Canada

Callidus Capital Announces Agreement to Sell Bluberi Gaming Canada Inc. to Catalyst Funds and New Date For Shareholders Meeting

Callidus Capital Corporation today announced that it has entered into an agreement with certain investment funds managed by The Catalyst Capital Group Inc. to sell the shares of Bluberi Gaming Canada Inc. owned by Callidus and to assign the debt owing by Bluberi to Callidus and its subsidiary to the Catalyst Funds. The purchase price to be paid by the Catalyst Funds for the shares is $92.7 million, and for the Bluberi Debt is the amount of that debt outstanding on closing.

The purchase price will be satisfied by setting off $92.7 million of the indebtedness of Callidus owing to the Catalyst Funds under Callidus’ subordinated bridge facility and by the Catalyst Funds assuming a portion of the indebtedness owing by Callidus to the lenders under the Company’s collateralized loan agreement equal to the amount of the Bluberi Debt on the Closing Date.

Callidus’ board of directors (the “Board”), having received the unanimous recommendation of the special committee of independent directors of the Board (the “Special Committee”), has unanimously determined (with the Board members nominated by the Catalyst Funds abstaining) that the Bluberi Transaction is in the best interests of the Corporation and that the consideration under the Bluberi Transaction is fair to the shareholders other than the Catalyst Funds and their related parties (the “Minority Shareholders”), and unanimously recommends (with the Board members nominated by the Catalyst Funds abstaining) that the Minority Shareholders vote FOR the Bluberi Transaction.

BDO Canada LLP was retained by the Special Committee to prepare a valuation and fairness opinion, which concluded that as of the date of the opinion, and subject to the assumptions, limitations and qualifications contained therein, the fair market value of the Bluberi shares is between $84.5 million and $100.9 million and that the consideration to be received by Callidus pursuant to the Bluberi Transaction is fair from a financial point of view to the Minority Shareholders. The purchase price for the shares of Bluberi of $92.7 million is the mid-point of the valuation range.

In order to enable shareholders to consider the Bluberi Transaction, Callidus’ shareholders meeting previously scheduled for June 26, 2019 will now be held on July 2, 2019. Callidus and the Catalyst Funds anticipate that, if approved by Minority Shareholders, the Bluberi Transaction will be completed shortly after the shareholders meeting.

Callidus acquired control of Bluberi in February 2017 pursuant to a formal restructuring proceeding in Quebec. Bluberi is a Drummondville, Quebec-based gaming company that specializes in the development of casino games that are installed in electronic gaming machines and leased or sold to a variety of licensed casinos and gaming establishments.

Callidus first approached the Catalyst Funds regarding a potential transfer of Bluberi in March 2019 as a result of regulatory challenges associated with Callidus’ ownership of Bluberi. In particular, regulators in Maryland and certain other states and provinces in which Bluberi operates and intends to operate in the future require extensive disclosure relating to significant shareholders of Callidus on the basis that they are presumed to have influence on the operations of Bluberi.

Callidus understands that Braslyn Ltd. is the holder of approximately 14.5% of the outstanding common shares of the Company and that Braslyn, as a matter of general policy, does not make regulatory filings that might subject it to legal obligations in jurisdictions in which it does not operate.

In the absence of such disclosure by Braslyn, Bluberi is not able to comply with state licensing disclosure requirements or to submit new licensing applications in Maryland and certain other states and provinces. An inability to comply with these requirements limits Bluberi’s current business and growth plans, and negatively impacts Bluberi’s value, operating results and cash flows.

The BDO valuation and fairness opinion assumes that these regulatory requirements will no longer be applicable after June 30, 2019. As the purchase price for the Bluberi shares is equal to the mid-point of BDO’s valuation range, the Special Committee believes that the Bluberi Transaction will allow Callidus to get full value for Bluberi as if the regulatory issues were resolved. In addition to resolving the regulatory issues, the Bluberi Transaction will enable the Company to significantly reduce its debt and focus on its core lending business.

The Catalyst Funds and their affiliates currently own approximately 72.2% of the Company’s common shares. As a result, the Bluberi Transaction is a “related party transaction” and must be approved by a majority of the votes cast at a meeting of shareholders by Minority Shareholders.

Completion of the Bluberi Transaction is subject to certain closing conditions including obtaining third party consents. In the event any required consents in connection with the assignment of the Bluberi Debt are not obtained, the sale of the shares of Bluberi will proceed but the Bluberi Debt will not be assigned and amendments will be made to the loan agreement including to provide for guarantees of the Bluberi Debt by the Catalyst Funds.

The Bluberi Agreement also includes provisions permitting Callidus to solicit other proposals for the acquisition of Bluberi at any time until Minority Shareholders have approved the Bluberi Transaction, and to terminate the Bluberi Agreement if the Corporation accepts a superior proposal or changes its recommendation subject to payment of a termination fee to the Catalyst Funds of $4.64 million. Callidus is also entitled to participate in any after-tax appreciation in value received by the Catalyst Funds if they enter into an agreement to sell Bluberi within six months of closing and that sale is completed within nine months of closing.

About Callidus Capital Corporation:

Established in 2003, Callidus Capital Corporation is a Canadian company that specializes in innovative and creative financing solutions for companies that are unable to obtain adequate financing from conventional lending institutions. Unlike conventional lending institutions who demand a long list of covenants and make credit decisions based on cash flow and projections, Callidus credit facilities have few, if any, covenants and are based on the value of the borrower’s assets, its enterprise value and borrowing needs. Further information is available on our website, www.calliduscapital.ca.

Source: Callidus Capital Corporation

-

Interviews7 days ago

Interviews7 days agoHIPTHER Community Voices: Alieu Kamara – Founder and CTO of AmaraTech

-

Compliance Updates7 days ago

Compliance Updates7 days agoCT Interactive grows its certified portfolio in Romania

-

Asia7 days ago

Asia7 days agoMetal Genesis Announces “Barrel of a Gun” Song Collab with Priscilla Abby

-

Latest News7 days ago

Latest News7 days agoFrom gut feeling to game-changer: how AI is rewriting the rules of sports betting

-

Latest News7 days ago

Latest News7 days agoWeek 36/2025 slot games releases

-

Latest News7 days ago

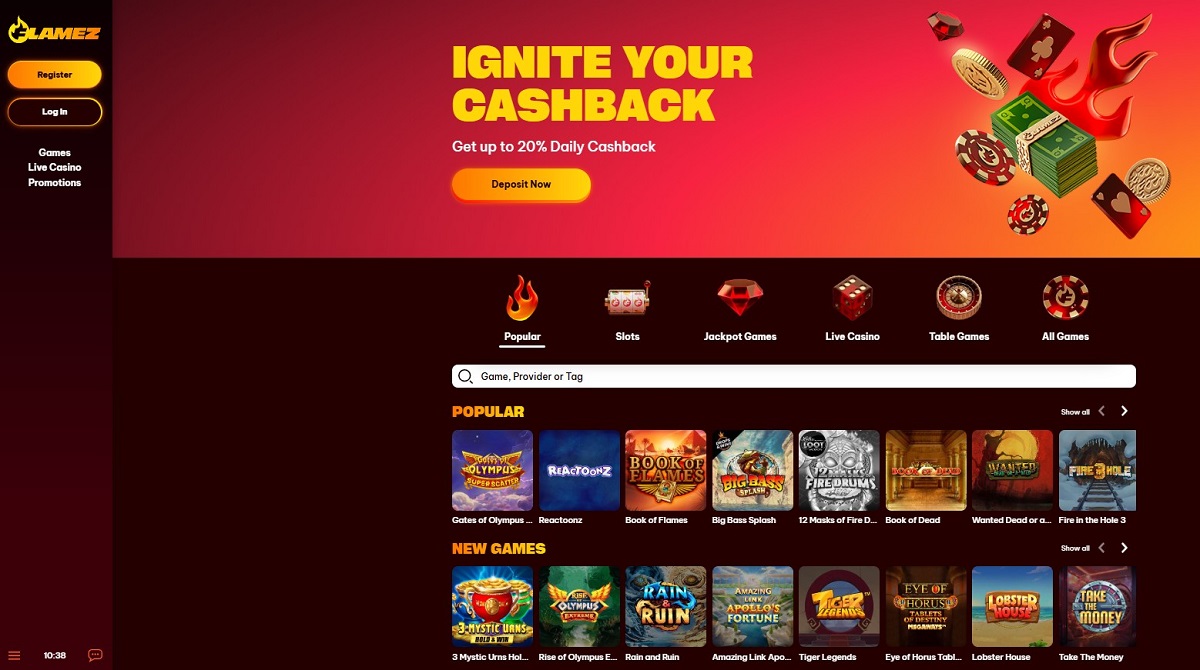

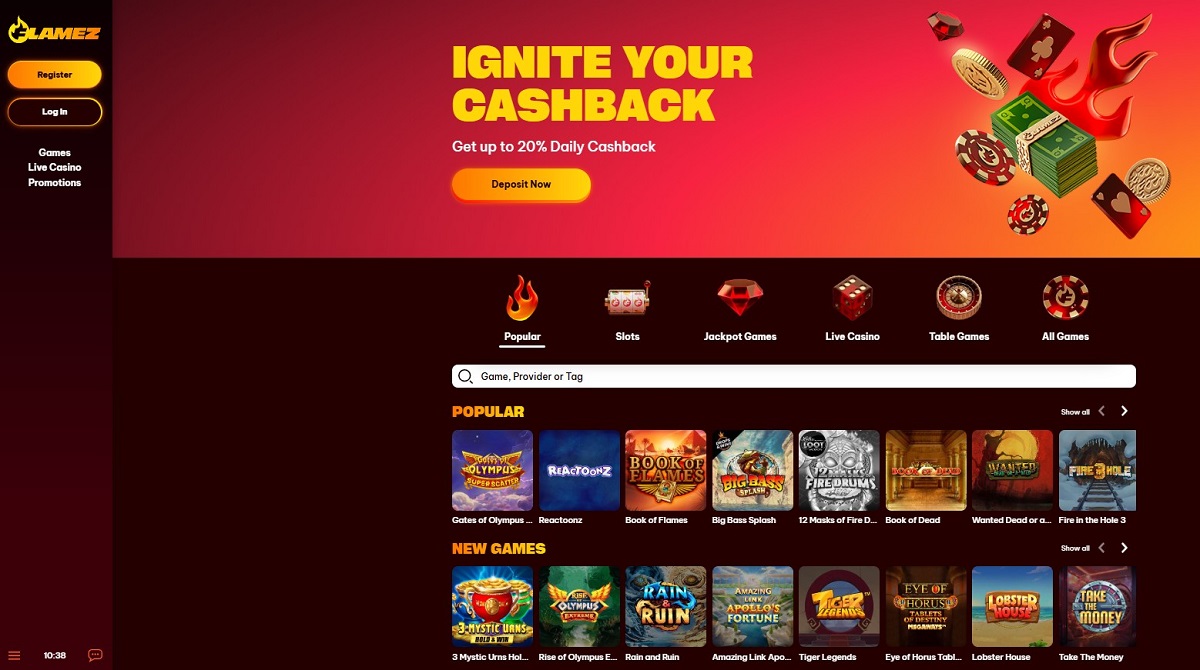

Latest News7 days agoFlamez – A Fiery New Online Casino Contender from Ganadu

-

Latest News7 days ago

Latest News7 days agoProgressPlay to Unveil Standalone Platform Upgrades at SBC Summit 2025

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoEurasia and the Middle East in Focus at SBC Summit 2025 Emerging Markets Stage