LeoVegas Press Releases

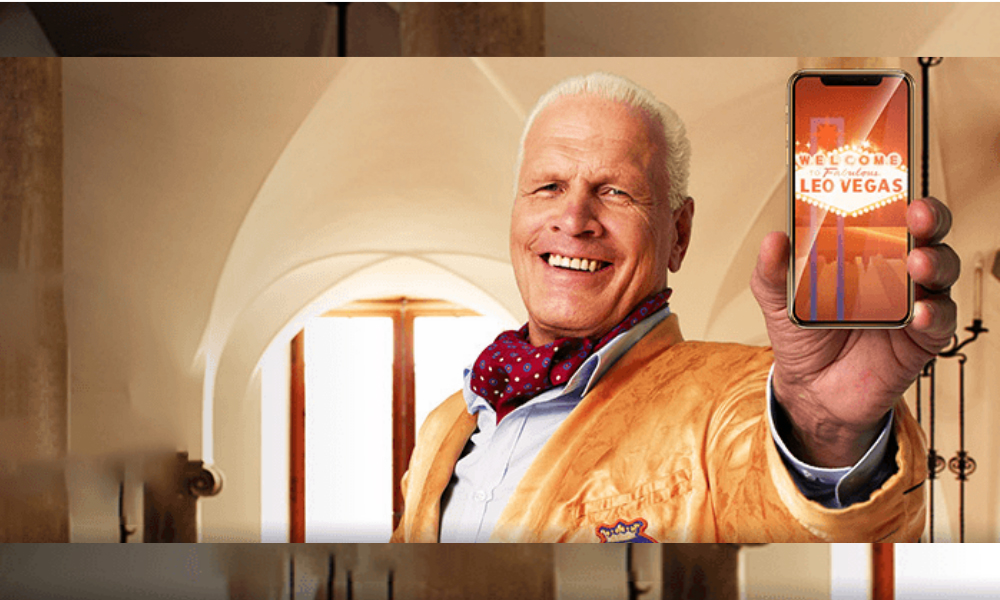

LeoVegas concludes partnership with Frank Andersson

22, May, 2018 – LeoVegas has decided to conclude its partnership with brand ambassador Frank Andersson.

The partnership is being concluded in connection with the recent launch by LeoVegas of a new communication concept that is based on several brand ambassadors.

“We thank Frank for the years he has helped profile LeoVegas in Sweden. He has been a contributing factor behind LeoVegas’ strong growth in the Swedish market. LeoVegas has entered a new phase with several brands and greater breadth with more product categories. After a long and successful cooperation with Frank, it is now time to take the next step,” comments Gustaf Hagman, CEO of LeoVegas.

“I have concepts and ideas for developing my own games and want to focus more on this, so that will be the next step for me,” says Frank Andersson. “I had some great years with LeoVegas and want to thank LeoVegas for believing in me. We had a great time working together!”

About the LeoVegas mobile gaming group:

LeoVegas’ passion is “Leading the way into the mobile future”. LeoVegas is Sweden’s premier GameTech company and is at the forefront of using state-of-the-art technology for mobile gaming. In 2017 the company passed the threshold for being classified as a unicorn, i.e., a start-up valued at more than USD 1 billion. A large part of this success can be credited to an extreme product and technology focus coupled with effective and data-driven marketing. Technology development is conducted in Sweden, while operations are based in Malta. LeoVegas offers casino, live casino and sports betting, and operates two global and scalable brands – LeoVegas and Royal Panda – as well as a local, multibrand operator collectively referred to as Rocket X. The company’s shares are listed on Nasdaq Stockholm. For more about LeoVegas, visit www.leovegasgroup.com.

Latest News

Blackpool FC features Safer Gambling logos on team shirts in collaboration with LeoVegas

During Saturday’s Football League One match against Shrewsbury, Blackpool FC’s regular front-of-shirt sponsorship will promote the nationwide ‘Safer Gambling Week’ campaign. Blackpool FC is the only club this weekend to feature this important message, thanks to the brand placement that has been donated by the club’s principal partner, LeoVegas. This initiative aims to raise awareness and promote the importance of gambling responsibly.

As the official principal partner of Blackpool FC, LeoVegas has been showcasing its brand on the front of the first-team adult shirt since July this year. The partnership offers an opportunity not only to promote the greatest igaming experience but also to emphasise the importance of gambling in a safer way. In support of the cross-industry initiative ‘Safer Gambling Week’ in the United Kingdom and Ireland, LeoVegas Group is replacing the shirt’s ordinary branding with ‘Safer Gambling’ logos. Blackpool FC’s first team will wear the special match kit at the Football League One match against Shrewsbury Town FC on Saturday, 18 November. Blackpool will be the only club that weekend to showcase these logos on their shirts, highlighting the commitment to the campaign.

Sam Behar, LeoVegas Group Director of UK and Ireland, said “Responsible gaming is at the heart of our offering at LeoVegas. We are incredibly proud to work with Blackpool and to make sure all fans understand the range of tools we have on offer to ensure our players keep their play safe. Safer Gambling Week is an important time of the year and, as such, ensuring that we replace our logo on the front of shirt to promote the week was crucial to us at LeoVegas. We thank Blackpool for their ongoing support for this week and for how we communicate our commitment to responsible gaming.”

Jonty Castle, Blackpool FC Chief Operating Officer, added, “Safer Gambling Week is an important nationwide initiative, which both ourselves at the football club and LeoVegas wanted to bring to the forefront of people’s thinking this weekend.”

“Raising awareness on the importance of safer gambling is vital, and Saturday’s match will see us promote this in a unique way, with LeoVegas replacing their front of shirt sponsorship with the ‘Safer Gambling’ logos. Alongside crucial information, support and advice being spread across our website and social media platforms, the key messaging surrounding Safer Gambling Week is being circulated as far and wide as possible by both ourselves and our valued partners at LeoVegas.”

“We thank LeoVegas for their ongoing support and for their kind donation of their front of shirt sponsorship to such a worthy cause this weekend.”

Safer Gambling Week, 13-19 November, is an annual campaign to promote safer gambling across the UK and Ireland with the support of a wide range of partners. The objective is to stimulate nation-wide conversations about safer gambling, giving people the information they need to gamble more safely, as well as directing those who need further advice and support to the right point of contact. For more information, visit https://safergamblinguk.org/.

Latest News

LeoVegas Group launches LeoVegas.nl in the Netherlands

LeoVegas Group has launched LeoVegas.nl in the Dutch market through LeoVegas Gaming PLC. The Group was granted a gaming license earlier this year by the Dutch regulatory authority KSA (Kansspelautoriteit), and the launch of LeoVegas.nl marks an important step in the Group’s international growth strategy. Players in the Netherlands will be able to enjoy the greatest igaming experience on verticals such as casino, live casino, and sports betting.

LeoVegas Group is pleased to announce that LeoVegas.nl has been launched in the strategically important Dutch market through LeoVegas Gaming PLC. The Group was recently granted a five-year gaming license for casino, live casino, and sports betting, allowing LeoVegas, “The King of Casino”, to welcome Dutch players and gain market share as the Group’s international growth journey continues.

LeoVegas.nl will offer an ever-growing portfolio of entertaining slot games, Dutch-speaking live casino croupiers, and competitive sports betting odds to ensure the greatest igaming experience for players in the Netherlands.

Commenting on the announcement, Gustaf Hagman, CEO of LeoVegas Group, said, “The King of Casino is finally home in the orange kingdom! I am delighted that we are taking steps into the Dutch market. The combination of a well known brand, our platform, and cutting-edge content will make LeoVegas.nl a contender for the leader’s jersey in the Dutch igaming market.”

During 2023, LeoVegas Group has been deepening its commitment to the European igaming market by launching sports betting and igaming brands in Denmark (expekt.dk), Germany (LeoVegas.de) and the UK (BetMGM.co.uk). The Group has also entered into strategic partnerships with top European football clubs such as Champions League finalists Inter and treble winners Manchester City F.C., as well as Newcastle United F.C. These partnerships are increasing brand awareness and visibility in connection to sports, and expanding the Group’s reach with audiences worldwide, supporting the ambition to launch LeoVegas Group as a global provider of the greatest igaming experience for both casino and sports betting.

Latest News

LeoVegas Group launches “nye expekt” in Denmark, strengthening the sports betting offering

LeoVegas Group is launching its sports betting brand expekt in Denmark, as part of the Group’s continuing international expansion. This follows expekt’s successful launch in the Swedish market in 2021, where it has grown rapidly to become one of the leading sports betting brands. The launch of nye expekt – the new expekt – in Denmark will strengthen LeoVegas Group’s sports betting offering to Danish customers and is part of the Group’s strategy to launch its brands in new markets and grow in sports betting.

Expekt, one of the Nordics’ oldest sports betting brands, was relaunched in Sweden in 2021 as “nya expekt”, meaning the “new expekt”. Following strong growth, the brand has re-established itself as a leader in sports betting in the Nordics. The brand is now relaunching in Denmark, after a 10-year absence, and Danish customers will benefit from a new smartphone app, competitive odds, and the greatest igaming experience.

Gustaf Hagman, CEO at LeoVegas Group, said “Expekt is one of the strongest brands in the Nordics, and we’re thrilled to be relaunching nye expekt in Denmark with a modern app and competitive odds. We have a clear strategy to expand by increasing the number of brands and markets where we’re present, and we see great potential for growth in sports betting.”

The launch of “nye expekt” will strengthen LeoVegas Group’s position in Denmark, and is part of the Group’s strategy to increase its focus on sports betting. In the past year, the Group has also entered into strategic partnerships with top European football clubs Manchester City F.C and FC Internazionale Milano.

-

Gambling in the USA5 days ago

Gambling in the USA5 days agoGaming Americas Weekly Roundup – July 15-21

-

Gaming5 days ago

Gaming5 days agoMainStreaming Announces Appointment of Nicola Micali as Chief Customer Officer

-

Eastern Europe5 days ago

Eastern Europe5 days ago7777 gaming is now available on WINBET Romania

-

Industry News5 days ago

Industry News5 days agoSafer Gambling Tools Use Hits Record High in 2023 – New Report from EGBA

-

Australia5 days ago

Australia5 days agoAustralian eSports Star Joins Team Liquid

-

eSports5 days ago

eSports5 days agoINSPIRED LAUNCHES RE-PLAY ESPORTS™ FEATURING CS:GO IN PARTNERSHIP WITH KAIZEN GAMING

-

eSports5 days ago

eSports5 days agoNODWIN(R) Gaming ropes in Android as title partner for BGMS Season 3; to be powered by Garnier Men

-

Latest News5 days ago

Latest News5 days agoSpinomenal shines again with Super Wild Fruits release