Cryptocurrency

Cryptocurrencies in Casinos – the Promises & Pitfalls

Cryptocurrencies are having a moment. Bitcoin, the first and most well-known cryptocurrency, has seen its value skyrocket in recent months, with one bitcoin worth more than $18,000 at the time of this writing. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. This makes them a potentially appealing option for online casinos, which could use them to make deposits and withdrawals faster and more secure. But there are some potential pitfalls to consider before jumping into cryptocurrencies for online casino gaming. Let’s take a closer look at both the promise and the risks of using cryptocurrencies in casinos.

How Does a Bitcoin Casino Work?

When it comes to online gambling, there are a lot of options to choose from. One type of online casino that has been gaining popularity in recent years is the Bitcoin casino. So, how does a Bitcoin casino work?

Essentially, a Bitcoin casino is just like any other online casino, except that it allows players to gamble using the cryptocurrency Bitcoin. This can be beneficial for both the casino and the player, as it offers a more secure and anonymous way to gamble. Lots of recent brands which were launched in 2022, offer crypto payments to players in India and beyond. For the player, this means that their personal information is not at risk of being compromised.

For the casino, it means they can accept payments from players worldwide without having to deal with banks or other financial institutions. In order to get started with a Bitcoin casino, all you need is a Bitcoin wallet. Once you have set up your wallet, you will be able to deposit Bitcoins into your account and start playing your favorite casino games.

What are the Pros of Crypto in a Casino?

The advantages of cryptocurrencies in casinos are many and varied. Below are the top benefits of the use of cryptocurrencies in online casinos:

- Anonymity and Security: When most people think of casinos, they envision a seedy underworld where cheaters prosper, and their personal information is at risk. However, Bitcoin casinos are changing this perception by offering a secure and anonymous way to gamble online. Unlike traditional casinos, which require their users to fill out extensive personal information forms, Bitcoin casinos allow users to gamble anonymously. This not only protects their personal information from being hacked or stolen but also allows them to avoid any government scrutiny. As a result, Bitcoin casinos are becoming the preferred choice for many online gamblers. In addition to offering enhanced security and anonymity, Bitcoin casinos also allow users to take advantage of lower transaction fees and faster payouts. With all these benefits, it’s no wonder that Bitcoin casinos are quickly gaining popularity worldwide.

- Cheap & fast payment: Cryptocurrency transactions are carried out directly between the user and the operator without the interference of any third party. This makes for seamless and speedy transactions. The lack of a central authority also means that there are no delays or “red tape”, as is often the case with traditional financial institutions. In addition, cryptocurrency payments can be made cheaply and quickly without the need for expensive infrastructure or middlemen. As a result, cryptocurrencies are an attractive option for those looking for fast and efficient payments.

- Bonuses: Bitcoin casinos offer various bonuses and rewards for their customers. One of the most popular bonuses is the no deposit bonus, which is offered to new customers. This bonus allows you to play without having to make a deposit, and it can be a great way to try out a new casino. However, it’s important to read the terms and conditions of the bonus before you claim it, as some bonuses have wagering requirements or other restrictions. There are also often reload bonuses available, which give you a bonus when you make a second or third deposit. These bonuses can be a great way to boost your bankroll and increase your chances of winning. Bonuses are one of the many reasons why Bitcoin casinos are becoming increasingly popular.

- Decentralised: The decentralised nature of Bitcoin is one of its key advantages. Unlike traditional currencies, which central banks regulate, Bitcoin is not subject to any central authority. This means that no government or financial institution can interfere with Bitcoin transactions or freeze a person’s account. Instead, Bitcoin transactions are verified by a global network of computers known as miners. These miners work together to confirm each transaction and are rewarded for their efforts with new bitcoins. As a result, Bitcoin’s decentralised nature ensures that no single entity can control the currency or manipulate the transaction process. This makes Bitcoin a more secure and trustworthy currency system.

What are the Cons of Crypto in a Casino?

Cryptocurrencies in casinos are not without their risks and drawbacks. One of the most significant dangers is the possibility of theft or fraud. Because digital currencies are stored in digital wallets, they are susceptible to hacking. If a hacker can gain access to a user’s wallet, they could theoretically steal all of the currency stored inside.

Another risk associated with cryptocurrencies is volatility. The value of Bitcoin and other digital currencies can fluctuate wildly, creating problems for casinos that accept them. If the value of a currency plummets suddenly, a casino could end up taking a big loss.

Finally, there is the regulatory risk. Cryptocurrencies are still not well understood by most governments and regulators. This could create problems down the line if authorities decide to crack down on casinos that accept them.

Cryptocurrency

Bitblox announce more fast-paced crypto fun in Up or Down? Turbo

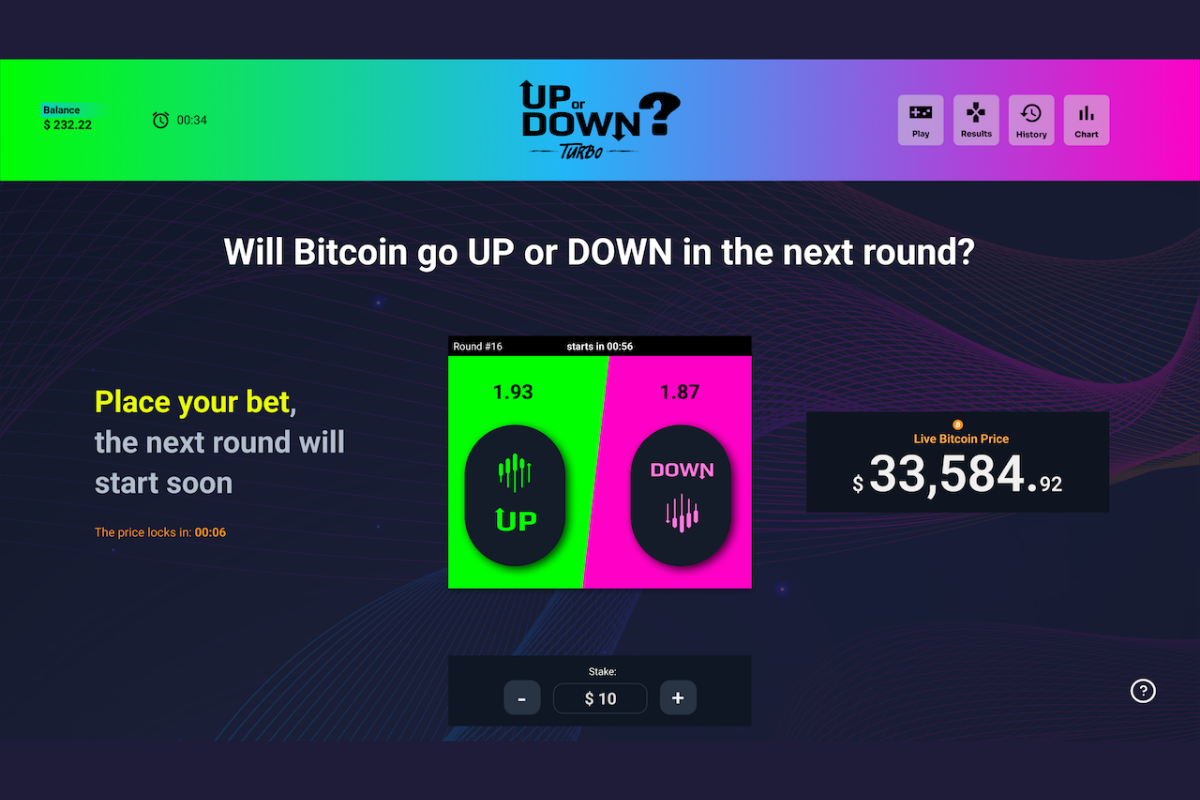

Fasten your seatbelts and get ready to put your crypto price prediction prowess to the test once more, because this month revolutionary software provider, Bitblox, is back in action with an even faster version of its Up or Down format in the new Up or Down? Turbo.

Played out over quick-fire 20 second rounds, Up or Down? Turbo is a simple yet exhilarating thrill-ride that challenges players to correctly guess whether the value of Bitcoin will rise or fall in real-time, meaning it’s the perfect way to enjoy fast-paced crypto fun where every second truly counts.

Featuring a straightforward premise and an intuitive user interface where players can place their bets and track their performance after each round, Up or Down? Turbo provides an engaging experience that will appeal to crypto aficionados and those new to the market in equal measure.

Optimised for mobile and desktop, the game is currently available in fixed odds and parimutuel betting formats with a rake/margin and maximum bet that can be fully customised by operators, making it a versatile title that offers players scope to realistically win up to 10x their bet per round.

Up or Down? Turbo and all games from the Bitblox studio have been approved for release by the Gambling Supervision Commission for IOM-licensed operators, allowing them to add an exciting new vertical to their existing casino line-ups.

Of course, with the original Up or Down game also available and more innovative new releases planned for 2024, this is just the tip of the iceberg in terms of what operators can expect going forward as Bitblox begin to usher in a new era of accessible crypto-based betting for the masses.

Brandt Page, CEO at Bitblox, said: “Just when you thought the rush of predicting the Bitcoin market in real-time couldn’t get any more exciting, we’ve kicked the action up a notch to provide players even more opportunities to turn a quick profit in Up or Down Turbo.

“With a new round starting every 20 seconds, Up or Down Turbo takes our classic ‘higher or lower’ format and puts it into overdrive, supplying a fun and fast-paced betting experience that can be customised by the operator to deliver optimised RTP and engagement for their business.”

Cryptocurrency

Betting on Crypto: How Crypto Casinos are Driving Mainstream Adoption

Author: Scott Major, CCO, Transact365

In the digital age, two revolutionary trends are converging to reshape the landscape of financial entertainment: cryptocurrencies and online gambling. At the forefront of this intersection are crypto casinos, innovative platforms that are not only leveraging blockchain technology but also driving the widespread adoption of digital currencies.

By integrating digital assets into an engaging and familiar activity like gambling, crypto casinos are introducing a wider audience to the practical uses of blockchain technology. Conversely, the growing popularity of cryptocurrencies is attracting more users to online gambling platforms, expanding the reach of such platforms to tech-savvy individuals who prioritise privacy and decentralisation.

Crypto Casinos: Pioneering Adoption

Crypto casinos represent a new frontier in the gambling industry, leveraging blockchain technology to offer players a secure, transparent, and decentralised gaming experience. By accepting cryptocurrencies like Bitcoin, Ethereum, and others, these platforms provide users with unparalleled privacy, faster transactions, and lower fees compared to traditional fiat currency casinos. This alignment with the ethos of decentralisation and financial sovereignty inherent in cryptocurrencies has attracted a growing number of tech-savvy users and early adopters to the world of online gambling.

Moreover, crypto casinos are not just leveraging cryptocurrencies; they are actively promoting their adoption. In fact, crypto casinos are expected to become more mainstream by the end of 2024. Players who may have been previously unfamiliar with digital assets are now acquiring and using them for entertainment purposes, thereby integrating cryptocurrencies into their everyday lives. This increased exposure to cryptocurrencies through gambling fosters a deeper understanding and acceptance for their utility and benefits beyond the gaming sphere. Therefore, as cryptocurrencies gain wider acceptance, more traditional gamblers are likely to explore crypto gambling options. This trend could expand the market share of crypto casinos within the overall online gambling industry.

The Ripple Effect: Cryptocurrencies and Online Gambling

Cryptocurrencies are also revolutionising the online gambling industry by addressing long-standing challenges related to payment processing. One of the critical barriers for traditional online casinos has been the inefficiency for certain underbanked sectors and at times costliness of payment solutions – exacerbated by stringent regulations and geographical limitations. Cryptocurrencies circumvent these hurdles by offering a decentralised payment method that operates across borders with minimal fees and swift transaction times.

An efficient payment solution is paramount to maximising the synergy between cryptocurrencies and online gambling. Crypto casinos have capitalised on blockchain technology’s ability to facilitate instant and secure transactions, ensuring seamless deposits and withdrawals for players worldwide. This efficiency not only enhances the user experience but also expands market reach by attracting players from regions where traditional banking systems may be unreliable or inaccessible.

Harnessing Efficiency for Growth

By streamlining financial transactions through blockchain technology, crypto casinos are able to offer competitive advantages that resonate with today’s digital-first consumers. This includes faster payouts, reduced transaction fees, and heightened security measures that inspire trust and confidence among players.

The rise of crypto casinos is not merely a trend but a transformative force that is propelling the adoption of cryptocurrencies and reshaping the online gambling industry. By embracing blockchain technology and user-friendly crypto and local payment solutions, these platforms are fostering a symbiotic relationship that not only benefits both industries but most importantly the customers alike.

Bitcoin

Navigating Bitcoin’s Impact: SOFTSWISS’ iGaming Industry Overview

In March 2024, Bitcoin soared to a historical high, nearing 70,000 euro per coin. How does this impact the iGaming market? Being a tech company with over 15 years of experience and an innovator in crypto iGaming software development, SOFTSWISS shares anticipations in its quarterly crypto analysis.

Over 220 brands powered by the company engaged in crypto transactions during the first quarter of 2024, which is 12% higher than the previous quarter. SOFTSWISS experts analyse the data gathered from crypto-friendly brands by employing extrapolation, comparative, and correlative analysis.

iGaming Market Overview: Unveiling Anticipated Growth

The size of the global online gambling and sports betting industry is expected to rise significantly and exceed 170 billion euro by 2032, according to Statista. Based on SOFTSWISS data, the iGaming market has demonstrated a stable pattern of growth year after year.

In absolute terms in euro, the Total Bet Sum grew by 5.8% in the first quarter of the year compared to the last quarter of 2023. Analysing the year-on-year increase, comparing Q1’24 with Q1’23, the growth is more impressive, showcasing a 47.2% boost.

Simultaneously, the Total Bet Count, both fiat and crypto, displayed a slightly larger gain in the first quarter of 2024 compared to the previous quarter, surpassing 6.1%. The indicator’s year-on-year boost is much more notable, revealing a 57.2% increase.

The popularity of iGaming in recent years has been fuelled by its global reach and accessibility due to constant technological advancements. On one hand, the quality of internet connectivity continues to rise, while on the other, new payment methods are emerging, simplifying payment procedures.

The in-depth quarterly analysis, ongoing since the beginning of 2022, reveals that fiat bets are undergoing more substantial growth compared to crypto bets. In Q1’24, the Fiat Bet Sum increased by 6.9% compared to Q4’23, while the rise of Crypto Bet Sum was at 2.4%.

The more active growth of fiat bets led to a slight decrease in the share of crypto. In the first quarter of 2024, the crypto share in the Total Bets Sum settled at 24.4%, decreasing by 0.8 percentage points (p.p) compared to the last quarter of 2023.

What is the State of Crypto in iGaming?

Analysing crypto bets, it is crucial to highlight that almost 93% of them are facilitated through the in-game currency conversion tool, which is gaining traction. This mechanism allows operators to engage players with cryptocurrency assets in games initially tailored for fiat only. Operators that adopt such options are gaining more competitive advantages in the market.

While the Q1’2024 Crypto Bet Sum shows a moderate 2.4% growth compared to the previous quarter, the year-on-year analysis demonstrates a 20.8% increase. The Crypto Bet Count remained unchanged in Q1’24 compared to the previous quarter’s indicator. Simultaneously, the metric increased by 21.3% year-on-year. The figures speak volumes, showcasing a consistent interest among players in crypto gaming.

“The lack of a substantial increase in the number of crypto bets during Q1’24 can be partly attributed to the significant rise of the Bitcoin exchange rate during this period, leading players to be more cautious with their crypto bets. This trend mirrors the situation in the first quarter of the previous year when the Bitcoin exchange rate surged following a decline at the end of 2022,” comments Vitali Matsukevich, Chief Operating Officer at SOFTSWISS.

What Distinguishes the Average Crypto Bet?

The average crypto bet increased to 1.71 euro in the first quarter of the year from 1.66 euro in the last quarter of 2023. This growth correlates with a significant strengthening of the Bitcoin rate during the first quarter of 2024.

The average fiat bet remained steady at around 0.81 euro in Q1’24 and Q4’23. The average total bet stayed constant since the second half of the previous year and is equal to 0.93 euro.

Notably, the average crypto bet is double that of fiat. This indicates that digital currencies are preferred by higher-income players.

Why Did Bitcoin’s Share Drop?

The Top Five most operated digital coins in iGaming have remained stable during the last two years with minor changes in ranking order. The top still includes Bitcoin, Ethereum, Litecoin, Dogecoin, and Tether.

In Q1 2024, Bitcoin experienced a significant decline of 9.4 p.p. compared to Q4 2023. This could be attributed to the bolstering Bitcoin exchange rate and players exercising a more cautious approach towards it.

In contrast, the shares of other digital coins have increased. Ethereum and Litecoin showed growth of 4.0 p.p. and 3.8 p.p., respectively, during the same period. Simultaneously, Dogecoin rose to fourth place in the ranking, leaving Tether behind.

Vitali Matsukevich, Chief Operating Officer at SOFTSWISS, summarises: “The benefits of employing digital currencies, such as fast transactions and anonymity, still attract many players. Embracing cryptocurrencies in iGaming can boost operator profits despite their volatile nature.

As the Bitcoin rate is expected to strengthen after the Bitcoin Halving, the average crypto bet and projected gains may see a notable impact. During such promising times, it is crucial to have reliable and experienced partners to navigate the path to success.”

About SOFTSWISS

SOFTSWISS is an international tech company supplying software solutions for managing iGaming projects. The expert team, which counts over 2,000 employees, is based in Malta, Poland, and Georgia. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform, and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.

-

Eastern Europe5 days ago

Eastern Europe5 days ago7777 gaming is now available on WINBET Romania

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – July 15-21

-

Gaming5 days ago

Gaming5 days agoMainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

-

Industry News5 days ago

Industry News5 days agoSafer Gambling Tools Use Hits Record High in 2023 – New Report from EGBA

-

Australia5 days ago

Australia5 days agoAustralian eSports Star Joins Team Liquid

-

eSports5 days ago

eSports5 days agoINSPIRED LAUNCHES RE-PLAY ESPORTS™ FEATURING CS:GO IN PARTNERSHIP WITH KAIZEN GAMING

-

eSports5 days ago

eSports5 days agoNODWIN(R) Gaming ropes in Android as title partner for BGMS Season 3; to be powered by Garnier Men

-

Latest News5 days ago

Latest News5 days agoSpinomenal shines again with Super Wild Fruits release