Press Releases

INTRALOT announces its financial results for the nine-month period in 2018, prepared in accordance with IFRS

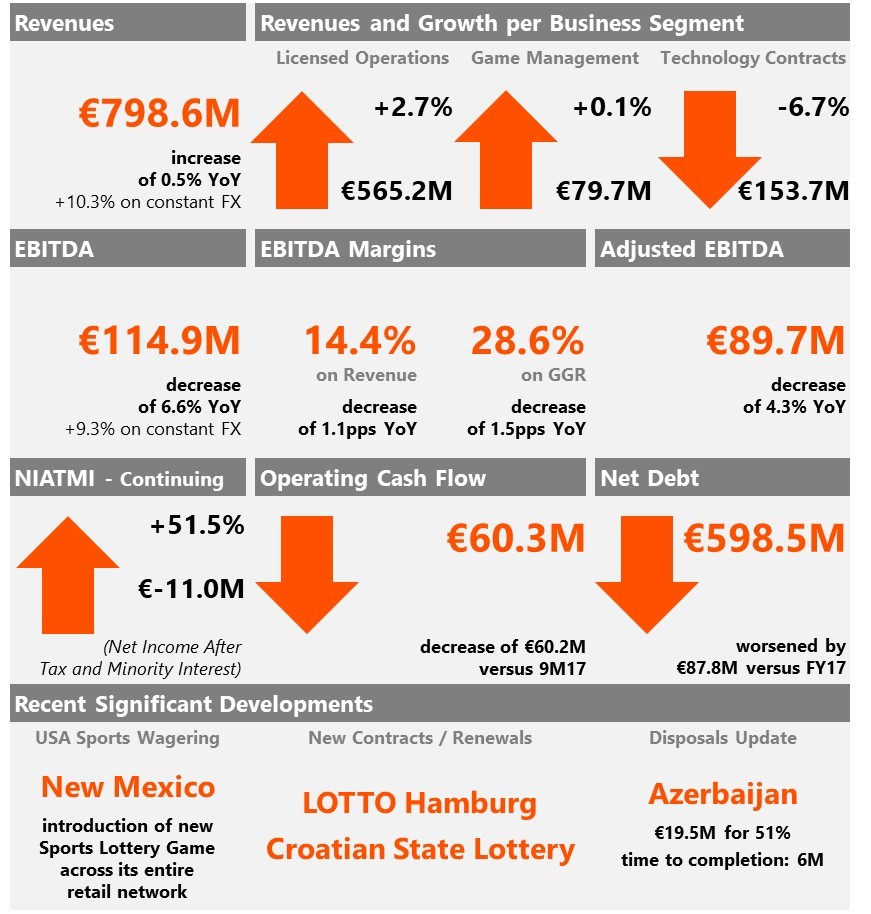

INTRALOT announces Revenue on par (+0.5%), consolidated EBITDA contraction (-6.6% y-o-y) following FX turmoil in key markets, and stable organic EBITDA y-o-y for 9M18

INTRALOT SA (RIC: INLr.AT, Bloomberg: INLOT GA), an international gaming solutions and operations leader, announces its financial results for the nine-month period ended September 30th, 2018, prepared in accordance with IFRS.

| Revenue and EBITDA growth of +10.3% and +9.3% year over year respectively on a constant currency basis.

Group Revenues at similar levels in 9M18, compared to 9M17 (+0.5%). EBITDA in the nine-month period lower by 6.6% year over year. EBITDA margins on sales and on GGR contracted by 1.1pps (at 14.4%) and 1.5pps (at 28.6%), respectively. EBT concluded to €46.3m higher by 85.2% vs. 9M17. EBT margin developed to 5.8% (+2.7pps vs. 9M17). NIATMI (Net Income After Tax and Minority Interest) from continuing operations improved by €11.7m vs. last year, developing to €-11.0m. Operating Cash Flow in 9M18 below last year by €-60.2m. Net Debt stood at €598.5m, up €87.8m compared to December 31st 2017. On September 5th, 2018, INTRALOT announced the signing of a 10-year contract with the German State Lottery “LOTTO Hamburg GmbH” for the provision of a new Lottery System Platform based on LotosX. On October 10th INTRALOT announced a 10-year contract with the Croatian State Lottery “Hrvatska Lutrija” for the implementation of the new integrated LotosX ecosystem and the provision of operational support. In late October 2018, INTRALOT signed a 2-year contract extension with the New Mexico Lottery along with the green light to be the provider of the New Mexico Sports Lottery Game available through the Lottery’s entire retail network. On November 21st, 2018, Inteltek, the business partnership of Turkcell and Intralot, capitalizing on 15 years of successful operation of the iddaa game, announced its plans for the creation of a global research and software development center in the area of mobile games in Turkey. |

OVERVIEW

9M18 INFOGRAPHIC

Group Headline Figures

| (in € million) | 9M18 | 9M17 | %

Change |

3Q18 | 3Q17 | %

Change |

LTM |

| Revenues (Turnover) | 798.6 | 794.7 | 0.5% | 251.0 | 260.0 | -3.5% | 1,108.1 |

| GGR | 401.3 | 409.3 | -2.0% | 125.7 | 135.5 | -7.2% | 571.1 |

| EBITDA | 114.9 | 123.0 | -6.6% | 34.8 | 40.9 | -14.9% | 163.4 |

| EBITDA Margin (% on Revenue) | 14.4% | 15.5% | -1.1pps | 13.9% | 15.7% | -1.8pps | 14.8% |

| EBITDA Margin (% on GGR) | 28.6% | 30.1% | -1.5pps | 27.7% | 30.2% | -2.5pps | 28.6% |

| Adjusted EBITDA[1] | 89.7 | 93.7 | -4.3% | 26.1 | 31.2 | -16.6% | 127.1 |

| EBT | 46.3 | 25.0 | 85.2% | 13.8 | 7.5 | 85.3% | 31.6 |

| EBT Margin (%) | 5.8% | 3.1% | +2.7pps | 5.5% | 2.9% | +2.6pps | 2.9% |

| NIATMI from continuing operations | -11.0 | -22.7 | 51.5% | -7.9 | -7.1 | -11.3% | -46.9 |

| NIATMI from total operations | -11.0 | -32.0 | 65.6% | -7.9 | -6.2 | -27.4% | -32.4 |

| Total Assets | 929.3 | 1,333.1 | – | – | – | – | – |

| Gross Debt | 749.8 | 987.0 | – | – | – | – | – |

| Net Debt | 598.5 | 497.0 | – | – | – | – | – |

| Operating Cash Flow | 60.3 | 120.5 | -50.0% | 23.6 | 43.3 | -45.5% | 93.8 |

| “INTRALOT has successfully won new projects in the past two months such as Lotto Hamburg and the Croatian Lottery as well as extended its New Mexico contract in the US; in the latter case including approval for a new sports prognostics game, available through the entire retail footprint of the lottery. All these projects will apply new technological solutions developed by INTRALOT, reflecting the positive prospects created by our significant investments in the last two years. We are also looking forward to the commencement of our operations in Illinois, a project that has heavily impacted our financials in 9M18. Such developments confirm our positive outlook after the current transition year according to our business plan.” |

INTRALOT Group CEO Antonios Kerastaris noted:

“INTRALOT has successfully won new projects in the past two months such as Lotto Hamburg and the Croatian Lottery as well as extended its New Mexico contract in the US; in the latter case including approval for a new sports prognostics game, available through the entire retail footprint of the lottery. All these projects will apply new technological solutions developed by INTRALOT, reflecting the positive prospects created by our significant investments in the last two years. We are also looking forward to the commencement of our operations in Illinois, a project that has heavily impacted our financials in 9M18. Such developments confirm our positive outlook after the current transition year according to our business plan.”

OVERVIEW OF RESULTS

WAGERS HANDLED

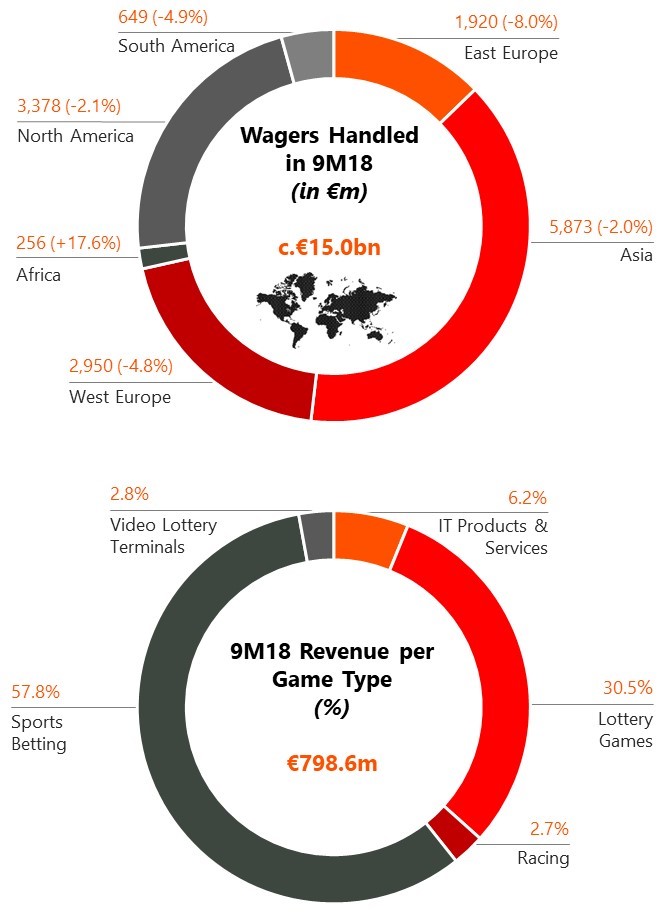

During the nine-month period ended September 30th, 2018, INTRALOT systems handled €15.0b of worldwide wagers (from continuing operations[2]), a 3.2% y-o-y decrease. Africa’s wagers increased by 17.6% (driven by Morocco’s performance), East Europe’s by 8.0% (affected by the TRY currency devaluation), South America’s by 4.9% (affected by the Argentinean Peso movement), West Europe’s by 4.8%, North America’s by 2.1% (FX driven), and Asia’s by 2.0%.

During the nine-month period ended September 30th, 2018, INTRALOT systems handled €15.0b of worldwide wagers (from continuing operations[2]), a 3.2% y-o-y decrease. Africa’s wagers increased by 17.6% (driven by Morocco’s performance), East Europe’s by 8.0% (affected by the TRY currency devaluation), South America’s by 4.9% (affected by the Argentinean Peso movement), West Europe’s by 4.8%, North America’s by 2.1% (FX driven), and Asia’s by 2.0%.

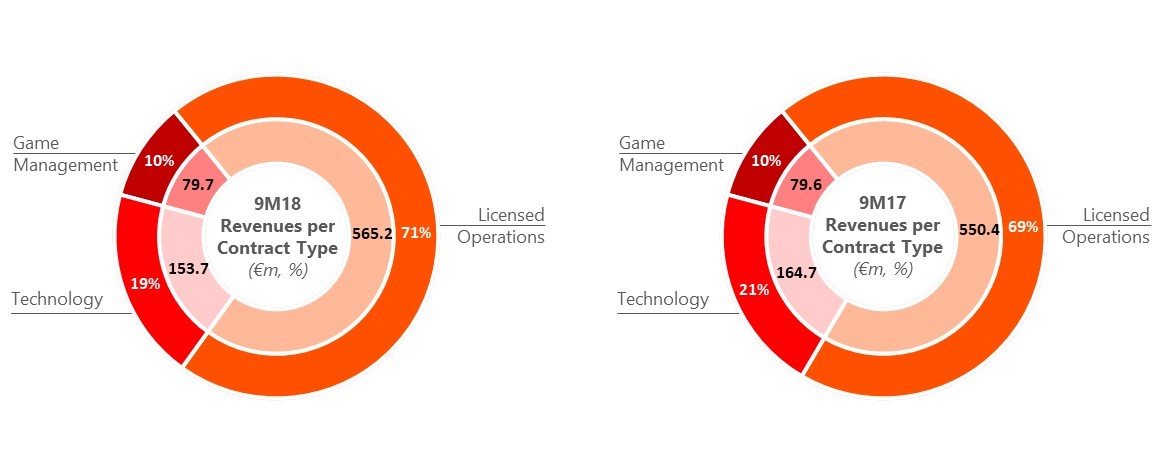

REVENUE

- Reported consolidated revenues slightly higher compared to 9M17, leading to total revenues for the nine-month period ended September 30th, 2018, of €798.6m (+0.5%).

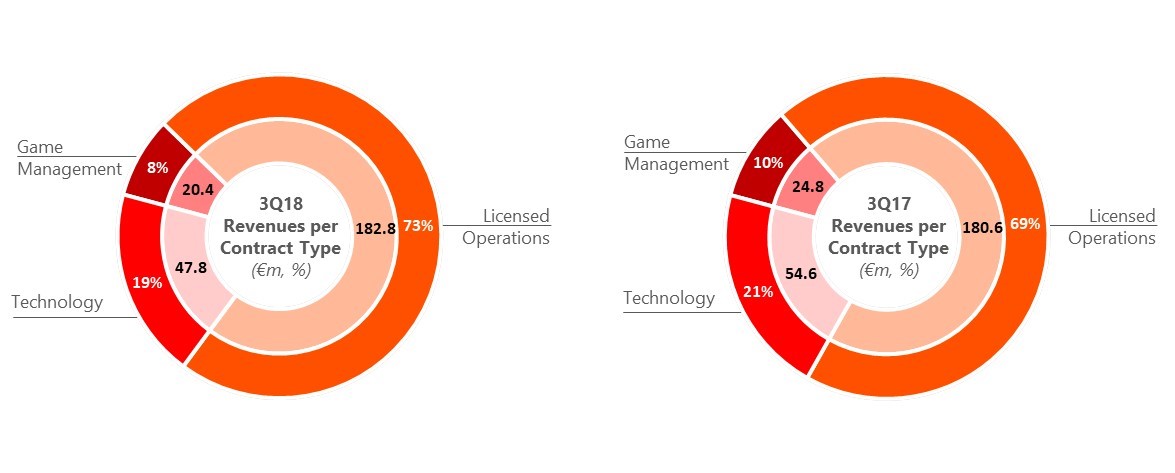

- Sports Betting was the largest contributor to our top line, comprising 57.8% of our revenues (posting a 6.8% revenue growth, year over year), followed by Lottery Games contributing 30.5% to Group turnover. Technology contracts accounted for 6.2% and VLTs represented 2.8% of Group turnover while Racing constituted the 2.7% of total revenues of 9M18.

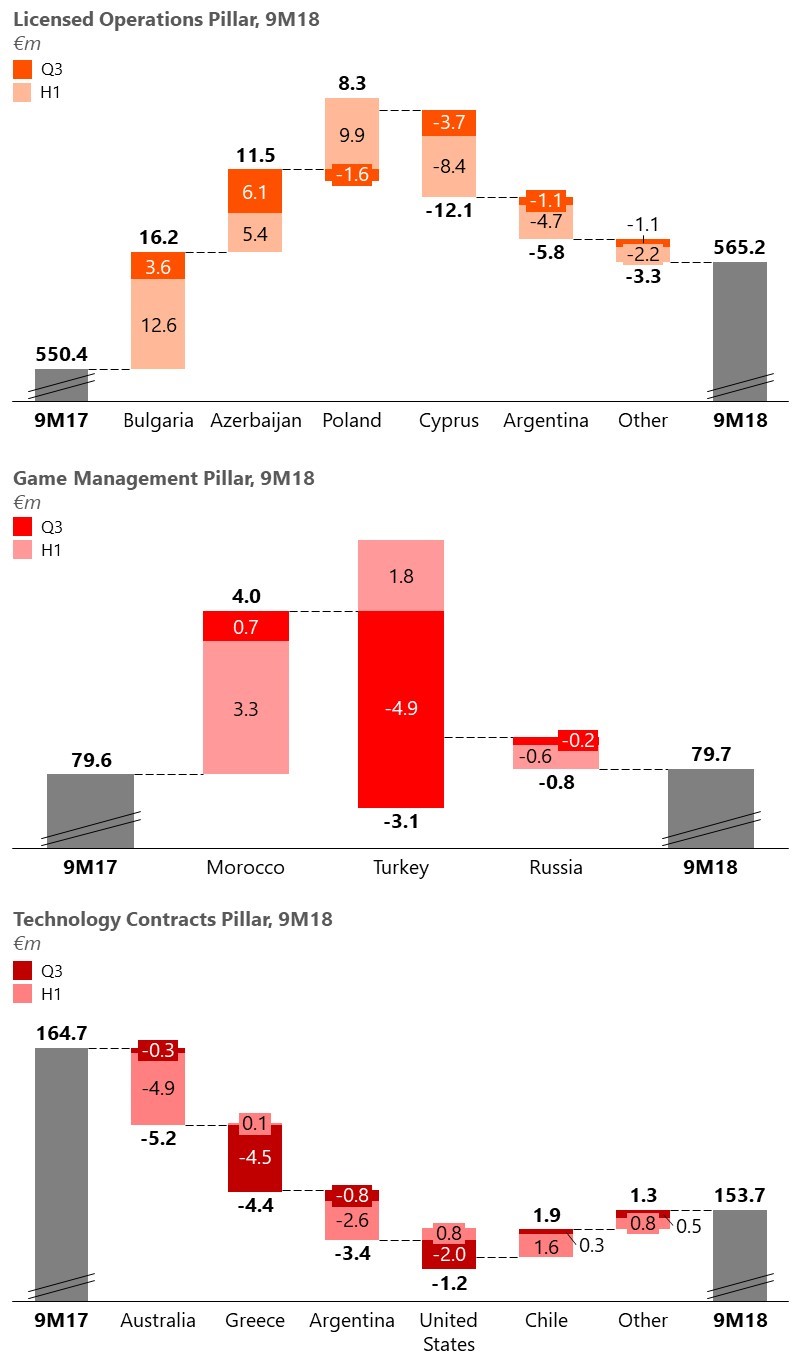

- Reported consolidated revenues for the nine-month period are up by €3.9m year over year. The main factors that drove top line performance per Business Activity are:

- €+14.8m (+2.7%) from our Licensed Operations (B2C) activity line with the increase attributed mainly to higher revenues in:

- Bulgaria (€+16.2m), mainly following the growth in Virtual Sports and Racing; with the growth in both types of games in part fueled by the increasing Payout,

- Azerbaijan (€+11.5m), driven by the enhanced Sports Betting portfolio (both retail and online),

- Poland with additional revenues of €8.3m due to the growth of the interactive Sport Betting channel (following market regulation) and the introduction of Virtual Games in 2Q17,

- in part offset by the impact of the suspended license in Cyprus in 4Q 2017 (€-12.1m),

- and the lower recorded revenues, in Euro terms, from our Argentinean[3] licensed operations (€-5.8m). In local currency, 9M18 results posted a c.+45.0% year over year increase (higher compared to the 2015-2017 CAGR of c.27.0%), heavily affected though by the local currency fluctuations (c.64.0% Euro appreciation versus a year ago – in YTD average terms), with that being the key driver for the worsening performance in

Euro terms in the nine-month period.

Euro terms in the nine-month period. - €+0.1m (+0.1%) from our Management (B2B/ B2G) contracts activity line with the positive variance driven by:

- Morocco’s (€+4.0m or c.+26% y-o-y growth) Sports Betting sales uplift attributed to the enhanced product offering,

- absorbing the deficit, in Euro terms, from our Turkish operations (€-3.1m). In local currency, 9M18 revenue showcased a c.+31.0% increase attributed both to the growth of the Sport Betting Market year over year (c.+24.0% in local currency) and the shift towards Online Sports Betting (slightly over 60% sales mix participation vs. about 50% a year ago). Nevertheless, the benefit of the Sports Betting market expansion and mix change has been fully counterbalanced by the devaluation of the local currency (c.38.0% Euro appreciation versus a year ago – in YTD average terms).

- €-11.0m (-6.7%) from our Technology and Support Services (B2B/ B2G) activity line with the decrease attributed mainly to:

- Australia’s lower recorded revenue (€-5.2m) largely as a result of a software license right sale in 2Q17 coupled with adverse local currency movement (c.8.4% Euro appreciation – in YTD average terms),

- lower sales in Greece (€-4.4m) driven by the transition to the new OPAP contract, after July, that has a smaller contract value, due to its limited scope (vs. the previous contract), specifically in the field of numerical games,

- Argentina’s[4] lower recorded sales in Euro terms (€-3.4m) as a result of the significantly adverse FX movement. In local currency, 9M18 results posted a c.+38.0% year over year increase (higher compared to the 2015-2017 CAGR of c.32.0%), heavily affected though by the local currency fluctuations (c.64.0% Euro appreciation versus a year ago – in YTD average terms), and to

- our US operations’ lower revenues in Euro terms (€-1.2m) impacted by the adverse USD movement (c.7.0% Euro appreciation versus a year ago — in YTD average terms). In local currency base our US operations presented a c.5.0% increase driven by the improved contract terms (e.g. Idaho) and higher equipment sales vs. a year ago (Massachusetts driven), thus, fully absorbing the impact of the expired contract in South Carolina,

- in part offset by the maturing Chilean contract (€+1.9m) that went live in early 1Q17.

- On a quarterly basis, revenues decreased by 3.5% compared to 3Q17, leading to total revenues for the three-month period started in July 1st, 2018, and ended in September 30th, 2018, of €251.0m. Decreased revenues for the quarter (€-9.0m) are primarily the result of Turkey’s and Argentina’s FX impacted revenues, the lower sales in Greece (OPAP driven), the Cyprus suspended SB license, the US (last year’s high Powerball Jackpot in 3Q17 and the discontinuation of our South Carolina contract), and Poland (increasing competition), in part offset by Azerbaijan’s and Bulgaria’s better top line performance

- Constant currency basis: In 9M18, revenues — net of the negative FX impact of €78.3m —reached €876.9m (+10.3% y-o-y), while 3Q18 revenues — net of the negative FX impact of €30.2m – reached €281.2m (+8.1% y-o-y).

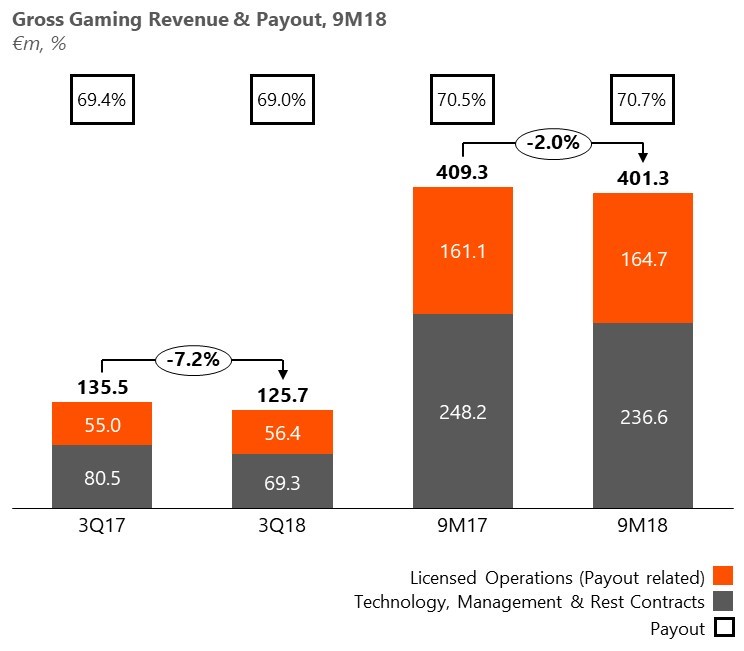

GROSS GAMING REVENUE & Payout

Gross Gaming Revenue (GGR) from continuing operations decreased by 2.0% (€-8.0m to €401.3m) year over year driven by:

Gross Gaming Revenue (GGR) from continuing operations decreased by 2.0% (€-8.0m to €401.3m) year over year driven by:- the significant drop in the non-payout related GGR (€-11.6m vs. 9M17), largely due to the revenue shortfall in Australia (software license right sale in 2Q17), Greece (OPAP driven), US (Powerball and SC discontinuation) and FX impacted sales in Turkey and Argentina; counterbalanced by the stronger top line in Morocco,

- in part offset by the increase in our payout related GGR (+2.2% y-o-y or €+3.6m), following the stronger top line growth of our licensed operations (+2.9% y-o-y on wagers[5]) which came at a slightly increased YTD average Payout. YTD Average Payout Ratio was up by 0.2pps vs. LY (70.7% vs. 70.5%) primarily due to an increasing weighted contribution from Bulgaria (Payout and wagers driven), Poland (wagers driven), and Azerbaijan (wagers driven) counterbalanced by the suspended license in Cyprus in 4Q 2017, Brazil (decreasing wagers contribution) and Argentina (wagers and payout driven).

- In 3Q18, GGR from continuing operations decreased by -7.2% (or €-9.8m) year over year driven by:

- the decrease of the non-payout related GGR (-14.1% y-o-y or €-11.4m) largely due to the FX impacted revenues in Turkey and Argentina, Greece’s revenue shortfall (OPAP driven), and our US operations’ decreased revenues as a result of last year’s high Powerball Jackpot in 3Q17 and the SC contract discontinuation,

- partially counterbalanced by the increase in our payout related GGR (+2.5% y-o-y or €+1.4m) following the better top line performance of our licensed operations (+1.3% y-o-y on wagers5) supported further by a lower recorded average Payout Ratio. In 3Q18 the average Payout Ratio improved by -0.4pps vs. 3Q17 (69.0% vs. 69.4%).

- Constant currency basis: In 9M18, GGR — net of the negative FX impact of €54.9m —reached €456.1m (+11.4% y-o-y), while 3Q18 GGR — net of the negative FX impact of €21.6m – reached €147.3m (+8.7% y-o-y).

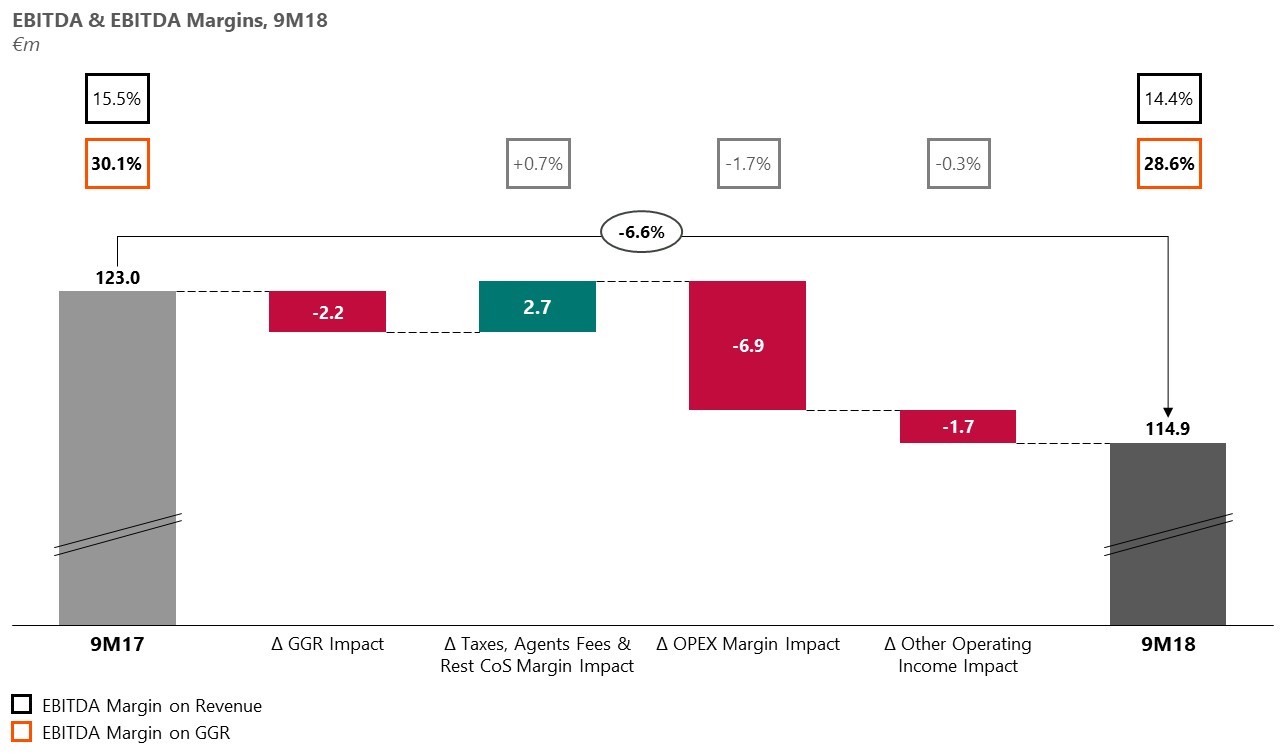

EBITDA & EBITDA MARGINS[6]

- EBITDA, from continuing operations, developed to €114.9m in 9M18, posting a decrease of 6.6% (€-8.1m) compared to the 9M17 results. On an organic level[7], growth fully absorbed LY’s software license right sale in Australia, Powerball impact along with the SC contract discontinuation and the IL implementation expenses in the US, OPAP’s new contract scope, and Bit8’s first time consolidation but could not fully absorb the extremely adverse FX movement across markets (mainly Turkey, Argentina, Australia and the US).

- The main drivers for the decrease in 9M18 EBITDA, besides the 9M18 GGR decrease, are:

- the deterioration in the OPEX margin (-1.7% over GGR); mainly driven by the deterioration of the respective B2B/ B2G OPEX margin as a result of the increased administrative expenses (US mainly) and advertising expenses (largely driven by the increased marketing expenses in Turkey related to our Online Sport Betting activity), coupled with penalty provisions in Morocco (based on a performance reconciliation mechanism). The impact of the first-time consolidation of Bit8 has been fully offset by Intralot HQ OPEX savings/ phasing.

- the decrease in the Other operating income in 9M18, which totaled €11.3m compared to €13.0m in 9M17, mainly driven by the less equipment lease income in USA (following the recent contract renewal in ID; the shortfall, in local currency terms, has been more than recouped from the increased revenue), coupled with the adverse USD movement against the Euro.

- partially offset by the improvement in the Taxes & Agent Fees margin (+0.5% over GGR), driven by the improvement in the respective B2B/B2G margin as a result of a more favorable sales mix in the retail Sports Betting segment in Turkey,

- and the improvement in the Rest of Cost of Sales margin (+0.2% over GGR) driven mainly by the improvement in the margin of the B2B/ B2G contracts, that fully absorbed the SC contract discontinuation and IL implementation expenses’ impact.

- On a yearly basis, EBITDA margin on sales, has been impacted by the worsening margins of the B2B/ B2G segment, decreasing to 14.4% compared to 15.5% in 9M17 mainly due to Australia’s software license right sale in 2Q17, OPAP’s new contract scope, US Powerball impact in 3Q17, SC contract discontinuation, IL implementation expenses and first-time consolidation of Bit8.

- On a quarterly basis, EBITDA decreased by -14.9% to €34.8m, mainly due to OPAP impact, US Powerball in 3Q17, Admin Cost increase, SC contract discontinuation, IL implementation expenses’ impact, and adverse FX vs. a year ago.

- On a quarterly basis, EBITDA margin on GGR, deteriorated to 27.7% compared to 30.2% in 3Q17, as a result of the B2B/ B2G segment margin contraction following mainly the impacts from US Powerball in 3Q17, SC contract discontinuation, IL implementation expenses’ impact, OPAP impact, and the first-time consolidation of Bit8.

- LTM EBITDA developed to €163.4m posting a decrease of -3.6% vs. 1H18.

- Constant currency basis: In 9M18, EBITDA, net of the negative FX impact of €19.6m, reached €134.5m (+9.3% y-o-y) while 3Q18 EBITDA, net of the negative FX impact of €7.7m reached €42.5m (+3.8% y-o-y).

EBT / NIATMI

- EBT in 9M18 totaled €46.3m, significantly higher compared to €25.0m in 9M17. The impact of the decreased EBITDA described above (y-o-y: €-8.1m) was completely counterbalanced by the significantly better FX results (mostly unrealized) (€+16.2m vs. 9M17) driven mainly by the better USD performance against the local currencies (e.g. high portion of Cash and Cash equivalents in Turkish Entities are held in USD) — being in part offset though by the deterioration of local currencies against EUR, the better Net Interest results (€+7.6m) driven mainly by higher Finance Income (including a legal case won, and Turkey’s Interest Income on Cash & Cash Equivalents) and of a lower Finance Expense (lower LG expenses, lower charge from interest bearing liabilities, and part of the prior year accelerated amortization, amounting to €3.5m, due to Refinancing of 2017), the better results derived from the equity method consolidation of associates (€+1.8m vs. 9M17; benefited by the better performance of our equity investment in Peru and the full consolidation of Bit8 in 4Q17), the lower D&A for the period (favorable impact: €+1.7m vs. 9M17), the higher income from participations/investments (€+1.5m; assisted mainly by the higher dividend received from our investment in Hellenic Lotteries in 2Q18), and the lower impairments of assets for the period (€+0.6m).

- In 3Q18, the significantly better FX results (mostly unrealized) (€+8.3m driven by the USD performance against the local currencies), and the better Net Interest results (€+6.0m) driven by a higher Finance Income (including a legal case won, higher Interest from Turkey’s Cash & Cash Equivalents) and the lower Finance Expense (driven by the lower charge from interest bearing liability, and of the 3Q17 accelerated amortization amounted to €3.5m), being in part offset by the higher D&A (impact: €-1.4m) more than absorbed the recorded y-o-y EBITDA deficit (€-6.1m vs. 3Q17), thus, concluding to an EBT of €13.9m (+6.4m vs. 3Q17).

- Constant currency basis: In 9M18 EBΤ, adjusted for the FX impact, reached €54.7m from €31.0m in 9M17 while in 3Q18 adjusted for the FX impact, concluded to €15.3m from €9.2m in 3Q17.

- NIATMI from continuing operations in 9M18 concluded at €-11.0m compared to €-22.7m in 9M17. NIATMI from total operations in 9M17 was further deteriorated from the PAT contribution of the prior period’s discontinued operations (€-9.3m) and concluded at €-32.0m (in 9M18 there were no discontinued entities). In 3Q18, NIATMI from continuing operations shaped at €-7.9m (vs. €-7.1m y-o-y). NIATMI from total operations in 3Q17 was €-6.2m positively affected by the PAT contribution of the prior period’s discontinued operations (€+1.0m)

- Constant currency basis: NIATMI (total operations) in 9M18, on a constant currency basis, reached €-7.2m from €-11.7m in 9M17 while in 3Q18 reached €-7.4m from €-4.3m

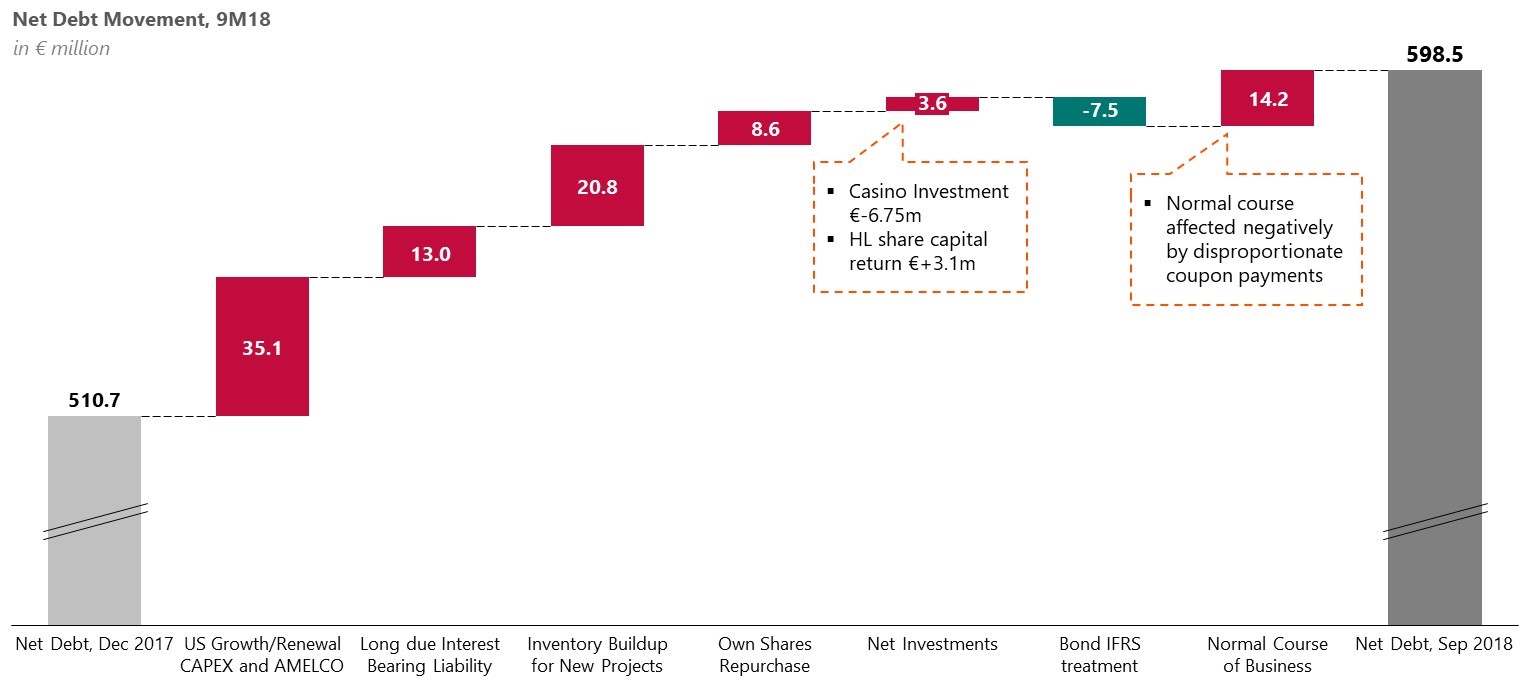

CASH-FLOW

- Operating Cash-flow posted a considerable decrease in 9M18 at €60.3m vs. €120.5m in 9M17. Excluding the operating cash-flow contribution of our discontinued operations (Jamaica, Santa Lucia, Russia, and Slovakia) in 9M17 (€+12.7m), the cash-flow from operating activities is lower by €47.5m (€60.3m vs. €107.8m) mainly driven by the lower recorded EBITDA y-o-y (€-8.1m) and the adverse working capital movement of 9M18 (€-34.3m vs. €+5.8m in 9M17). Current period WC impact is driven by the repayment of a long due interest-bearing liability (€-13.0m) and the inventory buildup for new projects (€-20.8m) largely as a result of the Illinois and Ohio projects.

- Adjusted Free Cash Flow[8] in 9M18 decreased by €13.4m, to €9.9m compared to €23.3m a year ago. Main contributors to this variance were the lower recorded EBITDA y-o-y, the higher Net Finance Charges (higher bond debt exposure and timing variance of the bond coupons payment schedule, being in part offset by lower RCF lines exposure), and the higher dividends received from our equity investment in Italy & Greece (Gamenet first-time dividend distribution and the higher dividend vs. 9M17 from “Hellenic Lotteries S.A.”). In 3Q18, the Adjusted Free Cash Flow reached €-2.7m, decreased by €15.6m vs. 3Q17, mainly affected by the lower EBITDA in 3Q18 (vs. 3Q17) and the timing variance of the bond coupons payment schedule (following the refinancing that took place in 3Q17 resulting in coupon payments across Q1 and Q3 vs. a coupon payment every Quarter previously).

- Net CAPEX in 9M18 was €65.0m compared to €59.3m in 9M17 affected mainly by the ongoing US CAPEX. Headline CAPEX items in 9M18 include €13.9m towards R&D, €30.4m in the US mainly towards the Illinois new contract, Ohio contract renewal, and New Hampshire’s “Keno” service launch, and €5.8m towards AMELCO. All other net additions amount to €14.9m for 9M18. Maintenance CAPEX for 9M18 stood at €16.5m, or 25.2% of the overall capital expenditure in 9M18 (€65.4m), at similar levels vs. a year ago (9M17; €15.7m or 26.4%).

- Net Debt, as of September 30th, 2018, stood at €598.5m, up €87.8m compared to December 31st 2017 as a result of the investments in our US business (€-29.3m towards growth & renewal CAPEX in the US), the payment of the last instalment in AMELCO software (€-5.8m), the repayment of a long due interest bearing liability (€-13.0m), the inventory buildup for new projects (€-20.8m; as described above), own shares repurchase (€-8.6m), the net results from investments (€-3.6m; the outflow for an indirect stake in “Hellenic Casino Parnitha S.A.” of €6.8m being in part offset by the share capital return of €3.1m from the Hellenic Lotteries equity investment) and the bond IFRS treatment (€+7.5m). On a quarterly basis, Net Debt increased by €26.0m significantly affected by the increased US CAPEX and Inventory buildup outflow.

- As of September 30th, 2018, a repurchase of Notes amounting to €5.0 million (€500M, 5.25% Senior Notes due 2024 ISIN XS1685702794) has occurred. We may proceed to repurchases of our debt again in the future subject to market conditions.

RECENT/ SIGNIFICANT COMPANY DEVELOPMENTS

- On September 5th, 2018, INTRALOT Global Operations B.V. a fully owned subsidiary company of INTRALOT S.A., following a competitive tender process procured by the German State Lottery “LOTTO Hamburg GmbH” was awarded a ten (10) years contract for the provision of a new integrated Lottery System Platform with multi-mandate capability, customized to the individual needs and requirements of Lotto Hamburg as well as to the German Lottery Market, supporting LOTTO Hamburg’s Strategic and Operational objectives.

- On October 10th, 2018, INTRALOT announced the signing of a 10-year contract with the Croatian State Lottery “Hrvatska Lutrija” for the implementation of the new integrated LotosX ecosystem with Omni Channel capability, the deployment of innovative Retail technology and the provision of operational support. All of the above will be customized to the specific needs and requirements of Hrvatska Lutrija and the Croatian gaming market, supporting the strategic and operational objectives for the extensive growth and future expansion of Hrvatska Lutrija in the verticals of Numerical & Instant Games, Betting and Online Casino.

- On October 19th, 2018, INTRALOT announced that its Group Chief Financial Officer Mr. George Koliastasis will step down on 31 December 2018. He will be succeeded by current Group Finance, Controlling & Budgeting Director Mr. Andreas Chrysos.

- On October 30th, 2018, the New Mexico Lottery Board voted unanimously to move forward with the creation of a game tied to the outcome of sporting events (Sports Lottery) as well as to grant a 2-year extension on its existing online systems contract with INTRALOT. The New Mexico Lottery will be the first Lottery in the United States to authorize a Sports wagering lottery game to be available through its entire retail network, approximately 1,100 retail terminals.

- In November 19th, 2018, INTRALOT Group announced the signing of an agreement with respect to the sale of the shares held by the Company’s 45% owned subsidiary İnteltek İnternet Teknoloji Yatırım ve Danışmanlık Ticaret A.Ş. (“INTELTEK”) in its 51% owned subsidiary Azerinteltek QSC (“Azerinteltek”) with a nominal value of AZN 51,000 to Baltech Investment LLC, shareholder of Azerinteltek with a 24.5% shareholding, for a total consideration of EUR 19,530,177. The transfer of shares is anticipated to be completed within 6 months.

- On November 21st, 2018, Inteltek, the business partnership of Turkcell and Intralot, capitalizing on 15 years of successful operation of the iddaa game, announced its plans for the creation of a global research and software development center in the area of mobile games in Turkey. In the first phase this center will employ 100 engineers.

- During the period between 01.01.2018 and 30.09.2018, Intralot SA has proceeded with the repurchase of 9,218,779 own shares amounting to €8.59m with an average price of €0.93, while for the period between 01.10.2018 and 23.11.2018, Intralot SA did not proceed with any repurchases of own shares.

APPENDIX

Performance per Business Segment

YTD Performance

Quarterly Performance

Performance per Geography

Revenue Breakdown

| (in € million) | 9M18 | 9M17 | %

Change |

| Europe | 467.6 | 456.8 | 2.4% |

| Americas | 152.4 | 166.4 | -8.4% |

| Other | 216.0 | 209.1 | 3.3% |

| Eliminations | -37.4 | -37.6 | – |

| Total Consolidated Sales | 798.6 | 794.7 | 0.5% |

Gross Profit Breakdown

| (in € million) | 9M18 | 9M17 | %

Change |

| Europe | 56.3 | 49.0 | 15.1% |

| Americas | 17.5 | 22.4 | -21.9% |

| Other | 93.3 | 92.2 | 1.2% |

| Eliminations | -4.9 | -0.3 | – |

| Total Consolidated Gross Profit | 162.2 | 163.3 | -0.7% |

Gross Margin Breakdown

| 9M18 | 9M17 | %

Change |

|

| Europe | 12.0% | 10.7% | +1.3pps |

| Americas | 11.5% | 13.5% | -2.0pps |

| Other | 43.2% | 44.1% | -0.9pps |

| Total Consolidated Gross Margin | 20.3% | 20.5% | -0.2pps |

INTRALOT Parent Company results

- Revenues for the period decreased by 2.8% to €41.9m. The sales deficit is mainly driven by the lower sales in Greece, due to the transition to the new OPAP contract, after July, that has a smaller contract value, due to its limited scope (vs. the previous contract), specifically in the field of numerical games, which was in part offset by the increased royalties/ software license fees from subsidiaries and associates (e.g. Peru).

- EBITDA shaped at €2.9m from €3.1m in 9M17. The impact from the gross profit deficit (driven by the lower top line) and the lower Other Operating Income was mitigated by the reduced OPEX (savings and timing).

- Earnings after Taxes (EAT) at €-6.3m from €-1.3m in 9M17.

- LTM EBITDA figure is lower by €1.8m vs. LTM 2Q18 following the 3Q18 performance of the Company (vs. 3Q17).

| (in € million) | 9M18 | 9M17 | %

Change |

LTM |

| Revenues | 41.9 | 43.1 | -2.8% | 65.6 |

| Gross Profit | 14.0 | 14.7 | -4.8% | 27.4 |

| Other Operating Income | 0.1 | 1.6 | -93.8% | 0.5 |

| OPEX | -21.3 | -24.2 | -12.0% | -31.8 |

| EBITDA | 2.9 | 3.1 | -6.5% | 8.6 |

| EAT | -6.3 | -1.3 | – | -16.5 |

| CAPEX (paid) | -13.5 | -10.6 | 27.4% | -18.2 |

CONFERENCE CALL INVITATION – 9M18 FINANCIAL RESULTS

Antonios Kerastaris, Group CEO, Georgios Koliastasis, Group CFO, Nikolaos Pavlakis, Group Tax & Accounting Director, Andreas Chrysos, Group Finance, Controlling & Budgeting Director and Michail Tsagalakis, Capital Markets Director, will address INTRALOT’s analysts and institutional investors to present the Company’s Third Quarter 2018 results, as well as to discuss the latest developments at the Company.

The financial results will be released on the ATHEX website (www.helex.gr), and will be posted on the company’s website (www.intralot.com) on Monday 26th November 2018 (after the close of the ATHEX trading session).

AGENDA: Brief Presentation – Question and Answer Session

CONFERENCE CALL DETAILS

| Date: Wednesday, 28th November 2018

Time: Greek time 17:00 – UK time 15:00 – CET 16:00 – USA time 10:00 (East Coast Line) |

|

| Conference Phone GR | + 30 211 180 2000 |

| Conference Phone GR | + 30 210 94 60 800 |

| Conference Phone GB | + 44 (0) 203 059 5872 |

| Conference Phone GB | + 44 (0) 800 368 1063 |

| Conference Phone US | + 1 516 447 5632 |

| We recommend that you call any of the above numbers 5 to 10 minutes before the conference call is scheduled to start. |

|

LIVE WEBCAST DETAILS

The conference call will be available via webcast in real time over the Internet and you may join by linking at the internet site:

https://services.choruscall.eu/links/intralot18Q3.html

DIGITAL PLAYBACK

There will be a digital playback on the 28th November 2018 at 19:00 (GR Time).

This Service will be available until the end of the business day 7th December 2018.

Please dial the following numbers and the PIN CODE: 059 # from a touch-tone telephone

Digital Playback UK: + 44 (0) 203 059 5874

Digital Playback US: + 1 631 257 0626

Digital Playback GR: + 30 210 94 60 929

In case you need further information, please contact Intralot, Mr. Michail Tsagalakis, at the telephone number: +30 213 0397000 or Chorus Call Hellas S.A., our Teleconferencing Services Provider, Tel. +30 210 9427300.

SUMMARY OF FINANCIAL STATEMENTS

Group Statement of Comprehensive Income

| (in € million) | 9M18 | 9M17 | %

Change |

3Q18 | 3Q17 | %

Change |

LTM |

| Revenues | 798.6 | 794.7 | 0.5% | 251.0 | 260.0 | -3.5% | 1,108.1 |

| Gross Profit | 162.2 | 163.3 | -0.7% | 45.7 | 54.9 | -16.8% | 240.8 |

| Other Operating Income | 11.3 | 13.0 | -13.1% | 3.9 | 4.2 | -7.1% | 15.5 |

| OPEX | -106.6 | -103.0 | 3.5% | -31.0 | -33.1 | -6.3% | -154.2 |

| EBITDA | 114.9 | 123.0 | -6.6% | 34.8 | 40.9 | -14.9% | 163.4 |

| Margin | 14.4% | 15.5% | -1.1pps | 13.9% | 15.7% | -1.8pps | 14.8% |

| EBIT | 66.9 | 73.3 | -8.7% | 18.6 | 26.0 | -28.5% | 102.1 |

| Interest expense (net) | -31.5 | -39.1 | -19.4% | -9.6 | -15.6 | -38.5% | -55.3 |

| Exchange differences | 10.2 | -6.0 | – | 6.6 | -1.7 | – | 10.3 |

| Other | 0.7 | -3.2 | – | -1.7 | -1.3 | 30.8% | -25.5 |

| EBT | 46.3 | 25.0 | 85.2% | 13.9 | 7.5 | 85.3% | 31.6 |

| NIATMI | -11.0 | -32.0 | 65.6% | -7.9 | -6.2 | -27.4% | -32.4 |

| NIATMI continuing | -11.0 | -22.7 | -51.5% | -7.9 | -7.1 | 11.3% | -46.9 |

| NIATMI discontinued | 0.0 | -9.3 | – | 0.0 | 0.9 | – | 14.5 |

Group Statement of Financial Position

| (in € million) | 9M18 | FY17 |

| Tangible Assets | 116.2 | 102.8 |

| Intangible Assets | 319.7 | 324.5 |

| Other Non-Current Assets | 171.9 | 178.6 |

| Inventories | 48.8 | 31.5 |

| Trade receivables | 62.0 | 84.2 |

| Other Current Assets | 210.7 | 300.3 |

| Total Assets | 929.3 | 1,021.9 |

| Share Capital | 47.1 | 47.7 |

| Other Equity Elements | -33.4 | 10.1 |

| Non-Controlling Interests | 26.9 | 32.0 |

| Total Shareholders’ Equity | 40.6 | 89.8 |

| Long-term Debt | 745.4 | 729.4 |

| Provisions/ Other Long term Liabilities | 30.7 | 29.6 |

| Short-term Debt | 4.4 | 19.3 |

| Other Short-term Liabilities | 108.2 | 153.8 |

| Total Liabilities | 888.7 | 932.1 |

| Total Equity and Liabilities | 929.3 | 1,021.9 |

Group Statement of Cash Flows

| (in € million) | 9M18 | 9M17 |

| EBT from continuing operations | 46.3 | 25.0 |

| EBT from discontinued operations | 0.0 | 0.7 |

| Plus/less Adjustments | 69.0 | 113.0 |

| Decrease/(increase) of Inventories | -18.5 | -3.8 |

| Decrease/(increase) of Receivable Accounts | 11.5 | 0.7 |

| (Decrease)/increase of Payable Accounts | -27.3 | 9.7 |

| Income Tax Paid | -20.7 | -24.8 |

| Net Cash from Operating Activities | 60.3 | 120.5 |

| Net CAPEX | -65.0 | -59.3 |

| (Purchases) / Sales of subsidiaries & other investments | -3.6 | 6.2 |

| Interest received | 4.1 | 4.0 |

| Dividends received | 7.6 | 2.0 |

| Net Cash from Investing Activities | -56.9 | -47.1 |

| Repurchase of own shares | -8.6 | 0.0 |

| Cash inflows from loans | 60.3 | 571.8 |

| Repayment of loans | -45.4 | -234.2 |

| Bond buybacks | -5.0 | 0.0 |

| Repayment of Leasing Obligations | -4.2 | -2.2 |

| Interest and similar charges paid | -48.0 | -37.8 |

| Dividends paid | -31.5 | -34.0 |

| Net Cash from Financing Activities | -82.4 | 263.6 |

| Net increase / (decrease) in cash for the period | -79.0 | 337.0 |

| Exchange differences | -7.6 | -11.4 |

| Cash at the beginning of the period | 238.0 | 164.4 |

| Cash at the end of the period from total operations | 151.4 | 490.0 |

About INTRALOT

INTRALOT, a public listed company established in 1992, is a leading gaming solutions supplier and operator active in 50 regulated jurisdictions around the globe. With €1.1 billion turnover and a global workforce of approximately 5,100 employees (3,100 of which in subsidiaries and 2,000 in associates) in 2017, INTRALOT is an innovation – driven corporation focusing its product development on the customer experience. The company is uniquely positioned to offer to lottery and gaming organizations across geographies market-tested solutions and retail operational expertise. Through the use of a dynamic and omni-channel approach, INTRALOT offers an integrated portfolio of best-in-class gaming systems and product solutions & services addressing all gaming verticals (Lottery, Betting, Interactive, VLT). Players can enjoy a seamless and personalized experience through exciting games and premium content across multiple delivery channels, both retail and interactive. INTRALOT has been awarded with the prestigious WLA Responsible Gaming Framework Certification by the World Lottery Association (WLA) for its global lottery operations.

For more info:

-Mr. Chris Sfatos, Group Director Corporate Affairs, email: [email protected] or

-Investor Relations Dept. email: [email protected]

Phone: +30-210 6156000, Fax: +30-210 6106800, www.intralot.com

[1] Calculated as Proportionate EBITDA of fully consolidated entities including EBITDA from equity investments in Italy, Peru, Greece, and Taiwan

[2] Discontinued operations and contracts ended within the current period are excluded from the analysis.

[3] Argentina 2018 figures have been restated based on IAS 29 (Financial Reporting in Hyperinflationary Economies) so as to reflect current purchasing power. LY figures have not been restated based on IAS 21 (The Effects of Changes in Foreign Exchange Rates). 2018 Q3 P&L figures have a positive impact from the application of the hyperinflation standard. For further information, you may refer to the Notes of the Interim Financial Report for the period ended 30 September 2018.

[4] Argentina 2018 figures have been restated based on IAS 29 (Financial Reporting in Hyperinflationary Economies) so as to reflect current purchasing power. LY figures have not been restated based on IAS 21 (The Effects of Changes in Foreign Exchange Rates). 2018 Q3 P&L figures have a positive impact from the application of the hyperinflation standard. For further information, you may refer to the Notes of the Interim Financial Report for the period ended 30 September 2018.

[5] Licensed Operations Revenue include also a small portion of non-Payout related revenue, i.e. value-added services, which totaled €3.2 million and €4.0 million for 9M18 and 9M17, and €1.1 million and €1.2 million for 3Q18 and 3Q17 respectively

[6] Analysis in the EBITDA section excludes Depreciation & Amortization

[7] CPI adjusted for Turkey and Argentina

[8] Calculated as EBITDA – Maintenance CAPEX – Cash Taxes – Net Cash Finance Charges (excluding refinancing charges) – Net Dividends Paid; all finance metrics exclude the impact of discontinued operations

-

Asia5 days ago

Asia5 days agoDigital gaming disruption tackled in 1st AsPac Regulators’ Forum

-

Asia7 days ago

Asia7 days agoBGCS and BGMS league stages conclude; rising stars set to meet pros in the playoffs

-

Latest News7 days ago

Latest News7 days agoHigh Roller Technologies and Flows partner to launch player engagement experiences, with technical integration complete in record time

-

Central Europe7 days ago

Central Europe7 days agoFootball Stats Startup Challenges Multi-Million Company With Free Publication Of Blueprints

-

Latest News7 days ago

Latest News7 days agoThe Current State of the German iGaming Market and Its Role in Europe

-

Eastern Europe7 days ago

Eastern Europe7 days agoSYNOT Games Partners with WIN2

-

Latest News7 days ago

Latest News7 days agoDiffusionData Releases Diffusion 6.12

-

Latest News7 days ago

Latest News7 days agoOperator-Exclusive Slots: Do Content Bundles Still Deliver ROI?