Central Europe

German Games Market Stabilises at a High Level

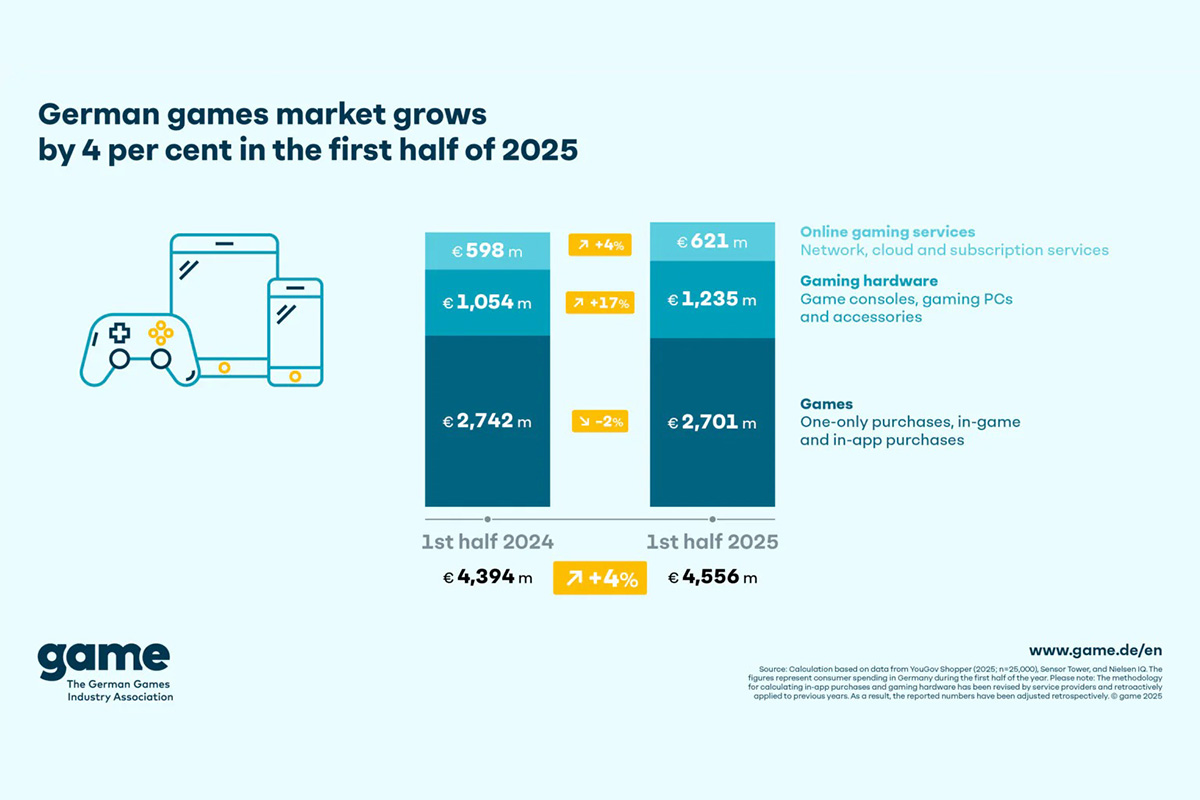

Following major increases in sales revenue in both 2020 and 2021, the German games market stabilised at a high level in 2022 – that was the conclusion offered by game – the German Games Industry Association when presenting the market data from surveys carried out by market research companies GfK and data.ai. Whereas the Covid-19 pandemic had resulted in annual growth of 32% and 17% respectively, in 2022 sales revenue generated by games, gaming hardware and charges for online services rose by an additional 1% to 9.87 billion euros.

“The German games market was amazingly stable in 2022 despite various challenges. Following the strong growth achieved in the wake of the Covid-19 pandemic, many people had expected sales revenue to decline in 2022, for example due to the high rate of inflation over the course of the year, the decline in time spent playing games, or the many games whose release dates had been postponed. In light of these circumstances, the 1% growth achieved in 2022 is yet another sign of the industry’s success as the German games market manages to consolidate its gains near the ten-billion-euro mark,” said Felix Falk, Managing Director of game – the German Games Industry Association.

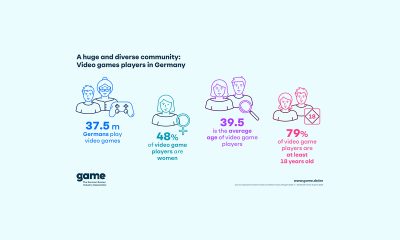

Even the number of video game players has managed to stabilise at a high level following the growth achieved in the Covid-19 years: approximately six out of every ten people between the ages of six and 69 in Germany play games. There is also little difference according to gender, with women making up 48% of video game players in Germany, and men 52%. As has been the case in recent years, the average age once again rose slightly and is now 37.9 years. In all, 78% of players in Germany are at least 18 years old.

Sales revenue from online gaming services is growing, while demand for gaming hardware has declined somewhat.

As with the market overall, the market segment devoted to games for PCs, game consoles and mobile devices has remained stable. For computer and video games (−1% to approximately 1.1 billion euros) as well as in-game and in-app purchases (+2% to approximately 4.5 billion euros), sales revenue figures were similar to last year’s. These include season passes, additional levels, cosmetic items (for example skins) and subscription fees for individual online games. In total, sales revenue from games for PCs, game consoles and mobile devices grew by roughly 1% to 5.5 billion euros in 2022.

The online gaming services market segment experienced yet another year of strong growth, with sales revenue from these services increasing by 20% to 866 million euros. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based games, online multiplayer functions, and the ability to save game progress in the cloud. This market segment has enjoyed particularly dynamic growth. This is demonstrated not only by the large increase in sales revenue, but also by the wide range of gaming services on offer. Even though some large providers discontinued certain services last year, other services were expanded and revamped. As a result, numerous online gaming services have long since begun offering a range of functions – thereby rendering the old distinctions between online gaming services, subscription gaming services and cloud gaming services obsolete. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+.

One of the most significant growth drivers in recent years has been gaming hardware, including gaming PCs, game consoles and the corresponding accessories. Following huge leaps in growth of 30 and 18% in the past two years, 2022 saw this market segment decline slightly, by around 3% to 3.5 billion euros. Reasons for this fall in revenues include the fact that game consoles like PlayStation 5 and Xbox Series X as well as the latest graphic cards were not available across the board. In addition, the major growth of the past two years means that numerous video game players already own the very latest gaming hardware.

-

Asia6 days ago

Asia6 days agoTesla to showcase Model Y with NODWIN Gaming at the thrilling BGMS Season 4 Grand Finals

-

Compliance Updates6 days ago

Compliance Updates6 days agoSOFTSWISS Compliance Expert Shares Knowledge on AML in iGaming for Sumsub Academy

-

Africa6 days ago

Africa6 days agoRacing1 is exhibiting for the first time at the Grand Prix D’Afrique

-

Latest News6 days ago

Latest News6 days agoÅland-Based Gaming Company Paf Becomes Main Partner of the Finnish Ski Association – One of the Most Significant Sponsorship Agreements in the Association’s History

-

Latest News6 days ago

Latest News6 days agoAnimo Studios debuts virtual hosts for live table games starting with Stake

-

Latest News6 days ago

Latest News6 days agoKaizen Gaming data – FC Barcelona the fan favourite to win the Champions League

-

Latest News6 days ago

Latest News6 days agoWeek 37/2025 slot games releases

-

Latest News6 days ago

Latest News6 days agoBehind the surge in XRP, DL Mining brings new opportunities to get 0.1BTC or 2ETH with your XRP