Latest News

Monzo offers option to block gambling transaction.

Monzo, a UK-based bank that offers only mobile-based banking services, has come up with a unique service for those who want to self-exclude from all gambling activities. A soon-to-be-introduced feature in the bank’s app will allow the users to to block all gambling transactions from their Monzo accounts.

At present, Monzo’s policies about problem gambling include identifying certain behavioral patterns, initiating a “sensitive, tactful conversation” with the customer and then leading them to the direction of the GamCare charity, which provides free software to block customers’ access to gambling sites.

The new blocking functionality to its mobile app will come into effect “in the next few weeks.”

The feature will be included in the app’s settings, which, if switched on, will prevent the use of customers’ Monzo accounts from being used for gambling purposes, be it online or land-based.

Monzo said its new feature will rely on identifying merchant category codes, and the company will “do our best to block any payments you try to make” to merchants whose codes indicate a gambling connection.

Should a customer decide to disable the feature, Monzo will require them to “chat with customer support first.” Should the customer still wish to disable the feature following this chat, Monzo will impose a 48-hour time-out before the customer can make the switch on their mobile device.

Monzo calls these steps “positive friction” intended to ensure customers do not “impulsively” disable the self-exclusion, but do so only after they have had the chance to “understand the implications and make a considered decision.”

Monzo recognises that the feature “isn’t a perfect or catch-all solution” but the company pledged to tinker with the tech following its release in the hope of helping customers avoid financial problems related to gambling, rather than closing the barn door after the cows have bolted.

Monzo is also considering allowing customers to set a “30-day rolling gambling limit” that would prevent gamblers from exceeding their spending, requiring a “trusted friend” to authorise gambling transactions, lowering limits on cash withdrawals and other payments, and setting aside money for bills in a “protected” zone that ensures customers cannot blow the rent or car payment on gambling.

Last year, the GambleAware charity issued a report that claimed the industry’s retail self-exclusion scheme was performing well, but investigative media poked a few holes in that claim. In March, Paddy Power Betfair rolled out a new electronic self-exclusion system, replacing its retail paper-based system.

Online gambling accounted for 96 per cent of self-exclusions in a recent UK market study and the UK Gambling Commission has been spanking numerous UK operators for failures in their individual self-exclusion programmes.

Source: calvinayre.com

-

Interviews7 days ago

Interviews7 days agoHIPTHER Community Voices: Alieu Kamara – Founder and CTO of AmaraTech

-

Compliance Updates7 days ago

Compliance Updates7 days agoCT Interactive grows its certified portfolio in Romania

-

Asia6 days ago

Asia6 days agoMetal Genesis Announces “Barrel of a Gun” Song Collab with Priscilla Abby

-

Latest News7 days ago

Latest News7 days agoFrom gut feeling to game-changer: how AI is rewriting the rules of sports betting

-

Latest News6 days ago

Latest News6 days agoWeek 36/2025 slot games releases

-

Latest News6 days ago

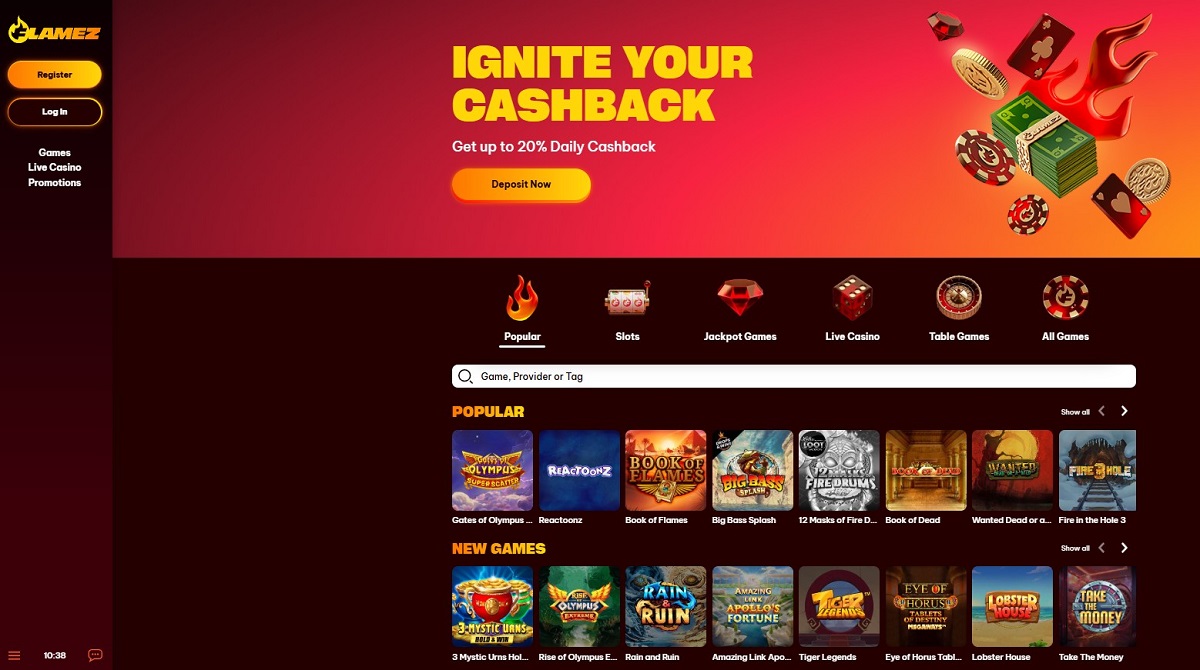

Latest News6 days agoFlamez – A Fiery New Online Casino Contender from Ganadu

-

Latest News6 days ago

Latest News6 days agoProgressPlay to Unveil Standalone Platform Upgrades at SBC Summit 2025

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoEurasia and the Middle East in Focus at SBC Summit 2025 Emerging Markets Stage