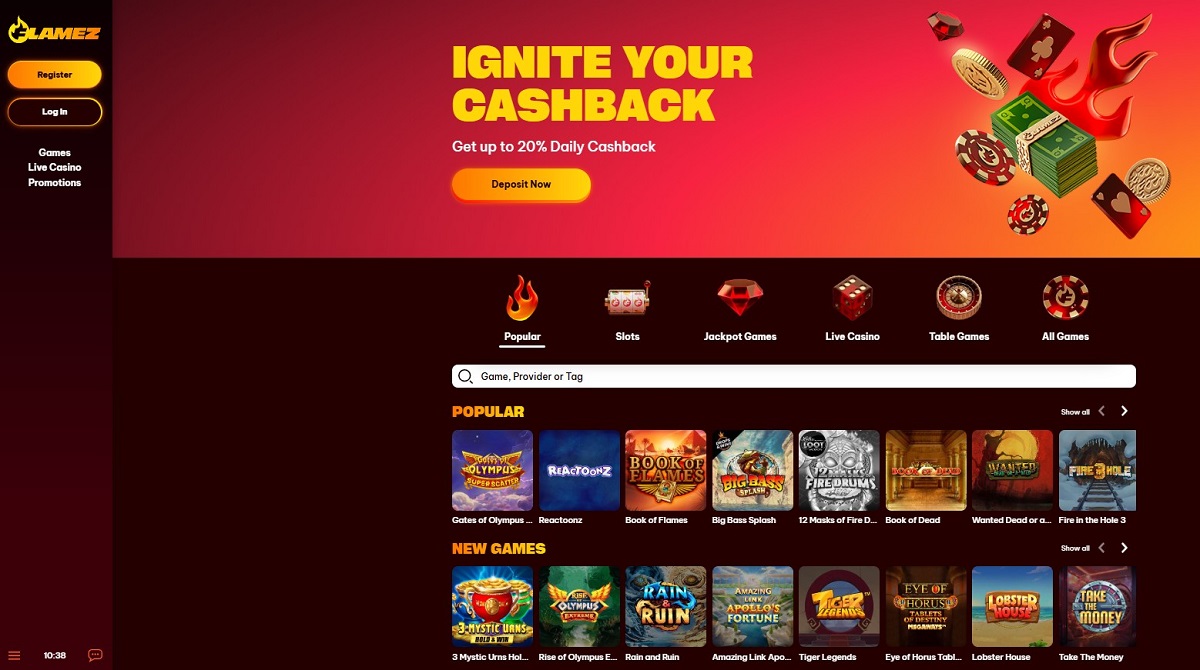

Latest News7 days agoFlamez – A Fiery New Online Casino Contender from Ganadu

-

Latest News7 days ago

Latest News7 days agoProgressPlay to Unveil Standalone Platform Upgrades at SBC Summit 2025

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoEurasia and the Middle East in Focus at SBC Summit 2025 Emerging Markets Stage