Interviews

Platform power

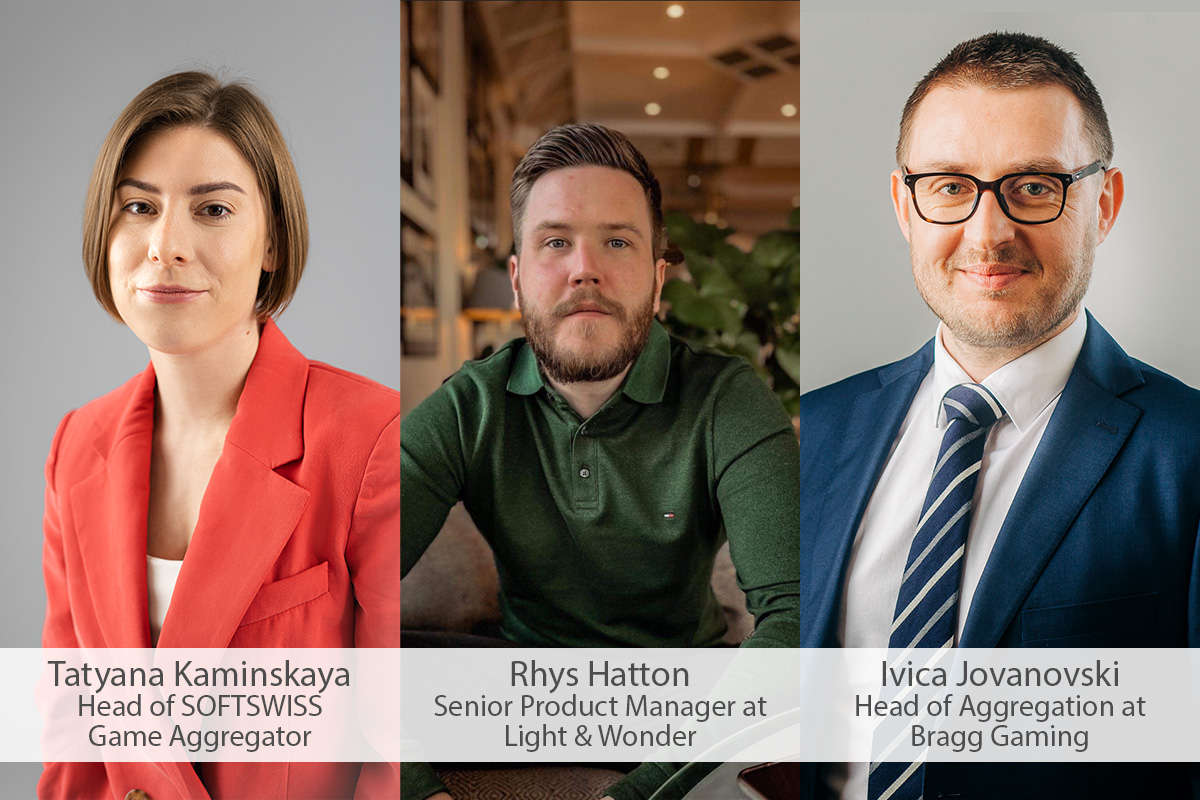

In this round-table feature, we look at the ways in which aggregation platforms are advancing and embracing new technology to overcome pain points for studios entering unfamiliar markets, enabling them to focus on creating quality content for players. Insight is provided by Rhys Hatton, Senior Product Manager at Light & Wonder; Ivica Jovanovski, Head of Aggregation at Bragg Gaming; and Tatyana Kaminskaya, Head of SOFTSWISS Game Aggregator.

How would you define the relationship between a modern aggregation platform, an ambitious games studio, an operator and its players?

Rhys Hatton: When aggregation platforms do their job well, it’s a really powerful relationship. Ultimately, our role as a provider is to remove complexity and provide distribution at scale, into regulated markets all over the world. We do this through the delivery of premium in-house and third-party content, through our OpenGaming platform which is truly scalable and which also contains all of the promotional tools and gamification features operators need to attract and retain players.

The penny has also dropped for some operators when new regulations have been imposed in certain markets including the UK, Germany and Sweden. Our technology platform is able to pivot quickly to react to these changes at a network level, keeping operators legal and compliant without the need to drop content, or having to suddenly handle huge projects and take on fire drills.

Ivica Jovanovski: It is an advanced 360-degree ecosystem that is interconnected and highly interdependent. Each segment plays an essential role, with the biggest emphasis on the player who is the initiator and main driver for competing game studios. An aggregator acts as the link, determining how innovative products will perform among a target audience, while the operator gets the opportunity to test and trial the offering and to enhance their portfolio.

Tatyana Kaminskaya: All actors in this line depend on each other. I guess it is a lot easier when it comes to players, as their major goal is entertainment. Most vulnerable are game studios, as they need to attract literally everyone – players, operators, and game aggregation platforms. And the spheres of interest they target may be totally contradictory, so it is important to find balance.

Generally, there’s no way to leave any of these actors out – they function as an organic whole. Of course, we could imagine studios, operators, and players coping without game platforms’ involvement and without content hubs, but this trend never stays long in the market. Working with aggregators is much more beneficial both for studios and operators in terms of saving resources. Despite spotted direct contracts between studios and casinos, aggregators cannot be ousted because of their ability to handle legal, technical and account management issues. It is the economic viability that tips the scales. Aggregators deal with high volumes, build price offerings, and are a kind of security guarantor for providers.

In which markets are aggregation platforms particularly advantageous as a route to market for studios?

Ivica Jovanovski: In markets with stricter regulations, and ones with few operators where barriers to entry are high and the immediate return for direct integration is expected. Europe and North America are regions where aggregation has really been advantageous to date. However, with upcoming regulations and consolidations in South America, I expect this will change the competitive landscape on the continent and aggregators will play a bigger role.

Tatyana Kaminskaya: Advantages do not depend on markets but on the scale and maturity of a game studio or aggregation platform. The concept is roughly the same for both. At the start, when a studio is new to the industry, it should try getting maximum output at minimum input. The priority should be given to loosely regulated markets which would not involve large expenditures. The first steps in such markets do not require excessive effort to obtain licences or certificates, but help understand the process and build up capital. It gets you prepared for landing in more serious and regulated destinations, such as the UK, already fully mature and weathered to withstand challenges and bear financial costs. It is a certain degree of product maturity when you can afford to invest six to twelve months of your effort and reap the benefit, bringing much more value, later.

I believe studios should focus on choosing a game aggregator rather than a market and seek the best offering matching their current development stage. And while choosing, they start analysing access to operators, services, and technical functionality. The SOFTSWISS Game Aggregator works with over 180 game studios, which is a testament to trust in our functionality and features.

Rhys Hatton: Overall, it is more about the universality of platforms, rather than simply catering to any one market. The breadth of access is important, but at the same time we really earn our lunch when markets are regulating and have evolving requirements. North America stands out in this regard with its fragmented, complex regulatory environment, which varies a great amount from state to state. From a supplier standpoint, this necessitates undertaking major costs in gaining individual licences, given the weight of resources that need to be assigned to this lengthy process. However, a platform provider can remove these pain points at a stroke through the development of strong working relationships with regulators – even before a market has gone live for the first time.

Across the board, the support of a modern aggregation platform nurtures and drives innovation for studios worldwide. We aim to provide operators with stand-out content that occupies every gaming niche, including local, market-specific games. It is vital that the scope of content we can offer is both as broad and as market-specific as possible, taking in every potential player preference. One interesting example here is Light & Wonder LIVE DEALER by Authentic Gaming, which we have taken live in Colombia with other regulated markets set to follow. There is a real appetite for live casino entertainment across the Americas and through the power of our platform, we are perfectly positioned to satisfy the demand by rolling this content out at speed.

What is changing in terms of technology at a platform level, and to what benefit?

Tatyana Kaminskaya: There is no common pattern that would apply to all aggregation platforms. I can say that not only the SOFTSWISS Game Aggregator but also some of our competitors see the need for technology upgrades and closer communication with players. Traditionally, a content hub has been an invisible mediator allowing players to run a game. At the same time, players are unaware that this mediator exists. That is why game aggregators try to input their value and approach players – for example, to create engaging tools to bring additional value both for game providers and operators or add functionality unavailable in games.

But this is only possible if a platform has grown its basic functionality to the golden standard – an extensive game portfolio, data processing, help desk, multifunctional back office, and high-level service. And after that it is time to add icing to its cake – additional player engagement and retention tools.

Rhys Hatton: It has also been interesting to see some of our competitors now adopting solutions that we have had in our locker for a while – such as our client middleware solution. It’s inspiring to see others incorporate and build upon our ideas, as it shows the impact and relevance, they have in the industry. Going forward, we believe the future is also about continuing to build out our network services. For many years, we have offered network-wide Free Rounds, which removes the complexity of many different back offices and systems for operators, and we are busy expanding this to incorporate new features. There are smaller aggregators and single studios that have developed great products in this space and there is no question we have areas we are targeting to catch up. At the same time, achieving what we already do at global scale across the whole network is already huge for us and not something you can get easily elsewhere.

In terms of content, our acquisition of Playzido has significantly increased the scope of our capabilities. Its proprietary Remote Gaming Server (RGS) platform is one of the best in the iGaming industry for rapid custom game development and already, it is helping to accelerate the pace at which we can help both game studios and operators across the world to co-create new and exclusive content for players. With competition higher than ever for player attention, this approach drives differentiation and innovation for the benefit of all stakeholders.

Ivica Jovanovski: There are two streams, in which change is guided. First are the technological improvements, from blockchain, VR, and AI which can help build up the gamification experience. The second thing is the easier compliant adaptation to new regulated markets, enabling faster delivery, which is crucial when first-mover advantage is so important.

How important is it for these platforms to be robust at scale, to provide players with a seamless entertainment experience?

Ivica Jovanovski: Due to the large data and traffic volume processing, stability and security are exceptionally important. This serves as one of the biggest competitive advantages for operators. As technology continues to advance, the platforms will only become better, and more elements and functions will be added that will further improve the experience for players.

Rhys Hatton: We often talk about online gaming as being part of the wider entertainment ecosystem and rightly so. However, that idea goes hand in hand with the expectation of a perfect playing experience and this means platform resilience at a global level. Wherever they happen to be in the world, players demand a gaming session free of all technical bugs. If a game breaks down upon trying to open it, there’s a risk that a player will never play it again – or worse, leave the operator altogether. In emerging markets in particular, the implications on revenue of losing a casino player due to a substandard gaming experience is of major significance. That is why for major platform providers, such as Light & Wonder, reliability at scale is not only desirable, but utterly essential.

Scalability at a platform level is also about customer protection. Technical attacks across global markets will continue to become more advanced, ranging from data breaches to ransomware. Operators need to know that their chosen platform is resilient and reactive to such adversity, so that its operations continue to be efficient while running at scale.

Tatyana Kaminskaya: Since game aggregators are invisible actors in the gameplay process, the bare minimum of seamless operation is when a player starts a game without noticing its technical side. Players value good gameplay which is free of technical issues. Therefore, flawless operation is a must for game aggregators, same as the ability to process big data flows, so that no technical anomalies would interfere with exceptional player experience. And only when you have reached perfection at this stage you should approach players – with no pressure but giving space to accept or decline your offer. That’s exactly what we do with the SOFTSWISS Game Aggregator’s Tournament Tool – we analyse, and adjust to, player preferences, showcase the benefits we offer, and give a choice.

The same story is with bonus games, savings, challenges and others. They all can become valuable assets and find their niche, but are absolutely worthless without the basic functions working properly. But the more competitors offer, the faster these additional features will outgrow from pleasant additions into a must.

How do you see the future landscape developing for aggregation platforms?

Tatyana Kaminskaya: Answering this question, I will repeat my previous words: aggregators will interact more with players. Historically, only operators used to have direct access to players – they kept in touch, built communities, etc. Once a game is downloaded, the game provider also gets access to players, but it is not communication that matters at this stage, but a quality gaming experience. At this point, aggregation platforms could enter the communication process and work on retaining and engaging players through additional features and tools. It doesn’t mean that players will remember our brand – we would rather not brand ourselves in this context. But we will show operators that an aggregator can help boost player retention, increase the number of players, their LTV and potential deposits without any additional effort from a casino. Operators will want to work with us and recommend us in that case. And if we develop sought-after and popular functionality, casino players will ask for specific features available only through aggregation platforms. This will facilitate the growth of game aggregators and strengthen their impact on player experience, boosting further developments and updates to their functionality.

Ivica Jovanovski: If the pace of innovation is sustained, adeptness of modern technology is accelerated, and adaptation to new regulations is expedited, operators will value a reliable partner across multiple markets, and this bond will get even stronger. Since many parameters inevitably have to be adapted, platforms will geographically divide and develop in different directions. One thing is certain – the future is strong for aggregation platforms as they solve a number of headaches for operators and help them boost their offering and accelerate their reach in key markets.

Rhys Hatton: We believe that particularly when it comes to emerging markets, the future for aggregation platforms such as OpenGaming continues to be very bright. In addition to delivering content to operators quickly and at scale across multiple jurisdictions, with a tech stack and tools that are designed to aid this process, there is also the issue of agility at play. Again, it is about suppliers being able to utilise the resources that an aggregation platform has available: the ability to conduct adaptive planning and to continually assess and evolve whole responding to changing requirements. Regulatory change, which can often be imposed without consultation, is a fact of life in our industry. It is about how a platform provider can adapt and meet shifting requirements and expectations for the benefit of everyone, while also providing added value beyond scale and distribution.

Interviews

Changing the game for content aggregation

We sit down with Dee Maher, CEO of La Royale Gaming Investments, to learn more about her recent appointment as CEO and how the company is set to challenge the gaming industry’s conventions.

La Royale Gaming Investments has bold plans to become a true power player and redefine industry standards. Through acquisitions and mergers, it intends to build an “ecosystem” of online and offline companies, covering both B2B and B2C. Its first play is Quanta, a unique content aggregation platform designed to leverage a high volume with a focus on delivering unparalleled value at a fair price, aiming to introduce innovative solutions for both operators and suppliers. To learn more about La Royale and its goals for the coming 12 months, we spoke with recently appointed CEO, Dee Maher.

Tell us more about your journey to being appointed as CEO of La Royale Gaming Investments.

I’ve been working in the global online gambling industry for many years now in roles covering legal and compliance leadership. Over the past 15 years, I have had the privilege to work for some of the biggest organisations in the business including the likes of Genesis Global, Betclic, Vera&John and Evolution Gaming. When I was approached about joining La Royale Gaming Investments as CEO, it was an offer that I couldn’t turn down. Recognising the company’s ambition to forge a transformative path in the gaming sector, I was compelled by the vision to lead change and drive innovation. My decision to accept was driven by a profound commitment to spearhead our mission, leveraging the remarkable talents of our team to redefine industry standards and make a lasting impact.

What are your main responsibilities and where are you looking to progress most?

I have been tasked with supervising the expansion of our investment portfolio by recognising opportunities that are aligned with our online and offline strategies. I am also overseeing the day-to-day running of Quanta, our inaugural venture, which stands out in the crowded marketplace as a game aggregation platform like no other. In terms of where we are looking to make the most progress, we plan to curate a unique ecosystem of innovative offline and online gaming companies through strategic mergers and acquisitions which combined will make La Royale Gaming Investments a real tour-de-force in the sector and one of the top tier companies with interests across both B2B and B2C.

How is La Royale Gaming Investments going to disrupt the industry? Is it taking a different approach?

La Royale Gaming Investments is poised to redefine the gaming industry with a strategy rooted in bold vision and innovation. We have built out the best team to deploy these ambitious plans and achieve our strategic goals. We are well-capitalised and have lined up our first run of acquisitions, starting with Quanta. Our approach focuses on identifying USPs within each business we engage, introducing ground-breaking offerings to the market. With Quanta, that is being the first mass-market game aggregation platform, creating value for both operators and suppliers. This is an industry where many follow the same blueprint, but we know that to pull distance from our competitors, we need to do things a little differently.

I think our biggest point of difference is that we are curating an ecosystem of innovative businesses across all areas of gambling and gaming. This includes both online and offline, and both B2B and B2C. There are not many organisations in the industry that are this broad and diverse so again this is an area where we can really stand out.

You mentioned that Quanta is the first mass-market game aggregation platform. What does it offer operators and suppliers and how is it different to other solutions in the market?

Quanta has been developed so that it can handle the largest possible volume of games from a diverse array of providers and seamlessly integrate with a vast network of operators. Due to this volume, we can offer the best commercial deals to both parties. Our scale, in collaboration with leading studios and casinos, positions us as a frontrunner in content distribution. Furthermore, we are committed to achieving certifications across all significant regulated markets. For operators, this means they can quickly and easily add games to their lobbies and for studios, it means access to the widest distribution network and thanks to our minimum reseller fee structure, we make this access available to all providers from the established titans to the rising stars.

But just to be clear, Quanta transcends the ordinary, offering not just a cost-effective solution but a sophisticated high-performance platform. The platform is state of the art, allowing for seamless integrations for both operators and suppliers while ensuring the highest standards of resilience and performance. The concept is simple – high volume, low cost – but the advanced technology and strategic foresight required to realise this vision set us apart from conventional solutions in the market.

Content provision is highly competitive so what makes you confident that Quanta will be heard above the noise being made by other providers and aggregators?

Our mass market approach is unique and is already helping us to stand out and generate significant interest from both studios and operators. In the current challenging economic landscape, efficiency and cost-effectiveness are paramount for all stakeholders. But our advantageous commission structure is not the only way we are helping here. At present, operators often have many integrations with various aggregators and directly with game providers. This is inefficient and expensive. With Quanta, operators can plug into a single platform and access all the content they need for each market they target allowing them to save significant resources or to deploy these resources elsewhere.

On the subject of the current economic climate. Is now a good time to be building a business based around M&A?

That depends on how you are approaching your M&A activity and whether an organisation is taking on debt. Timing can be crucial here – you just have to look at the likes of 888 to see how a change in the direction of the wind can have a brutal impact on the wider organisation. That said, there are always plenty of opportunities to acquire great businesses, technologies, solutions and so on, and part of my remit as CEO is to spot these and if they align with our wider approach, make a move. I think the 12 months ahead will be incredibly exciting when it comes to M&A, with some truly transformational deals taking place – something that La Royale Gaming Investments intends to be a part of.

Interviews

The Full Spectrum Strategy: How Betting on Both Popular and Lesser-Known Sports Pays Off

In an insightful interview with Alexander Kamenetskyi, Head of SOFTSWISS Sportsbook, we delve into the complex balance between promoting mainstream sports events and exploring niche markets in the betting world. This strategy enhances profitability and ensures a steady engagement across diverse betting markets, crucial for maintaining a dynamic and resilient business model in the competitive world of sports betting.

How should operators balance promoting popular sports events versus niche ones?

The effective strategy in betting is to diversify wagers across a broad range of sports events and markets. This approach helps minimise fluctuations in outcomes, enhancing both the profitability and predictability of your betting business.

Based on this, we recommend that operators promote all sports comprehensively to maintain steady activity and turnover. This ensures that players remain engaged with alternative options, even during periods lacking major events.

It’s crucial not only to focus on popular events like top football matches or major NBA tournaments but also to spotlight less mainstream sports such as water polo, badminton, and Formula 1. For instance, Australian football is notably underappreciated despite offering unique scheduling advantages that can be leveraged during off-peak times to attract bets.

How can you choose sports that have the best chance of attracting your audience?

To effectively capture your audience’s attention, it’s crucial to identify alternative events during periods when popular events like the Champions League are not happening. Our strategy involves actively promoting these alternatives to familiarise players with new tournaments and sports.

We have two dedicated teams: one that selects potential events and advises operators on what to highlight, while the other crafts promotional campaigns to ensure these events resonate with your audience.

The primary factors we consider when selecting events are Total Bets and the number of bets placed on a specific event or tournament. Popularity is our second criterion, which we measure by comparing the turnover to the number of participating players.

For instance, if there are no football championships over a weekend due to Euro qualifying matches, we might suggest promoting NBA evening games or volleyball tournaments to fill the gap left by high-profile football events.

However, it’s also beneficial to occasionally promote sports other than football, even when popular football matches are available. This strategy helps diversify the betting habits of the audience, which is vital for maintaining a stable and engaging product.

How far in advance do you need to start working on a promotional campaign?

We typically share promotional materials with operators two weeks prior to the event. This timeframe usually provides ample opportunity for operators to finalise the text and graphics. If we opt to use bonuses as the main promotional tool, we generate the rules, bonuses, and banners automatically. It’s then up to the operator to create and either self-publish the content or do so with our assistance.

What promotional channels would you recommend focusing on?

Operators have a variety of tools at their disposal, from email and SMS campaigns to managing their own channels on Telegram and other messaging platforms where they can share updates, offer bonuses, and more. Many even offer additional bonuses for subscribers of these communities, which proves effective in building a targeted and loyal audience interested in your project’s bonuses.

Another effective strategy involves placing promotional banners on various sections of the operator’s website, such as the homepage, event pages, and user dashboards. Additionally, collaborating with influencers like streamers can significantly boost traffic.

It’s also crucial not to overlook the power of email newsletters. When crafting content for these, it’s important to consider user behaviour and device preferences. For instance, with over 90% of our current revenue coming from mobile devices, it’s safe to assume most emails will be opened on a smartphone. Thus, optimising for mobile viewing is key. Our tests show that simple, structured, and transparent offers tend to perform best – you only have a few seconds to capture the player’s attention and persuade them to click through.

Do promotions without financial incentives like bonuses still work?

Let’s be clear: bonuses and promotions are fundamental to attracting players, especially those who rely on luck to multiply their capital. Seen as lucky breaks, bonuses allow participation without direct cost. Properly integrated into the marketing strategy, these incentives not only maintain player interest but significantly enhance financial performance.

For example, if an operator earns 15% from express bets, they can afford to redistribute 5% of that as bonuses, slightly reducing their margin to 10%, but potentially increasing user engagement and solving other operational issues.

Furthermore, promotions enable operators to direct betting activity efficiently. While major events naturally draw attention, incorporating bonuses for lesser-known events like the World Curling Championship can broaden a player’s interest and betting activities, introducing them to new sports and betting markets. This strategy not only diversifies the player’s experience but also stabilises the operator’s financials by spreading funds across various sports, thereby reducing the impact of financial peaks and troughs during major events.

Some operators focus primarily on significant events, leading to considerable financial volatility. For example, many faced challenges during the European Football Championship qualification matches when favourites won, negatively impacting financial outcomes. Operators that engage their audience across a spectrum of events tend to experience more stable performance.

Ultimately, using high-profile events to attract new players while promoting a diverse range of smaller events can create a more robust and diversified betting environment. This approach mitigates risks and cultivates a more engaged and knowledgeable betting community.

How likely is it that a person who came to a particular event will continue engaging with you afterwards? What influence can an operator have during this time?

Welcome packages with various bonuses are highly effective in this scenario. The primary goal is to familiarise new players with the range of bonuses and sports offered. Ideally, the entrance bonus program should provide about 20-30% to engage the player effectively.

Besides the welcome package, we can implement trigger-based rules during major events. For instance, a new player might come for the World Cup, and we could offer a promotion like: “Win three World Cup bets and receive a free bet for Wimbledon.”

Once engaged, they might notice a dominant player like Djokovic and place a bet on tennis, triggering another promotion. For example, we could offer a 50% bonus for making an express bet with specific odds on three tennis events. This showcases our diverse bonus system and introduces new sports gradually.

Furthermore, promoting sports tends to be easier than casinos because there are more events and thus more opportunities to engage players through channels like email newsletters, with less risk of being flagged for spam.

We advise our operators to customise bonuses for specific player demographics – like promoting Brazilian tennis players to Brazilian users or Nigerian athletes to Nigerian users. This targeted approach is significantly more effective than generic offers and resonates even with experienced casino players.

However, it’s crucial for operators to view their offerings holistically; they don’t just have a casino or sports section, but a comprehensive project where every part should function seamlessly together, including promotions and the product’s internal functionality.

Interviews

Tom Galanis: giving a First Look at the Top of the Slots

Gone are the days when we would spend a Thursday evening waiting for Top of the Pops to come on our televisions so that we could see who would be performing that week. The music show may no longer be running, but First Look Games has taken inspiration from the long-running staple and added a slot spin, to create Top of the Slots.

To give us more insight, First Look Games Founder Tom Galanis walks us through the ideation process behind Top of the Slots and how this is helping to give an accurate representation of the top-performing slot titles each month.

You launched Top of the Slots by First Look Games a couple of weeks ago. For those that may have missed the launch, what does this involve?

Tom Galanis: Top of the Slots is a showcase for the top 10 games launched by game studios via the First Look Games platform over the previous 90 days. It’s a never-before-seen take on game popularity and one our game studio partners, and affiliate users are already loving!

What was the thought process behind launching Top of the Slots?

Tom Galanis: First Look Games captures unique data for our game studio partners and Top of the Slots is designed to illustrate the most successful games, benchmarked by this unique data insight, to the industry.

What do game providers have to do to make it into the top ten releases for the month? What metrics do you use to evaluate success?

Tom Galanis: In order to make it in to the top 10, game studios need to release titles via our platform that successfully resonate with the 850+ affiliates that utilise First Look Games, making full use of the suite of tools we offer on and outside of the platform to engage affiliate marketers in the promotion of their game. The rankings are based on the First Look Games Index for all games launched to the market in the preceding 90 days, which combines:

- a) Downloads – which is the aggregated total of download sessions amongst affiliates on the platform. Affiliates download assets including logos, game sheets, video files, screenshots, banners and game artwork;

- b) Hits – this is the aggregated total number of game reviews for the game, created by affiliates using the First Look Games platform;

- c) Reach – this is the aggregated unique visitor count of the websites containing the Hits;

- d) Demo Game Sessions – this is the number of free to play demo game sessions that have taken place from iFrames placed on Hits.

- e) Sentiment Score – this is the average sentiment score from Hits

The games that rank well in this index are obviously commercially successful in their own right but are also being reviewed by affiliates because of the engagement of the game studio with the First Look Games platform, and consequently, with affiliates.

Our most active game studios are not just releasing great games with frequency but are also ensuring their game and studio news is distributed across the First Look Games platform and social channels and that a full and diverse range of marketing assets and game information is being provided through the platform prior to a game’s release. This best equips affiliates to understand the features of a game so that they can successfully convey this to their player audience, which, collectively amongst FLG affiliates, is very significant, totalling more than 20 million slots players worldwide.

Tell us a bit more about the First Look Games sentiment analysis – how is this helping to remove the biases from the ranking process? What data do you use to inform this analysis?

Tom Galanis: Once our technology has identified a new game review, First Look Games uses Natural Language Processing to ‘read’ the review and assess what the affiliate makes of the game. We share a short snapshot of this with the game studio and assign a score to the review based on how positive the affiliate has been in their review of the game. The more positive the language used in the review, the higher the score.

Sentiment scores are then aggregated across all reviews of the game to give a score for the game, and across all games to give the studio a score to benchmark against peers. Using AI, we are able to objectify the subjective to provide true 360 analysis on how affiliates are promoting a game.

What can we expect to see from First Look Games for the remainder of this year?

Tom Galanis: We have a perpetual roadmap of both new studio launches and technical advancements of the platform for affiliates and game studios to look forward to!

-

Asia7 days ago

Asia7 days agoOnlyplay Enters into Strategic Partnership with Ritchie Rabbit

-

Interviews7 days ago

Interviews7 days agoTom Galanis: giving a First Look at the Top of the Slots

-

Baltics6 days ago

Baltics6 days agoEvoplay bolsters presence in Lithuania with Betsafe deal

-

Australia7 days ago

Australia7 days agoCrown Reinstated at Sydney Casino

-

Compliance Updates6 days ago

Compliance Updates6 days agoEGBA Welcomes European Parliament’s Approval Of New EU Anti-Money Laundering Framework

-

Interviews6 days ago

Interviews6 days agoThe Full Spectrum Strategy: How Betting on Both Popular and Lesser-Known Sports Pays Off

-

Gambling in the USA7 days ago

Gambling in the USA7 days agoNebraska’s First Permanent Casino to Open in May in Columbus

-

Latest News7 days ago

Latest News7 days agoWilliam Hill Announced as Official Betting Partner of Qipco Guineas Festival