Asia

TikTok Partners with FIGHT Esports for the #TikTokGGPH Creator Cup Tournament

The Creator Cup is the first of a series of tournaments hosted by the new TikTok Gaming Ground PH

TikTok inks a year-long partnership with Forest Interactive Gaming Habitat Team (FIGHT Esports), a global esports organizer, to make online gaming more socially accessible than ever.

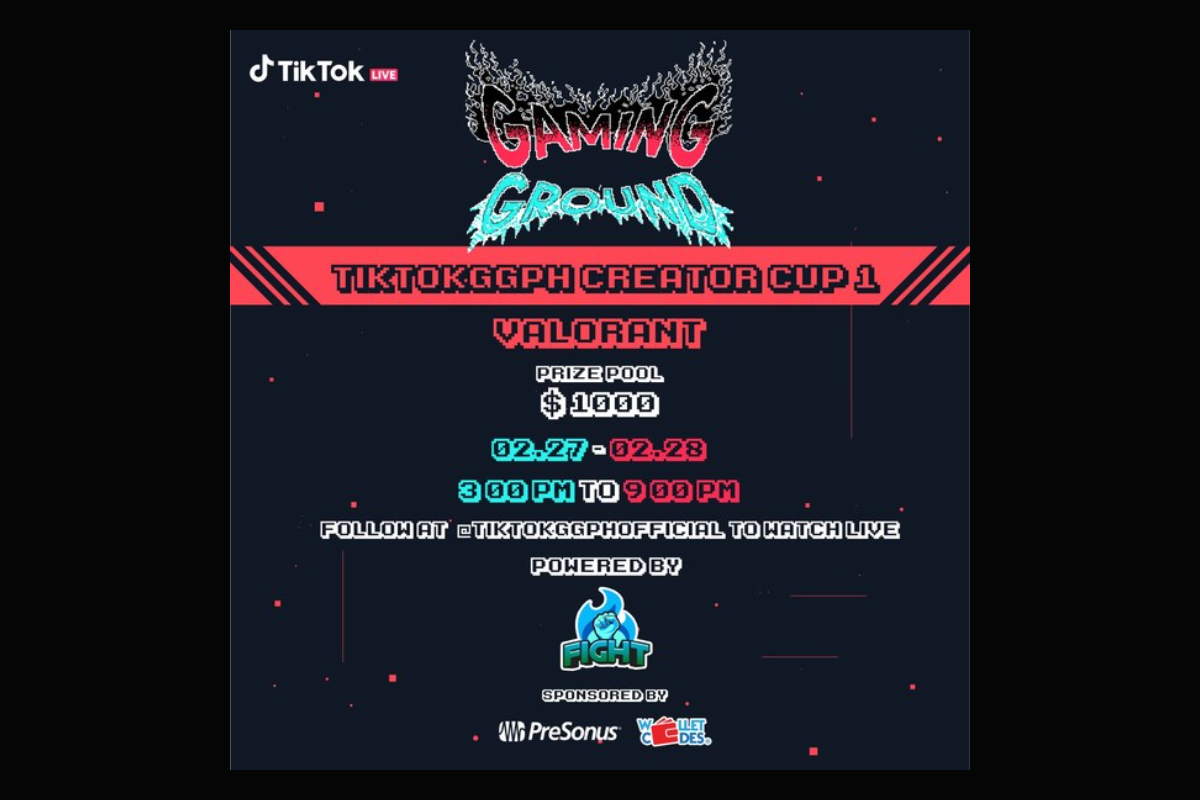

The partnership kicks off with the inaugural #TikTokGGPH Creator Cup Tournament jointly hosted by TikTok Philippines and FIGHT Esports. The Creator Cup, which will be set within Valorant, is taking place on February 27 and 28, from 3 pm to 9 pm (GMT+8), and the entire event will be live-streamed on TikTok Gaming Ground PH (TikTok GGPH) account via @tiktokggphofficial. To raise the stakes, TikTok Philippines is offering a $1,000 prize pool to be awarded to the champion, 1st runner up, and 2nd runner up of the tournament.

“TikTok¬†continues to pursue opportunities to inspire creativity and bring joy to all Filipinos. With gaming actively becoming a positive source for community building and enjoyment, we are happy to be doing our part in providing the growing gaming community with a platform for education, positive connections and interaction,” said John Castro,¬†TikTok’s¬†Gaming Operations Manager for the Philippines.

“TikTok¬†is fast becoming a place where people create, share, and enjoy a new type of experience. It really makes a lot of sense for us to leverage TikTok to reach the gaming community and give them the opportunity to connect and share their passion with fellow gamers around the world. This will create a unique and innovative esports experience where they can follow and engage with their favorite gaming content creators, tune in to esports tournament livestreams, as well as celebrate esports in ways that have never been done before,” noted¬†Chantal-Denise Ortega, FIGHT’s Project Manager.

Prior to the tournament, a video campaign was held within the¬†TikTok¬†app, as part of the official #TikTokGGPH launch. From¬†February 12 to 28, creators on the platform can upload a video that perfectly¬†captures their gaming style, and shows the community exactly what it’s like to be a gamer. To qualify, creators must use the hashtag #TikTokGGPH when they post their video entries. At the end of the campaign period, 20 creators will be selected to become part of¬†TikTok’s¬†community of gamers, based on the level of passion for gaming, and creative potential seen in their videos.

About TikTok

TikTok is the leading destination for short-form mobile video. Our mission is to inspire creativity and bring joy. TikTok has global offices including Los Angeles, Mountain View, New York, London, Paris, Berlin, Dubai, Mumbai, Singapore, Jakarta, Seoul, and Tokyo.

-

Africa6 days ago

Africa6 days agoNew Governing Board of the Gaming Commission of Ghana Sworn in

-

Asia6 days ago

Asia6 days agoMacau Government Extends Lottery Concession of Macau Slot Until 5 June 2026

-

Latest News6 days ago

Latest News6 days agoWeek 26/2025 slot games releases

-

Latest News7 days ago

Latest News7 days agoDATA.BET Launches Bet Builder for Sports Betting

-

Africa6 days ago

Africa6 days agoQTech Games hires Ekaterina Mayorova as sales lead for Africa & Eastern Europe

-

Interviews7 days ago

Interviews7 days agoPortrait of a Fraudster Then and Now: How Scammers’ Habits and Tactics Are Changing

-

Industry News6 days ago

Industry News6 days agoCHIPS confirmed as Clarion Gaming charity partner ahead of appearance at iGB Affiliate Awards

-

Central Europe6 days ago

Central Europe6 days agoGerman Federal Government Significantly Increases the Budget for Games Funding