Gaming

What Will the Uk’s Approach Be To Gambling if Scotland Decides To Become Independent?

The Gambling Commission regulates the UK gambling industry, an executive non-departmental public body sponsored by the Department for Digital, Culture, Media and Sport. The Gambling Act 2005, which is the primary legislation governing gambling in the UK, sets out a framework for licensing and regulating all forms of gambling, including online and remote gambling.

In addition to the Gambling Commission, several other bodies are responsible for regulating different aspects of the gambling industry, including local authorities, the Advertising Standards Authority, and the Financial Conduct Authority.

The potential impact of Scotland’s independence on gambling regulation is a complex issue that could have significant implications for both the Scottish and UK gambling industries. At present, Scotland operates under the same gambling laws and regulations as the rest of the UK, but if Scotland were to become independent, it would be free to establish its own regulatory framework for gambling.

This could potentially lead to significant changes in the way that gambling is regulated in Scotland, as well as impacting cross-border gambling between Scotland and the rest of the UK. Additionally, it could impact the Scottish gambling industry and economy and have wider implications for gambling-related harm reduction measures.

Overview of the current gambling landscape in Scotland

The regulation of gambling in Scotland is carried out by the Scottish Government and local authorities. The primary legislation governing gambling in Scotland is the Gambling Act 2005, which is enforced by the Gambling Commission. In addition to this, the Scottish Government has also developed its own specific policies and initiatives aimed at reducing gambling-related harm and promoting responsible gambling.

The Scottish gambling industry is diverse and encompasses a range of different sectors, including casinos, betting shops, online gambling platforms, and the national lottery. According to recent statistics, the gambling industry in Scotland generated a gross gambling yield of £1.7 billion in 2019-2020.

There are currently 362 licensed betting shops in Scotland, which employ around 4,000 people. In addition to this, there are several large casinos located in major Scottish cities such as Glasgow and Edinburgh, which employ around 1,000 people.

The gambling industry is an important contributor to the Scottish economy, both in terms of employment and tax revenue. However, there are also concerns about the potential negative impacts of gambling, such as gambling-related harm and addiction.

According to a recent report, around 0.7% of the Scottish population are problem gamblers, and a further 1.7% are considered at-risk gamblers. These figures are higher than the UK average, highlighting the need for robust gambling regulation and harm reduction measures.

In addition, there are concerns about the social impacts of gambling, such as its potential to contribute to poverty and inequality. Some research has suggested that gambling is more prevalent in deprived areas and that it can exacerbate existing social inequalities.

Overall, the Scottish gambling landscape is complex and multi-faceted, with a range of different stakeholders and perspectives involved. The potential impact of Scotland’s independence on gambling regulation is therefore an issue that will need to be carefully considered and managed.

Possible Scenarios for gambling regulation in an Independent Scotland

One possible scenario for gambling regulation in an independent Scotland would be for Scotland to adopt the existing UK gambling regulations. This would involve Scotland continuing to operate under the framework set out in the Gambling Act 2005 and other related legislation and continuing to be regulated by the Gambling Commission.

The advantages of this scenario would be that it would provide continuity and stability for the Scottish gambling industry, as well as ensuring a consistent approach to gambling regulation across the UK. It would also mean that Scottish gambling operators would continue to have access to the UK market, a significant revenue source for many Scottish companies.

However, there are also potential drawbacks to this scenario. For example, Scotland may wish to establish its own regulatory framework to reflect its specific needs and priorities better. Additionally, there may be concerns about Scotland being subject to UK gambling regulations over which it has no say or influence.

Another possible scenario for gambling regulation in an independent Scotland would be for Scotland to establish its own regulatory framework for gambling. This would involve the creation of new Scottish-specific legislation and regulatory bodies, aiming to better reflect Scotland’s specific needs and priorities.

The advantage of this scenario would be that it would allow Scotland to tailor its approach to gambling regulation to its own specific context and needs. It could also help to ensure that the Scottish gambling industry is more closely aligned with Scottish values and priorities, such as promoting responsible gambling and reducing gambling-related harm.

However, there are also potential drawbacks to this scenario. For example, there may be concerns about the costs and administrative burden associated with establishing a new regulatory framework. Additionally, there may be concerns about the potential impact of Scottish-specific regulations on cross-border gambling between Scotland and the rest of the UK.

The impact of different scenarios for gambling regulation in an independent Scotland on the Scottish gambling industry and the economy is likely to be complex and multi-faceted. It will depend on a range of factors, including the specific regulations and policies put in place, as well as wider economic and political factors.

In general, however, any significant changes to gambling regulation could likely positively and negatively impact the Scottish gambling industry and economy. For example, stricter regulations could reduce problem gambling and associated harm but could also reduce revenue for the industry.

Conversely, looser regulations could increase revenue for the industry but could also increase the risk of gambling-related harm and addiction. Overall, the challenge for an independent Scotland will be to strike the right balance between promoting a thriving gambling industry and protecting consumers from harm.

Considerations for cross-border gambling

If Scotland were to become independent, one of the key considerations for gambling regulation would be the potential impact on cross-border gambling between Scotland and the rest of the UK. At present, Scottish gambling operators are subject to the same regulations as operators in the rest of the UK and are able to operate freely in the UK market.

If Scotland were to establish its own regulatory framework, however, it is possible that this could lead to changes in how cross-border gambling operates. For example, it could create additional barriers or requirements for Scottish gambling operators to enter the UK market or vice versa. For example, you can see online UK casinos that currently support Scottish users if you click here, but this can change if Scotland leaves the UK.

It is also possible that an independent Scotland could seek to establish its own trade agreements with other countries or regions, which could have implications for cross-border gambling between Scotland and the rest of the UK.

Another consideration for cross-border gambling is the potential impact on online gambling platforms that operate in both Scotland and the UK. At present, many online gambling platforms are licensed by the Gambling Commission and are able to operate across the UK market, including in Scotland.

If Scotland were to establish its own regulatory framework, however, it is possible that this could lead to changes in how online gambling platforms are regulated. For example, it could create additional requirements or restrictions for platforms operating in Scotland.

This could potentially have implications for online gambling platforms that operate across both Scotland and the rest of the UK. For example, they may be required to obtain separate licenses or comply with different regulations in each jurisdiction.

Overall, the implications for cross-border gambling in the event of Scottish independence will depend on the Scottish government’s specific regulations and policies. However, it is clear that any significant changes to gambling regulation could have important implications for both the Scottish and UK gambling industries.

Implications for Gambling-Related Harm Reduction

The UK has one of the most robust systems of gambling regulation in the world, with a particular focus on harm reduction and consumer protection. The Gambling Commission, as the primary regulator of the industry, has a statutory duty to promote responsible gambling and reduce gambling-related harm.

In recent years, the UK has introduced a range of measures aimed at reducing gambling-related harm, including mandatory affordability checks, a ban on credit card gambling, and tighter restrictions on advertising and promotions. There is also a strong emphasis on research and data collection, with a range of bodies and organizations working to better understand the nature and extent of gambling-related harm in the UK.

If Scotland were to become independent, there is likely to be some impact on the approach to gambling-related harm reduction. At present, Scottish gambling operators are subject to the same regulations as operators in the rest of the UK and are therefore required to comply with the same harm reduction measures.

If Scotland were to establish its own regulatory framework, it is possible that this could lead to changes in the way that harm reduction is approached. For example, Scotland may wish to introduce its own specific measures or policies aimed at reducing gambling-related harm, such as different restrictions on advertising or promotions.

There is also the potential for Scotland to take a more proactive approach to harm reduction, building on the UK’s existing system. This could include the introduction of more stringent requirements for operators to collect and analyze data on gambling-related harm, or the development of new initiatives aimed at reducing the social and economic impacts of gambling.

Overall, the implications for gambling-related harm reduction in an independent Scotland will depend on the specific regulatory framework put in place. However, it is clear that there is a growing recognition of the need for robust harm reduction measures, and that this will be a key consideration for any future gambling regulation in Scotland.

Conclusion

The potential impact of Scottish independence on gambling regulation is a complex issue with significant implications for both the Scottish and UK gambling industries. Currently, Scotland is regulated by the same gambling laws and regulations as the rest of the UK, but if Scotland were to become independent, it would be free to establish its own regulatory framework for gambling.

Possible scenarios for gambling regulation in an independent Scotland include adopting existing UK regulations or creating new Scottish-specific regulations. The impact on cross-border gambling and harm reduction measures will depend on the specific regulatory framework put in place.

The potential outcomes and next steps for gambling regulation in an independent Scotland are difficult to predict. However, it is clear that any significant changes to gambling regulation could have important implications for both the Scottish and UK gambling industries.

It will be important for any future regulatory framework to strike the right balance between promoting a thriving gambling industry and protecting consumers from harm. This may involve adopting a proactive approach to harm reduction, building on the UK’s existing system and developing new initiatives aimed at reducing the social and economic impacts of gambling.

Overall, the potential impact of Scottish independence on gambling regulation is a complex and multifaceted issue that will require careful consideration and management by policymakers and industry stakeholders.

Gaming

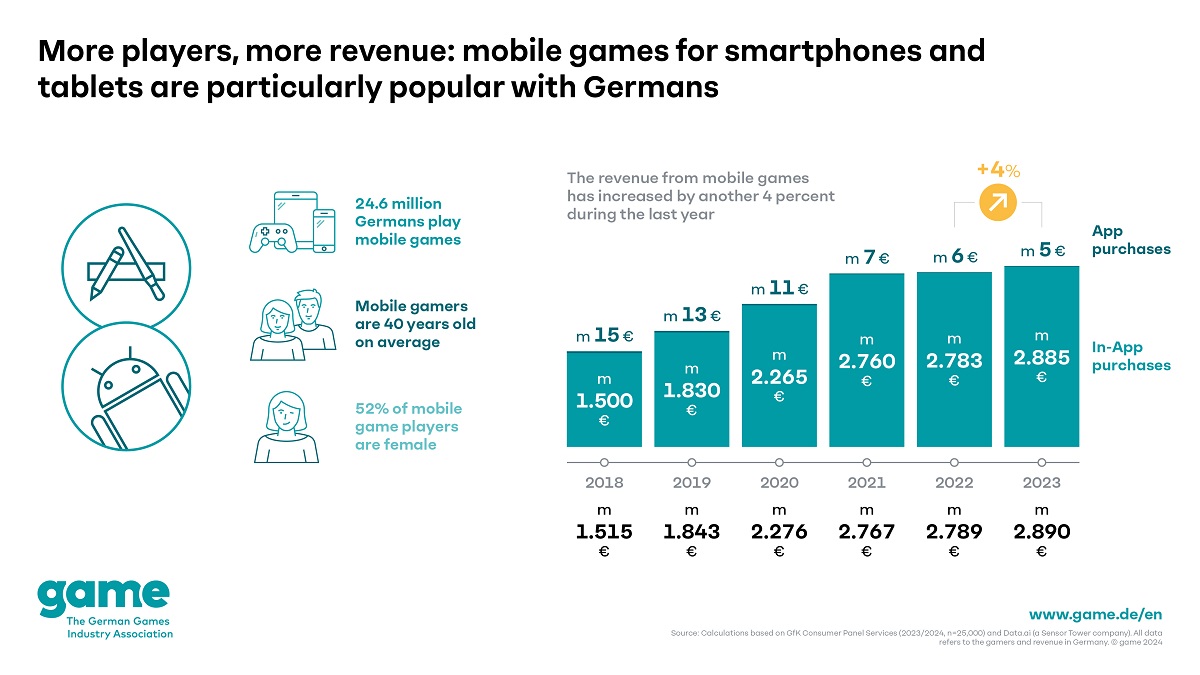

More players, more revenue: mobile games are very popular among Germans

- Revenues from games apps grow in Germany by 4 per cent to over 2.9 billion euros

- Smartphones and tablets attract 300,000 additional players in twelve months

- ‘Mobile games often attract people with little or no experience of playing video games’

Games apps for smartphones and tablets continue to do well in Germany: revenues from mobile games grew by another 4 per cent to 2.9 billion euros within a year. This part of the games market has almost doubled since 2018, when revenues amounted to 1.49 billion euros. These are the figures released today by game – The German Games Industry Association, based on data collected by the market research company data.ai. Not only were games app revenues up, but the number of mobile game players also grew by 300,000 to 24.6 million in the space of a year. The average age of people who play video games on their smartphone in Germany is 40. Women tend to play more on smartphones and tablets (52%) compared to men (48%).

‘Games apps for smartphones and tablets are very popular among Germans,’ says Felix Falk, Managing Director of game. ‘Although we’ve been witnessing the unstoppable rise of the smartphone for almost a decade and a half, this is still an area of the game market that continues to grow. Mobile games often attract people with little or no experience of playing video games. The mobile gaming market has grown hugely over recent years: alongside classic casual games for spare moments, complex games and even esports titles are now also firmly established. This variety is unique and one of the strengths of games apps.’

A closer look at the mobile gaming market in Germany highlights the distinctive features of the sector: around 5 million euros – significantly below 1 per cent of total revenues – is generated by the sale of individual mobile games. Revenues from online gaming services on smartphones and tablets are significantly higher, amounting to 43 million euros or around 1 per cent. 98 per cent and therefore almost the entire revenue from games apps – 2.9 billion euros – is generated with in-app purchases. These include cosmetic enhancements for players’ own avatars along with virtual currencies and loot boxes or large story expansions.

Strong development of the German game market in 2023

The German games market showed significant overall growth again in 2023, with revenues from games, gaming hardware and online gaming services increasing by 6 per cent, to some 9.97 billion euros. This considerable rise follows a revenue increase of just 1 per cent in the preceding year. The largest drivers of this growth include game consoles and related accessories, as well as in-game and in-app purchases. At the same time, sales of gaming PCs and laptops saw clear declines in some areas.

Gaming

Games Lift 2024: These five developer teams will receive the Hamburg incubator funding

Five teams have won over the Games Lift awarding committee with their game projects. On September 9, the Games Lift Incubator will start for them as a unique support program in Germany. Included is a one-year workshop and mentoring program with international industry experts and 15,000 euros in financial support, as well as room for collaboration and exchange with the other participating teams. More than 30 experts in game design, product development, pitching, business development, press relations and marketing from the Games Lift network will share their experience with the teams to give their projects a professional start. Starting this year, the program also offers participating teams a joint trip to an international industry event. The Games Lift Incubator is organized and implemented by Gamecity Hamburg on behalf of the Free and Hanseatic City of Hamburg.

A total of 21 teams and solo developers applied for the fourth Games Lift Incubator. The decision for the five participating teams was made by the awarding committee, consisting of Kristin von der Wense (Publishing Producer Daedalic Entertainment), Ole Schaper (Managing Director The Sandbox Hamburg (Sviper GmbH)), Heiko Gogolin (Managing Director Rocket Beans Entertainment) and Tobias Graff (Co-Founder, Programmer and CEO Mooneye Studios).

Margarete Schneider, Project Manager at Gamecity Hamburg, on the award committee’s decision: “We are delighted with the large number of applications for our incubator and the high standard of the pitch decks submitted once again. It is particularly pleasing that we are receiving more applications from outside Hamburg, who see the city as an attractive location for starting a new business. The Games Lift Incubator provides gaming start-ups with comprehensive starting support and enables them to forge connections in Hamburg’s diverse games scene.

The five winner projects and teams for Games Lift Incubator 2024:

- ForeFeathers by Team Honeybeak

- Frisia – Cozy Villages by Rouven Cabanis

- Light of Atlantis by Duck ‘n’ Run Games

- Pubcrawler by Triflgard

- Tiny Garden by Tales from the Garden

ForeFeathers by Team Honeybeak is a 3D Puzzle-Platformer where players slip into the role of a penguin, who explores the sky-high ruins of an ancient civilization of birds. Traversing the flying islands with the ancient powers of flight, solving tricky puzzles and keeping the penguin’s friends away from trouble are some main aspects of the game.

In Frisia – Cozy Villages by Rouven Cabanis the player gains control over an uninhabited Northsea island and is tasked with building a functional, yet cozy and beautiful little town. Inspired by the frisian architecture of the Dutch and German Northsea coast, Frisia aims to create a cozy gameplay experience in harmony with simple town-building and strategy game mechanics.

Light of Atlantis by Duck ‘n’ Run Games is a 2D puzzle metroidvania in which players take on the roles of various robots with individual abilities to explore the sunken ruins of Atlantis. By draining and releasing water into the various rooms, the robots shape their environment and improve their chances against different enemies. Light of Atlantis was part of the Gamecity Hamburg prototype funding in 2023 and received in the same year the German Computer Game Award (Deutscher Computerspielpreis) in the category “Best Prototype”.

Pubcrawler by Triflgard is a co-op PC game in which up to four players need to work as a team, to navigate a giant, mechanic, wandering pub through an apocalyptic wasteland. In the process, they must complete a variety of challenging tasks that can only be mastered as a team. Working together efficiently, pleasing the different guests and keeping a cool head even when the giant pubcrawler faces technical issues are the key to a successful journey.

In Tiny Garden by Tales from the Garden players slip into the role of a deity who fills a deserted planet with life. Together with their servants, a group of cute leaf creatures that must be protected from evil spirits, they plant a constantly growing garden. As soon as the garden is fully grown, the evil spirits can be soothed and the player can move on to the next planet in help.

Gaming

MainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

MainStreaming, an iMDP INTELLIGENT MEDIA DELIVERY COMPANY, which is redefining the CDN market with its innovative Edge Network services, announced the appointment of Nicola Micali as its new Chief Customer Officer (CCO).

With a track record of improving processes and efficiency and creating go-to-market strategies, Harvard alumnus and former Akamaite, Nicola Micali joins MainStreaming with the goal of solidifying a customer-centric organisation that prioritises long-term relationships, customer experience (CX) and satisfaction, ensuring MainStreaming’s continued business growth and market leadership.

Nicola brings a wide range of professional experience as a Leader of Customer Success & Professional Services at Akamai for over 10 years, where he was responsible for services and overall revenue. He developed the services strategy for the Americas’ media & entertainment, gaming and partners verticals exceeding all revenue targets year after year. Nicola’s expertise in leading technical customer-facing teams has resulted in higher customer satisfaction and successful worldwide streaming events.

With a Master’s degree in Business Administration and Management from Harvard, Micali’s educational background further enhances his capability to lead and innovate in the Edge video technology sector. As Nicola steps in as CCO, he will play a pivotal role in guiding the entire customer lifecycle journey. His expertise in customer success positions him perfectly to lead MainStreaming’s efforts in providing world-class service to a global clientele.

MainStreaming’s CEO, Antonio G. Corrado, said: “QoS for our customers and QoE for end users are at the core of our streaming business. It is the best proxy for customer satisfaction for us. We are happy to welcome Nicola Micali, who demonstrates his expertise in customer success. Together, we are set to strengthen our commitment to being a customer satisfaction-oriented company, leveraging our world-class services directed to broadcast-quality standards that are requested by industry players.”

MainStreaming’s video delivery technology is meticulously developed in-house, offered as managed private Edge Network to help broadcasters, OTT TVs and content owners overcome the toughest challenges of live streaming at scale, addressing the limitations of classic CDN and enabling new application solutions on the Edge.

“I am honored to join a team that is on a mission to write a new chapter in video streaming delivery, setting new standards, and paving the way for the future of TV. I am ready to contribute to MainStreaming’s innovative approach and customer-centric philosophy. Together, we are set to revolutionize how the streaming industry approaches Edge Network architecture for live streaming, emphasizing a more distributed, ultra-low-latency, energy-efficient, and globally scalable design,” Nicola Micali said.

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – July 15-21

-

Eastern Europe5 days ago

Eastern Europe5 days ago7777 gaming is now available on WINBET Romania

-

Gaming5 days ago

Gaming5 days agoMainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

-

Industry News5 days ago

Industry News5 days agoSafer Gambling Tools Use Hits Record High in 2023 – New Report from EGBA

-

Australia5 days ago

Australia5 days agoAustralian eSports Star Joins Team Liquid

-

eSports5 days ago

eSports5 days agoINSPIRED LAUNCHES RE-PLAY ESPORTS™ FEATURING CS:GO IN PARTNERSHIP WITH KAIZEN GAMING

-

eSports5 days ago

eSports5 days agoNODWIN(R) Gaming ropes in Android as title partner for BGMS Season 3; to be powered by Garnier Men

-

Latest News5 days ago

Latest News5 days agoSpinomenal shines again with Super Wild Fruits release