Industry News

Trustly merges with PayWithMyBank to deliver transatlantic online banking payments coverage

Trustly, Europe’s leading online banking payments provider, is pleased to announce that it is merging with Silicon Valley-based online banking payments leader PayWithMyBank.

Together, Trustly and PayWithMyBank will enable merchants with a global footprint to accept online banking payments from European and US consumers. The merger addresses the needs of merchants to have an alternative to the card networks and accept online payments directly from consumers’ bank accounts, and for consumers to be able to pay in a fast, simple, and secure way.

In many European markets, consumers are used to paying directly with their bank account and the payment method is now also emerging in the US as a compelling alternative to credit cards. Following the merger, PayWithMyBank founder and CEO, Alexandre Gonthier, will be the US CEO, with overall responsibility for US market development. Gonthier will report to Group CEO, Oscar Berglund.

Oscar Berglund, CEO of Trustly, said: “This transformative merger creates the first and only online banking payments network with transatlantic coverage and accelerates our path towards global coverage. Alex was a co-creator of the online banking payments model in the year 2000 and we are very much looking forward to working with him and the impressive team at PayWithMyBank. Together we’re thrilled to be able to offer merchants and billers a unique alternative to card payments, allowing them to accept payments from 600 million consumers across Europe and the US.”

Alexandre Gonthier, CEO of PayWithMyBank, said: “Our large, US-headquartered customers were all asking us to expand our consumer coverage globally beyond the US. So, joining forces with Trustly, the established leader in our space in Europe, was a natural strategic next step for PayWithMyBank, the emerging leader in the US. We look forward to offering a richer service to our existing customers and partners, and building an unparalleled solution for merchants and billers with global ambitions.”

Trustly, as part of its product offering, holds merchant funds and is a licensed payment institution while PayWithMyBank does not hold any merchant funds. The shareholders of PayWithMyBank are joining the shareholders of Trustly in the merged group. The merged group had revenues in excess of EUR100 million (USD120 million) in the calendar year of 2018.

-

Balkans7 days ago

Balkans7 days agoGoldenRace is opening up the Bulgarian market with Inbet

-

Latest News7 days ago

Latest News7 days agoOctoplay advances on its European growth strategy by partnering with Evoke Group in the UK and Denmark

-

Asia7 days ago

Asia7 days agoSkyesports Wraps Up Gaming Thiruvizha – Chennai Edition With 17,000+ Fans in Attendance

-

eSports7 days ago

eSports7 days agoEsports Set To Take Over the Capital as BLAST Premier London Open Heads to Wembley Arena

-

Asia5 days ago

Asia5 days agoPAGCOR: Online Gaming fuels nation-building, but illegal sites pose risks

-

Africa6 days ago

Africa6 days agoGhana’s NLA Introduces New Sticker to Clamp Down on Illegal Lotto Operators

-

Latest News7 days ago

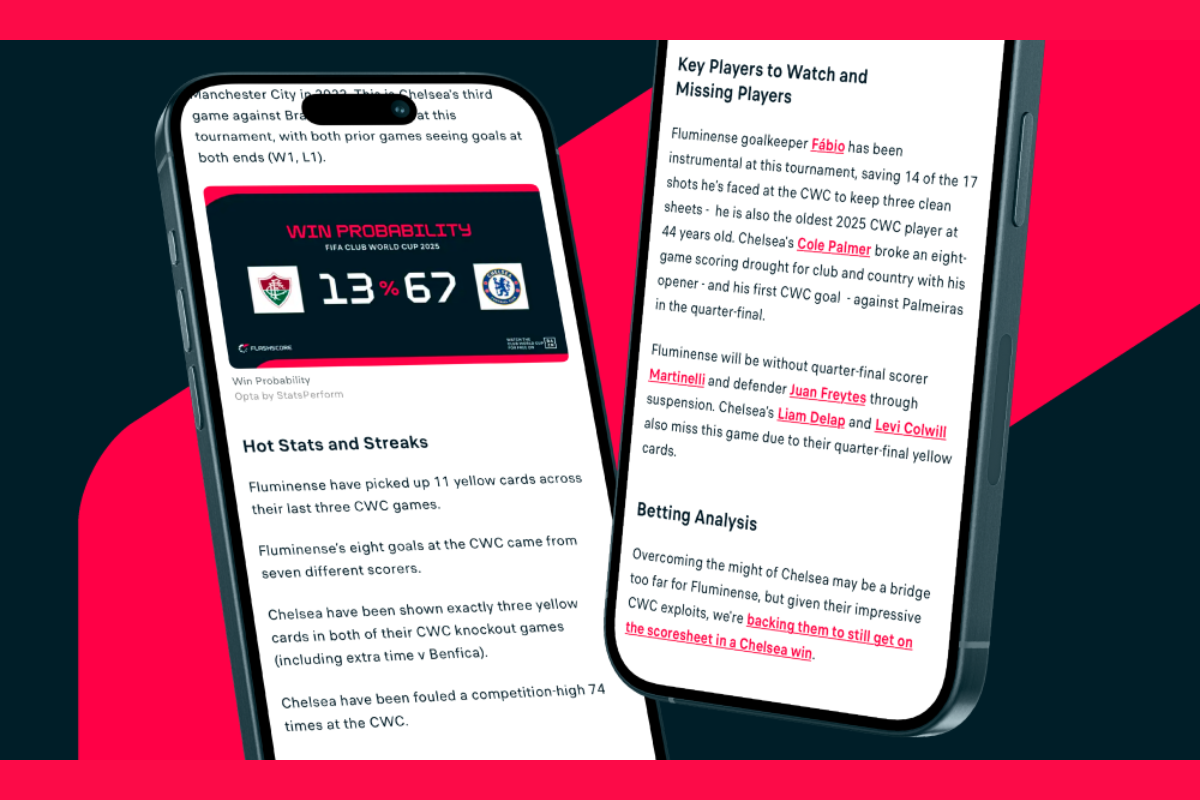

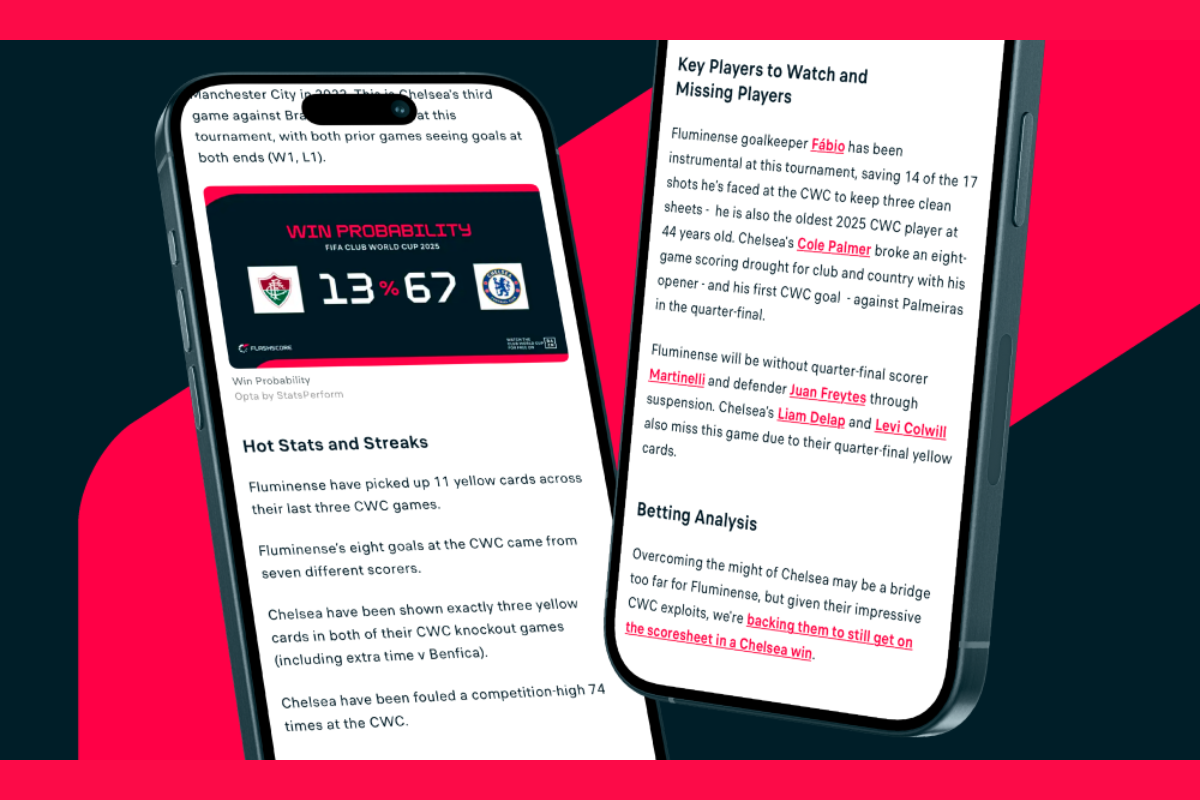

Latest News7 days agoFlashscore kicks off a season of transformation with new-look match previews

-

Latest News7 days ago

Latest News7 days agoGlitnor Group Secures €55 Million Facility to Finance Acquisition, Accelerate Growth and Strategic Initiatives