Latest News

8.17 million people at risk of exclusion in a cashless society

-

At least 8.17 million people are at risk of digital exclusion in the UK, including the elderly, homeless and mentally ill, new research shows.

-

Global Payment Trends reveals the financial and societal impacts of going cashless, as society shifts towards exclusively digital transactions in 2018.

-

320,000 people are estimated to be homeless in the UK, while another 1.3 million adults don’t have access to bank accounts.

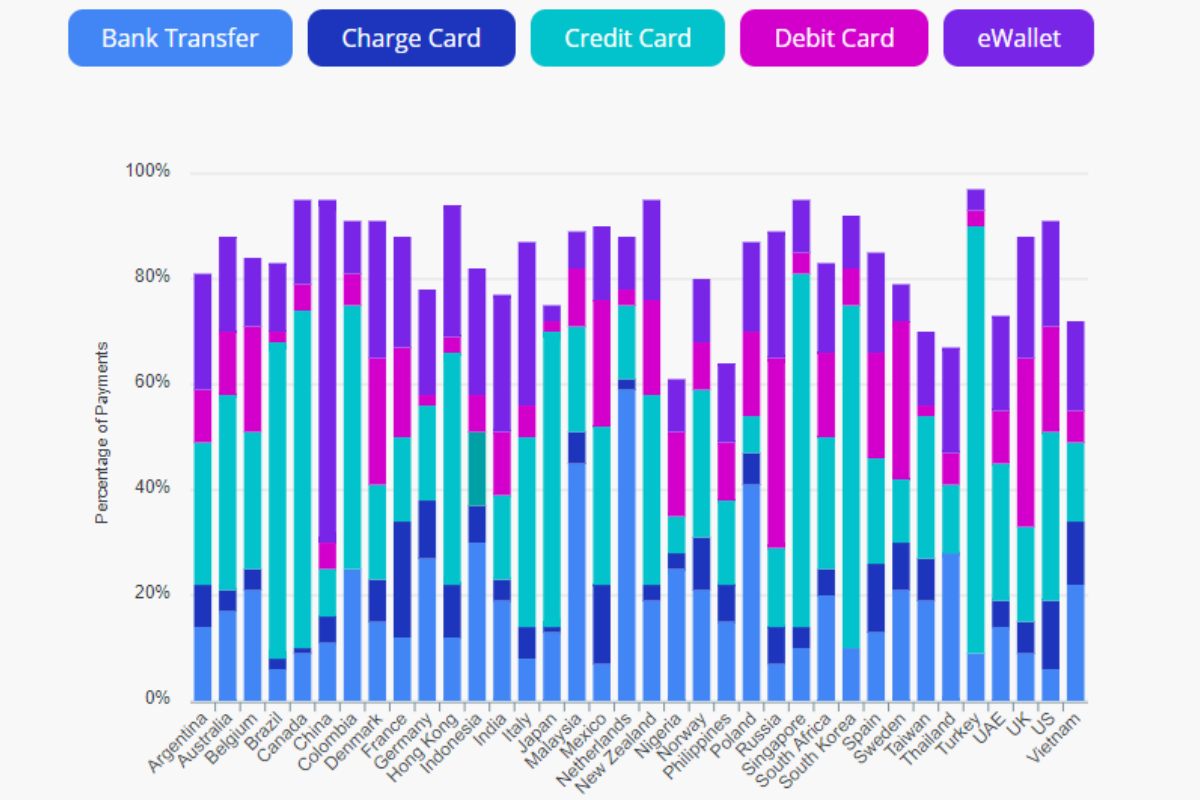

Cash usage is in decline in every region around the world, with eWallets, credit cards and bank transfers becoming the most popular payment methods in 2018, new research shows.

Analysis has revealed that if current trajectories towards digitisation continue, 8.17 million vulnerable members of society would suffer due to their dependence on physical payment methods. This includes 5.2 million households, or 80% of elderly homes, that rely on cash.

Also at risk of digital exclusion in the UK are the 320,000 estimated people living rough on the streets, 1.3 million adults without bank accounts and 1.352 million people with physical or mental health issues.

Global Payment Methods collates official reports to reveal the potential societal repercussions of digital exclusivity, whereby coins, banknotes and cheques are replaced by eWallets, cryptocurrencies and bank cards.

This rise in alternative payment methods has also led to a decline in ATMs, with the number in the UK dropping from 54,000 to 49,700 between January 2018 and July 2019 alone.

Since 2015, digital payment methods have risen to meet the needs of online shoppers, with eWallets and bank transfers the most popular in 2018. Cash is forecasted to be replaced by debit card as the leading payment method by the end of this year.

Percentage of transactions paid for with cash in the UK

|

Country |

2016 |

2017 |

2018 |

Total % change |

|

UK |

9% |

9% |

7% |

-2% |

This predicted shift would have detrimental societal impacts worldwide, with 1.7 billion adults without access to a bank account, 100 million people reported to be homeless and 617 million people aged 65 and over around the globe – many of whom will struggle to go digital.

There are 450 million people currently suffering from mental or neurological disorders according to the World Health Organization (WHO), with one in four people predicted to be affected by mental illness at some point in their lives.

These figures mean that a staggering 1.875 billion people could be isolated from a digitised society at any one time, due to mental health problems alone.

WHO has pleaded for governments to provide affordable treatments for mental health, as two-thirds (67%) of people with a known disorder never seek help from a health professional. Currently, at least 40% of countries have no mental health policy and over 30% have no mental health legislation.

Establishing affordable and equal access to mental health treatments is more important now than ever before, with the latest figures implying that debit cards, credit cards and eWallets will eradicate cash usage by 2022.

Helen Undy, Chief Executive of the Money and Mental Health Institute, said: “When you’re struggling with your mental health it can be much harder to stay in work or manage your spending, while being in debt can cause huge stress and anxiety – so the two issues feed off each other, creating a vicious cycle which can destroy lives.

“Ensuring that money advice is routinely offered to people using mental health services would increase recovery rates, as well as improving the financial wellbeing of the 1.5 million people currently dealing with this terrifying combination of problems.”

To read more about the impacts of digital exclusion in Global Payment Methods, visit: https://a2zcasinos.org/global-payment-trends

-

Africa5 days ago

Africa5 days agoQTech Games wins Best Innovation of the Year at the 2025 SBWA+ Eventus Awards

-

Asia5 days ago

Asia5 days agoNODWIN Gaming and JioStar Unveil OnePlus Android BGMS Season 4

-

Latest News5 days ago

Latest News5 days agoVindral appoints Henrik Fagerlund as Chairman of the Board

-

Latest News5 days ago

Latest News5 days agoCalema to Perform at Legends Charity Game in Lisbon

-

Conferences in Europe5 days ago

Conferences in Europe5 days agoEGT Digital and EGT to rock the show at SiGMA Euro-Med 2025

-

Latest News5 days ago

Latest News5 days agoPush Gaming redefines its portfolio, unveiling new game categories and sub-brand for extended player reach

-

Affiliate Industry5 days ago

Affiliate Industry5 days agoNikita Lukanenoks Brings Slotsjudge Into Spotlight With Affiliate Leaders Awards 2025 Nomination

-

Latest News5 days ago

Latest News5 days agoThunderkick returns for an even fierier fiesta in Carnival Queen 2