Central Europe

Germany: Sales revenues from paid online services for games rises significantly once again

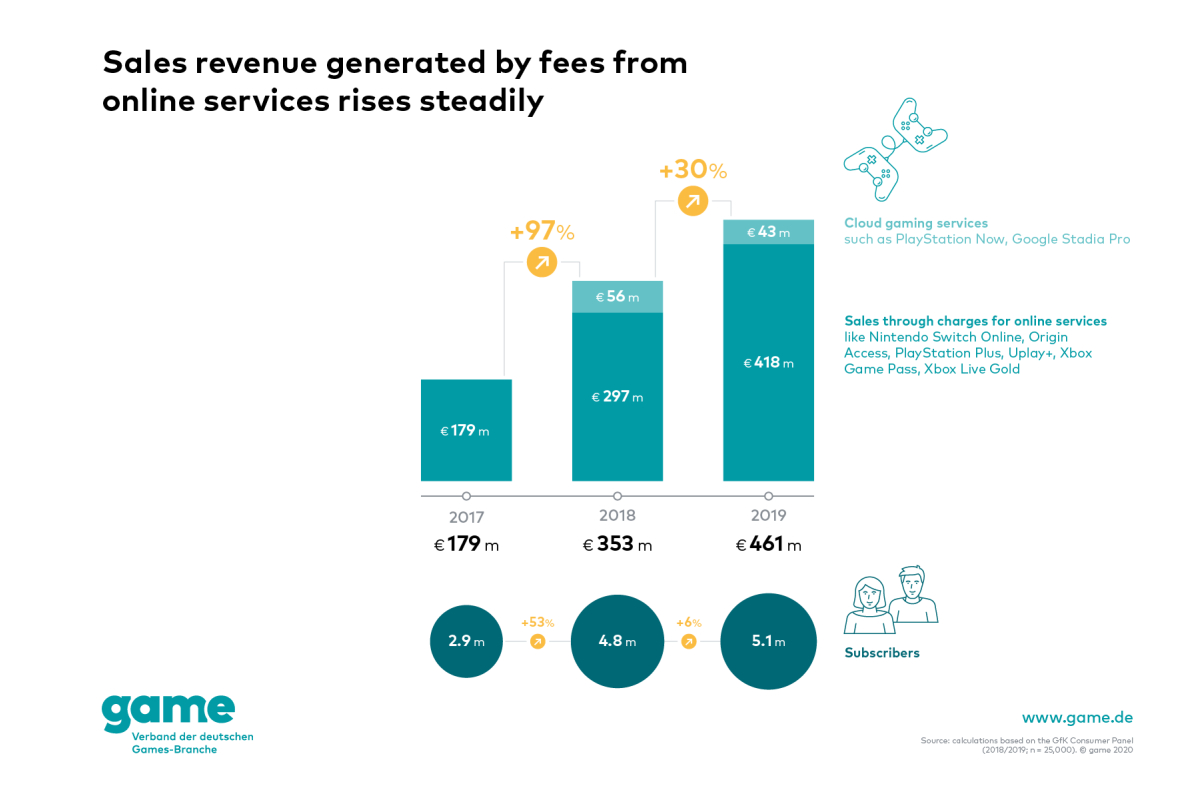

• 461 million euros generated by fees from online services

• More than 5 million people in Germany pay for online services

• German games industry tops 6-billion-euro mark

Sales revenue generated by fees from online services in Germany rose significantly once again. The segment grossed approximately 461 million euros in 2019, which is an increase of 30 per cent compared to 2018 (353 million euros) – and even that year, the segment had nearly doubled, with growth of 97 per cent. These are the figures released today by game – the German Games Industry Association, based on data collected by the market research company GfK. Fee-based online services are currently available in multiple versions and for a range of different gaming platforms. For example, services on consoles including Nintendo Switch Online, PlayStation Plus and Xbox Live Gold offer options such as playing online with and against other players, saving games in the cloud and receiving discounts on games and expansions. Subscription services for PC such as Origin Access Premier (EA) and Uplay+ (Ubisoft) allow players to pay a fixed monthly fee to access a huge rotating library of games and to play some new games before the release date. With cloud gaming services such as Google Stadia Pro and PlayStation Now, on the other hand, gamers no longer need high-performance hardware to play titles with their full range of graphics, as the computing power to run the games is provided in the cloud. Monthly fees for online services can range from 4 to 10 euros, depending on the provider. Last year, a total of approximately 5.1 million gamers paid for these fee-based services, which is around 300,000 people more than in 2018 (4.8 million).

In Germany, growing numbers of gamers are discovering fee-based online services that give them access to an enormous selection of the latest hot titles, offers and discounts for a monthly fee. The strong growth in this segment also indicates how much the games market is currently changing: long-term access and usage rights for games are becoming much more important than purchasing individual titles,’ says Felix Falk, Managing Director of game. ‘Cloud gaming services are an interesting option for many gamers, particularly if we consider future trends and blockbuster titles that require a lot of processing power. All the heavy processing takes place in data centres, so the players themselves no longer need particularly high-performance hardware. There’s a lot going on in this budding market segment at the moment, and we expect to hear much more about it in future.’

German games market grows by 6 per cent

As already reported by game, the German games market grew by 6 per cent in 2019, to around 6.2 billion euros. Sales of games hardware, including consoles, gaming PCs and accessories, dropped by 2 per cent from the previous year, to 2.4 billion euros. In contrast, the market for games software showed a gain of 11 per cent: in 2019, a total of about 3.9 billion euros was spent on computer and video games and the charges for the respective online services.

About the market data

The current data takes into account further dedicated games hardware like gaming PCs and the corresponding accessories, resulting in a larger market size than previously reported. This is true also of the adjusted data for 2018, which accordingly differs from that reported last year.

The market data is based on statistics compiled by GfK, the GfK Consumer Panel and App Annie. The methods used by GfK to collect data on Germany’s digital games market are unique in terms of both their quality and their global use. They include an ongoing survey of 25,000 consumers who are representative of the German population as a whole regarding their digital game purchasing and usage habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games.

game – the German Games Industry Association

We are the association of the German games industry. Our members include developers, publishers and many other games industry actors such as esports event organisers, educational establishments and service providers. As a joint organiser of gamescom, we are responsible for the world’s biggest event for computer and video games. We are an expert partner for media and for political and social institutions, and answer questions relating to market development, games culture and media literacy. Our mission is to make Germany the best games location.

-

Africa6 days ago

Africa6 days agoNew Governing Board of the Gaming Commission of Ghana Sworn in

-

Asia6 days ago

Asia6 days agoMacau Government Extends Lottery Concession of Macau Slot Until 5 June 2026

-

Latest News6 days ago

Latest News6 days agoWeek 26/2025 slot games releases

-

Latest News7 days ago

Latest News7 days agoDATA.BET Launches Bet Builder for Sports Betting

-

Africa6 days ago

Africa6 days agoQTech Games hires Ekaterina Mayorova as sales lead for Africa & Eastern Europe

-

Interviews7 days ago

Interviews7 days agoPortrait of a Fraudster Then and Now: How Scammers’ Habits and Tactics Are Changing

-

Industry News6 days ago

Industry News6 days agoCHIPS confirmed as Clarion Gaming charity partner ahead of appearance at iGB Affiliate Awards

-

Compliance Updates6 days ago

Compliance Updates6 days agoNick Rust to Step Down as Chair of UKGC’s Industry Forum