Press Releases

MGA | The Malta Gaming Authority and the Financial Intelligence Analysis Unit sign a Memorandum of Understanding

The Malta Gaming Authority (MGA) and the Financial Intelligence Analysis Unit (FIAU) have consolidated their long-standing relationship by means of a Memorandum of Understanding (MoU), specifically aimed at improving the sharing of information and co-operation between the two entities, on the areas of supervision of Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT), provided for by the Prevention of Money Laundering Act (Cap. 373 of the Laws of Malta).

The MGA’s Chief Executive Officer, Heathcliff Farrugia, said he was delighted to sign such an important MOU with the FIAU, stating: “Our relationship with the FIAU has gone from strength to strength, particularly since the introduction of EU’s 4th Anti-Money Laundering Directive. Due to the nature of our roles, we are in regular contact, also conducting joint supervision on MGA-licensed entities. This MOU will thus continue to strengthen this collaboration, underpinning our resolve to ensure Malta’s gaming sector is kept free from crime, preventing money laundering and combating the funding of terrorism.” It will influence MGA casinos such as Crazyno, Casumo and other gambling operators and make them provide stricter KYC and AML verifications for players.

Kenneth Farrugia, Director of the FIAU, said that “the MGA is a strategic partner of the FIAU in ensuring that the highest levels of AML/CFT compliance are applied across the gaming sector. The MOU will therefore further strengthen the long-standing excellent relationship and the level of collaboration between the two authorities and demonstrates our commitment and determination in increasing Malta’s effectiveness in combatting money laundering and terrorism financing.”

The provisions of the MOU also allow both parties to discuss avenues of further co-operation in the area of AML/CFT, including in relation to training of respective employees, training of persons and entities licensed by the MGA, and assessing the competency on AML/CFT of individuals holding key positions with licensed entities, particularly those appointed as Money Laundering Reporting Officer (MLRO).

The MOU was signed by Heathcliff Farrugia, Chief Executive Officer of the MGA and Jesmond Gatt, Chairperson of the FIAU.

Latest News

HÖLLE GAMES SIN IN BERLIN

The latest slot from Hölle Games is now live: “Sin in Berlin”, is a 5×4, 25 payline game/trip into the party-scene of a capital known for its party scene since the Roaring Twenties.

This continues today with Berlin known as a clubbing mecca, and the latest slot from Hölle Games pays homage to that with its thumping techno beat, dark yet stylish visuals, and symbols from the scene – ranging from vinyl turntables to a “No photos” sign, a familiar sight in certain well-known techno clubs, where anything can (and does) happen behind those closed doors.

The slot also features a special wheel game, which when triggered, can award up to 30 Free Spins with a 3x multiplier! On top of that, the Free Spins always feature an expanding wild character, which can provide some truly epic win potential.

With 4 different RTPs available the game is now available in Sweden and MGA regions with additional territories to follow soon. Hölle Games have another release coming in June but for now though, enjoy the Sin – in Berlin!

Latest News

Unveiling Social Casino Trends: Insights into Player Behaviour

Who plays social casino games, and when and how do they engage? SOFTSWISS, a global tech company with over 15 years of expertise in iGaming, has analysed the data of about 700,000 SpinArena.net users to present major social casino gaming patterns and trends.

SOFTSWISS recently announced the acquisition of a stake in Ously Games GmbH, the German provider of the fastest-growing European social casino, SpinArena.net. SOFTSWISS experts explored the data provided by its partner to uncover major trends in social casino gaming and its differences compared to traditional online casinos.

Who is a Social Casino Player?

When discussing the social casino player profile, it is essential to highlight that over 80% of users conceal their age and gender. Among those who reveal this information are young men under 30.

Naturally, the majority of SpinaArena players are from Germany. The United Kingdom of Great Britain and Northern Ireland takes second place in the ranking, followed by players from other European countries, such as the Netherlands, Latvia, Italy, Greece and Poland.

For the sake of analysis, it is essential to consider that downloading applications for social casino games does not require age verification or the mandatory disclosure of a player’s gender or country of residence. Therefore, the analysis assumes that the data provided by players who chose to share their information is accurate.

When Do People Play in Social Casinos?

According to SpinArena.net data, the average player session lasts about 47 minutes. The longest player session recorded in 2024 exceeded 12 hours.

Players are most active during the day and in the evenings. The largest number of players is registered from 4 p.m. to 9 p.m., while the fewest – from 2 a.m. to 5 a.m. The activity is almost three times higher in the evenings than at night, and it is worth highlighting that judgement.

During the week, players are usually more active on Fridays and Sundays, while less activity is observed on Mondays. At the same time, the difference between the most and the least active days of the week is only around 10%.

Regarding the retention rate, SpinArena.net can boast intriguing figures. Data from German users shows that almost 40% of players are active on the first day after installing the application, while by the thirtieth day, this figure equals 14%.

The analysis of player gaming habits revealed that average users’ activity follows predictable patterns and fully aligns with human biorhythms and social responsibilities.

Most Popular Social Casino Games

The largest European social casino by the number of slot games, SpinArena.net, has a robust collection of over 3,000 games from almost 40 providers. Half of all gaming sessions are spent playing the top 15 games.

In SpinArena.net, the top 5 most popular games make up one-third of all games played. Like in traditional online casinos, slots are the most common choice among players. Certain popular games such as Gates of Olympus, Sweet Bonanza and Sugar Rush are favourites in both social and traditional online casinos.

Ously Games GmbH Founder Jochen Martinez comments: “This analysis perfectly illustrates how social casinos fulfil the same player needs as traditional casinos, offering a safer gaming experience. Combining gaming with social interactions provides a unique environment and neutralises financial risks. Players can enjoy activities like connecting with friends while playing their favourite games.”

Vitali Matsukevich, COO at SOFTSWISS, summarises: “Social casinos are part of the mega trend in the global entertainment industry, where player behaviour coincides with those in traditional online casino gaming. Anticipating social casinos’ evolution and integration with iGaming, SOFTSWISS partnered with Ously Games GmbH to present a new B2B software product – a comprehensive platform for social casinos.”

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS holds a number of gaming licences and provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Online Casino Platform, the Game Aggregator with over 20,000 casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS revolutionised the industry by introducing the world’s first Bitcoin-optimised online casino solution. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

About Ously Games

Ously Games is a German enterprise, the provider of SpinArena.net, Europe’s largest social casino by number of slots. It boasts an extensive collection of over 3000 games from 40 renowned providers. With an annual turnover exceeding a million euros, Ously Games is driven by a team of 20 professionals.

Latest News

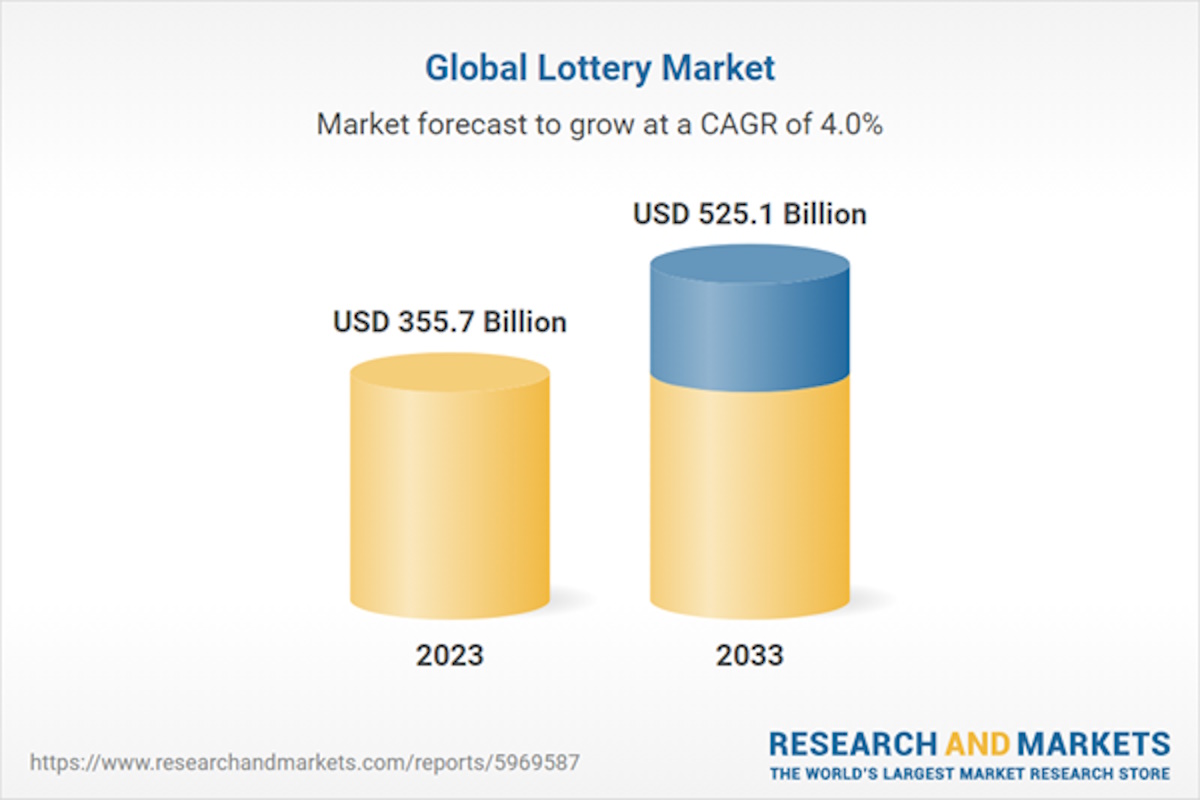

Lottery Industry Analysis and Opportunities to 2033: Scratch-Off Instant Games Expected to Register the Fastest Growth

The “Lottery Global Market Opportunities and Strategies to 2033” report has been added to ResearchAndMarkets.com’s offering.

This report describes and explains the lottery market and covers 2018-2023, termed the historic period, and 2023-2028, 2033F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global lottery market reached a value of nearly $355.7 billion in 2023, having grown at a compound annual growth rate (CAGR) of 2.6% since 2018. The market is expected to grow from $355.7 billion in 2023 to $453.7 billion in 2028 at a rate of 5%. The market is then expected to grow at a CAGR of 3% from 2028 and reach $525.1 billion in 2033.

Growth in the historic period resulted from the increase in advertising strategies and promotions of lottery products, expansion of multi-jurisdictional lottery games and strong economic growth in emerging markets. Factors that negatively affected growth in the historic period were increase in fraud in gambling and lotteries and regulation on age limit for selling lotteries.

Going forward, changes in legislation and regulation regarding lottery operations, growing popularity of online lottery and global population growth and urbanization will drive the growth. Factor that could hinder the growth of the lottery market in the future include intense competition from casinos and other forms of entertainment and economic recession or instability.

The lottery market is segmented by type into lotto, quizzes type lottery, numbers game, scratch-off instant games, terminal-based games and other types. The lotto market was the largest segment of the lottery market segmented by type, accounting for 31.3% or $111.5 billion of the total in 2023. Going forward, the scratch-off instant games segment is expected to be the fastest growing segment in the lottery market segmented by type, at a CAGR of 6.2% during 2023-2028.

The lottery market is segmented by platform into online and offline. The offline market was the largest segment of the lottery market segmented by platform, accounting for 96.8% or $344.1 billion of the total in 2023. Going forward, the online segment is expected to be the fastest growing segment in the lottery market segmented by platform, at a CAGR of 8.9% during 2023-2028.

The lottery market is segmented by category into charitable lotteries and prize home lotteries. The charitable lotteries market was the largest segment of the lottery market segmented by category, accounting for 70.3% or $250.2 billion of the total in 2023. Going forward, the prize home lotteries segment is expected to be the fastest growing segment in the lottery market segmented by category, at a CAGR of 6% during 2023-2028.

North America was the largest region in the lottery market, accounting for 36.8% or $131 billion of the total in 2023. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the lottery market will be Middle East and South America where growth will be at CAGRs of 10.8% and 7.8% respectively. These will be followed by Asia Pacific and Africa where the markets are expected to grow at CAGRs of 6.8% and 6.7% respectively.

The global lottery market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 16.09% of the total market in 2022. The market concentration can be attributed to the presence of large number of players in different geographies. Prominent players are acquiring the products and entering into partnerships with the other companies to consolidate their market positions across the globe, while others are distributing products. The New York State Lottery was the largest competitor with a 3.28% share of the market, followed by New York State Gaming Commission with 3.27%, Camelot Group with 2.78%, Georgia Lottery Corp. with 1.91%, Loterias y Apostasy Del Estado with 1.64%, Singapore Pools with 1.18%, Francaise des Jeux with 0.65%, Arizona Lottery with 0.47%, Ontario Lottery and Gaming Corporation with 0.46% and Lotto NZ with 0.44%.

The top opportunities in the lottery market segmented by type will arise in the lotto segment, which will gain $30.7 billion of global annual sales by 2028. The top opportunities in the lottery market segmented by platform will arise in the offline segment, which will gain $92.5 billion of global annual sales by 2028. The top opportunities in the lottery market segmented by category will arise in the charitable lotteries segment, which will gain $62.1 billion of global annual sales by 2028. The lottery market size will gain the most in China at $13.6 billion.

Market-trend-based strategies for the lottery market include innovative product developments with focus on scratch-off games, strategic collaborations and partnership to expand reach and capabilities, introduction of mobile lottery apps to improve user convenience, use of data analytics for enhanced lottery insights and roll out of new lottery games to redefine entertainment.

Player-adopted strategies in the lottery market include strengthening operational capabilities through new product developments and expanding product portfolio through strategic partnerships.

To take advantage of the opportunities, the analyst recommends the lottery companies to focus on innovating lottery offerings, focus on mobile apps for enhanced lottery services, focus on innovative lottery games for enhanced player engagement, focus on data-driven insights to navigate lottery market dynamics, focus on fastest growing market segments: scratch-off instant games and quizzes type lottery, focus on online market segment for growth, expand in emerging markets, continue to focus on developed markets, focus on strategic collaborations, focus on competitive pricing strategies for market expansion, focus on strategic promotion mix for optimal lottery market visibility, target smartphone users and focus on customer-centric engagement for enhanced lottery market reach.

Scope

Markets Covered:

- by Type: Lotto; Quizzes Type Lottery; Numbers Game; Scratch-Off Instant Games; Terminal-Based Games; Other Types

- by Platform: Offline; Online

- by Category: Charitable Lotteries; Prize Home Lotteries

Key Companies Mentioned: The New York State Lottery; New York State Gaming Commission; Camelot Group; Georgia Lottery Corp; Loterias y Apostasy Del Estado

Time Series: Five years historic and ten years forecast

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; lottery indicators comparison

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments

Key Attributes

| Report Attribute | Details |

| No. of Pages | 301 |

| Forecast Period | 2023 – 2033 |

| Estimated Market Value (USD) in 2023 | $355.7 Billion |

| Forecasted Market Value (USD) by 2033 | $525.1 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes, but is not limited to:

- The New York State Lottery

- New York State Gaming Commission

- Camelot Group

- Georgia Lottery Corp

- Loterias y Apostasy Del Estado

- Singapore Pools

- Francaise des Jeux

- Arizona Lottery

- Ontario Lottery and Gaming Corporation

- Lotto NZ

- 1x-bet.in

- Dhankesari Lottery Sambad

- Lottery Sambad Result

- Takarakuji-official.jp

- Ichiban Kuji Club

- The Lott

- Lotterywest

- Oz Lotteries

- 500.com

- Baidu Inc

- China Sports Lottery Operation and Management Co. Ltd.

- 360 Lottery

- QQ lottery

- National Lottery

- Jackpot.com

- Betfred Lotto

- Intralot SA

- Zeal Network SE

- Francaise des Jeux (FDJ)

- EU Lotto Limited

- Legacy Eight Curacao N.V

- Wejdz do swiata LOTTO

- Megalotto

- SYNOT W, a. s.

- Betfred Lotto

- DraftKings Inc.

- BetAmerica

- LeoVegas AB

- Jackpocket

- Mido Lotto

- Prize Pool

- Scientific Games Corp

- Long Game

- Linq3

- EMIDA Technologies

- Atlantic Lottery Corporation

- Hipodromo Argentino de Palermo

- GammaStack

- Mega Sena

- Quina

- Lotofacil

- Dupla Sena

- Mifal HaPayis

- Milli Piyango Idaresi

- O! Millionaire

- NeoGames S.A.

- Emirates Draw

- Mahzooz

- BuyLottoOnline

- Camelot Lottery Solutions Group

- Ithuba National Lottery

- wow!lotto

- Lottomania Nigeria

-

Industry News7 days ago

Industry News7 days agoIGT Reports First Quarter 2024 Results

-

Asia7 days ago

Asia7 days agoFrom LatAm to Asia: Meet GR8 Tech at SiGMA Manila

-

eSports7 days ago

eSports7 days agoANICHESS PARTNERS WITH ESPORTS LEADER TEAM SECRET AHEAD OF PVP LAUNCH

-

Bitcoin6 days ago

Bitcoin6 days agoNavigating Bitcoin’s Impact: SOFTSWISS’ iGaming Industry Overview

-

Balkans6 days ago

Balkans6 days agoBulgarian President Approves Gambling Law Amendments

-

Africa6 days ago

Africa6 days agoBGaming debuts in Africa with Premier Bet

-

Asia7 days ago

Asia7 days agoWazdan secures Philippines market entry with SG8 partnership

-

Balkans6 days ago

Balkans6 days agoWazdan adds to Croatian presence with SuperSport tie-up