Latest News

The ANJ publishes the results of the online gambling market for the 2nd quarter of 2020: the sectors are very differently impacted by the COVID crisis

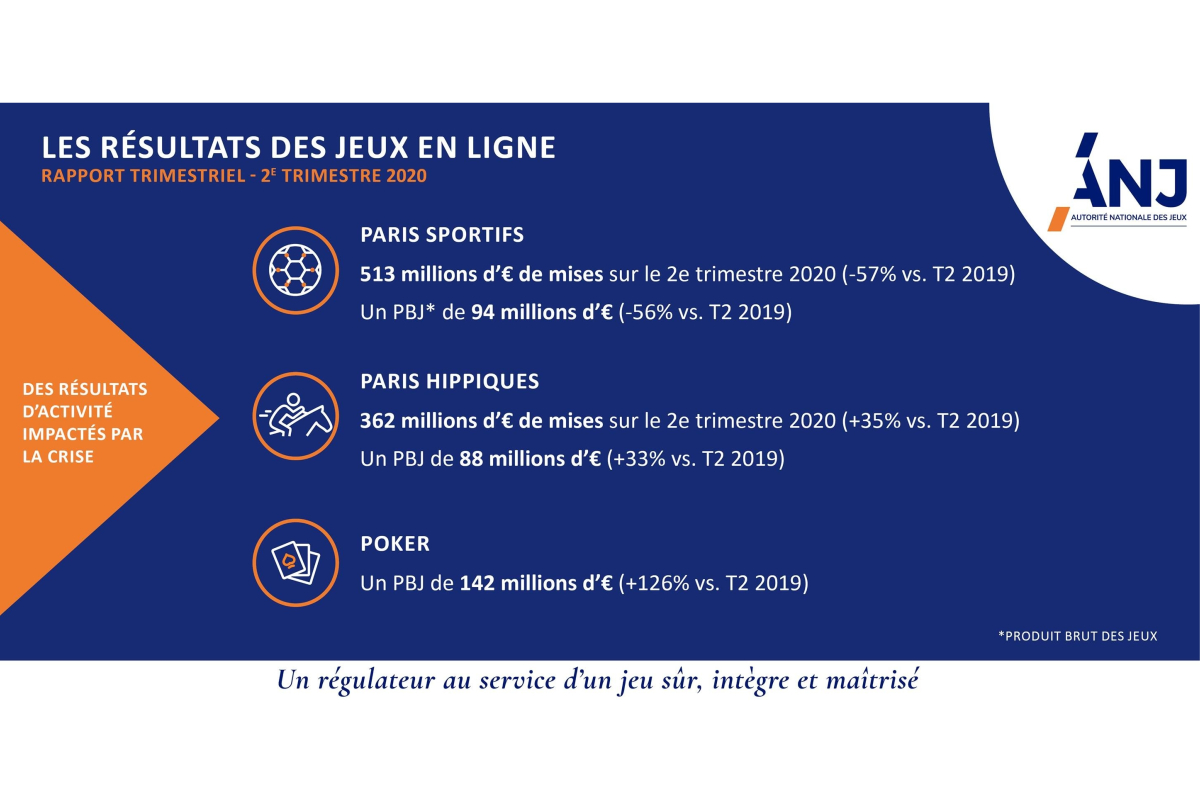

In the 2nd quarter of 2020, the online gambling market recorded a decrease of 6% of its GGR[1] and a decrease in active player accounts of 9%. It is the sports betting sector that has been the most affected by the effects of the health crisis with a decrease of 56% of its GGR. Conversely, the poker and, to a lesser extent, horseracing betting segments recorded a sharp increase of their GGR.

The lockdown (from 16 March to 10 May) was particularly handicapping for operators, who recorded a decrease of 24% over the period compared to 2019.

However, despite this health crisis, the GGR of the legal online market reached 758 million euros over the first 6 months of the year, an increase of 8% compared to the first half of 2019.

The collapse of online sports betting : -56% of the GGR

The online sports betting segment is generally the most dynamic part of the online gambling market. On the flip side of this trend, the sports betting offer for the quarter was profoundly altered by the massive cancellations or the delayed recovery of sporting events. With this reduction of the supply, and in order to support the market, the ARJEL Board authorized the add of 7 competitions to the list of sporting events, allowing them for sports betting in France (Australian football, 1st Australian soccer league, Hungarian football cup, 1st South Korea and China football leagues, baseball in Korea and hockey in Belarus).

These new competitions, while meeting ARJEL’s requirements regarding the fight against sports manipulation, have made it possible for operators to maintain a sports betting offer throughout the period of suspension of major competitions. All in all, operators’ GGR in the sports betting market amounted to 94 million euros in the second quarter, a decrease of 56% compared to 2019. The decline in operators’ turnover fell to 87% over the lockdown period.

As a result of this unprecedented situation, the number of active player accounts fell by 36%, albeit at a slower pace than the decrease of the GGR. The average spending per active player account over the quarter[2] amounted to 86⏠compared to 126 ⏠in Q2 2019 (-32%).

While operators had planned to make a significant marketing effort for EURO 2020, they sharply reduced their sports betting advertising spending during the 2nd quarter of 2020[3] in response to the decline in their activity.

The results provided by the FDJ demonstrate similar difficulties in the sports betting segment. The monopoly recorded indeed a decrease of 39% in sports betting stakes, all channels combined, in the first semester and up to around 61% in the second quarter alone.

An increase of online horseracing betting: +33% of the GGR

The horseracing betting offer was significantly affected this quarter following the interruption of French horseraces until 11 May 2020. However, the bets recorded during this period increased by 16%, in particular thanks to the maintenance and additions of foreign horseraces to the French horseraces betting calendar, approved by the Ministry of Agriculture and Food after an informal advice from ARJEL[4]. The increase of horseracing stakes is also due to the shift of some sports bettors to horseracing betting during the period. As soon as French races resumed, the market recorded an increase of the number of players, that accelerated the growth of the stakes over the quarter.

The online horseracing betting market activity is once again growing at a rate not observed since the market opened in 2010. The playersâ stakes reached 362 million euros this quarter, up 35% compared to the second quarter of 2019. This volume of stakes also corresponds to the highest level generated over a quarter. At the same time, the GGR of the quarter increased by 88 million euros in proportions almost similar to stakes (+ 33%), its highest level since the opening of the market.

The PMU, operator under exclusive rights regarding offline horseracing betting, reported a decrease of 31% of the stakes in the 1st half of the year, all channels combined. However, business results improved at the end of the semester, thanks to the gradual reopening of points of sale and racecourses.

The booming of online poker: +126% of the GGR

The lockdown period has been very advantageous to the online poker segment. The popularity for this activity has led to the recruitment of many new players. As a result, nearly 1.100.000 active player accounts (APAs) participated in online poker games during the quarter, an increase of 68% relative to last year.

As a result, the poker GGR reached 142 million euros in the second quarter, its biggest result for a quarter and 44 million higher than the GGR of the first quarter of 2020. The growth of the poker GGR is of 126% compared to Q2 2020, which corresponds to the most significant increase recorded over a quarter.

This growth is due both to an increase in the number of active players (+ 68% compared to Q2 2019) and to the intensification of gambling. The average spending per active player account thus increased sharply in Q2 2020 (+ 34%), reaching ⏠134 compared to ⏠99 in Q2 2019.

The ANJ in brief

The âPacteâ Act and the ordinance of October 2, 2019 reforming the regulation of gambling have set up a new gambling regulatory authority (ANJ). It follows ARJEL with a significantly extended regulatory scope and enhanced powers.

The ANJ is now responsible for all components of the legal gambling market, both online andoffline:

- online games that ARJEL regulated, such as sports betting and horse racing betting and poker offered by the 14 licensed operators ;

- all the games of La Française des Jeux or the PMU sold in physical points of sale or online;

- 237 racecourses;

- 202 casinos, with the exception of anti-money laundering issues and the integrity of the games offered, which remain under the responsibility of the Ministry of Home Affairs.

Methodology

The following elements have been compiled using data provided by licensed online gambling and betting operators on a weekly and quarterly basis. The ANJ communications take account of statistical confidentiality. It cannot publish information relating to the activity of monopoly markets (FDJ and PMU) other than that already disclosed by operators under exclusive rights.

-

Africa4 days ago

Africa4 days agoNew Governing Board of the Gaming Commission of Ghana Sworn in

-

Africa7 days ago

Africa7 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live â Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI

-

Gambling in the USA7 days ago

Gambling in the USA7 days agoGaming Americas Weekly Roundup â June 16-22

-

Africa6 days ago

Africa6 days agoSA Rugby Renews its Partnership with Betway

-

Asia6 days ago

Asia6 days agoPolemos Announces Partnership with Guinevere Capital

-

Asia6 days ago

Asia6 days agoWiseGaming strikes content partnership with Zenith Gaming