Latest News

The ANJ publishes the results of the online gambling market for the 2nd quarter of 2020: the sectors are very differently impacted by the COVID crisis

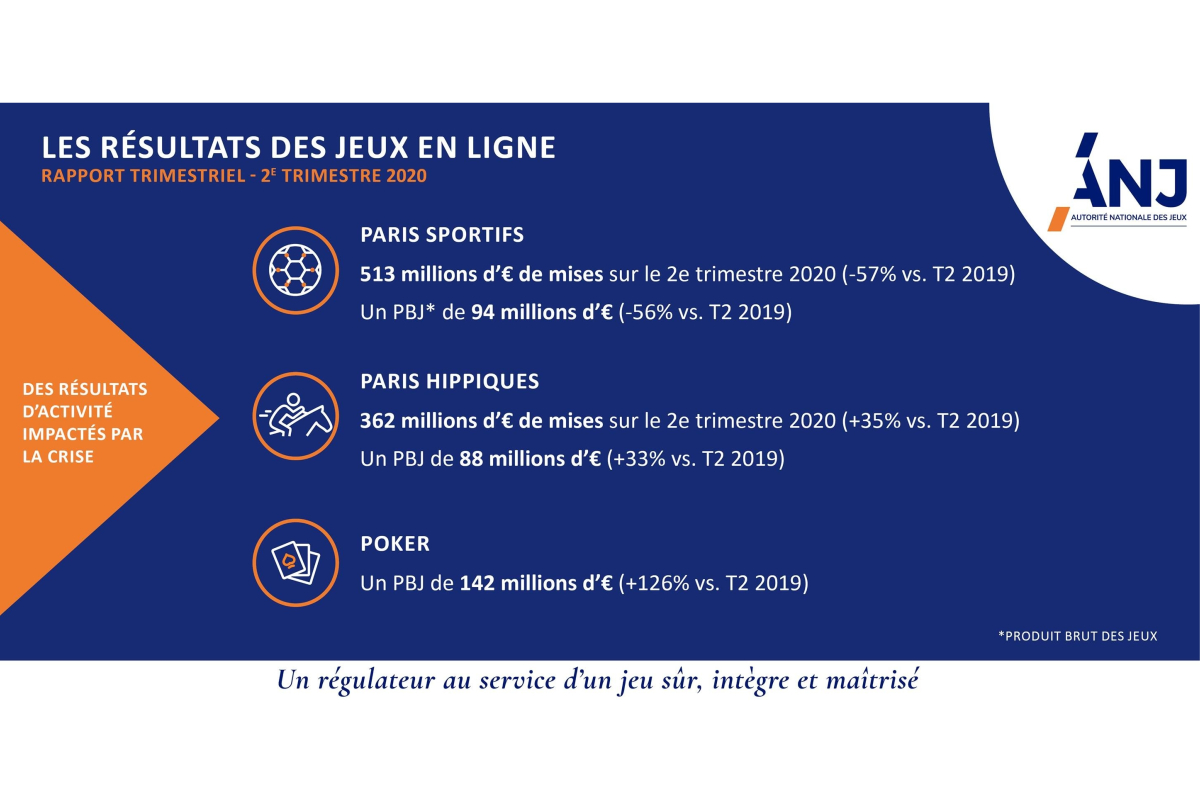

In the 2nd quarter of 2020, the online gambling market recorded a decrease of 6% of its GGR[1] and a decrease in active player accounts of 9%. It is the sports betting sector that has been the most affected by the effects of the health crisis with a decrease of 56% of its GGR. Conversely, the poker and, to a lesser extent, horseracing betting segments recorded a sharp increase of their GGR.

The lockdown (from 16 March to 10 May) was particularly handicapping for operators, who recorded a decrease of 24% over the period compared to 2019.

However, despite this health crisis, the GGR of the legal online market reached 758 million euros over the first 6 months of the year, an increase of 8% compared to the first half of 2019.

The collapse of online sports betting : -56% of the GGR

The online sports betting segment is generally the most dynamic part of the online gambling market. On the flip side of this trend, the sports betting offer for the quarter was profoundly altered by the massive cancellations or the delayed recovery of sporting events. With this reduction of the supply, and in order to support the market, the ARJEL Board authorized the add of 7 competitions to the list of sporting events, allowing them for sports betting in France (Australian football, 1st Australian soccer league, Hungarian football cup, 1st South Korea and China football leagues, baseball in Korea and hockey in Belarus).

These new competitions, while meeting ARJEL’s requirements regarding the fight against sports manipulation, have made it possible for operators to maintain a sports betting offer throughout the period of suspension of major competitions. All in all, operators’ GGR in the sports betting market amounted to 94 million euros in the second quarter, a decrease of 56% compared to 2019. The decline in operators’ turnover fell to 87% over the lockdown period.

As a result of this unprecedented situation, the number of active player accounts fell by 36%, albeit at a slower pace than the decrease of the GGR. The average spending per active player account over the quarter[2] amounted to 86€ compared to 126 € in Q2 2019 (-32%).

While operators had planned to make a significant marketing effort for EURO 2020, they sharply reduced their sports betting advertising spending during the 2nd quarter of 2020[3] in response to the decline in their activity.

The results provided by the FDJ demonstrate similar difficulties in the sports betting segment. The monopoly recorded indeed a decrease of 39% in sports betting stakes, all channels combined, in the first semester and up to around 61% in the second quarter alone.

An increase of online horseracing betting: +33% of the GGR

The horseracing betting offer was significantly affected this quarter following the interruption of French horseraces until 11 May 2020. However, the bets recorded during this period increased by 16%, in particular thanks to the maintenance and additions of foreign horseraces to the French horseraces betting calendar, approved by the Ministry of Agriculture and Food after an informal advice from ARJEL[4]. The increase of horseracing stakes is also due to the shift of some sports bettors to horseracing betting during the period. As soon as French races resumed, the market recorded an increase of the number of players, that accelerated the growth of the stakes over the quarter.

The online horseracing betting market activity is once again growing at a rate not observed since the market opened in 2010. The players’ stakes reached 362 million euros this quarter, up 35% compared to the second quarter of 2019. This volume of stakes also corresponds to the highest level generated over a quarter. At the same time, the GGR of the quarter increased by 88 million euros in proportions almost similar to stakes (+ 33%), its highest level since the opening of the market.

The PMU, operator under exclusive rights regarding offline horseracing betting, reported a decrease of 31% of the stakes in the 1st half of the year, all channels combined. However, business results improved at the end of the semester, thanks to the gradual reopening of points of sale and racecourses.

The booming of online poker: +126% of the GGR

The lockdown period has been very advantageous to the online poker segment. The popularity for this activity has led to the recruitment of many new players. As a result, nearly 1.100.000 active player accounts (APAs) participated in online poker games during the quarter, an increase of 68% relative to last year.

As a result, the poker GGR reached 142 million euros in the second quarter, its biggest result for a quarter and 44 million higher than the GGR of the first quarter of 2020. The growth of the poker GGR is of 126% compared to Q2 2020, which corresponds to the most significant increase recorded over a quarter.

This growth is due both to an increase in the number of active players (+ 68% compared to Q2 2019) and to the intensification of gambling. The average spending per active player account thus increased sharply in Q2 2020 (+ 34%), reaching € 134 compared to € 99 in Q2 2019.

The ANJ in brief

The “Pacte” Act and the ordinance of October 2, 2019 reforming the regulation of gambling have set up a new gambling regulatory authority (ANJ). It follows ARJEL with a significantly extended regulatory scope and enhanced powers.

The ANJ is now responsible for all components of the legal gambling market, both online andoffline:

- online games that ARJEL regulated, such as sports betting and horse racing betting and poker offered by the 14 licensed operators ;

- all the games of La Française des Jeux or the PMU sold in physical points of sale or online;

- 237 racecourses;

- 202 casinos, with the exception of anti-money laundering issues and the integrity of the games offered, which remain under the responsibility of the Ministry of Home Affairs.

Methodology

The following elements have been compiled using data provided by licensed online gambling and betting operators on a weekly and quarterly basis. The ANJ communications take account of statistical confidentiality. It cannot publish information relating to the activity of monopoly markets (FDJ and PMU) other than that already disclosed by operators under exclusive rights.

Latest News

Extendy – Premier platform for affiliate teams looking to create online casinos.

An innovative platform for creating turnkey online casinos is entering the market, developed over more than four years by a team of 150 engineers in collaboration with top arbitration experts. The platform’s main advantages are its exceptionally quick return on investment, a fully autonomous turnkey operating system, and a focus on mobile traffic.

Owning a casino brand offers arbitration teams several benefits. The primary advantage is that investing in paid traffic can build free, high-quality organic traffic from social media, SEO, external sites, etc., over the long term. When traffic is directed to a partner, the team receives immediate financial returns but loses out on the long-term bonuses of owning their brand.

Return on Investment in 6 Months

Close partnerships with top arbitration teams over several years have allowed thousands of hypotheses to be tested, resulting in an ideal product tailored for these teams. This product maximizes player lifetime value (LTV) and reduces traffic payback time to just six months.

This effect is achieved through numerous technical solutions that enable real-time analysis of advertising campaigns and predictive determination of which to halt and which to scale up. One such solution is the “Traffic Light” technology, which quickly predicts whether the traffic will be profitable. Each partner is marked with a colour: green for excellent traffic that should continue, yellow for questionable traffic that requires caution, and red for bad traffic that should be stopped immediately. Arbitration teams that have used the “Traffic Light” technology for some time report that quick traffic analysis makes it almost impossible to incur losses.

Best ROI for Mobile Traffic with AppAI Technology

One of Extendy’s standout features is its unique AppAI technology, which unlocks new possibilities for attracting mobile traffic. A specially developed neural network analyzes the user’s profile and the ad they came from, creating a unique onboarding flow that significantly increases conversion rates. This drastically reduces the return on investment time for this type of traffic.

“AppAI is a perfect demonstration that Extendy is created by professionals for professionals. During the development process, our arbitration partners repeatedly emphasized the importance of working with mobile traffic. We dedicated a significant amount of time to optimizing the product for mobile players,” said Aivar, CBDO of Extendy.com.

Autonomous Operating System and Turnkey Brand

Another key advantage of Extendy is its fully autonomous operating system, which meets the highest industry standards.

The entire infrastructure is designed so that arbitration teams receive a fully functional casino for long-term development and profit without the need to manage any operational processes.

The CRM, Support, VIP, Content, Payment, Legal, and other operational components of the product are fully automated and self-sufficient. Ready-made, tested, and unique retention funnels, email sequences, gamification systems, 24/7 support, and VIP support in all languages, along with many other solutions, allow casino owners to fully focus on marketing and player acquisition.

In a closed beta phase, dozens of successful casinos were launched on the platform, including BetOnRed, CryptoLeo, BDMBet, and many others. Millions of players are attracted and an average traffic payback period of six months proves that the platform is effective and ready for public launch and further growth.

All you need to create your online casino on the Extendy platform is to submit an application on the Extendy website. Within 2 months of signing the contract, you will receive a license, necessary payment gateways and game providers will be connected to the brand, and final adjustments will be made.

To celebrate the platform launch, a promotion has been launched. Write in the comments of your application that you are from EuropeanGaming and receive special setup conditions.

Latest News

Hacksaw Gaming and Come On! Commemorate Yet Another Expansion Together

As of April, Hacksaw Gaming and Come On! are celebrating their fourth expansion together. Though an already strong partnership, the link between the two powerhouses has been further strengthened with this new endeavour!

Come On! players can access Hacksaw content in a number of jurisdictions, including Sweden, Ontario, and now the Netherlands. Come On! is an award winning, top tier market leader with over 5000 games placed across their platforms. Hacksaw staples such as Wanted Dead or a Wild, Chaos Crew, Gladiator Legends and Stack ‘Em will be joining their vast collection.

It’s been 5 years since the partnership first began, and Hacksaw Gaming CEO Marcus Cordes expressed his elation towards the ongoing growth between the two industry trailblazers, “We’re all about progress; and our continued collaboration with Come On! is a great example of what we are prioritising here at Hacksaw – bringing players across the globe entertaining games that break through market norms! A huge thank you to the teams on both sides for making this happen.”

Affiliate Industry

Better Collective Acquires AceOdds

In a strategic move to strengthen its foothold in the UK, digital sports media group Better Collective has acquired sports betting media AceOdds for a total consideration of 42 mEUR implying 4x last twelve months EBITDA.

AceOdds, a versatile multi-language sports betting brand, offers a comprehensive range of betting tools, odds, reviews and streaming schedules through its web and app based platforms. With a robust presence in the UK market, Better Collective’s global reach through local expertise aligns perfectly with AceOdds’s vision of expanding its influence outside the borders of the UK. Following the acquisition, Better Collective upgrades its 2024 full year financial targets.

Ian Bowden, Better Collective’s Senior Director for UK & Ireland, said: “I am thrilled to announce the addition of AceOdds to the Better Collective group. This strategic acquisition brings us a robust owned and operated sports betting media brand in the UK market, poised for global scalability. Aligned perfectly with Better Collective’s overarching strategy of acquiring leading sports media brands across various niches, the AceOdds brand fills a crucial gap by offering a vital sports betting affiliation brand in a pivotal growth market for the Better Collective group, along with an app benefiting from hundreds of thousands installs to further increase the reach we can provide our partners.”

Established in 2008, AceOdds was founded with the aim of providing UK sports enthusiasts with an easy-to-use betting calculator. Over the years, the brand has expanded, offering a well-regarded web platform featuring a range of betting tools, comparison features, live streaming schedules, an odds and parlay calculator, and more. Additionally, AceOdds has introduced a popular app.

The acquisition aligns with Better Collective’s strategy of owning the full range of sports media across key regions, spanning from traditional sportsbook comparison brands to general sports media, social media content creators, podcast producers and beyond.

-

Latest News7 days ago

Latest News7 days agoA Guide to the Security of Digital Gambling Transactions

-

Affiliate Industry6 days ago

Affiliate Industry6 days agoInterview w/ Andre Machado, Head of Publishers Relations and Affiliation at Sportradar

-

Latest News6 days ago

Latest News6 days agoRedefining iGaming: The Thrilling Journey of Atlas-IAC to Atlaslive

-

Latest News7 days ago

Latest News7 days ago7777 gaming expands African reach with Integration of Casino Games on betPawa

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoHIPTHER’s European Gaming Congress 2024 Extends to a Two-Day Spectacle at a Stunning New Venue

-

Asia5 days ago

Asia5 days agoGoogle I/O 2024 Project Gameface Android Showcase Powered By Made-in-India Indus Battle Royale

-

eSports7 days ago

eSports7 days agoMOUZ Crowned Back-To-Back ESL Pro League Champions After 3-0 Victory During Season 19 Grand Finals

-

Conferences in Europe7 days ago

Conferences in Europe7 days agoJoin key decision makers at 2024 Gaming in Holland Conference