Asia

Nazara Technologies Ltd. – Business Update for the year ended on March 31, 2021

In accordance with SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015 and Code of Practices and Procedures for Fair Disclosure of Unpublished Price Sensitive Information in terms of Regulation 8 of SEBI (Prohibition of Insider Trading) Regulations, 2015, the Company would like to update on the following key business parameters on consolidated basis for the Year ended March 31, 2021

Business Overview:

Nazara is an India based, diversified gaming and sports media platform with presence in India and across emerging and developed global markets such as Africa and North America.

As of March 31, 2021, Nazara has diverse business segments with revenue generation happening across gamified learning, Esports, freemium and telco subscription.

| S. No. | Business Segment | Business Model | Content IP Ownership | IP Name | % Revenue Contribution FY21 |

| 1 | Early learning | Gamified App for 2–6 year old kids with subscription paid by parents | Yes | Kiddopia | 39% |

| 2 | Esports | Premium exclusive content / (Media rights licensing) & brand sponsorships (ads shown on the platform) | Yes | Nodwin, Sportskeeda | 37% |

| 3 | Freemium | Ads & virtual items purchased within the games | Yes | WCC | 4% |

| 4 | Telco Subscription Business | Players subscribing to curated game packs and payment collected through telecom operator channel | No | – | 16% |

| 5 | Skill Based Real Money Gaming | Platform fee collected from the skill games played on the platform | Yes | Halaplay, Qunami | 4% |

Income Statement Performance: Snapshot of FY21 over FY20

Key Highlight of FY21: Delivered 84% YoY revenue growth and 470% YoY EBITDA growth

Revenue Performance: Snapshot – FY21 when compared to FY20

Nazara Technologies delivered consolidated revenue of 4,542 Mn INR (unaudited) in FY21 which is 84% growth over FY20 (2,475 Mn INR). Gamified learning and Esports segments have not only demonstrated strong growth momentum in FY21 but have also laid foundation for predictable growth on account of proven user engagement and retention KPIs in gamified learning and multiyear media licensing and game publisher agreements in case of Esports.

Segment wise revenue breakup is as follows:

| Revenue INR Mn | FY21

(unaudited) |

FY20

(audited) |

% Growth |

| Gamified Learning | 1,758 | 191* | 820% |

| Esports | 1,701 | 842* | 102% |

| Freemium | 195 | 198 | (2%) |

| Telco Subscription | 749 | 818 | (8%) |

| Real Money Gaming | 139 | 426 | (67%) |

| Total Revenue | 4,542 | 2,475 | 84% |

*included from date of acquisition in the consolidated financial statement for FY20.

Consolidated EBITDA Performance: Snapshot – FY21 when compared to FY20

EBITDA including share of non-controlling interest for FY21 has witnessed 470% growth over FY20.

| Particulars | FY21

(unaudited) |

FY20

(audited) |

| EBITDA margin | 12% | 4% |

As Nazara is operating in high growth business segments such as gaming, gamified learning and Esports, we will continue to drive profitable growth while prioritizing growth over profit maximization at this stage so that we can achieve and maintain market leadership in the segments we operate in.

Segment wise commentary on business performance:

- Gamified Learning: Kiddopia had 340,282 paying subscribers as of March 2021 which is a 172% increase in number of paying subscribers as compared to March 2020 (197,522).

LTV (Lifetime Value) – CAC (Consumer Acquisition Cost) Parameters: Cost per trial has stayed range bound between 22 USD to 26 USD in last 12 months and activation ratio from free trial to subscription has also remained around 70%. Monthly ARPU of the user has been around 6.3 – 6.4 USD and monthly churn is range bound between 4% – 6% across the months in FY21.

- Esports: Esports revenues comprise of media rights licensing of own content, brands sponsorships for offline and online events, licensing fee received from game publishers for community activation and programmatic inventory selling on Sportskeeda. Esports is disrupting traditional sports worldwide and is an outcome of sports and gaming intersecting to create fast paced spectator entertainment content.

- Sportskeeda witnessed 487% growth in MAU in FY21. During peak cricket season (October 2020), Sportskeeda recorded 68.44 Mn MAU up from 10.53 Mn MAU in April 2020.Sportskeeda has emerged as a leading Esports news and content destination in India.

- Nodwin continued revenue growth momentum with 75% growth in FY21 over FY20. Media rights contributed to majority of the revenues in FY21 and game publishers formed second largest source of revenue wherein Nodwin partnered with them for grass route community tournaments across India. Nodwin also expanded into South Asia in FY21. Nodwin continues to be the dominant player in Esports in India with its marquee IPs like ESL India premiership, Dew Arena etc.

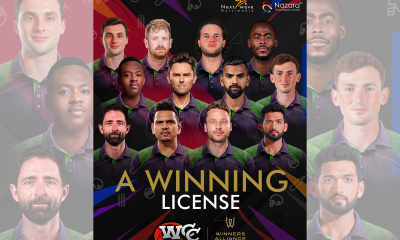

- Free to Download (Freemium): WCC (World Cricket Championship) is the world’s largest cricket simulation game franchise on mobile and is played for ~46 minutes / day by over 15 Mn monthly active users. The Game has a very strong franchise among the midcore gamers who love virtual sports simulation genre and gets over 100,000 downloads every day organically and without any marketing spends. WCC revenues were flat in FY21 on account of drop in advertising rates in India due to COVID. We expect growth in WCC to come from in app purchases of virtual goods and WCC3 – the latest version of the game launched in July has been designed for enhancing in-app purchase conversion rates.

- Scale of Daily Active Users (DAUs) of world cricket championship (WCC) is stable with few spikes seen during first phase of lockdown in April 20 and during IPL 20.

- Tangible progress has been made on % conversion ratio (daily paying to daily active users (DPU/ DAU)) in FY21 via launch of WCC3. The % conversion in WCC3 has increased multi-fold to 0.08% – 0.10% as compared to 0.01% in WCC2. % Conversion in WCC3 is expected to increase further in FY22 through new product updates.

Once positive LTV/CAC equation is achieved, the company will invest aggressively in user acquisition to scale up its user base on WCC and drive profitable growth.

- Telecom operator driven Subscription business declined by 8% in FY21 over FY20 primarily due to decline in India revenues in H2FY21. Nazara has acquired rights to distribute a library of premium Disney and Star Wars games based on iconic stories and characters including Star Wars, Frozen, Big Hero 6, Cars, Duck Tales, Finding Dory, Toy Story and many others in 100 countries for three years. These premium games will be distributed through Nazara’s network of telecom operators to their customer base. Under this agreement with Disney, Nazara is the only third party distributor that Disney has granted the right to create and operate Disney themed storefronts for premium Disney and Star Wars games on these telco channels.

- Sports Fantasy (Real Money Skill Gaming): Sports fantasy witnessed disruption in FY21 on account of lack of live matches in first half of FY21 and regulatory turbulence triggered by legislative ordinances passed in few of the large states banning real money gaming operations. The lack of stability in the regulatory framework lead to Nazara taking strategically cautious approach in this vertical till further clarity emerges. We have therefore pivoted to a product driven growth strategy versus an aggressive customer acquisition spends led strategy and the team is focused on enhancing existing as well as bringing new product features to differentiate ourselves in this segment.

About Non-Financial GAAP measurement

We use EBITDA as supplemental financial measures. EBITDA is defined by us as net income before interest expense, income tax expense and depreciation and amortization, including share of non-controlling interest. EBITDA as used and defined by us, may not be comparable to similarly-titled measures employed by other companies and is not a measure of performance calculated in accordance with GAAP. EBITDA should not be considered in isolation or as a substitute for operating income, net income, cash flows from operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. EBITDA provide no information regarding a Company’s capital structure, borrowings, interest costs, capital expenditures and working capital movement or tax position.

These numbers have not been subjected to audit or limited review.

-

Africa5 days ago

Africa5 days agoQTech Games wins Best Innovation of the Year at the 2025 SBWA+ Eventus Awards

-

Asia5 days ago

Asia5 days agoNODWIN Gaming and JioStar Unveil OnePlus Android BGMS Season 4

-

Latest News5 days ago

Latest News5 days agoVindral appoints Henrik Fagerlund as Chairman of the Board

-

Latest News5 days ago

Latest News5 days agoCalema to Perform at Legends Charity Game in Lisbon

-

Conferences in Europe5 days ago

Conferences in Europe5 days agoEGT Digital and EGT to rock the show at SiGMA Euro-Med 2025

-

Latest News5 days ago

Latest News5 days agoPush Gaming redefines its portfolio, unveiling new game categories and sub-brand for extended player reach

-

Affiliate Industry5 days ago

Affiliate Industry5 days agoNikita Lukanenoks Brings Slotsjudge Into Spotlight With Affiliate Leaders Awards 2025 Nomination

-

Latest News5 days ago

Latest News5 days agoThunderkick returns for an even fierier fiesta in Carnival Queen 2