Industry News

Europe Sports Betting Market Size, Share & Trends Analysis Report 2024-2030 Featuring Bet365, William Hill, Betfair, Paddy Power, 888sport, Bwin, Unibet, Ladbrokes, MGM, and Betsson

The “Europe Sports Betting Market Size, Share & Trends Analysis Report by Type, Platform, Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others), Country, and Segment Forecasts, 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

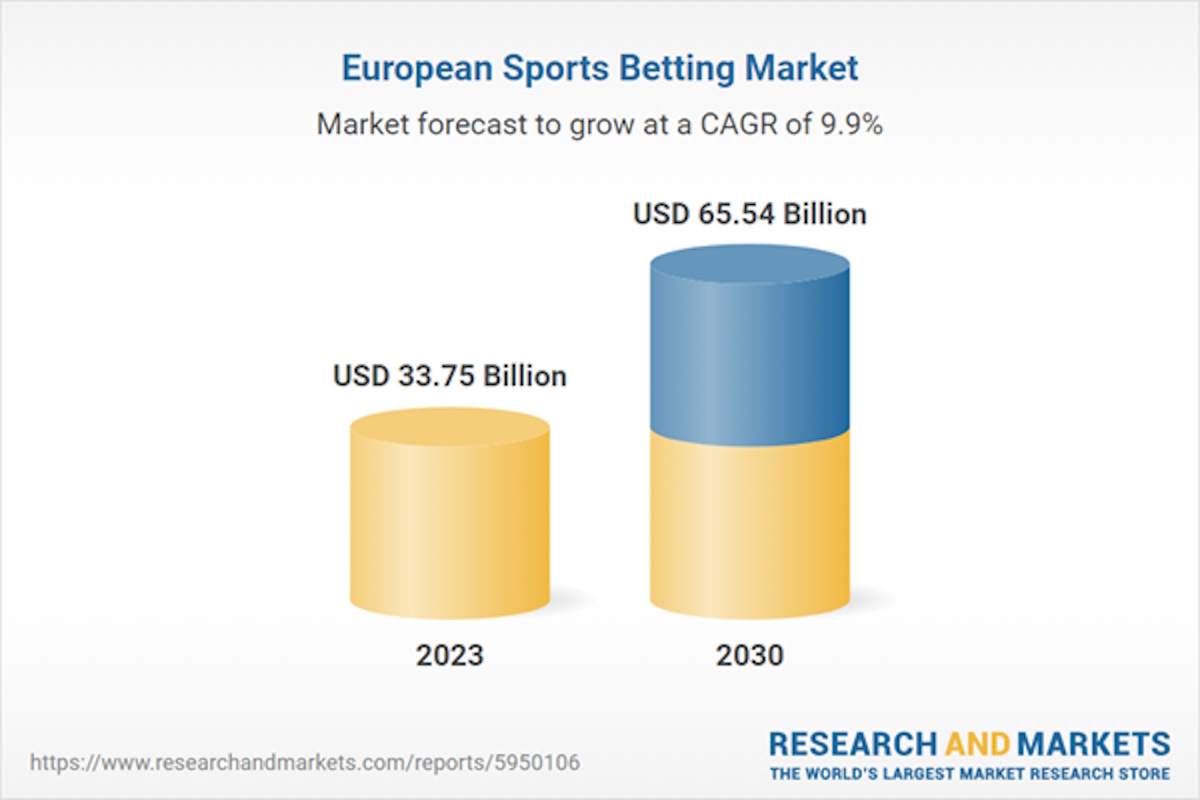

The Europe sports betting market size is anticipated to reach USD 65.54 billion by 2030 and is expected to expand at a CAGR of 9.9% from 2024 to 2030

The globalization of sports and the integration of international leagues and tournaments into European betting markets have fueled the growth of sports betting. Major sporting events such as the FIFA World Cup, UEFA European Championship, Wimbledon, and the Olympics attract widespread attention and betting interest from European consumers, driving significant betting volumes and revenues for sports betting operators, thus driving the growth of the sports betting market in Europe.

The COVID-19 pandemic had a negative impact on the European sports betting market. The cancellation or postponement of sports events during the pandemic restrained the market growth. With major tournaments, leagues, and competitions either suspended or canceled outright, the absence of live sports events severely diminished consumer betting opportunities. It led to a significant decline in betting volumes and revenues for sports betting operators.

The presence of favorable betting policies in the region is driving the growth of the sports betting market in the region. Many European countries, such as the UK, Ireland, Denmark, and France, have progressive policies promoting a competitive and well-regulated betting market. It facilitates the entry of new operators into the market and encourages competition, leading to innovation, improved services, and better value for consumers.

Moreover, established responsible gambling initiatives and regulatory bodies in Europe, such as the European Gaming & Betting Association, help build trust and confidence among consumers by promoting responsible gambling practices, ensuring fairness and transparency in betting operations, and providing avenues for dispute resolution, to protect consumers and maintain the integrity of the betting market, thus driving the growth of sports betting market in the region.

Europe Sports Betting Market Report Highlights

- Based on the type of betting, the fixed odd wagering segment accounted for the highest revenue share of 27.7% in 2023 due to the stability and predictability of the payouts

- Based on platform, the online segment dominated the market in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. It can be attributed to the collaborations between sports teams, leagues, and betting companies, thus increasing the visibility of sports betting and attracting a larger customer base.

- In terms of sports type, the football segment accounted for the largest revenue share in 2023. It can be attributed to the popularity of football in Europe due to popular football clubs like Real Madrid, Liverpool FC, FC Barcelona, and Manchester United.

- The UK held a significant share of 34.6% in 2023 and is expected to grow at a significant CAGR during the forecast period. Favorable gambling policies in the country drive the market’s growth.

Company Profiles

- Bet365

- Ali William Hill

- Betfair

- Paddy Power

- 888sport

- Bwin

- Unibet

- Ladbrokes

- MGM Resorts International

- Betsson

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 80 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $33.75 Billion |

| Forecasted Market Value (USD) by 2030 | $65.54 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Europe |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Europe Sports Betting Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing number of sport events

3.2.1.2. Growing number of sporting events and leagues in Europe

3.2.2. Market restraint analysis

3.2.2.1. Lack of unified regulations

3.2.3. Market opportunity analysis

3.2.3.1. Growth in E-sports audience

3.3. Europe Sports Betting Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.2. PESTEL Analysis

Chapter 4. Europe Sports Betting Market: Platform Estimates & Trend Analysis

4.1. Platform Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Europe Sports Betting Market by Platform Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

4.4.1. Offline

4.4.2. Online

Chapter 5. Europe Sports Betting Market: Type Estimates & Trend Analysis

5.1. Type Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Europe Sports Betting Market by Type Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

5.4.1. Fixed odds wagering

5.4.2. Exchange Betting

5.4.3. Live/In Play Betting

5.4.4. eSports Betting

5.4.5. Others

Chapter 6. Europe Sports Betting Market: Sports Type Estimates & Trend Analysis

6.1. Sports Type Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Europe Sports Betting Market by Sports Type Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030

6.4.1. Football

6.4.2. Basketball

6.4.3. Baseball

6.4.4. Horse Racing

6.4.5. Cricket

6.4.6. Hockey

6.4.7. Others

Chapter 7. Europe Sports Betting Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.4.1. UK

7.4.2. Germany

7.4.3. France

7.4.4. Italy

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.4. Company Profiles

For more information about this report visit researchandmarkets.com

Industry News

Playtech Live Launches Exclusive Bespoke Game with Kaizen Gaming

Playtech announced the launch of a new bespoke game, Pig Champions, developed exclusively for Kaizen Gaming, one of the biggest GameTech companies in the world. This launch marks the first Live Casino bespoke title for the leading sports betting & gaming operator and strengthens the strategic partnership between the two companies.

The game, designed to appeal to all audience types and player types across all markets, is a sporty animated universe in a Money Wheel Game show format, where 3 Pig Champions characters compete with each other to reach the highest multipliers within 3 exciting Bonus rounds. The studio is located in Playtech’s Romanian facility (PTR), offering a unique, immersive, animated experience made with fresh Unreal engine technology, featuring unique gameplay built from the ground up using advanced real-time animation.

Kevin Kilminster, Chief Product Innovation Officer at Playtech Live: “We are delighted to partner with one of the leading sports betting & gaming operators in the world to launch their bespoke Live Game Show, Pig Champions to their extensive player base. After being selected by Kaizen Gaming as the leading developer of bespoke live content, collaborating on Pig Champions has enabled the team to showcase their passion and experience by exploring new innovative ways of bringing live casino games to life that offer a fresh, safe gaming experience for players. Our partnership with Kaizen Gaming continues to evolve and we look forward to our next collaboration in bringing further exciting games to market.”

Christos Mavridis, Head of Live Casino of Kaizen Gaming: “Our content offering is some of the most exciting on the market and working with an established partner like Playtech will assist in enhancing our current portfolio even more. Pig Champions stands as evidence of Playtech’s expertise and extensive experience, elevating our live casino offering and emphasising our commitment to creating top-quality innovative game experiences for our players.”

Industry News

Amusnet Ranks Among Italy’s Top Casino Providers

Amusnet Italy is the fourth-best casino provider in the country for June 2024, according to iGaming Tracker. The company has made a significant leap in the rankings, advancing three positions to secure the fourth spot. The achievement is underscored by a 1.1% increase in market share, reflecting a substantial gain in visibility and preference among online casino operators and players. This rise reflects Amusnet’s growing influence and effectiveness in the Italian market, demonstrating the company’s leading place among the industry’s top providers.

Several notable accomplishments have bolstered Amusnet Italy’s presence in the country. The company’s commitment to excellence was recognised with the prestigious Gold Award for Casino Content Supplier 2023 from EGR Italy last November. Furthermore, Amusnet has added six new partnerships with operators since January, bringing the total number to over 30, and has maintained a robust portfolio with over 100 certified games. Additionally, Amusnet Italy has released 14 new games since the beginning of the year, with more games planned for release by the end of 2024.

Polina Nedyalkova, Director at Amusnet Italy, said: “We are incredibly proud of our progress and the milestones we have reached. This ranking highlights our leading position in the industry and our dedication to delivering high-quality, engaging gaming experiences to local players. Our advancement to the top position underscores our growing influence and effectiveness in the Italian market, and we look forward to continuing this momentum and bringing even more top-notch games to our audience.”

Affiliate Industry

Getting Sticky with It: Why Affiliate Traffic Should be About Quality Not Quantity

In a highly competitive “bonus blitzing” affiliate market, the only real winner is the bonus hunter. These affiliates may be sending traffic through to their partners in volume, but many of their users are just looking to play through a good deal, never to return.

At Slots Temple, we believe the “stack ‘em high, watch ‘em fly” approach to aggressive bonus-driven traffic no longer flies. We wanted to focus on improving the quality of the traffic and that meant doing things differently.

We began life as a site that offered free demo games and slots tournaments, and this helped to build a highly engaged base of players that genuinely loved playing slots. But we wanted to take this to the next level.

When we were awarded a UKGC gambling license in 2022, it meant we could offer cash prizes for our free tournaments. And then the next logical step was real-money tournaments in the UK with juiced-up prize pools, and ultimately real-money slots.

To create better quality traffic, you need to engage with your customers to better understand them and foster loyalty. It helps if you have a unique value proposition to increase the stickiness of your brand and engage audiences more effectively.

Our real money tournaments are a real UVP and are proving wildly popular with our users. The stakes we offer are low. You can play a slots tournament for as little as 1p, and the free-play model remains a large part of what we do – exclusively so outside the UK.

Ultimately, we want to be a safe place for players, which is why offering low stakes games is important. It’s about fostering a player base that trusts us and feels comfortable playing with us.

Yes, we’re blurring the lines between affiliate and operator, but our players know we’re not just chasing profits at the expense of everything else. Ultimately, our players see us primarily as a destination for fun play and prizes, and it’s important that we maintain that balance. If they thought we were simply out to rinse them, we’d lose their trust, and they wouldn’t come back.

Instead, it’s about offering more choice and increasing that stickiness. It also helps us better understand what games our players like to play so that we can offer more personalized recommendations.

And this is how real-money slots tournaments can really increase the quality of traffic. If a player has been playing a certain slot in a real-money tournament, for example, and wants to play at a partner site, we can guarantee that we are referring a player who is already highly engaged with the game and is ready to transition to higher stakes.

Of course, within the framework of real-money tournaments, it’s important to continue diversifying offerings by devising new formats. We have turbo tournaments, risk tournaments — a multitude of formats and price points so everyone can play the way they want to.

Our real-money tournaments are further enhanced by what was always a highly gamified platform. So, we have leaderboards, Xpoints, rewards chests, and challenges.

Continuous challenges, incentives and rewards keep users engaged over the long term. These elements can appeal to users’ competitive nature and desire for achievement, as they play for bragging rights. This enhances social elements and encourages them to engage frequently with the product

Adding fun and playful elements enhances the user experience beyond the tournaments themselves. Regular rewards and recognition prevent burnout and keep users motivated. And engaged and motivated players are more likely to become passionate about the brand.

Creating a player base that produces true value to your affiliate partners requires a number of the right ingredients, plus a lot of care and attention. But the affiliate landscape is changing, and affiliates need to get creative to get sticky.

Author: Fraser Linkleter, CEO at Slots Temple

-

Eastern Europe5 days ago

Eastern Europe5 days ago7777 gaming is now available on WINBET Romania

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – July 15-21

-

Gaming5 days ago

Gaming5 days agoMainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

-

Australia5 days ago

Australia5 days agoAustralian eSports Star Joins Team Liquid

-

eSports5 days ago

eSports5 days agoINSPIRED LAUNCHES RE-PLAY ESPORTS™ FEATURING CS:GO IN PARTNERSHIP WITH KAIZEN GAMING

-

Industry News5 days ago

Industry News5 days agoSafer Gambling Tools Use Hits Record High in 2023 – New Report from EGBA

-

eSports5 days ago

eSports5 days agoNODWIN(R) Gaming ropes in Android as title partner for BGMS Season 3; to be powered by Garnier Men

-

Latest News5 days ago

Latest News5 days agoSpinomenal shines again with Super Wild Fruits release