Latest News

Deep Dive into Peru’s iGaming Market: Insights from the Atlaslive Platform

Peru’s iGaming market is a standout in South America, being one of the few fully regulated markets — a result of more than forty years of collaboration between lawmakers and gaming companies. Today, real-money gaming has firmly established itself as a preferred entertainment choice among Peruvian adults, with land-based casinos and online betting flourishing as leading options. This structured regulatory framework has allowed the industry to evolve into a trusted and widely accessible form of recreation nationwide.

Peruvians have embraced online gambling, particularly sports betting, which ties perfectly with their deep-rooted love for football. At the same time, online casinos are gaining traction, offering a wide variety of games like slots and poker that make digital gambling increasingly popular. Thanks to Peru’s favorable regulations, which prioritize safety and diversity, the market has become highly attractive to both domestic and global operators.

In this expert article, Atlaslive provides a comprehensive look at Peru’s iGaming market, outlining its current scope, growth potential, and the two primary categories that drive the highest revenue. It also offers a regional comparison, shedding light on unique player behaviors and socio-economic trends shaping Peru’s gambling industry. Additionally, the analysis delves into the history of regulation and highlights the defining characteristics of Peruvian real-money players.

The State of Gambling in Peru: Insights and Growth Forecasts

Source: Statista 2024

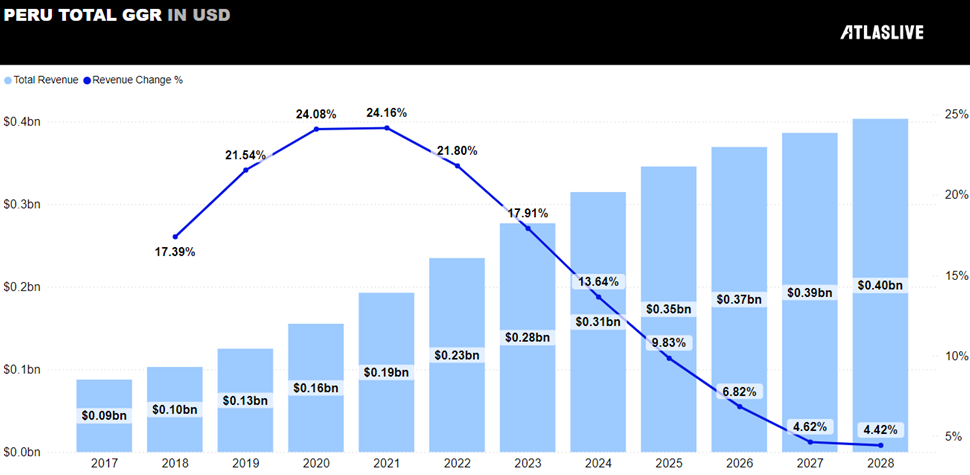

The Peruvian gaming market experienced steady growth between 2017 and 2021, with Gross Gaming Revenue (GGR) reaching an impressive 24.16% growth rate at its peak. This growth coincided with the legalization and expansion of online gaming and betting, drawing in new players and boosting overall engagement. During this time, the introduction of fresh platforms and innovative products likely fueled the industry’s upward momentum.

However, since 2021, growth rates have slowed, signaling a market that is beginning to mature. The pace of new player acquisition appears to have stabilized, suggesting that most operators have captured their target audience. Other contributing factors, such as increased competition and possible regulatory adjustments, may also be playing a role. This trend is not uncommon in the iGaming world—it’s a familiar pattern seen both globally and at the country level.

Despite the slower growth rate, Peru’s total gaming revenue continues to rise, reflecting the market’s stability. This suggests that while the influx of new players has diminished, existing customers remain active, keeping revenue streams consistent.

Compared to the broader South American market, Peru’s gaming sector is growing at a slower pace and doesn’t hold a leading position in the region. By 2025, Peru is expected to account for just over 5.5% of the region’s total iGaming market—a clear sign that it’s not a major player on the continent. Still, the market remains promising and continues to evolve.

It’s worth noting that the big GGR growth spikes seen across South America in 2020 and 2023 were largely driven by powerhouses like Argentina and Brazil. These countries, being the region’s largest markets, have spearheaded growth with their ambitious iGaming strategies and rapid development, leaving Peru to play a more modest role in the regional landscape.

Source: Statista 2024

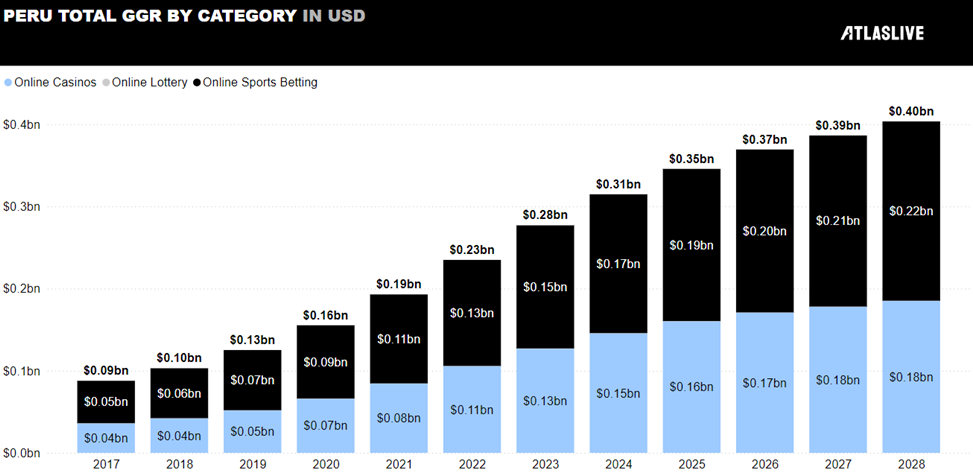

In Peru, Gross Gaming Revenue (GGR) is almost evenly split between two major categories: Online Casinos and Online Sports Betting. Each contributes roughly 50% to the total, creating a balanced market where both sides play a significant role. This distribution highlights how players are equally drawn to the excitement of casino games and the competitive edge of sports betting. Neither category overshadows the other, showing a healthy equilibrium in player preferences.

As for the online lottery, its share of revenue in Peru is so small that it doesn’t even register on most charts. However, this doesn’t rule out the potential for growth in this segment by 2030. Across South America, online lotteries have gained traction in countries like Argentina, Brazil, and Colombia, where player engagement is strong and revenue from this category is steadily climbing. Peru could follow suit in the coming years, carving out its own space in the online lottery market.

Opportunities for Innovation in Peru’s Evolving Online Gaming Market

Player interest in online lotteries in Peru remains consistent, though it hasn’t seen the explosive growth experienced by sports betting. Across South America, the Average Revenue Per User (ARPU) is relatively stable at around $280–$290, with a slight decline on the horizon. This creates an opportunity for innovation: if iGaming software providers introduce fresh, engaging products tailored to the region, particularly in Peru, these trends could see a positive shift. With the right mix of creativity and market adaptation, Peru’s online gaming market holds significant potential for future growth.

Source: Statista 2024

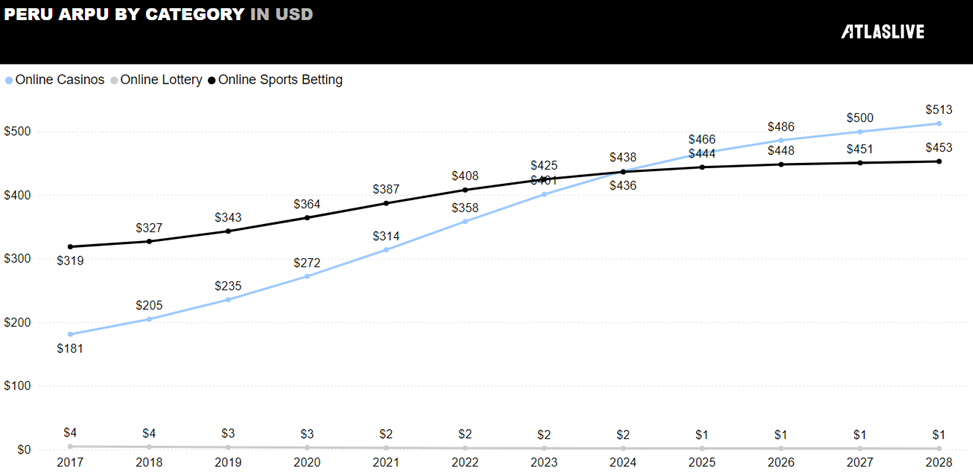

The Online Casinos category has shown steady growth in ARPU, rising from $181 in 2017 to an impressive $513 by 2028. This upward trend highlights the popularity of this segment and its loyal audience, who are gradually increasing their spending over time. Meanwhile, the Online Sports Betting category also displays stable ARPU growth, moving from $319 in 2017 to $453 in 2028. While it started with a higher ARPU than casinos, its growth has been more gradual, and by 2028, it will fall short of catching up with the casino ARPU. This could point to a slightly lower betting frequency among players.

As previously noted, the online lottery continues to contribute minimally to overall ARPU. This category’s lower performance may be due to a limited product range or a lack of strong player interest in online lottery formats compared to casinos and sports betting.

The Atlaslive iGaming Platform has been developed to allow partners to attract and retain players with ease. Offering a wide range of tools, the platform includes sportsbook software, a casino boasting over 15,000 games, virtual games, and lottery options. This diverse and localized content ensures maximum engagement and market growth.

Designed for flexibility, the platform allows operators to tailor the gaming experience to suit players’ unique preferences. With over 250 integrated payment solutions, it ensures fast, secure, and seamless transactions. Fully compliant with industry regulations, this comprehensive solution provides operators with a safe, reliable, and powerful way to succeed in the competitive iGaming market.

Peru vs. South America: ARPU Trends and Market Potential

Peru’s ARPU growth remains steady but lags significantly behind the broader South American region. This disparity could stem from certain social or financial constraints among Peruvian players or lower interest in specific gambling types compared to neighboring countries. By 2025, Peru’s ARPU is projected to hit $518, which is 18.7% below the regional average. By 2028, this gap is expected to widen further, exceeding 30%.

While Argentina will also have a lower ARPU in 2025, its Gross Gaming Revenue (GGR) will far surpass Peru’s due to its much larger player base — nearly seven times higher (Unique Players: Peru – 0.67 million, Argentina – 4.6 million). In Peru, GGR growth in 2025 will primarily come from an increase in unique players (66.5%) rather than ARPU growth, reflecting the country’s dependence on expanding its player base.

The total number of unique players in Peru is still on the rise, but the growth rate is slowing, signaling a maturing market. Online Sports Betting remains the most promising segment, while Online Casinos have room for expansion if innovation and development efforts continue. Although Peru’s market is one of the smallest in South America by player volume, it still accounts for 7% of the region’s total player base.

Despite lower GGR and ARPU figures, Peru boasts one of the highest penetration rates in South America, just slightly below the regional average. This indicates potential for further growth, particularly in Online Sports Betting, which continues to attract the most interest from players.

For operators aiming to enter or expand in the Peruvian market, the Atlaslive Sportsbook Platform offers a fast and reliable solution. With a seamless integration process that can be completed in as little as two days, the platform includes an array of tools such as risk management, CRM, a bonus engine, payment systems, and business analytics. These features are designed to boost player engagement and drive revenue, providing a competitive edge in this dynamic market.

The Development of the Gambling Regulation Environment in Peru

Peru’s journey in gaming regulation is a story of strategic decisions and steady progress. It all began in 1979 when the country took a major step by legalizing land-based casinos, laying the groundwork for what would later become a thriving, well-regulated industry. This wasn’t just about allowing gambling, it was about creating a foundation for a sustainable and well-structured gaming sector.

In the 1990s, Peru added more layers to its regulatory framework, introducing industry-specific taxes and guidelines for advertising. They even connected gaming with tourism, showcasing a forward-thinking approach that integrated gambling into the broader economy while ensuring the industry operated responsibly and ethically.

The real game-changer came with the rise of online gaming. In 2008, Peru became one of the first countries in Latin America to issue licenses for online operations, signaling its readiness to embrace the digital shift in gaming. By 2022, the country had incorporated all forms of gambling into a cohesive regulatory framework, and in 2024, it achieved full licensing coverage, completing its journey toward a fully regulated market.

Today, Peru boasts a robust and well-rounded gaming industry. Its approach balances growth with responsibility, prioritizing player protection and maintaining market stability. This isn’t just about growing the industry — it’s about doing it the right way, ensuring both profitability and order in a dynamic market.

How Peru’s Gambling Regulations Are Shaping Up Today

As demand for gaming continues to grow, Peru has stepped up its regulatory efforts to ensure fair taxation and maximize public benefits.

In 2022, the introduction of Laws N° 31557 and N° 31806 brought most gaming sectors under a unified regulatory framework. By 2023, Supreme Decree N° 005-2023 established detailed guidelines specifically for online sports betting and real-money gaming, providing clarity and structure for the industry.

To operate legally, online casino operators are now required to hold a valid DGJCMT license. These licenses come with clear standards and processes for application, maintenance, and compliance, ensuring operators adhere to the highest industry standards.

The licensing process officially began in mid-February 2024, emphasizing swift and strict compliance. Non-compliance comes with steep penalties, ranging from fines of up to $260,000 to permanent bans from the market — leaving no room for operators to skirt the rules.

Peru’s approach reflects a commitment to a well-regulated, fair, and transparent gaming environment, setting the stage for sustainable growth and greater public benefit.

The Future of Peru’s Gambling Industry

Peru’s gambling industry showcases a strong balance of regulation and innovation. With recent legislation addressing both traditional and digital gaming, the real-money sector is gradually maturing, creating a solid foundation for sustained growth in the years ahead.

Atlaslive continues to deepen its understanding of the South American iGaming market, analyzing the unique characteristics of each country in the region. The company actively monitors regulatory changes, ensuring full compliance with all legal requirements to maintain secure and trustworthy operations.

By staying ahead of trends and adapting to market challenges, Atlaslive tailors its software solutions to meet the evolving needs of operators and players alike. From cutting-edge tech capabilities to customizable features, the company is committed to helping partners succeed in a dynamic gaming landscape.

Atlaslive — the tech behind the game.

-

Asia7 days ago

Asia7 days agoDigital gaming disruption tackled in 1st AsPac Regulators’ Forum

-

Africa7 days ago

Africa7 days agoBetKing Renews Ikorodu City FC Partnership for 2025/26 NPFL Season

-

Compliance Updates6 days ago

Compliance Updates6 days agoKongebonus statement: Norway’s election result signals gambling policy continuity, but licensing debate is set to intensify

-

Balkans6 days ago

Balkans6 days agoBEGE Awards Nominations Now Open – Celebrating 16 Years of Industry Excellence!

-

Latest News6 days ago

Latest News6 days agoAnswer the Call of the Wild: ELA Games Unveils Its Latest Game “Buffalo Force”

-

Latest News6 days ago

Latest News6 days agoWin a Fruity Fortune in BGaming’s Bonanza Trillion

-

Latest News7 days ago

Latest News7 days agoSlots Temple Announces Exclusive Free-to-Play Tournament Partnership with Pragmatic Play

-

Latest News6 days ago

Latest News6 days agoSaddle up for big wins under the Bison Moon with the latest slot from Northern Lights Gaming