Cryptocurrency

iGamingGroup Explores Adding SameUSD to Its List of Cryptocurrency Payment Options

When cryptocurrencies proved to be a viable payment option, everyone was thrilled because of this blockchain technology. Talk about the speed of transactions, privacy, global reach, and the promise of hack-proof payment solutions.

However, as most of us have come to realize, it has been a bumpy ride for cryptocurrency payment providers with several reports of hacks, fluctuating prices, and regulatory restrictions. What could settle our fears and restore the confidence we once had in cryptocurrency payments? Online gaming platforms such as casinos are on the lookout for a solution that guarantees players gaming satisfaction for a secure and faster experience while also optimizing the casino’s operations.

Samecoin, a new entrant into the cryptocurrency space, seems to have all the solutions that online gaming platforms have been gunning for. The Samecoin ecosystem – which consists of a utility coin (Samecoin), stablecoins (SameUSD, SameEUR, etc) as well as the SameID and SamePay – has been endorsed by iGamingGroup as it explores integrating Samecoin ecosystem and its SameUSD as a cryptocurrency payment service provider of choice.

What is iGaming Group, and what does their endorsement say about Samecoin?

iGamingGroup Endorses Samecoin

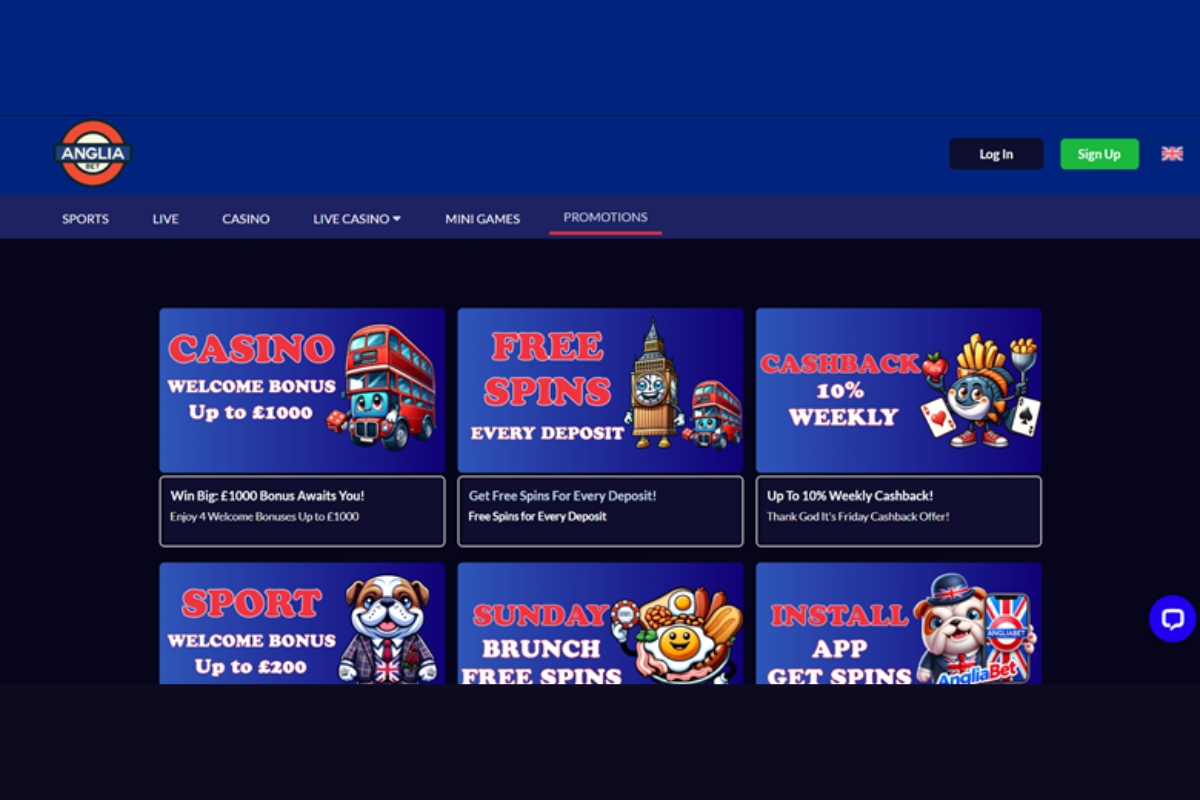

Touted as the ultimate iGaming technology stack provider, iGamingGroup is the one-stop-shop for all online gaming systems. The group boasts of high-end clients such as Evolution Gaming, Netent, BetSoft, Rela Gaming, Play n Go, and ORYX Gaming.

To date, the iGaming giant has helped develop 7000 games through advanced ready-to-deploy industry solutions while focusing on modern human-centered interfaces that are innovated and scaled to client’s demands.

iGG has been offering cryptocurrencies such as Bitcoin, Ripple, Dogecoin, Ethereum, and Litecoin as part of its vast payment options plans. The need to provide a faster and less costly transaction is what drove it towards Samecoin.

According to the company’s website, iGamingGroup is always looking to make deposits and withdrawals safer, easier and faster to satisfy casino players and owners. This makes perfect sense as to why the company would opt to endorse the Samecoin ecosystem.

The iGaming technology provider supports over 30 payment systems accepted globally, representing more than 150 payment options. Samecoin promises to be a worthy addition to iGG’s goal and mission.

Payment Solutions Designed For Online Gambling

Samecoin’s payment solution, SamePay, provides cryptocurrency payment solutions with stablecoins and secure SameID logins. The easy-to-integrate innovative payment solution makes for a smooth operating experience for both the owner and players.

The Samecoin system will integrate well with iGaming’s SSL encryption used for online banking, thus providing online gambling with the highest security. The ecosystem, which includes SameID and SamePay, fits well with iGG’s Know-Your-Customer and Anti-Money-Laundering procedures.

Samecoin’s stablecoins, the SameUSD and SameEuro, aim to eliminate cryptos’ fluctuating prices, which has discouraged many online casino players. These coins’ ability to mimic fiat currencies’ stability and simplicity while retaining the advantages of cryptos makes them perfect for online casinos.

Features that Make Samecoin Perfect for Online Casinos

Besides the stability and security of value provided by Samecoin’s family of stablecoins, the ecosystem also features the SameID and SamePay tools that are invaluable to online casinos.

SameID in Online Casinos

SameID is an easily integrated user identification feature that eliminates the need for online casino players to use their personal information. Although users of SameID have to undergo the KYC procedure, the process is faster than before, thus saving time and costs spent on costlier KYC procedures.

While using the SameID, the users’ verification process can be done through:

· Facial recognition selfie identification.

· Passport or ID card.

· Utility bill.

SamePay for Online Casinos Cryptocurrency Payments

SamePay integration simplifies the way players receive and send cryptocurrencies in online casinos. Whether it is SameUSD, Bitcoin, Litecoin, or Ethereum, SamePay will serve you well.

SamePay works with wallets for each crypto that casino players will be using. Even better, SameID also applies here; this ensures one account gives a user complete control of their cryptos while sealing any security loopholes.

Casino operators integrating SamePay can also enable SameID logins to solve any KYC problems that players might encounter when onboarding. It will only take 5 seconds for casino players using the SamePay payment option to get verified. What’s more, SamePay secures the players’ data by only sending the necessary data to casinos when SamePay users register through SameID. No personal data is ever given out.

Since SamePay users will have complied with the KYC procedure when registering through SameID, operators will receive verified players. This will save time and provide much-needed operational efficiencies – something iGamingGroup wants to take full advantage of.

The SamePay’s simple operational framework to both casino owners and the adoption-friendly interface with low crypto transaction costs will help grow a casino’s customer base and improve brand growth.

-

Latest News7 days ago

Latest News7 days agoPIN-UP Global Transforms into the RedCore Business Group

-

Asia7 days ago

Asia7 days agoNew Indian Law Aims to Curb Online Money Gambling Sector, Prohibits Related Advertising

-

Asia7 days ago

Asia7 days agoChicken Road Game Launches in India, Expands Mobile Gaming Catalogue

-

Latest News7 days ago

Latest News7 days agoSOFTSWISS Wins Best Game Aggregator Award in Latin America

-

Balkans7 days ago

Balkans7 days agoELA Games Partners With Superbet to Expand Offerings in Serbia

-

Compliance Updates7 days ago

Compliance Updates7 days agoRomania Blocks 30 Unlicensed Gambling Websites

-

Asia6 days ago

Asia6 days agoNational Sports Day: Why it’s time to see esports as a key pillar of India’s new-age sporting identity

-

Latest News7 days ago

Latest News7 days agoOG of fast cars drops in games: Porsche adopts in-car gaming with AirConsole