Latest News

Lottery Industry Analysis and Opportunities to 2033: Scratch-Off Instant Games Expected to Register the Fastest Growth

The “Lottery Global Market Opportunities and Strategies to 2033” report has been added to ResearchAndMarkets.com’s offering.

This report describes and explains the lottery market and covers 2018-2023, termed the historic period, and 2023-2028, 2033F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

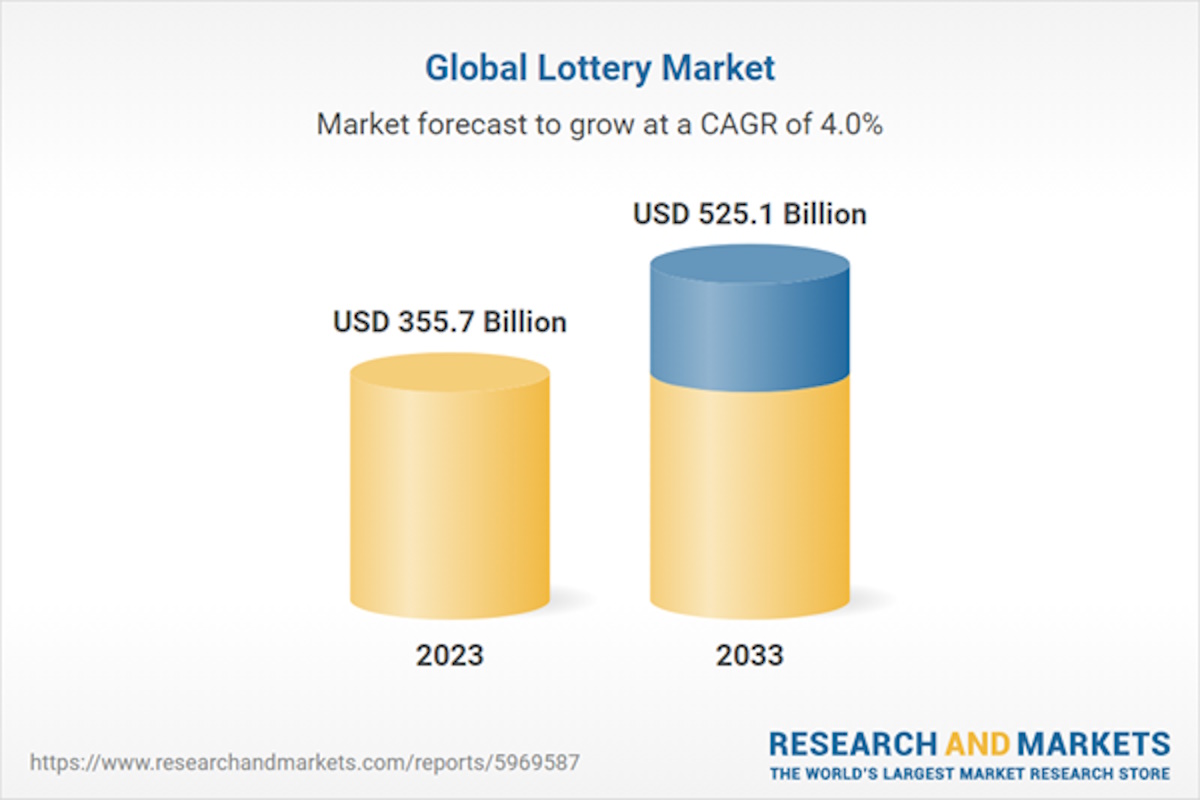

The global lottery market reached a value of nearly $355.7 billion in 2023, having grown at a compound annual growth rate (CAGR) of 2.6% since 2018. The market is expected to grow from $355.7 billion in 2023 to $453.7 billion in 2028 at a rate of 5%. The market is then expected to grow at a CAGR of 3% from 2028 and reach $525.1 billion in 2033.

Growth in the historic period resulted from the increase in advertising strategies and promotions of lottery products, expansion of multi-jurisdictional lottery games and strong economic growth in emerging markets. Factors that negatively affected growth in the historic period were increase in fraud in gambling and lotteries and regulation on age limit for selling lotteries.

Going forward, changes in legislation and regulation regarding lottery operations, growing popularity of online lottery and global population growth and urbanization will drive the growth. Factor that could hinder the growth of the lottery market in the future include intense competition from casinos and other forms of entertainment and economic recession or instability.

The lottery market is segmented by type into lotto, quizzes type lottery, numbers game, scratch-off instant games, terminal-based games and other types. The lotto market was the largest segment of the lottery market segmented by type, accounting for 31.3% or $111.5 billion of the total in 2023. Going forward, the scratch-off instant games segment is expected to be the fastest growing segment in the lottery market segmented by type, at a CAGR of 6.2% during 2023-2028.

The lottery market is segmented by platform into online and offline. The offline market was the largest segment of the lottery market segmented by platform, accounting for 96.8% or $344.1 billion of the total in 2023. Going forward, the online segment is expected to be the fastest growing segment in the lottery market segmented by platform, at a CAGR of 8.9% during 2023-2028.

The lottery market is segmented by category into charitable lotteries and prize home lotteries. The charitable lotteries market was the largest segment of the lottery market segmented by category, accounting for 70.3% or $250.2 billion of the total in 2023. Going forward, the prize home lotteries segment is expected to be the fastest growing segment in the lottery market segmented by category, at a CAGR of 6% during 2023-2028.

North America was the largest region in the lottery market, accounting for 36.8% or $131 billion of the total in 2023. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the lottery market will be Middle East and South America where growth will be at CAGRs of 10.8% and 7.8% respectively. These will be followed by Asia Pacific and Africa where the markets are expected to grow at CAGRs of 6.8% and 6.7% respectively.

The global lottery market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 16.09% of the total market in 2022. The market concentration can be attributed to the presence of large number of players in different geographies. Prominent players are acquiring the products and entering into partnerships with the other companies to consolidate their market positions across the globe, while others are distributing products. The New York State Lottery was the largest competitor with a 3.28% share of the market, followed by New York State Gaming Commission with 3.27%, Camelot Group with 2.78%, Georgia Lottery Corp. with 1.91%, Loterias y Apostasy Del Estado with 1.64%, Singapore Pools with 1.18%, Francaise des Jeux with 0.65%, Arizona Lottery with 0.47%, Ontario Lottery and Gaming Corporation with 0.46% and Lotto NZ with 0.44%.

The top opportunities in the lottery market segmented by type will arise in the lotto segment, which will gain $30.7 billion of global annual sales by 2028. The top opportunities in the lottery market segmented by platform will arise in the offline segment, which will gain $92.5 billion of global annual sales by 2028. The top opportunities in the lottery market segmented by category will arise in the charitable lotteries segment, which will gain $62.1 billion of global annual sales by 2028. The lottery market size will gain the most in China at $13.6 billion.

Market-trend-based strategies for the lottery market include innovative product developments with focus on scratch-off games, strategic collaborations and partnership to expand reach and capabilities, introduction of mobile lottery apps to improve user convenience, use of data analytics for enhanced lottery insights and roll out of new lottery games to redefine entertainment.

Player-adopted strategies in the lottery market include strengthening operational capabilities through new product developments and expanding product portfolio through strategic partnerships.

To take advantage of the opportunities, the analyst recommends the lottery companies to focus on innovating lottery offerings, focus on mobile apps for enhanced lottery services, focus on innovative lottery games for enhanced player engagement, focus on data-driven insights to navigate lottery market dynamics, focus on fastest growing market segments: scratch-off instant games and quizzes type lottery, focus on online market segment for growth, expand in emerging markets, continue to focus on developed markets, focus on strategic collaborations, focus on competitive pricing strategies for market expansion, focus on strategic promotion mix for optimal lottery market visibility, target smartphone users and focus on customer-centric engagement for enhanced lottery market reach.

Scope

Markets Covered:

- by Type: Lotto; Quizzes Type Lottery; Numbers Game; Scratch-Off Instant Games; Terminal-Based Games; Other Types

- by Platform: Offline; Online

- by Category: Charitable Lotteries; Prize Home Lotteries

Key Companies Mentioned: The New York State Lottery; New York State Gaming Commission; Camelot Group; Georgia Lottery Corp; Loterias y Apostasy Del Estado

Time Series: Five years historic and ten years forecast

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; lottery indicators comparison

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments

Key Attributes

| Report Attribute | Details |

| No. of Pages | 301 |

| Forecast Period | 2023 – 2033 |

| Estimated Market Value (USD) in 2023 | $355.7 Billion |

| Forecasted Market Value (USD) by 2033 | $525.1 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes, but is not limited to:

- The New York State Lottery

- New York State Gaming Commission

- Camelot Group

- Georgia Lottery Corp

- Loterias y Apostasy Del Estado

- Singapore Pools

- Francaise des Jeux

- Arizona Lottery

- Ontario Lottery and Gaming Corporation

- Lotto NZ

- 1x-bet.in

- Dhankesari Lottery Sambad

- Lottery Sambad Result

- Takarakuji-official.jp

- Ichiban Kuji Club

- The Lott

- Lotterywest

- Oz Lotteries

- 500.com

- Baidu Inc

- China Sports Lottery Operation and Management Co. Ltd.

- 360 Lottery

- QQ lottery

- National Lottery

- Jackpot.com

- Betfred Lotto

- Intralot SA

- Zeal Network SE

- Francaise des Jeux (FDJ)

- EU Lotto Limited

- Legacy Eight Curacao N.V

- Wejdz do swiata LOTTO

- Megalotto

- SYNOT W, a. s.

- Betfred Lotto

- DraftKings Inc.

- BetAmerica

- LeoVegas AB

- Jackpocket

- Mido Lotto

- Prize Pool

- Scientific Games Corp

- Long Game

- Linq3

- EMIDA Technologies

- Atlantic Lottery Corporation

- Hipodromo Argentino de Palermo

- GammaStack

- Mega Sena

- Quina

- Lotofacil

- Dupla Sena

- Mifal HaPayis

- Milli Piyango Idaresi

- O! Millionaire

- NeoGames S.A.

- Emirates Draw

- Mahzooz

- BuyLottoOnline

- Camelot Lottery Solutions Group

- Ithuba National Lottery

- wow!lotto

- Lottomania Nigeria

-

Africa7 days ago

Africa7 days agoQTech Games wins Best Innovation of the Year at the 2025 SBWA+ Eventus Awards

-

Asia7 days ago

Asia7 days agoNODWIN Gaming and JioStar Unveil OnePlus Android BGMS Season 4

-

Latest News7 days ago

Latest News7 days agoCalema to Perform at Legends Charity Game in Lisbon

-

Latest News7 days ago

Latest News7 days agoVindral appoints Henrik Fagerlund as Chairman of the Board

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoEGT Digital and EGT to rock the show at SiGMA Euro-Med 2025

-

Latest News7 days ago

Latest News7 days agoPush Gaming redefines its portfolio, unveiling new game categories and sub-brand for extended player reach

-

Affiliate Industry7 days ago

Affiliate Industry7 days agoNikita Lukanenoks Brings Slotsjudge Into Spotlight With Affiliate Leaders Awards 2025 Nomination

-

Latest News7 days ago

Latest News7 days agoThunderkick returns for an even fierier fiesta in Carnival Queen 2