Gaming

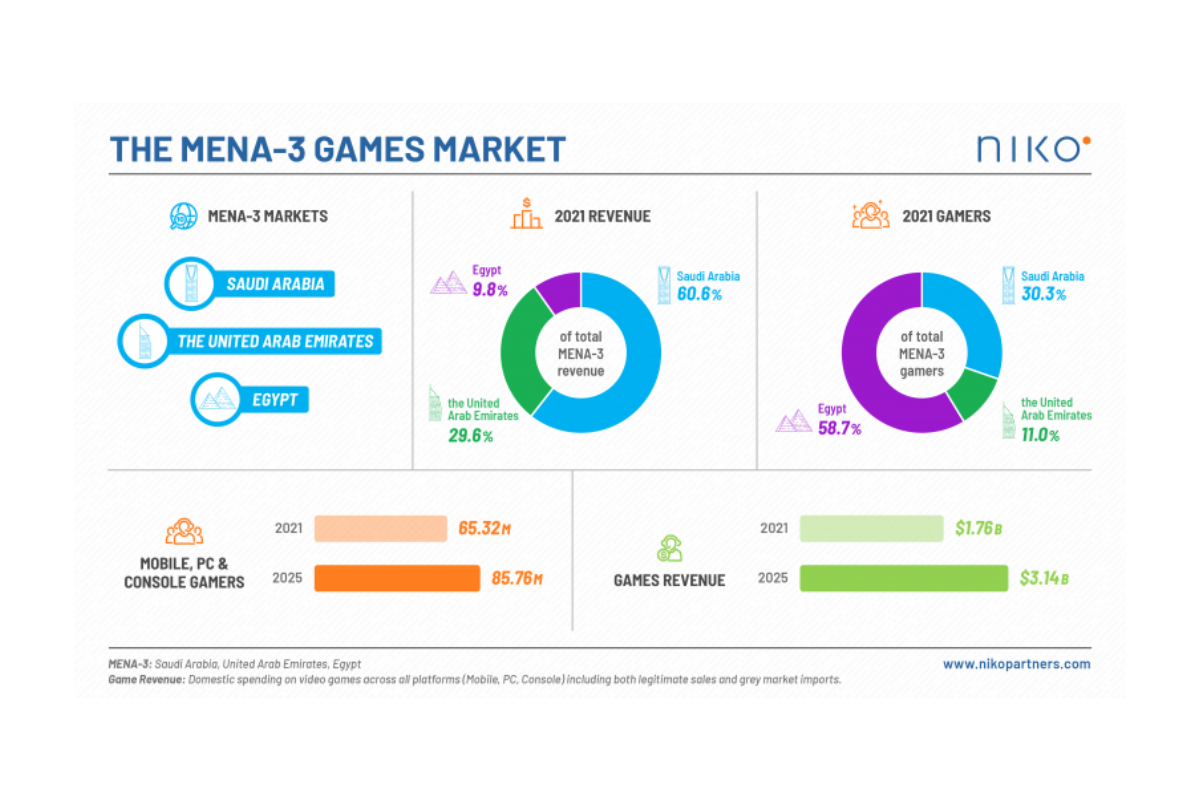

New data from Niko Partners: Saudi Arabia, United Arab Emirates, and Egypt together will have 85.8 million gamers generating $3.1 billion in games revenue by 2025

Niko Partners, a market research and consulting firm covering video games, esports, and streaming in Asia, today announced the release of their MENA (Middle East North Africa) Games Market Report. MENA has quickly emerged as a key growth region for the global video game industry, and this is the first major report covering the MENA region.

To provide a representative overview of Arabic speaking markets, the report focuses on what Niko calls the MENA-3: Saudi Arabia (KSA), the United Arab Emirates (UAE), and Egypt. The report includes a comprehensive market model and 5-year forecast through 2025 by games segment, key data on game publishers, games rankings, growth drivers, and trends. This includes details on esports, product distribution, payments, financial transaction events, regulations, and qualitative and quantitative analysis on gamer demand, spending, and behavior, with gamer behavior based off a survey of 3,000 gamers. Spotlights on the Gulf States, North Africa, and Jordan are also included.

Key takeaways from the reports include:

- MENA-3 games revenue was $1.76 billion in 2021, rising to $3.14 billion in 2025 at a 5-year CAGR of 13.8%.

- MENA-3 gamers reached 65.32 million in 2021, rising to 85.76 million in 2025.

- Saudi Arabia is the gaming powerhouse of Arabic speaking nations in MENA, balancing population size with high spending power yielding the highest revenue.

- The UAE is representative of smaller Gulf states. Arabic is the official language, yet the population is predominately expatriates.

- Egypt is an emerging games market with an active and competitive gaming community and MENA-3’s largest market by gamers.

- Growth will be driven by higher spending per user, additional government support across games and esports, and more gamers entering the market.

- Nearly half of the MENA population is under 25 years old and have grown up as digital natives with gaming playing a huge role in their entertainment.

- Governments in the region are supportive of the video game sector. Saudi Arabia and the UAE have introduced policies to encourage game localization, local game development, new studios and offices of international game companies, and hosting major esports tournaments.

Niko’s research methodology combines data from game developers and publishers, data from other sources such as retailers and app markets, our market model, and our gamer surveys. We also regularly interview executives at games and hardware companies as well as government officials. We leverage our own proprietary primary data combined with direct access to a panel of millions of consumers throughout Asia, to create deep qualitative and quantitative analysis, market models, and five-year forecasts. Our analysts regularly conduct gamer surveys, interviews, and focus groups throughout the region.

-

Asia6 days ago

Asia6 days agoTesla to showcase Model Y with NODWIN Gaming at the thrilling BGMS Season 4 Grand Finals

-

Compliance Updates6 days ago

Compliance Updates6 days agoSOFTSWISS Compliance Expert Shares Knowledge on AML in iGaming for Sumsub Academy

-

Africa6 days ago

Africa6 days agoRacing1 is exhibiting for the first time at the Grand Prix D’Afrique

-

Latest News6 days ago

Latest News6 days agoÅland-Based Gaming Company Paf Becomes Main Partner of the Finnish Ski Association – One of the Most Significant Sponsorship Agreements in the Association’s History

-

Latest News6 days ago

Latest News6 days agoAnimo Studios debuts virtual hosts for live table games starting with Stake

-

Latest News6 days ago

Latest News6 days agoKaizen Gaming data – FC Barcelona the fan favourite to win the Champions League

-

Latest News6 days ago

Latest News6 days agoWeek 37/2025 slot games releases

-

Latest News6 days ago

Latest News6 days agoBehind the surge in XRP, DL Mining brings new opportunities to get 0.1BTC or 2ETH with your XRP