Central Europe

Polish sports betting market sums up 2020: STS named the market leader

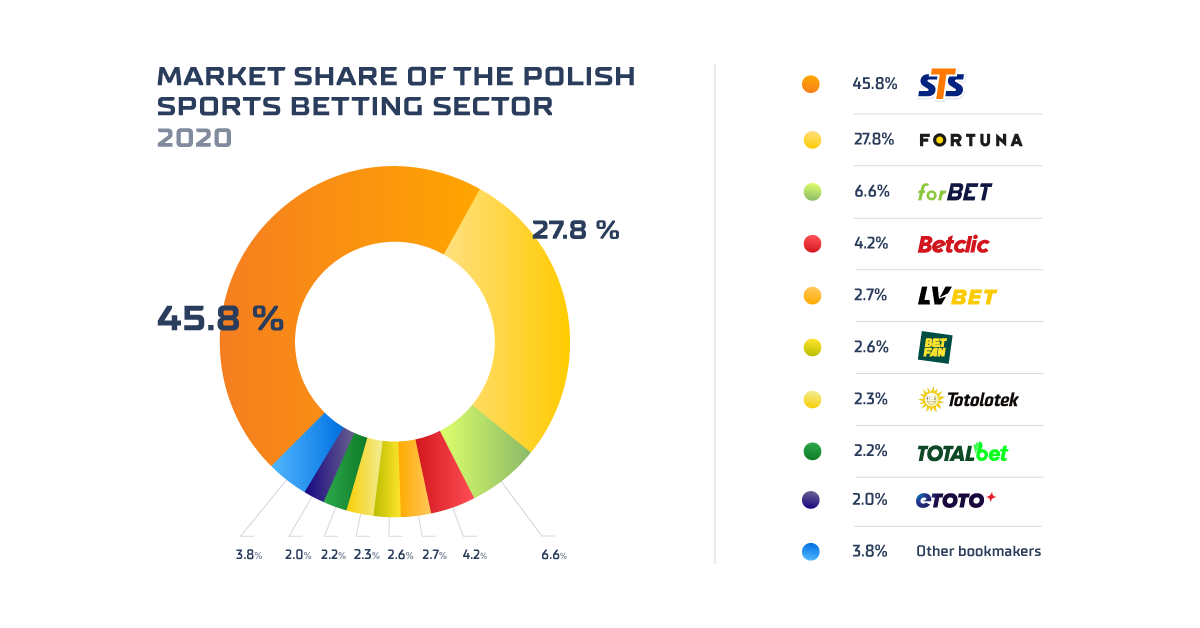

For another year in a row, STS was the largest bookmaking company with a year-over-year increase in shares. Fortuna, the runner-up, was in the decline. The third-best, forBet, is on the rise, as reported by “Stowarzyszenie Graj Legalnie” (Association for the Elimination of Black Economy Betting in Poland ‘Bet legally’). Revenues of licensed operators, as well as the amount of taxes contributed by the sector, would be higher if it were not for companies operating in the grey zone which are estimated by the “Graj Legalnie” association to account for several dozen per cent of the market.

STS is the largest sports betting company in Poland. The company managed by Mateusz Juroszek already controls 45.8 per cent of the licensed part of the sector, compared to its 45.1 per cent at the end of 2019. The sports betting company has also recorded an increase in revenues, from PLN 3.081 bn to PLN 3.319 bn.

According to the estimates of the “Graj Legalnie” association, the second-best, Fortuna, has recorded a decrease in revenues from over PLN 2.1 bn to ca. PLN 2 bn. The company has also lost its market share, from 30.9 per cent to 27.8 per cent. The third one on the podium is forBET (6.6 per cent of the market vs 6 per cent in 2019).

Other legal sports betting businesses in the ranking are Betclic (4.2 per cent of the market vs 1.7 per cent YoY), LV Bet (2.7 per cent vs 3.5 per cent YoY), Betfan (2.6 per cent vs 1.6 per cent YoY), Totolotek (2.3 per cent vs 4.5 per cent YoY), Totallbet (2.2. per cent vs 1.6 per cent YoY) and eToto (2 per cent vs 2.2 per cent YoY). Other players control the remaining 3.7 per cent of the market.

The full list:

|

Market share in 2020 |

Market share in 2019 |

|

|

STS |

45.8 % |

45,1% |

|

Fortuna |

27.8 % |

30.9 % |

|

forBet |

6.6 % |

6% |

|

Betclic* |

4.2 % |

1.7 % |

|

LV Bet |

2.7 % |

3.5 % |

|

Betfan* |

2.6 % |

1.6 % |

|

Totolotek |

2.3 % |

4.6 % |

|

Totalbet |

2.2 % |

1.6 % |

|

eToto |

2 % |

2.2 % |

|

Other |

3.7 % |

2.9 % |

*It should, however, be noted that Betfan and Betclic were not operating from the beginning of 2019, therefore their results are not fully reliable.

COMMENTARY: Katarzyna Mikołajczyk, President of the “Graj Legalnie” association

The year 2020 was very subversive for the sports betting industry. After a promising beginning, the second quarter brought the lockdown of global sport. The most flexible companies with a diversified portfolio and well-developed produce and technology were able to make up for the losses incurred during those months. The best example of this is the market leader – STS. The company, despite a decline in revenues in the second quarter, achieved at the end of 2020 a result better than in the previous 12 months.

The pandemic has also affected its local betting shops, most of which have been closed during the lockdown. After reopening, traffic at many of these locations did not return to pre-pandemic levels, and some customers moved to the online channel. Totolotek did not manage to cope in this difficult situation – it has recently announced the closing of all of its local betting shops. It was the leaders who made it.

Graj Legalnie

The mission of the Graj Legalnie association is to improve the situation of legal sports betting businesses in Poland. Its goal is to protect the sector from illegal and unfair competition. The organisation was founded in 2016 to support operators licensed by the Minister of Finance in their functioning in a complex legal and competitive environment. Challenges facing both the association and the Polish authorities include the grey economy accounting for several dozen per cent of the market and losses incurred by the state budget for unpaid taxes worth several billion zloty.

Moreover, the task of the association is to create a positive image of the sports betting industry, to shape and to disseminate the principles of ethics in business operations and share best practices, as well as information between its membrs. Since its foundation, the association has been focussed on providing reliable information and data concerning the Polish sports betting industry.

Central Europe

MightyTips announces collaboration agreement with Merkur Bets

MightyTips has announced a brand-new partnership with Merkur Bets targeting German-speaking bettors across Germany.

The move aims to expand the customer base for Merkur Bets, which is striving to build its position as a leading player in several Central European countries.

The exclusive partnership with the MightyTips platform – a tips and predictions hub – is hoped to boost acquisition rates in the region ahead of what is likely to be a busy conclusion to the summer.

The Olympics, the new Bundesliga and Premier League season, and other major sporting events are to take centre stage, with more people than ever engaging with sports betting.

After ten years of operating as XTiP, a recent rebranding means it is now known as Merkur Bets. The sports betting experience has been modernised, as the website now provides an updated design, faster loading times, and enhanced user-friendly navigation.

The change was announced by operators Merkur Group earlier in the year and included a fresh logo and redesigned aesthetics across both its online and physical outlets.

Stefan Bruns, CEO of Online Gambling and Sports Betting at Merkur Group, cited it as a new beginning for the company: “The renaming of XTiP to Merkur Bets is not only a new beginning, it also offers the opportunity to establish a completely renewed approach to sports betting within the Merkur Group.”

Since 2013, Merkur Group has been one of the leading operators in Germany. Its origins stretch back to 1957, when it was founded as a family-owned business by Paul Gauselmann.

Eugene Ravdin, MightyTips Communications and Marketing Manager said: “We are delighted to collaborate with Merkur Bets. They are one of the biggest betting companies in Europe and our services can further solidify their reputation as a leading player in this sector.”

Martin Collins, Head of Affiliates at Merkur Group added: “We are very pleased to continue our work with the MightyTips team. Both sides bring great knowledge to the table for our core markets, and we look forward to a long-term beneficial partnership.”

Central Europe

SYNOT Successfully Entered the Swiss Market with Casino Products

SYNOT, a leading provider of gaming systems and casino equipment, has entered the Swiss market with the installation of its products at Casino Admiral Mendrisio.

The first installation included a set of Eclipse FL-32 cabinets with the latest version of the Firebird Red gaming system. This version offers a range of original games including 6 Hold & Respin titles and over 40 classic games. Shortly after the successful first installation, the company also launched Firebird slots at the St. Gallen Casino.

“The Swiss market is one of the most lucrative casino markets in Europe and therefore we consider this launch a great success. The market is highly regulated and competitive. In addition, operating gaming equipment in this country requires GLI-11 certification, including the appropriate certification transfer for the Swiss market. Of course, our company meets all these requirements,” Miroslav Valenta Jr., Sales Director of the SYNOT Group, said.

SYNOT already operates online slots in the Swiss market in cooperation with several operators. Now these popular games will also be available in land-based casinos, specifically in the Firebird Red gaming system. With this step, SYNOT continues its omni-channel strategy, which includes both online and land-based sectors.

“We have high ambitions. Our goal is to gradually bring our products to all casinos in Switzerland. We are seeing an active interest in our products, which we are very pleased about. We also have strong support from our distributor. We are cooperating with our exclusive distributor for Germany and Switzerland – the company E-Systems,” added Miroslav Valenta Jr.

“After many positive feedbacks from German casinos throughout the past years, it soon became our combined goal to also enter the competitive Swiss market, which we have successfully achieved now! Many thanks go to our long-term partner Casinò Admiral Mendrisio, who acted quickly and therefore was able to celebrate the debut of SYNOT’s great cabinets & games in all of Switzerland. We’re looking forward to many more launches in other Swiss casinos in the near future and we’re confident that SYNOT will become an inherent part of the Swiss market product mix,” Thomas Steuer, Sales Director of E-Systems, said.

Central Europe

OKTO.CASH expands in Germany with bet-at-home go-live

OKTO announced the launch of its advanced cash-to-digital payment solution, OKTO.CASH with bet-at-home, a renowned and established operator in the German iGaming market. This collaboration marks a significant milestone for OKTO, expanding its footprint in Germany and further solidifying its reputation as an innovator in cash-to-digital solutions for iGaming enthusiasts.

OKTO.CASH offers bet-at-home users a hassle-free way to consume iGaming services with cash in real-time. Leveraging OKTO‘s always growing network of over 14,000 points of sale across Germany, including well-known brands such as Aral, Deutsche Post, Esso, Kiosk, Lotto, Shell, and many others, users can effortlessly convert physical cash into digital currency. This streamlined process provides a secure, fast, and easy-to-use top-up method that caters to the preferences of the market.

Richard Greslehner, Head of Product at bet-at-home Internet Ltd commented: “This partnership underscores our dedication to delivering cutting-edge and convenient payment solutions for our customers. With OKTO.CASH, users can now seamlessly deposit their physical cash into their online bet-at-home accounts at their favourite everyday stores.”

“We are thrilled to partner with bet-at-Home for the launch of OKTO.CASH in Germany,” said Mikhail Ovsepyan, Head of Germany at OKTO. “This collaboration underlines our dedication to expanding our presence in the German market and delivering cutting-edge payment solutions that meet the needs of iGaming enthusiasts. We look forward to revolutionizing the gaming payment experience and providing unparalleled convenience and security to users.”

OKTO‘s expansion in the German region follows the approval of both OKTO.WALLET and OKTO.CASH by the German Gaming License Authority (GGL) last year. Embedded into the merchant’s app or website, OKTO.CASH provides users with the fastest and most direct method to upload cash online, eliminating the need for third-party apps. Users can select OKTO.CASH as their payment method, choose the deposit amount, and select the nearest location from over 14,000 points to top up their accounts safely and in real-time.

-

Eastern Europe5 days ago

Eastern Europe5 days ago7777 gaming is now available on WINBET Romania

-

Gaming5 days ago

Gaming5 days agoMainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – July 15-21

-

Australia5 days ago

Australia5 days agoAustralian eSports Star Joins Team Liquid

-

eSports5 days ago

eSports5 days agoINSPIRED LAUNCHES RE-PLAY ESPORTS™ FEATURING CS:GO IN PARTNERSHIP WITH KAIZEN GAMING

-

Industry News5 days ago

Industry News5 days agoSafer Gambling Tools Use Hits Record High in 2023 – New Report from EGBA

-

eSports5 days ago

eSports5 days agoNODWIN(R) Gaming ropes in Android as title partner for BGMS Season 3; to be powered by Garnier Men

-

Latest News5 days ago

Latest News5 days agoSpinomenal shines again with Super Wild Fruits release