Latest News

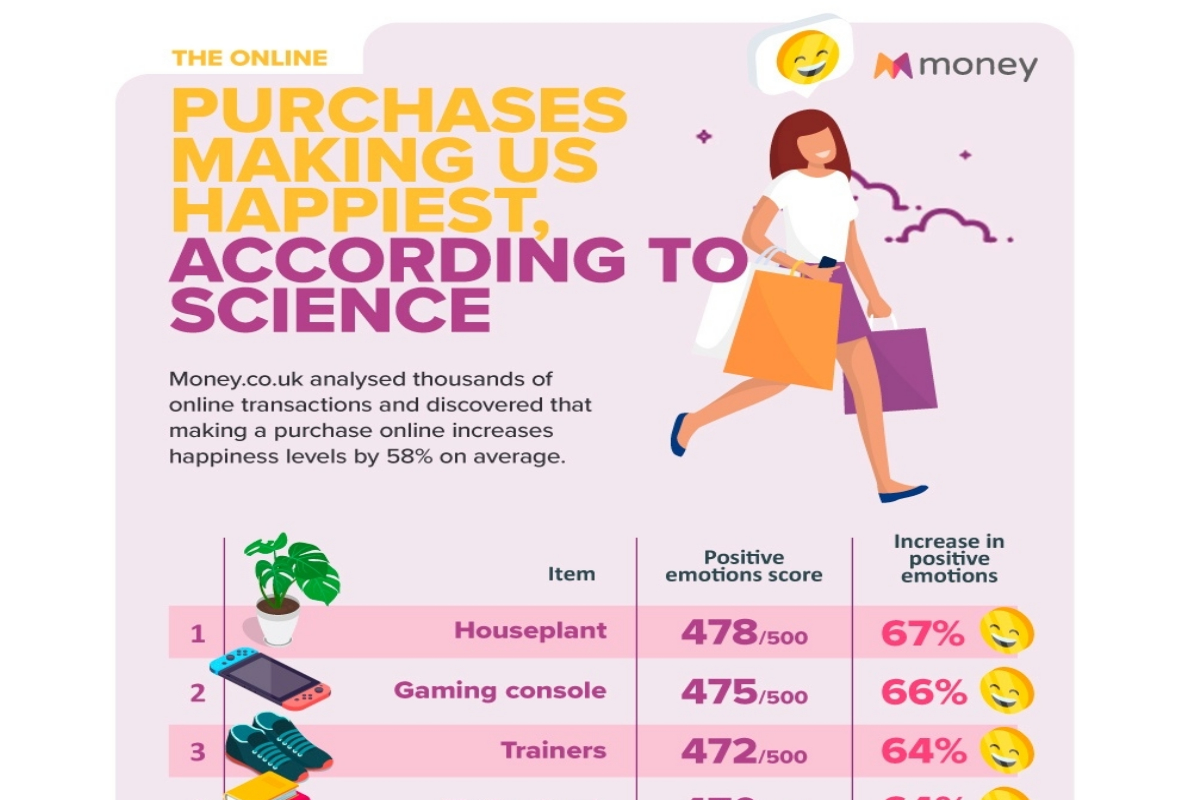

Emotions test reveals: The online purchases making us 67% happier!

- On average, online purchases are found to raise our positive feelings by 56%

- Participants reported the biggest increase in happiness when purchasing houseplants – positive emotions soared by 67%

- Gaming console purchases saw the second highest increase in positive feelings (+66%)

- Trainers and fiction books are also among the purchases raising positive emotions most

- Holidays abroad came in last; participants noted high levels of excitement but also reported an increase in concern due to its uncertainty

Thanks to ‘doom shopping’, it was revealed that the UK spends three times more when online shopping compared to the global average, costing the average person a whooping £1,382 per year! Clearly these purchases keep us coming back for more, but how do we enjoy splashing our cash the most?

Interested in online shopping, money.co.uk conducted an emotions test among 2,560 participants to discover which online purchases bring us the most joy!

Participants were asked to complete a variation* of the BMIS test (Brief Mood Intensity Scale) and record the intensity of 10 different emotions after making an online purchase. The intensity of each emotion was allocated a score based on its positivity, with a maximum score of 500 points per item – the higher the score, the better. Participants were also asked to complete the same test before making any purchases to uncover the percentage increase in positive emotions when shopping.

Which online purchases make us happiest?

Money.co.uk can reveal that a houseplant purchase increases our intensity of positive emotions more than any other transaction!

Collecting 478 points out of a potential 500, moods improved by 67% after making a plant purchase. Plants are proven to invoke feelings of vitality by improving the state of mind and lifting spirits – no wonder it scores highly!

With the PS5 still proving hard to get, purchasing a gaming console is the second online transaction that makes us happiest.

As many gamers are left on the edge of their seats waiting to snatch the latest console, it accumulated 475 points out of 500, and purchasing a console was found to raise positive feelings by 66% on average.

In third position are trainer purchases. With the demand for sneakers like Jordan 1s only increasing, those who purchased new trainers reported a 64% increase in happiness, and purchases racked up 472 points.

With bookworms reported to be happier than those who don’t read, the transaction that makes us fourth happiest is a fiction book, improving positive emotions by 64% and collecting 470 points.

Due to the huge surge in personal fitness and wellbeing during lockdown, home gym equipment purchases are found to make us fifth happiest! This transaction led to a 63% increase in positive emotions and scored a healthy 468 points.

To complete the top 10 purchases that increase our intensity of positive emotions:

6. Video game: 466 points, +62%

7. Eyeshadow palette: 465 points, +62%

8. Scented candle: 463 points, +61%

9. Exercise clothing: 461 points, +61%

10. Fashion jewellery: 459, +60%

Coming in last is a holiday abroad with 393 points out of 500 (+37%). Those who plan on jet-setting this year reported high levels of excitement and happiness but were pushed down the table as feelings of worry and nerves due to its current uncertainty.

Interested in the reasons behind our vast improvement in positive feelings, money.co.uk spoke exclusively to Lee Chambers, psychologist and wellbeing consultant, to uncover why shopping makes us happy.

“Online shopping has the ability to make us happy through several different mechanisms. Firstly, even in a world of plenty, we are still evolutionarily designed to consider scarcity. Because of this, acquiring new items, especially when discounted or limited, tends to make us happy, the feeling we have satisfied a need and potentially averted a future threat.

Shopping is also an exercise in control. We select from millions of items precisely what we want, and especially in the uncertain times we live in, we know we will get exactly what we have purchased, and it will be delivered straight to us. This control of selection and guarantee of receipt is powerful, as it becomes a defined event. We also build a level of expectation and anticipation from the moment we press the purchase button, as we believe we now have ownership over the item but have a delay until it is with us physically.

From a cultural perspective, we have been conditioned to see shopping as a reward, either an investment in ourselves or for the satisfaction of others. Shopping is likely to activate the nucleus accumbens in our brain, releasing dopamine and motivating us to repeat the behaviour. Buying printed media taps into our desire to better ourselves, gain knowledge, understand the world around us and provide stories and entertainment that can take us on a journey. And let’s not forget how lovely they look on your bookshelf on a video call, as books have become a decorative symbol over the past year.

And why do we keep buying? Our brain is adaptive, and shopping can relieve stress, provide entertainment when bored and give us a hit of dopamine. The rewarding feeling will keep us finding new things to purchase, especially since our excitement and anticipation fade once we’ve received the item.”

Catherine Hilley, mobiles expert at money.co.uk, said: “Our research reveals how small purchases can increase customers’ emotions in a positive way, something we all need after the past 12 months. With an average 63% increase in positive emotions noted across all top 10 purchases, it seems that shopping online for items such as houseplants, trainers and candles are sparking a lot more joy at the moment, than booking a holiday, which comes with a lot of added uncertainty.”

For more information, please see the blog post for the full rankings and a breakdown by sex, and age: https://www.money.co.uk/mobiles/online-shopping-joy

Latest News

BOS agrees with KV’s/KO’s advertising assessment of “Trisskrapet” in TV4

The Swedish Trade Association for Online Gambling (BOS) agrees with the Swedish Consumer Agency’s (KV) and the Consumer Ombudsman’s (KO) assessment that the daily scratch card commercial “Trisskrapet” in TV4 is an advertising feature, and thus not an editorial feature. BOS welcomes that KO is now ending that part of the process.

If Svenska Spel does not stop the advertising elements, BOS looks forward to KV following up on its earlier call to Svenska Spel to comply with the provisions on advertising identification and broadcaster declaration in section 9 of the Marketing Act and the information obligation in ch. 15. Section 3 of the Gambling Act with information on the 18-year-old age limit and where to turn in case of gambling problems.

– The Swedish gambling market must be characterized by a high level of consumer protection. A cornerstone of good consumer protection is that people are clear about what constitutes gambling advertising, i.e. that they are not tricked into thinking that an advertising feature would instead be an editorial feature. The daily “Trisskrapet” on TV4 has been anything but clear on that point, and we welcome that KO now finally establishes that the features constitute advertising and nothing else, says Gustaf Hoffstedt.

– Now it remains for Svenska Spel to introduce the mandatory consumer protection labelling of Trisskrapet. Since the company has not shown any excessive eagerness to introduce this voluntarily, KO should ensure that this happens as soon as possible. Every day and every “Trisskrapet” that does not contain the mandatory consumer protection label is another lost day for a safe and secure gambling market, Gustaf Hoffstedt concludes.

Balkans

Expanse Studios Launches in Bulgaria with Inbet

Expanse Studios, a leader in online gaming innovation, has secured a Bulgarian iGaming license and is now live on Inbet’s website. This expansion brings Expanse Studios’ popular game offerings including turn-based strategies gamified for iGaming, classic slots, traditional card games and the highly-acclaimed ones like Titan Roulette, Clown Fever Deluxe, Wild Icy Fruits, White Wild Whale and Joker Poker to Bulgarian players.

Diverse Gaming Portfolio Now Available to Bulgarian Players

With the Bulgarian market entry, Expanse Studios introduces a versatile gaming experience to Inbet’s platform. The offerings include a dynamic range of games tailored to diverse player preferences:

- Turn-based strategy games: Leveraging gamification, these games transform traditional strategy gameplay into engaging iGaming experiences, suitable for both novice and experienced players.

- Classic slots: Players will enjoy a variety of themed slots that combine traditional gameplay with modern graphics and sound.

- Traditional card games: A selection of popular card games offer something for every card game enthusiast.

- Titan Roulette: This standout feature, known for its immersive experience and innovative design, continues to be a favorite among roulette players.

Commitment to Quality and Compliance

Expanse Studios not only cultivates a diverse gaming library but also adheres to stringent regulatory standards to ensure a secure and fair gaming environment. The acquisition of the Bulgarian iGaming license is a testament to Expanse Studios’ commitment to compliance and excellence in the gaming industry.

The partnership between Expanse Studios and Inbet marks a significant milestone in Expanse Studios’ expansion efforts. By combining Expanse Studios’ innovative gaming solutions with Inbet’s established market presence, both entities are set to offer a superior gaming experience to players in Bulgaria and potentially beyond. As Expanse Studios continues to develop and release new games monthly, Bulgarian players can look forward to a continually evolving and enriching gaming landscape.

Latest News

Week 17/2024 slot games releases

Here are this weeks latest slots releases compiled by European Gaming

Belatra Games, the specialist online slots developer, is on point with its latest sharply designed game, Golden øks. This Norse-inspired adventure carries on from the popular Axe of Fortune title that hit the market at the turn of the year. Golden øks is set against a 5×3 layout and is brought to life with a powerful soundtrack to heighten the atmosphere.

Endorphina, has announced the release of its brand-new title, Jolly Queen, which will join its portfolio on April 27th. Jolly Queen is a 5-reel, 5-row fruit slot with 50 fixed paylines, introducing players to the lifestyle of the nobles. On top of the aristocratic ambiance, Jolly Queen provides players with Free Games, allowing them to master the reels.

Evoplay has released Candy Craze, a vibrant slot stacked with features and modifiers, including the powerful Gum Drop Multiplier which boosts win potential. Set amidst the backdrop of sumptuous sweets within a cloudy landscape, the 5×5 cascading reels title gives players a sugary rush when the Gum Drop Multiplier activates, revealing a mystery value at the end of each winning spin up to x100, enhancing the chance for wins during the main game and Free Spins.

Yggdrasil, a leading iGaming publisher, has revived the gold rush in a jackpot-filled game that embodies the spirit of old west prospecting in Gold Frontier Jackpots FastPot5™. Fans of lower volatility slots with straightforward mechanics that get fortune seekers right to the heart of the action are tasked with gathering keys to enter the treasure bonus game.

Relax Gaming is offering players some opulence in its latest release Sultan Spins. This high volatility slot sees its gold-trimmed reels set against a sprawling desert metropolis. Players have the chance to rack up riches via an entertaining free spins feature and lucrative local jackpot.

Greentube has introduced its latest title in the popular Diamond Link ™ series, Diamond Link ™: Mighty Dwarves Inc. Set deep in underground mines, this adventurous 5×3 slot is packed with innovative features for ample chance to win across its 25 paylines when players spin the reels adorned with hammers, hard hats and laser symbols.

Get your eyes ready because it’s time to take a trip to the pet centre to meet the ugliest, quirkiest, wildest-looking pets you’ve ever seen in the brand new slot, Fugly Pets, from Stakelogic. Fugly Pets takes players to a banged-up old pet store to explore its collection of weird and charming, downright ugly pets. Meet a scruffy parrot, a catnip crazed kitty, and an unfortunate-looking little dog.

Load your tackle box, bait your hook and get ready to reel in the catch of the day in Fishin’ The Biggest from Apparat Gaming, the in-demand German software provider’s latest splash hit slot that sees players trawl the sea for free spins and massively multiplied prizes. Played over five reels, three rows and ten fixed paylines, Fishin’ The Biggest is a highly-volatile title with an outdoor angling theme.

Thunderkick has announced the launch of Midas Golden Touch 2, the highly-anticipated sequel to the acclaimed 2019 original. This latest release invites players to rediscover an enchanted realm where everything King Midas touches turns to gold. The 3×5 video slot boasts 15 paylines and showcases Thunderkick’s signature high-quality design and innovative features.

Belatra Games, the specialist online slots developer, has served up another classic with its tasty Chef’s Sticky Fruits slot. This latest release from Belatra’s studio is a vibrant and juicy addition to its renowned catalogue of slots. It’s a 5×4 slot game bursting with colour that’s heightened with an upbeat, retro soundtrack that perfectly captures the essence of fun at the heart of every play.

3 Oaks Gaming has launched 3 China Pots: Hold and Win, the first time the company has integrated the popular 3 Pots mechanic within a Far East-themed title. The latest instalment from 3 Oaks to incorporate the 3 Pots functionality sees players transported to the allure of the Orient, where the Extra, Double and Multi modifiers influence the Bonus Game once activated.

Pragmatic Play has unleashed roaming wild re-spins and random guaranteed wins in Release the Bison. Symbols of the American frontier abound in this 5×4 slot, where hitting four or more rampaging bison triggers the wild re-spin feature, during which all wilds roam the reels to boost win potential.

Blueprint Gaming’s latest slot release tasks players to look for the leprechaun’s pot of gold under the water rather than at the end of the rainbow in Plenty O’ Fish, a 6×4 hybrid of sea creatures and shimmering rewards. Players must look to unlock a tackle box of treasure with a jaunty leprechaun being the key to wins, lurking behind a dynamically coloured underwater background that changes when the bonus game is triggered.

Booming Games has launched its latest sweet sensation to its collection of engaging slot games – Fruit Heaven Hold and Win™. This is a deliciously designed 5×3 slot game with 25 paylines, which promises players an exciting experience full of fantastic fruity features and Stacked Wilds.

Wazdan is multiplying jackpots in the follow-up to its top-performing game Mighty Wild™: Panther Grand Gold Edition. Venturing to the depths of the jungle where a black panther rules the reels on a 5×3 gameboard, the new edition provides even larger win potential. With the increased value of the Cash symbols and Cash Infinity™ symbols, there is also a more lucrative Grand Jackpot of 1500x the base bet.

-

eSports7 days ago

eSports7 days agoEverything you need to know ahead of ESL Pro League Season 19

-

Latest News7 days ago

Latest News7 days agoNew Market Alert! Hacksaw Gaming Touch Down in Portugal with Solverde.pt

-

Latest News4 days ago

Latest News4 days agoTHE UNIT APPOINTS ADAM NOBLE AS CHIEF COMMERCIAL OFFICER

-

Gaming4 days ago

Gaming4 days agoThe German Games Industry Association congratulates all winners of the German Computer Game Awards 2024

-

Baltics4 days ago

Baltics4 days agoMARE BALTICUM Gaming & TECH Summit Announces Final Agenda for 2024 Event

-

Latest News4 days ago

Latest News4 days agoINSPIRED LAUNCHES VIRTUAL SPORTS WITH COMEON GROUP

-

Africa4 days ago

Africa4 days agoNE Group powers 888bets launch in Angola

-

Industry News4 days ago

Industry News4 days agoWazdan set to gain more ground at Casino Beats Summit Malta