Gambling in the USA

AGA CEO Statement on the SBA’s Interim Guidelines for the Paycheck Protection Program

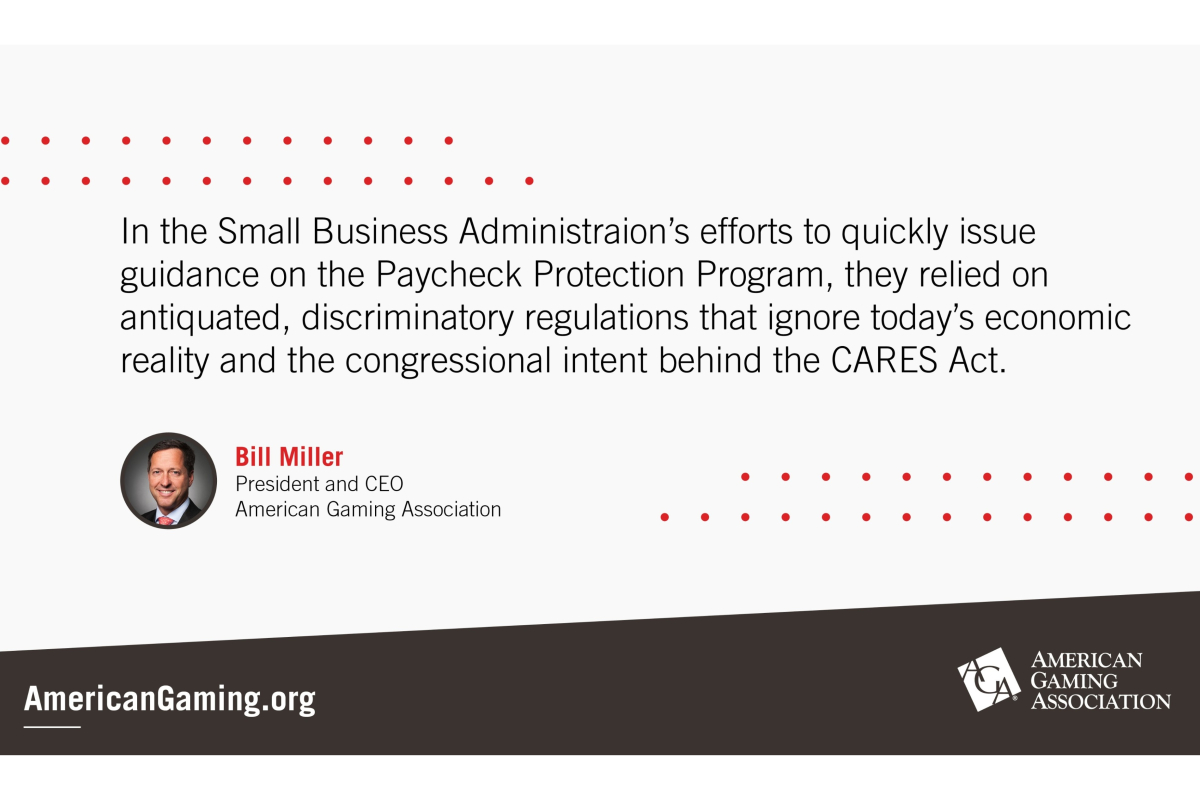

American Gaming Association President and CEO Bill Miller released the following statement on the interim regulatory guidelines issued by the Small Business Administration for the Paycheck Protection Program:

“The American Gaming Association (AGA) is deeply concerned with the interim regulatory guidelines issued by the Small Business Administration (SBA), which preclude small gaming entities and their employees from receiving economic support under the newly-established Paycheck Protection Program (PPP).

“In SBA’s efforts to quickly issue guidance on the PPP, they relied on antiquated, discriminatory regulations that ignore today’s economic reality and the congressional intent behind the CARES Act, which states that any business concern shall be eligible to receive an SBA loan if they meet specific qualifications regarding their number of employees.

“Unless amended, these initial guidelines will irreparably harm one-third of the U.S. casino industry and the hundreds of thousands of Americans that rely on gaming businesses for their livelihood.

“This decision will affect hard-working Americans from Pennsylvania to Nevada, Ohio to Colorado, and everywhere in between who need and deserve the same level of support as anyone across the country during these unprecedented times. Moreover, as the AGA pointed out in a letter to SBA and the U.S. Department of Treasury, the inclusion of gaming businesses in the PPP is critical to help ensure employees can remain connected to their employers, stay off of unemployment, and quickly return to their jobs when this pandemic subsides.

“The AGA urges SBA Administrator Carranza to immediately correct this oversight and extend this needed relief to all of America’s small businesses and their employees, including those in the communities across 43 states that rely on our industry’s contributions.”

Background

- Casino gaming is vital to local small businesses, supporting 350,000 small business jobs and delivering $52 billion annually in small business revenue, including construction, manufacturing, retail, and wholesale firms.

- Nearly all (987 of 989) commercial and tribal casino properties have shuttered their doors because of the COVID-19 pandemic. More than half of the 1.8 million jobs gaming supports are at non-gaming businesses, such as restaurants and local shops, which are all dramatically affected by a local casino’s closure.

- In many states, gaming pays among the highest tax rates of any industry with $10.7 billion in gaming taxes and tribal revenue share payments that support fundamental and critical programs from infrastructure to education.

More information on COVID-19’s impact on U.S. casino industry workers and local communities is available here.

Source: americangaming.org

-

Asia7 days ago

Asia7 days agoNational Sports Day: Why it’s time to see esports as a key pillar of India’s new-age sporting identity

-

Baltics7 days ago

Baltics7 days agoAll Gambling Halls in Riga Threatened with Closure – Industry Raises Alarm

-

Latest News7 days ago

Latest News7 days agoFavbet × Spinner: An Exclusive Live Studio That Has Already Gained Recognition in Ukraine

-

Latest News7 days ago

Latest News7 days agoCubeia announces Cubeia Platinum Freeroll at SiGMA Poker Tour Malta

-

Latest News7 days ago

Latest News7 days agoAfter $546M H1, Gurhan Kiziloz Bets on Brazil With Nexus HQ While Giants Look West

-

Latest News7 days ago

Latest News7 days agoPlay’n GO shortlisted in two categories at the prestigious Corporate Star Awards

-

Latest News7 days ago

Latest News7 days agoENHANCING COMMUNITY SPIRIT: SKY BET EFL BUILDING FOUNDATIONS FUND PROVIDES FIRST LOOK AT SOUTHLANDS HUB IN MIDDLESBROUGH

-

Latest News7 days ago

Latest News7 days agoEmbrace Your Inner Maverick in Hacker’s Haven