Industry News

NetEnt acquires casino software provider Red Tiger

NetEnt has entered into an agreement to acquire fast-growing online slot supplier Red Tiger Gaming Limited (“Red Tiger”) in an all-cash deal with an initial enterprise value of GBP 200 million plus a possible additional amount of maximum GBP 23 million in 2022. The transaction will be completed imminently and is expected to be accretive to NetEnt’s EPS in 2020.

Established in 2014, Red Tiger is a leading online supplier of casino games and software renowned for its daily jackpot games. The company has approximately 170 employees with operations in Malta, Isle of Man and Bulgaria. Red Tiger’s earnings before interest, taxes, depreciation and amortization (EBITDA) is expected to reach GBP 18 million for the full year 2019.

The deal is in line with NetEnt’s vision to create the future of gaming. Over the last several years, the company has invested in a global infrastructure focusing on customer reach and regulated markets, supporting a platform for scale. The acquisition of Red Tiger gives NetEnt the opportunity to capitalize on its scalable technology to support future growth.

“I am very pleased to welcome Red Tiger into the NetEnt Group. The acquisition combines two of the leading and most innovative companies in the online gaming industry. We look forward to working with Red Tiger’s fantastic team to enhance our combined global reach and to offer further value to operators and players. The transaction will provide significant revenue synergies across our markets worldwide,” says Therese Hillman, Group CEO of NetEnt.

Gavin Hamilton, CEO of Red Tiger, comments: “This is an exciting new stage of the Red Tiger story and we are delighted to become part of the NetEnt group. Accessing NetEnt’s unparalleled distribution network and geographic footprint will unlock new opportunities for Red Tiger and will further accelerate our growth. At Red Tiger we’ll remain focused as always on driving further innovation and we are looking forward to working with NetEnt on how to leverage our combined capabilities to create new products that wow our customers.”

NetEnt pays an initial consideration of approximately GBP 197 million for 100 percent of the shares of Red Tiger. In addition to the initial purchase consideration, a remaining amount of maximum GBP 23 million may become payable in 2022 on an earn-out basis, subject to Red Tiger’s financial performance over the coming two years. This implies a maximum enterprise value of GBP 223 million, corresponding to an enterprise value multiple of c. 12 times current year EBITDA. NetEnt’s income for the third quarter of 2019 will include approximately SEK 55 million of transaction- and financing-related costs.

The acquisition is financed primarily through new debt facilities provided by Danske Bank and Nordea.

Lazard has acted as financial advisor and Cirio Advokatbyrå has acted as legal advisor to NetEnt in connection with the transaction.

-

Interviews6 days ago

Interviews6 days agoHIPTHER Community Voices: Alieu Kamara – Founder and CTO of AmaraTech

-

Asia6 days ago

Asia6 days agoMetal Genesis Announces “Barrel of a Gun” Song Collab with Priscilla Abby

-

Compliance Updates6 days ago

Compliance Updates6 days agoCT Interactive grows its certified portfolio in Romania

-

Latest News7 days ago

Latest News7 days agoSpain and Regulated Innovation: How DGOJ-Licensed Casinos Are Beginning to Integrate Crypto

-

Latest News6 days ago

Latest News6 days agoFrom gut feeling to game-changer: how AI is rewriting the rules of sports betting

-

Latest News7 days ago

Latest News7 days agoZITRO TO PRESENT A BOOM OF NEW GAMES IN TORREMOLINOS

-

Latest News6 days ago

Latest News6 days agoWeek 36/2025 slot games releases

-

Latest News6 days ago

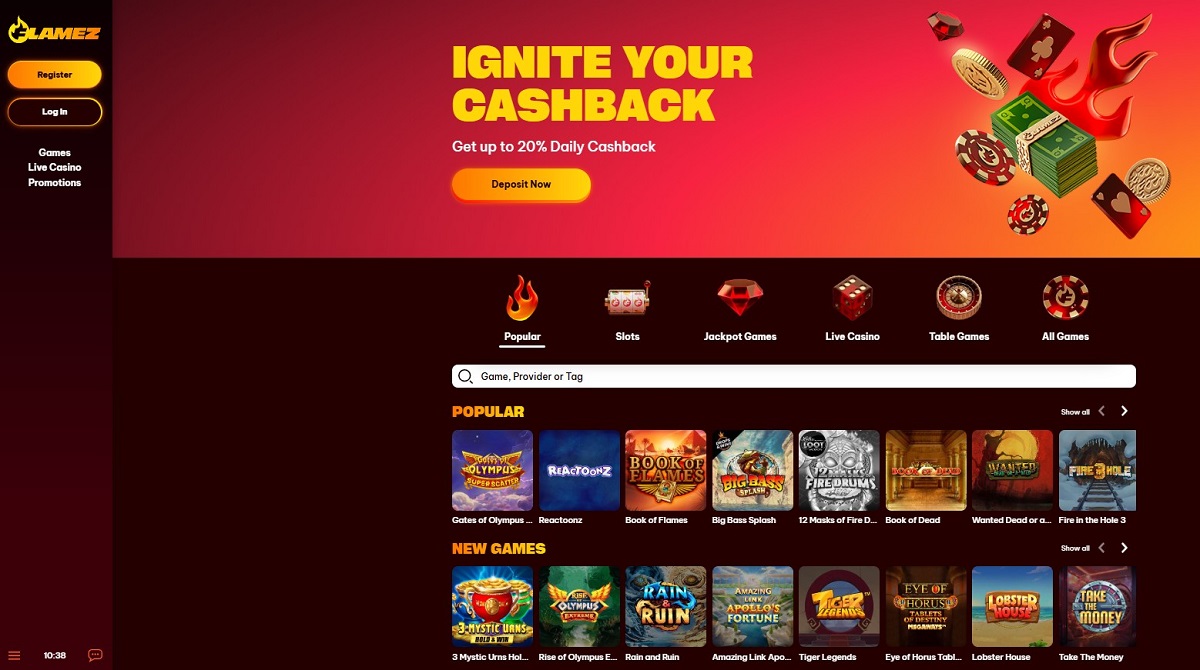

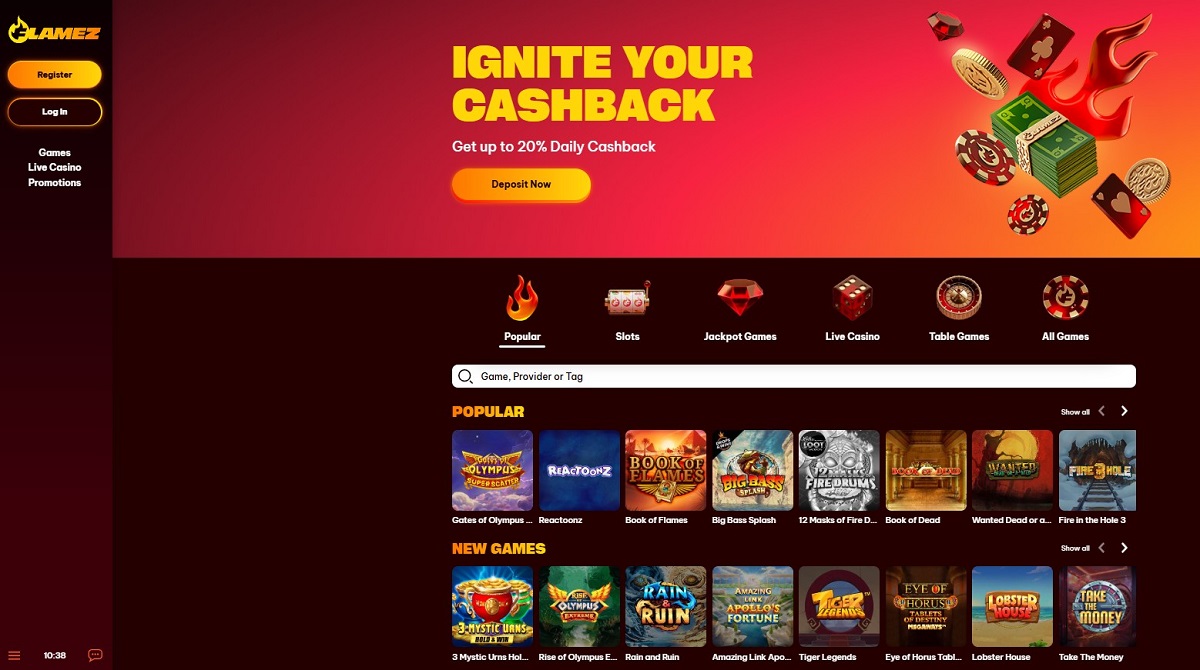

Latest News6 days agoFlamez – A Fiery New Online Casino Contender from Ganadu