Latest News

Aspire Global: Interim Report Third Quarter 2021

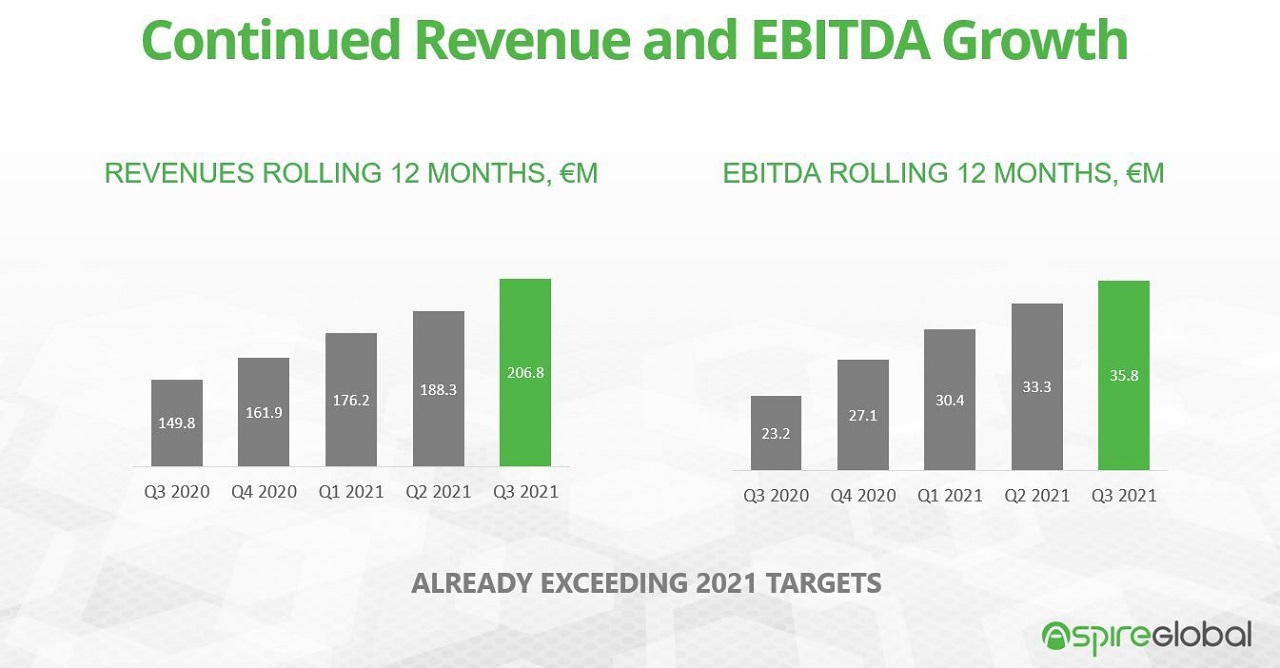

REVENUE INCREASED 46% AND EBITDA 38% IN Q3 2021

THIRD QUARTER

- Revenues increased by 46.0% to €58.6 million (40.1).

- EBITDA increased by 38.0 % to €9.1 million (6.6).

- The EBITDA margin amounted to 15.5% (16.4%).

- EBIT increased by 38.7% to €6.8 million (4.9).

- Earnings after tax increased 68.1% to €6.4 million (3.8).

- Earnings per share increased 62.5% to €0.13 (0.08).

NINE MONTHS

- Revenues increased by 38.2% to €162.4 million (117.5).

- EBITDA increased by 46.0% to €27.5 million (18.8).

- The EBITDA margin increased to 16.9% (16.0%).

- EBIT increased by 45.7% to €21.1 million (14.5).

- Earnings after tax increased 79.0% to €19.4 million (10.8).

- Earnings per share increased 77.2% to €0.39 (0.22).

SIGNIFICANT EVENTS IN THE QUARTER AND AFTER THE END OF THE QUARTER

- Revenues increased 46.0% from Q3 2020 driven by strong development in all segments.

- Organic growth of 39.0% from Q3 2020.

- B2B revenues grew 40.5% from Q3 2020 with organic growth of 31.2%.

- Strong performance in sub-segments Aggregation and Games – Pariplay and Sports – BtoBet.

- Agreement to sell the B2C segment to Esports Technologies announced 1 October – closing expected by 30 November 2021 upon completion

of certain contingent terms. The total value of the transaction sums up to about €65 million. The transaction also includes a four-year platform and managed services agreement with an estimated gross value of €70 million. - Aspire Global signed a platform deal with Esports Technologies in September for its leading brand Gogawi.

- Pariplay further strengthened its position in the Americas – first contract in Brazil signed and granted full supplier license in West Virginia.

- Pariplay signed a deal to provide its proprietary games to Holland Casino in the newly regulated Dutch market.

- First brand live with BtoBet’s sportsbook on Aspire Global’s platform. To date six brands are already live.

- Two deals covering Aspire Global’s complete offering signed.

CEO COMMENTS

“WE CLEARLY EXECUTE OUR GROWTH STRATEGY TO BECOME A WORLD LEADING IGAMING SUPPLIER”

With the sale of the B2C segment, Aspire Global will become a clearly focused B2B company and even stronger and more profitable. The sale will also give us additional resources to further develop and enhance our B2B offering as well as the opportunity to explore new M&A activities. In Q3 2021, we have made key progress towards our objective of establishing strong positions in the US and Brazil. Our success in these markets will be important steps in reaching our goal to become a world leading B2B iGaming supplier.

The sale of the B2C segment – expected to take place at the end of November 2021 – will have a significant positive impact on Aspire Global’s position as a focused B2B company and profitability. Excluding the B2C segment, revenues increased by 36.1% to €118.9 million and EBITDA increased by 54.1% to €22.7 million in the first nine months 2021 with an EBITDA margin of 19.1%. B2B organic growth in the nine-month period amounted to 27.1%.

We initiated the review of our B2C segment in March this year, and on October 1 we announced the agreement with US-based Esports Technologies to acquire the B2C segment. The consideration sums up to about €65 million, consisting of €50 million in cash, €10 million in a promissory note and €5 million in common stock in the listed entity of Esports Technologies. The transaction also includes a four-year platform and managed services agreement with an estimated gross value of €70 million, based on present volumes. The transaction is expected to close by November 30, 2021, pending Esports Technologies receipt of financing, and other closing requirements.

A TRANSFORMATIVE, STRATEGIC MOVE

The divestment of the B2C segment is a transformative, strategic move for Aspire Global. First of all, the change in business mix will affect the revenue so that it will consist only of B2B revenues and, at the same time, the share of managed services will increase. The divestment will also provide Aspire Global with additional resources to further develop the technology platform as well as its offering in casino, sports and managed services. The managed services part of our business is essential to us, not only because it is recurring, but also because it will secure our continued deep knowledge about player behaviour. Furthermore, we expect that Aspire Global will have other peers as a focused B2B company and that investors will find it easier to value the company.

Following the divestment, we will also look into M&A possibilities with the aim to control even more of the value chain. Our successful acquisitions of Pariplay in 2019 and BtoBet in 2020 are proof of our ability to identify and integrate companies that complement our offering in the value chain. In the first nine months of 2021, Pariplay has grown by 79.4% to €21.7 million with an EBITDA margin of 27.9%. BtoBet has also demonstrated strong growth of 68.7% to €7.8 million in the nine-month period with an EBITDA margin of 23.1%.

KEY PROGRESS IN THE US AND BRAZIL

The B2C divestment also provides us with increasing opportunities to continue to invest in establishing a considerable position in above all the big and quickly growing Brazilian and US markets. In Q3 2021, we have made key progress in the US and Brazil. Pariplay signed a deal with FansUnite Entertainment, entailing that Aspire Global enters the Brazilian market for the first time. FansUnite is a Canadian sports and entertainment company, and Pariplay will supply its wide portfolio of proprietary and third-party content, via its Fusion™ aggregation platform, to FansUnite’s B2C brands and B2B solutions in Europe and Americas and thereby allows Pariplay to enter Brazil for the first time.

Pariplay also further strengthened its position in Latin America by a deal with the world-famous land-based and online games provider Ainsworth Game Technology. The deal will see Ainsworth partnering exclusively with Pariplay for all new online releases in Latin America, with making its titles available to players through Pariplay’s Fusion™ aggregation platform.

Pariplay reached another milestone in its US expansion strategy during Q3 2021 after being granted a full iGaming Supplier License in West Virginia. Pariplay made its debut in the fast-growing US market when its content went live in New Jersey in February 2021 and Pariplay has applied for licenses in several states.

DEEPER ESPORTS RELATIONSHIPS

We are also proud and happy with the relationship we have established with Esports Technologies. Esports Technologies is a leading global operator and provider of products and marketing solutions in the quickly growing esports market. Beside the B2C deal, we also signed a strategic license agreement with Esports Technologies in Q3 2021. As part of the deal, Esports Technologies will launch its esports/sportsbook Gogawi.com in certain key markets on our platform and intends to launch an additional brand on the platform in the future. In addition, we will make the Esports Technologies proprietary esports feed available to our partners around the world.

Esports Technologies are at a rapid growth phase and aim to become the world’s number one esports company. As part of the B2C agreement, Karamba and our other B2C brands will join our B2B network, and will become one of our biggest B2B partners. I’m sure that the experience and excellence of our B2C team, together with the ambition and investment of Esports Technologies, will take the brands to new heights.

PROFITABLE GROWTH IN REGULATED MARKETS

In the quarter, Germany introduced a new regulation with higher gaming duties. Despite this regulatory change, the EBITDA margin in the B2B segment increased to 18.7% from 18.0% in Q3 2020. This clearly demonstrates Aspire Global’s ability to manage a profitable operation in regulated markets.

In October, the Netherlands opened for online gaming and Pariplay just a few days ago announced a deal to supply its proprietary games to Holland Casino. Holland Casino has a leading presence within the new regulated digital ecosystem in the Netherlands.

OUTLOOK

Aspire Global has consistently demonstrated its ability to execute its growth strategy, reaching its financial targets and create value. We see great growth opportunities by expanding with existing partners, gaining new partners and entering new markets. With the divestment of the B2C segment we will further enhance investments in our technology and product offering as well as geographic presence with focus on Brazil and the US. We will also put even more energy on increasing the M&A pipeline. We clearly execute our growth strategy to become a world leading iGaming supplier.

Tsachi Maimon, CEO.

-

Africa6 days ago

Africa6 days agoQTech Games wins Best Innovation of the Year at the 2025 SBWA+ Eventus Awards

-

Asia6 days ago

Asia6 days agoNODWIN Gaming and JioStar Unveil OnePlus Android BGMS Season 4

-

Latest News6 days ago

Latest News6 days agoCalema to Perform at Legends Charity Game in Lisbon

-

Latest News6 days ago

Latest News6 days agoVindral appoints Henrik Fagerlund as Chairman of the Board

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoEGT Digital and EGT to rock the show at SiGMA Euro-Med 2025

-

Latest News6 days ago

Latest News6 days agoPush Gaming redefines its portfolio, unveiling new game categories and sub-brand for extended player reach

-

Affiliate Industry6 days ago

Affiliate Industry6 days agoNikita Lukanenoks Brings Slotsjudge Into Spotlight With Affiliate Leaders Awards 2025 Nomination

-

Latest News6 days ago

Latest News6 days agoThunderkick returns for an even fierier fiesta in Carnival Queen 2